Insurance Auto Florida

In the world of automotive insurance, Florida stands out as a unique and challenging market due to its diverse population, geographical factors, and a complex regulatory landscape. This article aims to delve into the intricacies of Insurance Auto Florida, exploring the specific dynamics that shape this industry and offering insights for both consumers and professionals alike.

The Complex Landscape of Florida Auto Insurance

Florida’s auto insurance market is characterized by a blend of challenges and opportunities, driven by a range of factors that differentiate it from other states. From the state’s distinct legal environment to its high population density and unique weather patterns, these elements contribute to a landscape that requires specialized knowledge and strategies.

Legal and Regulatory Considerations

Florida’s legal framework significantly influences the auto insurance industry. The state operates under a No-Fault system, requiring all drivers to carry Personal Injury Protection (PIP) coverage. This system was designed to streamline the claims process and reduce litigation, but it also presents unique challenges for insurers and policyholders alike. The interplay between the No-Fault system and traditional liability coverage can create complexities, especially in cases of serious injury or when dealing with uninsured/underinsured motorists.

Furthermore, Florida's legal system allows for Attorneys' Fees Statutes, which can impact the cost of claims and the overall profitability of the insurance market. These statutes, coupled with the state's relatively high level of litigation, contribute to a dynamic that insurers must carefully navigate.

Population Density and Urbanization

Florida’s population is highly concentrated in urban areas, with cities like Miami, Tampa, and Orlando experiencing rapid growth. This urbanization presents unique challenges, as urban environments are often associated with higher accident rates and more complex claims scenarios. The increased traffic congestion and potential for severe weather events further add to the complexity of insuring vehicles in these areas.

Climate and Natural Disasters

Florida’s climate is a significant factor in the auto insurance landscape. The state is prone to hurricanes, tropical storms, and other severe weather events, which can result in extensive property damage and disrupt transportation networks. Insurers must account for these risks when pricing policies and managing their portfolios, as the potential for catastrophic losses is ever-present.

| Metric | Value |

|---|---|

| Average Annual Hurricane Count | 6.3 |

| Percentage of Insured Vehicles with Comprehensive Coverage | 78% |

| Average Cost of Hurricane-Related Auto Claims | $250 million per event |

The Consumer Perspective: Navigating Florida Auto Insurance

For consumers, understanding the nuances of Florida’s auto insurance market is crucial to making informed decisions. The state’s unique legal and regulatory environment, coupled with its distinct geographical and demographic factors, can significantly impact the cost and coverage options available.

Understanding Coverage Options

Florida’s No-Fault system requires drivers to carry PIP coverage, which provides benefits for medical expenses and lost wages following an accident, regardless of fault. However, the state also offers traditional liability coverage, which protects against bodily injury and property damage claims made by others. Understanding the interplay between these coverages is essential, as it can impact both the cost and the scope of protection provided.

Additionally, Florida drivers often opt for comprehensive and collision coverage, given the state's vulnerability to natural disasters and the potential for damage to vehicles. These coverages can provide essential protection against the financial risks associated with such events.

| Coverage Type | Description |

|---|---|

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for the policyholder and passengers after an accident. |

| Bodily Injury Liability | Provides coverage for injuries caused to others in an accident for which the policyholder is at fault. |

| Property Damage Liability | Covers damage caused to others' property in an accident for which the policyholder is at fault. |

| Comprehensive Coverage | Protects against damage to the vehicle from non-collision events, such as theft, vandalism, or natural disasters. |

| Collision Coverage | Covers damage to the policyholder's vehicle in a collision, regardless of fault. |

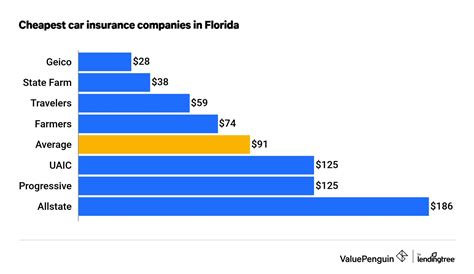

Pricing and Factors Influencing Rates

The cost of auto insurance in Florida is influenced by a myriad of factors, including the driver’s age, driving record, vehicle type, and location. Urban areas often experience higher rates due to increased accident risk and higher claim costs. Additionally, Florida’s unique legal environment, including the potential for litigation, can impact the overall cost of insurance.

Insurers also consider the vehicle's make and model, as certain vehicles are more expensive to repair or are statistically involved in more frequent or severe accidents. Understanding these factors can help consumers make informed choices when selecting coverage and providers.

