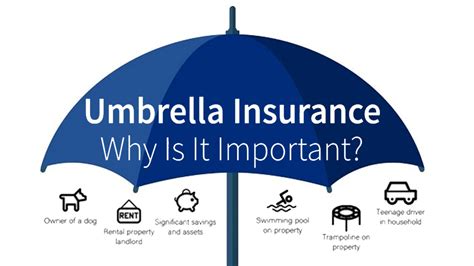

Umbrella Insurance

In today's world, where unforeseen events and liabilities can arise unexpectedly, having adequate insurance coverage is crucial. Umbrella insurance is an essential yet often overlooked type of policy that provides an extra layer of protection beyond standard liability limits. This comprehensive guide aims to delve into the world of umbrella insurance, exploring its intricacies, benefits, and real-world applications. By understanding the ins and outs of this policy, individuals and businesses can make informed decisions to safeguard their financial well-being.

Understanding Umbrella Insurance: A Comprehensive Overview

Umbrella insurance, often referred to as excess liability insurance, is a specialized type of policy designed to offer additional liability coverage above and beyond the limits of existing insurance policies. It acts as an umbrella, extending protection across various areas of one's life, including personal and business activities. This policy provides an extra layer of security, ensuring individuals and businesses are financially protected in the event of catastrophic losses or liability claims.

Imagine a scenario where an individual, despite having comprehensive auto and homeowners insurance, faces a lawsuit seeking damages exceeding the liability limits of these policies. In such cases, an umbrella policy can step in, providing the necessary coverage to protect the individual's assets and financial stability. Similarly, for businesses, umbrella insurance can safeguard against unexpected liabilities, ensuring that a single incident does not lead to financial ruin.

Key Features of Umbrella Insurance

-

Broad Coverage: Umbrella insurance offers extensive coverage, protecting against a wide range of liability claims, including bodily injury, property damage, personal injury (such as libel or slander), and more. It covers incidents that occur both on and off the insured's property, ensuring comprehensive protection.

-

Increased Liability Limits: One of the primary benefits of umbrella insurance is the substantial increase in liability limits. This policy typically provides coverage starting from $1 million, offering a significant boost to the limits provided by standard insurance policies.

-

Affordable Premiums: Despite the extensive coverage it offers, umbrella insurance is surprisingly affordable. Premiums are generally low compared to the high limits of coverage, making it an attractive option for individuals and businesses looking to enhance their liability protection.

Real-World Applications of Umbrella Insurance

Umbrella insurance finds its applications in various scenarios, providing peace of mind and financial security to policyholders. Here are some practical examples:

-

Auto Accidents: In the event of a severe car accident where the insured is at fault, resulting in significant property damage and injuries to multiple parties, umbrella insurance can step in to cover the excess liability costs beyond the limits of the auto insurance policy.

-

Homeowner's Liability: For homeowners, umbrella insurance provides an extra layer of protection against liability claims arising from accidents on their property. Whether it's a slip and fall incident or a child's injury during a neighborhood gathering, umbrella insurance can cover the costs of medical expenses and potential legal fees.

-

Business Operations: Small business owners often rely on umbrella insurance to protect their assets and personal finances from liability claims related to their business activities. This is especially crucial for industries with a higher risk of accidents or injuries, such as construction or hospitality.

-

Personal Injury Claims: Umbrella insurance can also cover personal injury claims, including defamation, invasion of privacy, or copyright infringement. These claims can be costly and time-consuming, and umbrella insurance provides the necessary financial backing to defend against such allegations.

How Umbrella Insurance Works: A Step-by-Step Guide

Understanding the mechanics of umbrella insurance is crucial to appreciating its value. Here's a step-by-step breakdown of how this policy functions:

1. Primary Insurance Coverage

Before an umbrella policy comes into play, primary insurance policies, such as auto, homeowners, or commercial general liability insurance, must be in effect. These primary policies provide the initial layer of protection, covering standard liability claims up to their specified limits.

2. Excess Liability Coverage

Once the liability limits of the primary insurance policies are exhausted, the umbrella policy kicks in. It provides excess liability coverage, stepping up to cover the remaining costs associated with the claim. This excess coverage ensures that policyholders are not left financially vulnerable in the event of a major loss or liability lawsuit.

3. Claims Process

When a liability claim arises, the insured individual or business should first report the incident to their primary insurance provider. The primary insurer will assess the claim and determine if it exceeds their liability limits. If so, the umbrella insurer is notified, and they will handle the excess coverage, working in coordination with the primary insurer.

