Why Car Insurance Went Up

The world of car insurance is a complex landscape, and understanding the factors that influence premium rates is crucial for both insurers and policyholders. In recent years, the cost of car insurance has seen a notable increase, prompting many to question the reasons behind this trend. This article aims to delve into the multifaceted aspects that contribute to rising car insurance premiums, shedding light on the economic, social, and technological forces at play. By exploring these factors, we can gain a comprehensive understanding of why car insurance rates have climbed and what the future may hold for this essential aspect of automotive ownership.

The Rising Cost of Car Insurance: A Multifaceted Analysis

The escalation in car insurance costs is a result of a convergence of various factors, each playing a unique role in the overall trend. From economic fluctuations to technological advancements, the insurance landscape is constantly evolving, and these changes directly impact the premiums that policyholders pay.

Economic Factors

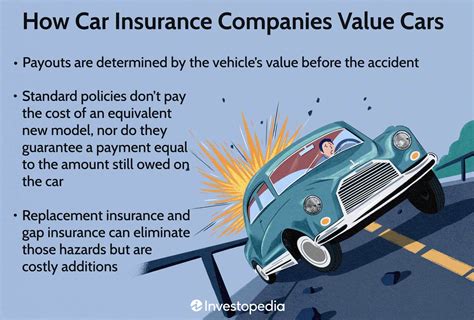

Economic conditions significantly influence the cost of car insurance. When the economy experiences inflation, the prices of goods and services rise, including those related to vehicle repairs and medical care. This increase in costs is often reflected in insurance premiums, as insurers must account for the higher expenses associated with paying out claims.

Additionally, economic recessions can also impact insurance rates. During economic downturns, unemployment rates tend to rise, leading to an increase in the number of uninsured drivers on the road. This poses a higher risk for insurers, who may then adjust their premiums accordingly to mitigate potential losses.

Changing Consumer Behavior

Consumer behavior has undergone significant shifts in recent years, particularly with the increasing adoption of technology. The rise of ride-sharing services and the growing popularity of electric vehicles have altered traditional driving patterns. These changes in consumer preferences can influence insurance rates, as insurers must adapt their coverage to accommodate these new trends.

Furthermore, the increasing use of smartphones and infotainment systems while driving has led to a rise in distracted driving incidents. This behavioral change contributes to a higher frequency of accidents, which in turn increases insurance claims and drives up premiums.

Technological Advancements and Their Impact

The automotive industry has witnessed rapid technological advancements, and these innovations have had a profound effect on car insurance rates. Advanced driver-assistance systems (ADAS), such as automatic emergency braking and lane-keeping assist, are becoming increasingly common in modern vehicles. While these technologies enhance safety, they also add complexity to the repair process, often requiring specialized equipment and training.

Moreover, the rise of connected cars and telematics has introduced new data points for insurers to consider. Telematics devices, which track driving behavior and provide real-time feedback, allow insurers to offer usage-based insurance (UBI) policies. These policies, while offering personalized rates, also present challenges in terms of data privacy and security.

Legal and Regulatory Changes

Changes in laws and regulations can have a direct impact on car insurance premiums. For instance, increases in minimum liability limits or the introduction of new coverage requirements can result in higher costs for insurers, which may then be passed on to policyholders.

Additionally, the implementation of no-fault insurance systems in some jurisdictions has led to a rise in insurance costs. While no-fault insurance aims to simplify the claims process, it can also result in higher overall payouts, particularly for medical expenses.

Catastrophic Events and Natural Disasters

The frequency and severity of natural disasters, such as hurricanes, floods, and wildfires, have been on the rise due to climate change. These events can result in significant property damage, including to vehicles. Insurers must factor in the increased risk of catastrophic losses when setting premiums, which can lead to higher rates for policyholders.

| Disaster Type | Average Cost Per Claim |

|---|---|

| Hurricanes | $15,000 |

| Floods | $10,000 |

| Wildfires | $7,500 |

Medical Costs and Injury Claims

The rising cost of medical care has a direct correlation with car insurance premiums. When medical expenses increase, the potential payout for injury claims also rises, leading to higher insurance costs. Moreover, the increasing severity of injuries sustained in accidents, due to higher vehicle speeds and more complex crashes, can further drive up the cost of insurance.

Mitigating Rising Costs: Strategies for Insurers and Consumers

In the face of rising car insurance premiums, both insurers and consumers have strategies to navigate this complex landscape. Insurers are adopting innovative approaches to risk assessment and pricing, while consumers can take steps to reduce their own insurance costs.