The Professional Lens: Insuring in Florida

For insurance professionals, operating in Florida presents both challenges and opportunities. The state’s dynamic market requires a nuanced understanding of the regulatory environment, consumer behavior, and risk management strategies.

Regulatory Compliance and Product Development

Insurers operating in Florida must navigate a complex regulatory landscape, ensuring compliance with the state’s unique No-Fault system and other relevant statutes. This involves developing products that meet the state’s coverage requirements while also offering competitive options to consumers. The challenge is to balance regulatory compliance with the need to provide comprehensive and affordable coverage.

Additionally, insurers must stay abreast of legislative changes and legal developments that could impact the market. This requires a dedicated focus on regulatory affairs and a proactive approach to product development and pricing.

Risk Management and Catastrophe Planning

Florida’s vulnerability to natural disasters is a critical consideration for insurers. Effective risk management strategies are essential to mitigate the financial impact of these events. This involves employing advanced modeling techniques to assess catastrophe risk, developing robust catastrophe plans, and maintaining sufficient reinsurance coverage.

Insurers must also consider the potential for severe weather to disrupt business operations and impact claim handling. Developing contingency plans and ensuring the resilience of their systems and processes is crucial to maintaining business continuity.

Market Trends and Consumer Behavior

Understanding consumer behavior and market trends is vital for insurers to develop effective marketing and sales strategies. Florida’s diverse population and unique geographical factors influence consumer preferences and purchasing behavior. Insurers must tailor their offerings to meet the specific needs of this market, considering factors such as language preferences, cultural nuances, and regional variations in risk profiles.

The Future of Insurance Auto Florida

Looking ahead, the future of auto insurance in Florida is likely to be shaped by a combination of technological advancements, regulatory changes, and evolving consumer expectations. Insurers will need to adapt to these dynamics to remain competitive and effectively serve their customers.

Technology and Innovation

The insurance industry is experiencing a wave of technological innovation, and Florida is no exception. Insurers are leveraging advanced analytics, machine learning, and telematics to improve risk assessment, pricing accuracy, and claim management. These technologies can help insurers better understand and manage risk, leading to more efficient and effective operations.

Additionally, the rise of connected and autonomous vehicles is likely to have a significant impact on the auto insurance market. Insurers will need to adapt their products and services to accommodate these new technologies, potentially leading to new coverage options and pricing models.

Regulatory and Legal Developments

Florida’s regulatory environment is subject to change, and insurers must stay informed to ensure compliance. Potential changes to the No-Fault system or other insurance-related statutes could significantly impact the market. Insurers will need to closely monitor legislative developments and be prepared to adapt their strategies accordingly.

Consumer Expectations and Market Competition

Consumer expectations are evolving, driven by increasing digital literacy and a demand for more personalized and efficient services. Insurers will need to invest in digital transformation to meet these expectations, offering seamless online and mobile experiences, and leveraging data to provide tailored coverage options.

Additionally, the market is likely to remain competitive, with new entrants and established players vying for market share. Insurers will need to differentiate themselves through innovative products, excellent customer service, and a strong understanding of the unique needs of the Florida market.

What are the average auto insurance rates in Florida, and how do they compare to other states?

+According to the Insurance Information Institute, the average annual premium for auto insurance in Florida was 2,212 in 2021, which is higher than the national average of 1,674. This difference is largely due to Florida’s unique legal and regulatory environment, as well as its vulnerability to natural disasters and high population density.

How can drivers in Florida reduce their insurance costs?

+Drivers can take several steps to reduce their insurance costs, including maintaining a clean driving record, shopping around for the best rates, and considering higher deductibles. Additionally, taking advantage of discounts for safe driving, multiple vehicles, or good grades can help lower premiums. Finally, understanding the coverage options and choosing the right combination of coverages for one’s needs can help optimize costs without sacrificing protection.

What is the role of reinsurance in the Florida auto insurance market, and how does it impact consumers and insurers?

+Reinsurance plays a critical role in the Florida auto insurance market by providing insurers with a means to transfer risk and protect their financial stability. By purchasing reinsurance, insurers can manage their exposure to large losses, particularly those associated with natural disasters. This helps to ensure that insurers can maintain adequate reserves and continue to provide coverage to consumers. For consumers, the presence of a robust reinsurance market can provide assurance that their insurer is financially stable and able to pay claims, even in the event of a catastrophe.