Cost For Homeowners Insurance

Homeowners insurance is a crucial aspect of protecting one's financial interests and ensuring peace of mind. It acts as a safety net, covering various aspects of homeownership, from the physical structure to personal belongings and even liability. However, the cost of this insurance can vary significantly depending on numerous factors, making it a topic of interest for prospective and current homeowners alike. Understanding these costs is essential for making informed decisions about insurance coverage.

Understanding the Variables in Homeowners Insurance Costs

The cost of homeowners insurance is influenced by a multitude of factors, each contributing to the overall premium. These variables can be broadly categorized into two main groups: factors related to the home itself and factors related to the policyholder’s personal circumstances. Let’s delve into each of these categories to gain a comprehensive understanding.

Home-Related Factors

The characteristics of your home play a pivotal role in determining the cost of your insurance. Insurers consider a range of aspects, including:

- Location: The geographical location of your home is a significant factor. Areas prone to natural disasters like hurricanes, tornadoes, or earthquakes typically attract higher insurance premiums due to the increased risk. Similarly, regions with a higher crime rate may also see elevated insurance costs.

- Construction and Age: The materials used in the construction of your home and its age are crucial. Homes built with fire-resistant materials or located in fire-safe zones may enjoy lower premiums. Likewise, newer homes are often considered less risky than older ones due to potential wear and tear and outdated electrical or plumbing systems.

- Square Footage and Design: Larger homes generally require more insurance coverage, leading to higher premiums. Additionally, the architectural design can impact costs; for instance, homes with intricate designs or unique features may require specialized coverage, adding to the overall expense.

- Claim History: If your home has a history of insurance claims, it can influence future premiums. Multiple claims, especially within a short period, may indicate a higher risk, potentially leading to increased costs.

- Security Features: The presence of security systems, fire alarms, and other safety measures can work in your favor, reducing insurance costs. These features not only protect your home but also make it less likely for insurers to face significant payouts.

Policyholder-Related Factors

Apart from the home’s characteristics, the personal circumstances of the policyholder also play a pivotal role in determining insurance costs. These factors include:

- Credit Score: Surprisingly, your credit score can impact your insurance premium. Many insurers use credit-based insurance scores to assess risk, with higher scores often resulting in lower premiums.

- Claims History: Your personal history with insurance claims can influence rates. A history of multiple claims, especially if they are deemed preventable, may lead to higher premiums.

- Deductible Choice: The deductible you select for your policy can significantly impact your premium. Opting for a higher deductible usually means lower premiums, as you'll be covering more of the cost in the event of a claim.

- Bundling Policies: Insurers often offer discounts when you bundle multiple policies, such as homeowners and auto insurance, with them. This can lead to substantial savings on your overall insurance costs.

- Discounts and Rewards: Many insurers provide discounts for various reasons, such as loyalty, installing safety features, or even for being a non-smoker. These discounts can reduce the overall cost of your insurance.

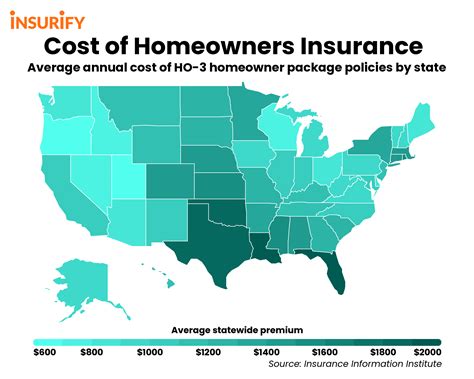

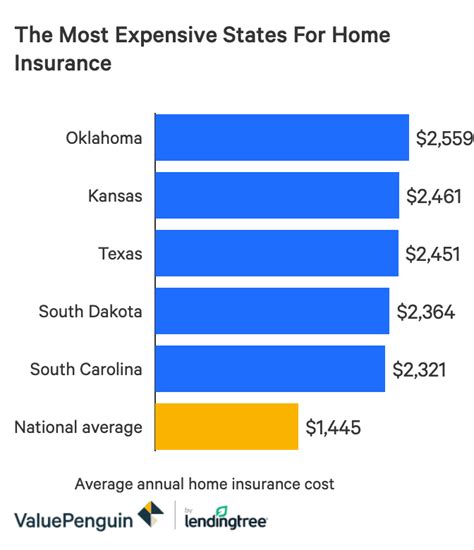

Comparative Analysis: Understanding Average Costs

To gain a clearer perspective on homeowners insurance costs, let’s examine some average premiums based on real-world data. These figures provide a benchmark to help homeowners understand the financial commitment associated with this essential coverage.

| Average Annual Premium by State | Average Annual Premium (USD) |

|---|---|

| Louisiana | 2,951 |

| Florida | 2,500 |

| Oklahoma | 2,135 |

| Texas | 2,080 |

| California | 1,776 |

| Alabama | 1,749 |

| Ohio | 1,279 |

| Indiana | 1,262 |

| North Carolina | 1,184 |

| Missouri | 1,122 |

It's essential to note that these averages provide a broad overview and that individual circumstances can significantly impact the actual premium. Factors like the home's value, location, and the policyholder's personal situation can cause premiums to deviate from these averages.