Insurers’ Strategies for Managing Rising Costs

Insurers are employing advanced analytics and machine learning to more accurately assess risk and set premiums. By leveraging data-driven insights, insurers can identify patterns and trends that traditional methods may miss, allowing for more precise pricing.

Additionally, insurers are exploring partnerships with technology companies to develop innovative solutions. For instance, collaborating with ride-sharing platforms can provide insurers with valuable data on driver behavior, helping them offer more tailored insurance products.

Consumer Strategies for Reducing Insurance Costs

Consumers have several options to potentially reduce their car insurance premiums. One effective strategy is to maintain a clean driving record. Insurers often offer discounts to drivers with no at-fault accidents or moving violations. By practicing safe driving habits, consumers can not only reduce their risk of accidents but also potentially lower their insurance costs.

Another approach is to shop around and compare quotes from multiple insurers. Insurance rates can vary significantly between providers, so obtaining multiple quotes can help consumers find the most competitive rates.

The Future of Car Insurance: Trends and Predictions

Looking ahead, several trends and predictions suggest how the car insurance landscape may evolve in the coming years.

The Rise of Telematics and Usage-Based Insurance

Telematics and usage-based insurance (UBI) are expected to play an increasingly significant role in the car insurance market. As more drivers embrace technology, insurers are likely to offer more UBI policies, which reward safe driving habits with lower premiums. This trend has the potential to revolutionize the insurance industry, as it shifts the focus from historical data to real-time driving behavior.

Increased Automation and AI Integration

The integration of automation and artificial intelligence (AI) is set to transform various aspects of the insurance industry, including claims processing and risk assessment. AI-powered systems can analyze vast amounts of data, detect patterns, and make predictions, enabling insurers to make more informed decisions and offer more accurate pricing.

Sustainable and Electric Vehicle Trends

The growing popularity of sustainable and electric vehicles (EVs) is expected to influence car insurance rates. While EVs may initially be more expensive to insure due to their higher purchase price and specialized repair needs, the long-term trend is likely to be downward. As EV technology matures and becomes more widespread, insurers may offer more competitive rates for these vehicles, reflecting their potentially lower risk profile.

The Impact of Autonomous Vehicles

The introduction of autonomous vehicles (AVs) is poised to revolutionize road safety and, consequently, the car insurance industry. While the full transition to AVs may take time, the potential for significantly reduced accident rates could lead to lower insurance premiums. However, the transition period may present challenges, as insurers navigate the complex liability and coverage issues associated with AV technology.

Conclusion: Navigating the Evolving Insurance Landscape

The world of car insurance is in a constant state of flux, influenced by economic, social, and technological forces. Rising insurance premiums reflect the complex interplay of these factors, and understanding this landscape is essential for both insurers and consumers. By embracing innovation, data-driven insights, and a focus on safety, the insurance industry can navigate these challenges and continue to provide essential coverage to drivers worldwide.

What are some common factors that can lead to an increase in car insurance premiums for individual drivers?

+

Several factors can influence an individual’s car insurance premiums, including their driving record, the type of vehicle they drive, and their location. Drivers with a history of accidents or moving violations may face higher premiums, as they are considered a higher risk. Similarly, sports cars or luxury vehicles often have higher insurance costs due to their higher replacement value and repair costs. Additionally, drivers in urban areas or regions with high accident rates may also see higher insurance rates.

How do changes in vehicle technology, such as the adoption of electric vehicles, impact insurance rates?

+

The shift towards electric vehicles (EVs) can have both positive and negative impacts on insurance rates. On the one hand, EVs are generally considered safer due to their advanced safety features and lower risk of fire. This could lead to lower insurance premiums for EV owners. However, EVs also have higher replacement and repair costs, which can result in higher insurance rates. Additionally, the limited availability of specialized repair facilities for EVs may also impact insurance costs.

What steps can consumers take to potentially reduce their car insurance premiums?

+

Consumers have several options to potentially lower their car insurance costs. Maintaining a clean driving record is essential, as insurers often offer discounts to drivers with no at-fault accidents or moving violations. Shopping around and comparing quotes from multiple insurers can also help consumers find the most competitive rates. Additionally, bundling insurance policies (e.g., combining car and home insurance) can sometimes result in discounts. Finally, understanding the coverage options and choosing the right level of coverage for their needs can help consumers avoid overpaying for insurance.