Looking Cheap Car Insurance

Welcome to the comprehensive guide on finding cheap car insurance! In this article, we'll explore the world of auto insurance and provide you with expert insights, tips, and strategies to secure the most affordable coverage for your vehicle. Whether you're a seasoned driver or a newcomer to the roads, understanding the factors that influence insurance costs is crucial to making informed decisions and saving money.

The quest for affordable car insurance is a top priority for many vehicle owners, as it directly impacts their monthly budgets and overall financial well-being. With the right knowledge and approach, you can navigate the complex insurance landscape and discover cost-effective options tailored to your specific needs.

So, let's embark on this journey together and uncover the secrets to obtaining cheap car insurance without compromising on quality and coverage.

Understanding the Factors that Influence Car Insurance Costs

Before diving into the strategies for finding cheap car insurance, it's essential to grasp the key factors that insurance companies consider when calculating premiums. These factors play a significant role in determining the cost of your policy and can vary depending on your unique circumstances.

1. Driving Record and History

Your driving record is a crucial factor in assessing insurance risk. Insurance providers carefully examine your history of accidents, traffic violations, and claims. A clean driving record with no major incidents or frequent claims can lead to lower insurance rates. On the other hand, multiple accidents or moving violations may result in higher premiums.

It's worth noting that the impact of your driving history on insurance costs can vary by state and insurance company. Some states place more emphasis on past accidents, while others focus on the overall number of claims made.

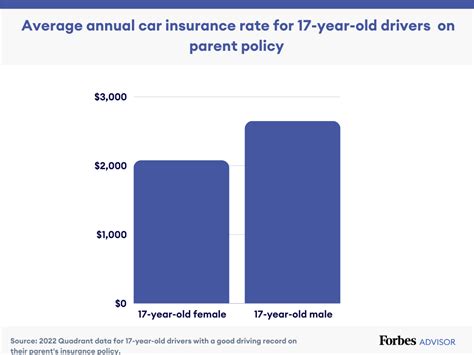

2. Age and Experience

Age and driving experience are closely intertwined when it comes to insurance rates. Young drivers, especially those under the age of 25, often face higher insurance costs due to their lack of experience on the road. Insurance companies statistically associate younger drivers with a higher risk of accidents and claims.

As drivers gain more experience and reach certain age milestones, insurance rates tend to decrease. This is because more experienced drivers have a better understanding of road safety and are less likely to be involved in accidents.

3. Vehicle Type and Usage

The type of vehicle you drive and its intended usage can significantly impact your insurance costs. Insurance companies consider factors such as the make, model, and age of your vehicle, as well as its safety features and repair costs. High-performance sports cars, for example, are often associated with higher insurance rates due to their increased risk of accidents and costly repairs.

Additionally, the purpose for which you use your vehicle can influence insurance premiums. Insurance companies may offer discounts for vehicles primarily used for pleasure driving or commuting, as opposed to commercial or business purposes.

4. Location and Mileage

Your geographical location and annual mileage can also affect your insurance rates. Insurance providers consider factors such as the population density, traffic conditions, and crime rates in your area. Urban areas with higher traffic congestion and crime rates may result in higher insurance premiums compared to rural or suburban regions.

Furthermore, the number of miles you drive annually can impact your insurance costs. Insurance companies may offer discounts for low-mileage drivers, as they are statistically less likely to be involved in accidents.

5. Credit Score and Insurance Score

Believe it or not, your credit score can play a role in determining your insurance rates. Many insurance companies use credit-based insurance scores to assess your financial responsibility and predict the likelihood of future claims. A higher credit score may lead to lower insurance premiums, as it indicates a lower risk of filing claims.

It's important to note that the use of credit-based insurance scores is not allowed in all states. However, in states where it is permitted, your credit score can be a significant factor in your insurance rates.

Strategies to Find Cheap Car Insurance

Now that we have a deeper understanding of the factors that influence car insurance costs, let's explore some effective strategies to secure cheap car insurance:

1. Shop Around and Compare Quotes

One of the most powerful tools at your disposal when searching for cheap car insurance is comparison shopping. Obtaining quotes from multiple insurance providers allows you to compare rates, coverage options, and discounts. Each insurance company has its own underwriting guidelines and pricing structures, so shopping around can reveal significant variations in premiums.

Online insurance comparison websites and insurance brokerages can simplify the process of gathering quotes from various providers. These platforms often have partnerships with multiple insurance companies, making it convenient to request and compare quotes in one place.

2. Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies together. By combining your car insurance with other types of insurance, such as homeowners, renters, or life insurance, you can often secure significant savings. Insurance companies appreciate the loyalty and convenience of having multiple policies with one provider.

For example, if you have a homeowners insurance policy with a particular company, inquire about potential discounts if you were to add your car insurance to the same provider. Bundling your policies can lead to reduced rates and streamlined billing.

