Auto Insurance Meaning

Auto insurance, often referred to as car insurance or vehicle insurance, is a vital financial safeguard designed to protect individuals and their vehicles from a wide range of risks and liabilities associated with owning and operating a motor vehicle. It is a mandatory requirement in most countries and plays a crucial role in ensuring the safety and security of drivers, passengers, and other road users. This comprehensive guide aims to delve into the world of auto insurance, exploring its meaning, importance, and the various aspects that make it an indispensable part of modern transportation.

Understanding Auto Insurance

Auto insurance is a contract between an individual (the policyholder) and an insurance company. In exchange for regular premium payments, the insurance provider agrees to financially protect the policyholder against losses and damages arising from specific events, as outlined in the insurance policy.

Key Components of Auto Insurance

- Liability Coverage: This is the most fundamental aspect of auto insurance. It covers the policyholder’s legal responsibility for bodily injury or property damage to others as a result of an at-fault accident.

- Comprehensive Coverage: This optional coverage protects against non-collision-related incidents, such as theft, vandalism, natural disasters, and animal collisions. It provides financial protection for the policyholder’s vehicle.

- Collision Coverage: Collision coverage is designed to cover the cost of repairing or replacing the policyholder’s vehicle after an accident, regardless of fault. It offers protection against physical damage to the insured vehicle.

- Medical Payments (MedPay): MedPay coverage assists with the medical expenses of the policyholder and their passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder in the event of an accident with a driver who has no insurance or insufficient insurance to cover the damages.

| Coverage Type | Description |

|---|---|

| Liability | Covers bodily injury and property damage to others. |

| Comprehensive | Protects against non-collision incidents and natural disasters. |

| Collision | Covers physical damage to the insured vehicle. |

| Medical Payments (MedPay) | Assists with medical expenses for the policyholder and passengers. |

| Uninsured/Underinsured Motorist | Protects against accidents with uninsured or underinsured drivers. |

The Importance of Auto Insurance

Auto insurance serves multiple critical purposes in the modern world, ensuring the well-being of individuals and maintaining order in the transportation sector.

Financial Protection and Peace of Mind

One of the primary benefits of auto insurance is the financial security it provides. In the event of an accident, the policyholder can rest assured that their financial liabilities are covered, preventing devastating financial consequences. Auto insurance offers peace of mind, knowing that the costs associated with vehicle repairs, medical expenses, and legal settlements are managed effectively.

Legal Compliance and Safety

In most jurisdictions, auto insurance is a legal requirement for all vehicle owners. This mandate is in place to ensure that drivers are financially responsible for their actions on the road. By requiring auto insurance, governments aim to promote safety and reduce the financial burden on society as a whole when accidents occur.

Reduced Risk of Uninsured Motorists

Auto insurance also plays a crucial role in minimizing the risk of uninsured motorists. With a majority of drivers carrying insurance, the chances of an accident involving an uninsured driver are significantly reduced. This, in turn, protects insured drivers from bearing the full financial burden of an accident caused by an uninsured individual.

Accident Assistance and Support

In the unfortunate event of an accident, auto insurance providers offer invaluable assistance. They guide policyholders through the claims process, ensuring a smoother and less stressful experience. Additionally, insurance companies often provide access to a network of trusted repair shops and medical professionals, making it easier for policyholders to navigate the aftermath of an accident.

How Auto Insurance Works

The process of obtaining and utilizing auto insurance involves several key steps, each designed to ensure a smooth and efficient experience for policyholders.

Policy Selection and Purchase

Individuals seeking auto insurance can compare policies offered by various insurance companies. Factors such as coverage types, limits, deductibles, and premiums are carefully considered. Once a suitable policy is identified, the policyholder purchases the insurance by paying the initial premium.

The Claims Process

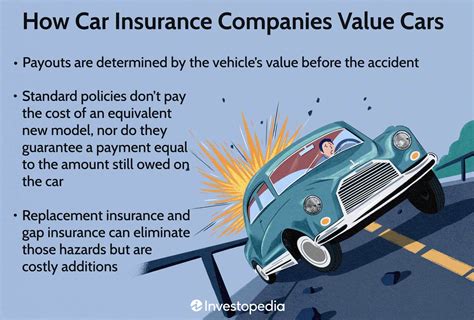

In the event of an accident or a covered incident, policyholders must report the claim to their insurance provider. The insurance company will then assess the claim, investigate the circumstances, and determine the extent of coverage based on the policy terms. If the claim is approved, the insurance company will provide the necessary financial assistance, either by directly paying the repair or medical expenses or by reimbursing the policyholder.

Policy Renewal and Updates

Auto insurance policies typically have a set term, often lasting one year. Policyholders must renew their insurance to maintain continuous coverage. During the renewal process, individuals can make adjustments to their policy, such as increasing or decreasing coverage limits or adding new drivers to the policy.

Factors Influencing Auto Insurance Rates

Auto insurance rates are determined by a variety of factors, each playing a role in assessing the risk associated with insuring a particular individual or vehicle. Understanding these factors can help policyholders make informed decisions and potentially reduce their insurance costs.

