Cost Of General Liability Insurance

General liability insurance is a cornerstone of business protection, safeguarding companies against a range of potential risks. This policy is designed to cover legal costs and damages if your business is sued for various reasons, including bodily injury, property damage, and advertising injuries. While the benefits of this insurance are well-established, the cost can vary significantly, making it a crucial factor for businesses to consider when budgeting and planning.

In this comprehensive guide, we will delve into the intricacies of general liability insurance costs, exploring the factors that influence them, providing real-world examples, and offering insights to help businesses make informed decisions. By the end of this article, you should have a clearer understanding of the costs involved and the steps you can take to find the right coverage for your business needs.

Factors Influencing the Cost of General Liability Insurance

Industry and Business Type

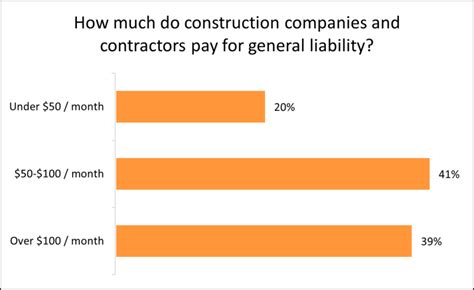

The industry your business operates in plays a significant role in determining the cost of your general liability insurance. High-risk industries, such as construction, manufacturing, and healthcare, typically face higher premiums due to the increased likelihood of accidents, injuries, or property damage. In contrast, low-risk industries, like consulting or graphic design, may enjoy more affordable rates.

Additionally, the specific nature of your business can impact insurance costs. For instance, a restaurant faces different risks compared to a software development company. Restaurants may need to consider food-related liabilities, slip-and-fall accidents, and other hazards, while software companies might prioritize data breaches and intellectual property concerns.

Location

The geographical location of your business is another critical factor. Insurance providers assess regional risks, including local crime rates, weather patterns, and the cost of living. Areas with a higher likelihood of natural disasters or a history of frequent lawsuits may experience higher insurance costs.

Policy Limits and Deductibles

The policy limits and deductibles you choose will directly affect your insurance premiums. Higher policy limits provide more extensive coverage but will cost more. Similarly, opting for a lower deductible (the amount you pay out of pocket before the insurance kicks in) can reduce your financial burden in the event of a claim but will result in higher premiums.

| Policy Limit | Annual Premium |

|---|---|

| $1,000,000 | $1,200 |

| $2,000,000 | $1,800 |

| $5,000,000 | $3,600 |

Claim History and Business Reputation

Insurance providers assess your business’s claim history and overall reputation when calculating premiums. A history of frequent claims or a reputation for high-risk activities may result in higher insurance costs. Conversely, a clean claim record and a positive reputation can lead to more favorable rates.

Size and Growth of the Business

The size and growth trajectory of your business are also considered. Larger businesses with a greater number of employees, customers, or clients are typically viewed as higher risk, leading to increased insurance costs. Similarly, rapidly expanding businesses may face higher premiums as they take on new risks and expand their operations.

Additional Coverage Options

The cost of general liability insurance can be impacted by the inclusion of additional coverage options. Depending on your business needs, you might consider adding endorsements or riders to your policy to address specific risks. For example, a retail store might opt for product liability coverage to protect against claims arising from defective products.

Real-World Examples of General Liability Insurance Costs

Small Business Case Study: A Local Bakery

Consider a small, family-owned bakery in a suburban town. This business primarily serves walk-in customers and has a few employees. Their annual general liability insurance premium might cost around 600 to 800, depending on their policy limits and deductibles. This relatively low cost reflects the bakery’s low-risk nature and the limited scope of its operations.

Mid-Sized Business Example: A Construction Company

A mid-sized construction company with multiple projects and a team of skilled workers would face significantly higher insurance costs due to the inherent risks in the construction industry. Annual premiums for this business could range from 5,000 to 10,000 or more, depending on the scale and complexity of their operations.

Large Enterprise: An E-commerce Giant

A large e-commerce company with a global reach and millions of customers would require extensive general liability coverage. Their insurance costs could exceed $100,000 annually, as they face a multitude of risks, including data breaches, product liability, and international legal complexities.

Strategies to Mitigate General Liability Insurance Costs

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Online tools and insurance brokers can help you gather multiple quotes to ensure you’re getting the best rate for your business.

Bundle Your Insurance Policies

Consider bundling your general liability insurance with other business insurance policies, such as commercial property insurance or business owner’s policies (BOPs). Bundling can often lead to discounted rates and simplified policy management.

Implement Risk Management Strategies

Implementing effective risk management strategies can help reduce the likelihood of claims and, consequently, lower your insurance costs. This might include employee training programs, safety protocols, and regular equipment maintenance to minimize accidents and injuries.

Review and Adjust Coverage Regularly

Regularly review your insurance coverage to ensure it aligns with your business’s current needs and risks. As your business grows or changes, your insurance requirements may evolve as well. Adjusting your coverage to match your current situation can help you avoid overpaying for unnecessary coverage or underpaying for essential protections.

Future Implications and Industry Trends

The landscape of general liability insurance is constantly evolving, influenced by various factors such as changing regulations, technological advancements, and emerging risks. Here are some key trends and future implications to consider:

Adoption of Technology and Data Analytics

Insurance providers are increasingly leveraging technology and data analytics to assess risk and price policies more accurately. This trend may lead to more tailored insurance offerings and potentially lower costs for businesses that can demonstrate effective risk management through data.

Focus on Preventative Measures

The insurance industry is placing greater emphasis on preventative measures to reduce the likelihood of claims. This shift encourages businesses to invest in robust safety protocols, employee training, and other risk mitigation strategies, which can lead to reduced insurance costs over time.

Emerging Risks and Coverage Gaps

As businesses adapt to a rapidly changing world, new risks are emerging. These may include cybersecurity threats, climate change-related disasters, and shifts in consumer behavior. Staying abreast of these emerging risks and ensuring your insurance coverage addresses them will be crucial in the years ahead.

Collaborative Partnerships

Some insurance providers are exploring collaborative partnerships with businesses to actively manage risks. These partnerships may involve shared risk assessments, data sharing, and joint efforts to implement preventative measures. Such collaborations could lead to more innovative insurance solutions and potentially lower costs for participating businesses.

Conclusion

Understanding the cost of general liability insurance is a critical aspect of running a business. By familiarizing yourself with the factors that influence these costs and implementing strategies to mitigate them, you can make more informed decisions about your insurance coverage. Remember, the right insurance policy is not just about cost; it's about finding the right balance between protection and affordability to ensure your business is adequately safeguarded.

What is the average cost of general liability insurance for a small business?

+

The average cost of general liability insurance for a small business can vary significantly based on factors like industry, location, and policy limits. However, a typical range for small businesses is between 500 and 1,500 annually.

How can I reduce my general liability insurance costs?

+

To reduce costs, consider shopping around for quotes, bundling your insurance policies, implementing effective risk management strategies, and regularly reviewing your coverage to ensure it aligns with your business’s current needs.

Are there any additional coverage options I should consider for my business?

+

Depending on your industry and specific business needs, you might consider adding endorsements or riders for product liability, professional liability (errors and omissions), cyber liability, or business interruption coverage. Consulting with an insurance professional can help you determine which additional coverages are most appropriate for your business.