3. Maintain a Good Driving Record

As mentioned earlier, your driving record is a critical factor in determining insurance rates. Maintaining a clean driving record by avoiding accidents and traffic violations can significantly impact your insurance costs. Insurance companies reward safe drivers with lower premiums, as they pose a lower risk of future claims.

If you have a less-than-perfect driving record, consider taking defensive driving courses or enrolling in safe driver programs. These courses can improve your driving skills, reduce the likelihood of accidents, and potentially lower your insurance premiums. Some insurance companies even offer discounts for completing such courses.

4. Explore Discounts and Savings Opportunities

Insurance companies offer a wide range of discounts and savings opportunities to attract and retain customers. By understanding the available discounts and meeting the eligibility criteria, you can maximize your savings on car insurance.

Some common discounts include:

- Safe Driver Discounts: As mentioned earlier, insurance companies reward safe drivers with lower premiums. If you have a clean driving record, be sure to inquire about safe driver discounts.

- Multi-Car Discounts: If you have multiple vehicles in your household, insuring them all with the same provider can lead to substantial savings. Many insurance companies offer discounts when you bundle multiple cars under one policy.

- Multi-Policy Discounts: Similar to multi-car discounts, bundling multiple insurance policies with the same provider can result in significant savings. Combine your car insurance with other types of insurance, such as homeowners or renters insurance, to maximize your discounts.

- Loyalty Discounts: Insurance companies often appreciate long-term customers and may offer loyalty discounts to those who have been with the provider for an extended period. If you've been a loyal customer, don't hesitate to inquire about potential loyalty rewards.

- Good Student Discounts: If you're a student or have a young driver in your household, some insurance companies offer discounts for maintaining good grades. Encourage academic excellence and take advantage of these incentives.

Be sure to ask your insurance agent or broker about the specific discounts offered by your provider and explore all the available opportunities to reduce your insurance costs.

5. Adjust Your Coverage Levels

The level of coverage you choose can significantly impact your insurance premiums. While it's essential to have adequate coverage to protect yourself financially in the event of an accident, you may be able to save money by adjusting certain coverage limits.

Consider your specific needs and assess the coverage levels that are appropriate for your situation. For example, if you own an older vehicle with low market value, you may opt for liability-only coverage or increase your deductible to reduce premiums. On the other hand, if you have a newer or more valuable vehicle, comprehensive and collision coverage may be necessary to protect your investment.

It's crucial to strike a balance between affordable coverage and adequate protection. Consult with an insurance professional to determine the coverage levels that best suit your needs and budget.

6. Consider Telematics or Usage-Based Insurance

Telematics or usage-based insurance programs offer a unique approach to calculating insurance premiums based on your actual driving behavior. These programs use technology, such as smartphone apps or onboard devices, to track your driving habits and provide real-time feedback.

By participating in telematics programs, you can potentially lower your insurance premiums by demonstrating safe driving habits. Insurance companies may offer discounts or reduced rates to drivers who consistently maintain safe driving practices, such as avoiding sudden braking, excessive speeding, or harsh acceleration.

However, it's important to note that telematics programs may not be available in all states or with all insurance providers. Additionally, these programs typically require the installation of additional devices or the use of smartphone apps, which may have associated costs.

7. Improve Your Credit Score

As mentioned earlier, your credit score can influence your insurance rates. A higher credit score indicates financial responsibility and can lead to lower insurance premiums. If you have a low credit score, taking steps to improve it can positively impact your insurance costs.

Consider reviewing your credit report for any errors or discrepancies and disputing them with the appropriate credit bureaus. Paying your bills on time, reducing credit card balances, and maintaining a healthy credit utilization ratio can all contribute to improving your credit score over time.

Keep in mind that the impact of your credit score on insurance rates may vary by state and insurance company. However, improving your credit score can have benefits beyond insurance, such as lower interest rates on loans and better financial stability.

FAQs: Unraveling Common Questions about Cheap Car Insurance

What is the cheapest type of car insurance coverage?

+

The cheapest type of car insurance coverage is typically liability-only insurance. This basic coverage option provides financial protection in the event of bodily injury or property damage to others caused by an at-fault accident. However, it does not cover damage to your own vehicle, theft, or other types of losses. It’s important to carefully assess your needs and consider additional coverage options to ensure adequate protection.

How much can I expect to save by comparing quotes from multiple insurance providers?

+

The amount of savings you can achieve by comparing quotes from multiple insurance providers can vary significantly. Factors such as your driving record, location, vehicle type, and coverage needs all play a role in determining insurance rates. By shopping around and comparing quotes, you can potentially save hundreds of dollars annually on your car insurance premiums. It’s worth investing the time and effort to find the most competitive rates.

Are there any downsides to bundling my car insurance with other policies?

+

While bundling your car insurance with other policies, such as homeowners or renters insurance, can lead to significant savings, there are a few potential downsides to consider. Firstly, you may become overly reliant on one insurance provider, limiting your options for future changes or adjustments. Additionally, if you encounter issues with one policy, it could impact your entire bundle. It’s important to carefully evaluate the benefits and potential drawbacks before deciding to bundle your policies.