Case Study: Exploring a Specific Scenario

Let’s consider a hypothetical case study to illustrate how these variables come into play when calculating homeowners insurance costs. Imagine a family living in a suburban area of a mid-sized city. Their home, a 2,500 square foot, two-story house built in the 1980s, is located in a relatively low-crime area with minimal natural disaster risks. The family has excellent credit, has never filed an insurance claim, and opts for a higher deductible to save on premiums.

In this scenario, the average annual premium for homeowners insurance might fall around $1,500. However, with their specific circumstances, including the higher deductible and their excellent credit, they could potentially reduce this premium to $1,200 or even lower. This example highlights how understanding your personal circumstances and the characteristics of your home can help you navigate the often complex world of homeowners insurance costs.

Maximizing Savings: Strategies for Lower Premiums

While the cost of homeowners insurance can vary significantly, there are strategies you can employ to potentially reduce your premiums. Here are some expert tips to help you save:

Bundling Policies

Consider bundling your insurance policies. Many insurers offer discounts when you purchase multiple policies from them, such as combining your homeowners and auto insurance. This can lead to substantial savings and is a simple way to reduce your overall insurance costs.

Increase Your Deductible

Opting for a higher deductible can significantly lower your premiums. While this means you’ll have to pay more out of pocket in the event of a claim, it can be a worthwhile trade-off if you’re looking to save money on your insurance.

Review Your Coverage Regularly

Insurance needs can change over time, so it’s essential to review your coverage annually. Ensure that your policy aligns with your current needs and circumstances. Regular reviews can help you identify areas where you might be overinsured or underinsured, allowing you to make necessary adjustments and potentially save money.

Explore Discounts

Insurers often provide a range of discounts, from loyalty discounts to those for installing safety features. Take the time to understand the discounts offered by your insurer and see if you qualify for any. These discounts can add up and make a significant difference in your overall premium.

Maintain a Good Credit Score

Your credit score can impact your insurance premium. Maintaining a good credit score can help you qualify for lower rates. If your credit score is less than ideal, consider taking steps to improve it, which can benefit not only your insurance costs but also other areas of your financial life.

Future Implications: Trends in Homeowners Insurance

As we look ahead, it’s essential to consider the evolving landscape of homeowners insurance. The industry is constantly adapting to new risks and technological advancements, which can impact both the cost and coverage of policies.

Climate Change and Natural Disasters

The increasing frequency and severity of natural disasters due to climate change are expected to influence insurance costs. Areas at higher risk of wildfires, hurricanes, or floods may see premiums rise to reflect this increased risk. Insurers are likely to continue developing more sophisticated models to assess and manage these risks, which could impact coverage availability and costs.

Technological Innovations

Advancements in technology are also shaping the homeowners insurance landscape. The use of smart home devices and sensors can provide real-time data on potential risks, allowing insurers to offer more tailored coverage. Additionally, the integration of artificial intelligence and machine learning can enhance risk assessment and potentially lead to more efficient and accurate pricing models.

Changing Consumer Expectations

As consumer expectations evolve, so too must the insurance industry. Homeowners are increasingly seeking more personalized and flexible coverage options. Insurers are responding by offering a wider range of policy choices, allowing policyholders to customize their coverage to fit their specific needs. This trend is likely to continue, with insurers focusing on providing tailored solutions to meet individual consumer demands.

Conclusion: Navigating the Cost of Homeowners Insurance

Understanding the cost of homeowners insurance is a complex but essential task for any homeowner. By considering the various factors that influence premiums and staying informed about industry trends, you can make informed decisions about your coverage. Remember, while costs are a significant consideration, it’s equally important to ensure you have adequate coverage to protect your financial interests and provide peace of mind.

As you navigate the world of homeowners insurance, keep in mind that every home and policyholder is unique. Your specific circumstances and the characteristics of your home will ultimately determine your insurance costs. By staying proactive, shopping around, and making informed choices, you can find the right balance between coverage and cost.

What is the average cost of homeowners insurance in the United States?

+The average cost of homeowners insurance in the U.S. varies widely depending on factors like location, home value, and policyholder circumstances. However, the national average annual premium is around $1,300, with premiums ranging from a few hundred dollars to several thousand dollars.

How can I reduce my homeowners insurance premium?

+There are several strategies to reduce your homeowners insurance premium. These include increasing your deductible, bundling policies with the same insurer, maintaining a good credit score, and reviewing your coverage regularly to ensure you’re not overinsured.

What factors influence the cost of homeowners insurance?

+The cost of homeowners insurance is influenced by various factors, including the location and construction of the home, the policyholder’s credit score and claims history, the deductible chosen, and any discounts or rewards available. The home’s value and the level of coverage desired also play a significant role.

Are there any ways to get discounts on homeowners insurance?

+Yes, insurers often offer a range of discounts. These can include loyalty discounts for staying with the same insurer, discounts for bundling policies, and rewards for installing safety features like smoke detectors or security systems. Some insurers also offer discounts for certain professions or affiliations.