4. Policy Limits and Deductibles

Umbrella insurance policies typically offer coverage limits starting from $1 million, with higher limits available upon request. The policy also includes a deductible, which is the amount the insured must pay out of pocket before the umbrella coverage takes effect. Deductibles can vary depending on the insurer and the specific policy.

| Policy Feature | Description |

|---|---|

| Coverage Limits | Starting from $1 million, with higher limits available |

| Deductibles | Varies by insurer and policy, typically ranging from $250 to $5,000 |

Benefits of Umbrella Insurance: A Comprehensive List

The advantages of umbrella insurance are numerous and far-reaching. Here's an overview of the key benefits this policy offers:

1. Enhanced Liability Protection

Umbrella insurance significantly increases liability protection, providing an extra layer of coverage beyond the limits of primary insurance policies. This added protection ensures that policyholders are financially secure in the face of unexpected and potentially devastating liability claims.

2. Peace of Mind

Knowing that you have an umbrella policy in place provides a sense of reassurance and peace of mind. Whether you're a homeowner, a business owner, or an individual with substantial assets, umbrella insurance offers the confidence that your financial well-being is protected against unforeseen liabilities.

3. Affordable Premium

Despite the extensive coverage it provides, umbrella insurance is surprisingly affordable. Premiums are generally low, making it an accessible option for individuals and businesses seeking to enhance their liability protection. The cost of an umbrella policy is often a small price to pay for the financial security it offers.

4. Broader Coverage

Umbrella insurance covers a wide range of liability claims, including bodily injury, property damage, personal injury, and more. This broad coverage ensures that policyholders are protected against various types of incidents, both on and off their property.

5. Protection for Assets

For individuals and businesses with substantial assets, umbrella insurance is essential. It safeguards their financial stability and prevents the liquidation of assets to cover liability claims. With an umbrella policy, policyholders can rest assured that their assets are protected, allowing them to focus on their business or personal goals.

Choosing the Right Umbrella Insurance Policy: A Guide

When it comes to selecting an umbrella insurance policy, several factors come into play. Here's a guide to help you make an informed decision:

1. Evaluate Your Risk Profile

Assess your personal or business risk profile to determine the level of liability coverage you require. Consider factors such as your assets, the nature of your business (if applicable), and any specific liabilities or exposures you may face.

2. Review Existing Insurance Policies

Examine your current insurance policies, including auto, homeowners, or commercial liability insurance. Understand their coverage limits and any exclusions or gaps in protection. This evaluation will help you identify where an umbrella policy can provide additional coverage.

3. Compare Insurance Providers

Research and compare different insurance providers offering umbrella insurance. Look for reputable insurers with a solid financial standing and a track record of providing reliable coverage. Consider factors such as policy limits, deductibles, and additional benefits or perks offered by each provider.

4. Consult with Insurance Professionals

Seek advice from insurance brokers or agents who specialize in umbrella insurance. They can provide expert guidance based on your specific needs and circumstances. An insurance professional can help you tailor your policy to ensure it aligns with your risk profile and provides adequate protection.

5. Read the Policy Documents

Before purchasing an umbrella insurance policy, carefully review the policy documents. Understand the coverage limits, deductibles, exclusions, and any specific terms or conditions. Ensure that the policy meets your expectations and provides the level of protection you require.

Frequently Asked Questions (FAQ)

How much does umbrella insurance cost?

+The cost of umbrella insurance varies depending on several factors, including the policy limits, the insured's risk profile, and the insurance provider. On average, umbrella policies start at around $150 to $300 per year for a $1 million limit. However, the premium can increase with higher coverage limits and specific endorsements.

Can I purchase umbrella insurance as a standalone policy, or do I need primary insurance coverage first?

+Umbrella insurance typically requires you to have primary insurance coverage in place first. This means you need to have policies like auto insurance, homeowners insurance, or commercial general liability insurance before adding an umbrella policy. The umbrella policy provides excess liability coverage above the limits of your primary policies.

Are there any exclusions or limitations to umbrella insurance coverage?

+Yes, like any insurance policy, umbrella insurance has certain exclusions and limitations. These may vary depending on the insurer and the specific policy. Common exclusions include intentional acts, certain types of business activities, and certain types of professional services. It's important to review the policy documents carefully to understand any exclusions or limitations that apply to your coverage.

How does an umbrella insurance policy handle multiple claims or incidents?

+Umbrella insurance policies are designed to provide excess liability coverage for multiple claims or incidents that occur during the policy period. The policy will cover the excess amounts above the limits of your primary insurance policies for each claim, up to the policy's overall limit. However, it's important to note that some policies may have specific limits or sub-limits for certain types of claims.

In conclusion, umbrella insurance is a vital component of any comprehensive insurance portfolio. It offers an extra layer of protection, ensuring that individuals and businesses are financially secure in the face of unexpected liabilities. With its affordable premiums, broad coverage, and peace of mind, umbrella insurance is an essential safeguard against potential financial disasters. By understanding its workings and benefits, policyholders can make informed decisions to protect their assets and future.