Driver Profile

- Age: Younger and less experienced drivers often face higher insurance premiums due to their increased risk of accidents.

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower insurance rates.

- Credit Score: In some regions, insurance companies consider an individual’s credit score when determining insurance rates, as it is seen as an indicator of financial responsibility.

Vehicle Factors

- Make and Model: Certain vehicle makes and models may be more expensive to insure due to their repair costs or theft risks.

- Vehicle Age: Older vehicles may have lower insurance premiums as they are generally less valuable and may not require extensive repairs.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes or airbags, often qualify for lower insurance rates.

Location and Usage

- Geographic Location: Insurance rates can vary based on the policyholder’s residence, as some areas may have higher rates of accidents or claims.

- Usage: The primary use of the vehicle, whether for commuting, business, or pleasure, can impact insurance rates.

- Mileage: Vehicles with higher annual mileage may be considered a higher risk, leading to increased insurance premiums.

Other Factors

- Insurance Provider: Different insurance companies offer varying rates and coverage options, so shopping around can lead to better deals.

- Discounts: Policyholders can often qualify for discounts based on factors such as safe driving records, multiple policies with the same insurer, or membership in certain organizations.

Tips for Choosing the Right Auto Insurance

Selecting the right auto insurance policy involves careful consideration and research. Here are some tips to guide individuals through the process:

Understand Your Needs

Before purchasing auto insurance, assess your specific needs and circumstances. Consider factors such as your driving record, the value of your vehicle, and any unique requirements you may have. This will help you determine the coverage types and limits that are most suitable for you.

Compare Multiple Providers

Don’t settle for the first insurance quote you receive. Compare rates and coverage options from multiple insurance companies. Online comparison tools can make this process more efficient and provide a clear overview of the market.

Review Policy Terms

When evaluating insurance policies, pay close attention to the fine print. Understand the coverage limits, deductibles, and any exclusions or limitations. Ensure that the policy aligns with your expectations and provides adequate protection.

Consider Bundling Policies

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with the same insurer. Many insurance companies offer discounts for policyholders who combine multiple policies, resulting in potential cost savings.

Ask for Discounts

Inquire about available discounts. Insurance companies often offer discounts for safe driving records, good grades (for young drivers), vehicle safety features, and loyalty (renewing with the same insurer for multiple years). Taking advantage of these discounts can reduce your insurance premiums.

Seek Expert Advice

If you’re unsure about the best auto insurance options for your situation, consider consulting with an insurance agent or broker. These professionals can provide personalized advice and help you navigate the complex world of insurance policies.

Future Trends in Auto Insurance

The auto insurance industry is evolving rapidly, driven by technological advancements and changing consumer expectations. Here are some trends shaping the future of auto insurance:

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance (UBI) are gaining popularity. These technologies track driving behavior, such as acceleration, braking, and mileage, and provide insurance rates based on actual driving habits. This allows for more accurate risk assessment and potentially lower premiums for safe drivers.

Digital Transformation

The digital revolution is transforming the insurance industry. Policyholders now have access to online platforms and mobile apps, allowing them to manage their policies, file claims, and receive real-time updates. Digital transformation enhances efficiency and convenience for both insurance providers and policyholders.

Data Analytics and Personalization

Insurance companies are leveraging advanced data analytics to personalize insurance offerings. By analyzing vast amounts of data, insurers can tailor policies to individual needs, offering more precise coverage and pricing. This level of personalization ensures that policyholders receive insurance that aligns with their specific circumstances.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles presents a unique challenge for the insurance industry. As self-driving cars become more prevalent, insurance providers will need to adapt their policies to address the new risks and liabilities associated with this technology. Insurance coverage for autonomous vehicles will likely evolve to cover a wider range of scenarios.

Conclusion

Auto insurance is a vital component of modern transportation, providing financial protection and peace of mind to millions of drivers worldwide. By understanding the meaning, importance, and various aspects of auto insurance, individuals can make informed decisions to ensure their safety and security on the road. As the industry continues to evolve, embracing technological advancements and personalized insurance offerings, policyholders can expect a more efficient and tailored insurance experience.

What happens if I don’t have auto insurance?

+Driving without auto insurance is illegal in most jurisdictions. If caught, you may face fines, have your driver’s license suspended, and even face criminal charges. Additionally, you would be financially responsible for any damages or injuries caused in an accident, which can lead to significant financial hardship.

How do I choose the right coverage limits for my auto insurance policy?

+Choosing the right coverage limits involves considering your financial situation and the potential risks you face. It’s recommended to consult with an insurance agent who can guide you based on your specific circumstances. Generally, it’s advisable to have sufficient liability coverage to protect your assets and consider comprehensive and collision coverage to protect your vehicle.

Can I switch auto insurance providers at any time?

+Yes, you can switch auto insurance providers at any time. However, it’s important to ensure that you have continuous coverage to avoid any gaps in protection. When switching, compare rates and coverage options from multiple providers to find the best fit for your needs.