Average Renters Insurance Cost Per Month

Renters insurance is an essential yet often overlooked form of protection for individuals living in rental properties. It provides coverage for personal belongings, liability, and additional living expenses in the event of unforeseen circumstances. The cost of renters insurance varies significantly depending on several factors, including the location, coverage limits, and the provider. Understanding the average monthly cost can help renters make informed decisions about their insurance coverage.

Factors Influencing Renters Insurance Costs

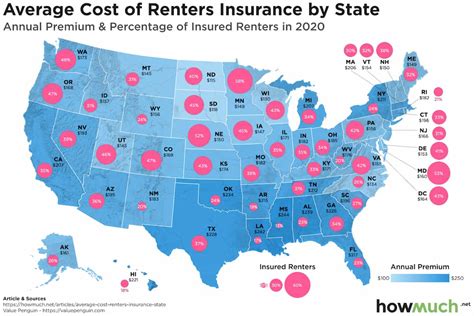

The price of renters insurance is influenced by a multitude of factors. Firstly, location plays a pivotal role in determining the cost. Areas with higher crime rates, natural disaster risks, or a dense population may experience elevated insurance premiums. For instance, a renter in a metropolitan city like New York City might pay more for insurance compared to someone residing in a rural area with a lower risk profile.

The coverage limits chosen by the renter also impact the cost. Renters insurance typically offers coverage for personal property, liability, and additional living expenses. Higher coverage limits will naturally result in a higher premium. It's crucial for renters to carefully assess their needs and choose coverage limits that provide adequate protection without being excessive.

The deductible amount selected can also affect the monthly cost. A higher deductible typically results in a lower monthly premium, while a lower deductible means a higher premium. Renters should consider their financial situation and risk tolerance when deciding on a deductible amount.

Furthermore, policy add-ons can increase the cost of renters insurance. Additional coverage for specific items like jewelry, artwork, or electronics may be available, but these come at an extra cost. Renters should evaluate their valuable possessions and decide if such add-ons are necessary.

Average Monthly Renters Insurance Costs

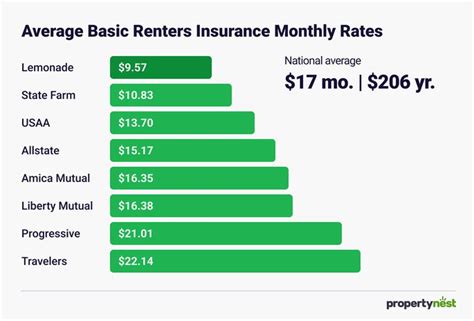

According to industry data and surveys, the average monthly cost of renters insurance in the United States ranges from 15 to 30, depending on the factors mentioned above. This estimate provides a general idea, but actual costs can vary significantly.

In certain states like Texas, the average monthly premium for renters insurance is around $16, making it one of the most affordable states for this coverage. On the other hand, states like New York and California often have higher average premiums, with costs ranging from $20 to $30 per month.

It's worth noting that these averages are based on standard coverage limits and deductibles. Renters who opt for higher coverage limits or lower deductibles can expect to pay more, potentially pushing their monthly premiums above the average range.

| State | Average Monthly Premium |

|---|---|

| Texas | $16 |

| New York | $25 |

| California | $28 |

| Florida | $22 |

| Illinois | $18 |

Tips for Reducing Renters Insurance Costs

Renters insurance is an investment in your financial security, but there are strategies to keep the costs manageable. Here are some tips to potentially reduce your monthly premiums:

- Bundle with other insurance policies: Many insurance companies offer discounts when you bundle multiple policies, such as renters and auto insurance. This can lead to significant savings.

- Increase your deductible: Opting for a higher deductible can lower your monthly premium. However, ensure that the chosen deductible is an amount you can comfortably afford if the need arises.

- Choose the right coverage limits: Assess your personal property value and select coverage limits that adequately protect your belongings without being excessive. Overinsuring can lead to unnecessary costs.

- Look for discounts: Insurance providers often offer discounts for various reasons, such as being a loyal customer, having multiple policies with the same provider, or being a non-smoker. Inquire about these discounts to potentially reduce your premiums.

- Shop around: Don't settle for the first quote you receive. Compare quotes from multiple providers to find the best value. Online comparison tools can be a great resource for this.

The Importance of Renters Insurance

Despite the relatively low cost, renters insurance provides invaluable protection for renters. It safeguards personal belongings against various risks, including theft, fire, and water damage. Additionally, it offers liability coverage in case someone gets injured on your rental property, and it can provide financial assistance for temporary living expenses if your home becomes uninhabitable due to a covered event.

While the average monthly cost of renters insurance is generally affordable, it's essential to tailor your coverage to your specific needs. By understanding the factors that influence insurance costs and following the tips provided, you can find a policy that offers adequate protection at a reasonable price.

Conclusion

Renters insurance is an affordable and essential form of protection for individuals living in rental properties. By being aware of the factors that influence insurance costs and taking steps to reduce premiums, renters can secure the coverage they need without breaking the bank. Remember, while the average monthly cost provides a general guideline, it’s always advisable to compare quotes and tailor your policy to your unique circumstances.

What is the purpose of renters insurance?

+

Renters insurance provides coverage for personal belongings, liability, and additional living expenses in the event of unforeseen circumstances such as theft, fire, or water damage.

How much does renters insurance typically cost per month?

+

The average monthly cost of renters insurance in the United States ranges from 15 to 30, but this can vary significantly based on factors like location, coverage limits, and deductibles.

What factors influence the cost of renters insurance?

+

The cost of renters insurance is influenced by location, coverage limits, deductibles, and policy add-ons. Locations with higher crime rates or natural disaster risks may have higher premiums. Higher coverage limits and lower deductibles generally result in higher premiums.