Who Can Help Me Find Health Insurance

Finding the right health insurance coverage can be a daunting task, especially when navigating the complex healthcare system. Fortunately, there are several professionals and resources available to guide you through the process and ensure you make informed decisions about your healthcare needs. In this comprehensive guide, we will explore the various experts and services that can assist you in your search for the perfect health insurance plan.

Navigating the Healthcare Landscape: Who to Turn to for Guidance

When it comes to finding health insurance, it's essential to have a trusted advisor who understands your specific requirements and can provide personalized recommendations. Here are some key professionals and organizations that can offer assistance:

Licensed Insurance Agents and Brokers

Licensed insurance agents and brokers are experts in the field of health insurance. They have extensive knowledge of the various plans, networks, and coverage options available in your area. These professionals can assess your needs, explain the benefits and limitations of different policies, and help you compare and choose the most suitable plan. Insurance agents often work with multiple carriers, allowing them to provide unbiased advice and present a wide range of options.

Navigating Marketplace Exchanges

If you are looking for health insurance through the Affordable Care Act (ACA) marketplace, you can benefit from the assistance of navigators and certified application counselors. These professionals are trained to guide you through the enrollment process, answer questions about eligibility and subsidies, and ensure you understand the available plans. They can also provide valuable insights into the unique features and requirements of the marketplace.

Employer-Provided Benefits Advisors

Many employers offer health insurance as part of their benefits package. If this is the case for you, your employer may have dedicated benefits advisors or human resources professionals who can assist with insurance-related inquiries. These individuals can explain the coverage options available to you, help you understand the enrollment process, and address any concerns you may have about your employer-sponsored plan.

State-Specific Health Insurance Assistance Programs

Each state has its own unique health insurance landscape, and some states offer additional resources to assist residents in finding coverage. These programs often provide specialized assistance for specific demographics, such as seniors, families, or those with low incomes. You can research state-specific programs through your state’s insurance department or healthcare agency website.

Non-Profit Organizations and Community Health Centers

Non-profit organizations and community health centers play a vital role in providing healthcare access and education to underserved populations. Many of these organizations offer assistance with insurance enrollment, helping individuals understand their options and connect them with appropriate coverage. These resources are especially valuable for those who may face language barriers or have limited access to traditional insurance channels.

The Role of Technology in Finding Health Insurance

In today's digital age, technology has revolutionized the way we search for and compare health insurance plans. Online platforms and comparison tools have made it easier than ever to explore and understand your options.

Online Insurance Marketplaces

Online insurance marketplaces, such as eHealthInsurance and HealthCare.gov, offer a convenient way to shop for health insurance plans. These platforms provide a wealth of information about different policies, including provider networks, prescription drug coverage, and out-of-pocket costs. You can compare plans side by side, read reviews from other policyholders, and even apply for coverage directly through the website. Online marketplaces often have helpful tools and resources to guide you through the decision-making process.

Comparison Websites and Apps

Comparison websites and apps, like HealthPocket and PolicyGenius, allow you to input your specific needs and preferences to receive tailored recommendations. These platforms aggregate information from multiple insurance carriers, making it easy to compare plans based on factors such as price, coverage limits, and customer satisfaction. Some comparison tools even offer real-time quotes and the ability to purchase insurance directly.

Telehealth and Digital Health Resources

Telehealth services and digital health platforms are increasingly being used to provide insurance-related assistance. Many insurance companies now offer virtual consultations with licensed professionals who can answer questions about coverage, explain benefits, and help you navigate the claims process. Additionally, some digital health apps and websites provide educational resources and tools to help you understand your healthcare options and make informed choices.

The Importance of Personalized Advice

While technology and online resources can be incredibly helpful, nothing replaces the value of personalized advice from a knowledgeable expert. Here's why seeking guidance from a licensed insurance professional is essential:

- Understanding Complex Policies: Health insurance policies can be intricate and challenging to decipher. A licensed agent or broker can explain the fine print, clarify exclusions, and help you understand the potential costs and benefits of different plans.

- Tailored Recommendations: Insurance professionals take the time to learn about your unique circumstances, including your health needs, financial situation, and preferences. They can then provide tailored recommendations that align with your specific requirements, ensuring you find a plan that offers the coverage you need at a price you can afford.

- Assistance with Claims and Billing: Navigating the claims process and understanding billing statements can be daunting. Licensed insurance experts can guide you through these processes, ensuring you receive the coverage you are entitled to and helping you resolve any issues that may arise.

- Keeping Up with Changes: The healthcare industry is constantly evolving, with new policies, regulations, and coverage options emerging regularly. Insurance professionals stay up-to-date with these changes, ensuring they can provide you with the most accurate and relevant advice.

Making Informed Decisions: A Step-by-Step Guide

Now that you know who can help you find health insurance, let's explore a step-by-step process to guide you through the decision-making journey:

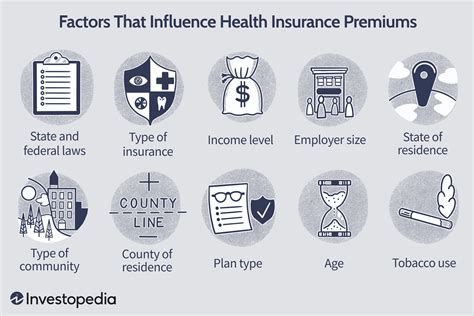

- Assess Your Needs: Start by evaluating your current and future healthcare needs. Consider factors such as your age, family size, pre-existing conditions, and preferred healthcare providers. Understanding your unique requirements will help you narrow down your options.

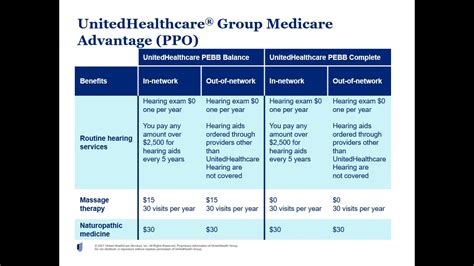

- Research Coverage Options: Explore the different types of health insurance plans available, including HMOs, PPOs, and EPOs. Research the networks, prescription drug coverage, and additional benefits offered by each plan. Online resources and comparison tools can be invaluable during this stage.

- Seek Professional Advice: Reach out to licensed insurance agents or brokers who can provide personalized recommendations based on your assessment. They can help you understand the nuances of different plans and guide you toward the most suitable options.

- Compare Costs and Benefits: Carefully evaluate the costs and benefits of the recommended plans. Consider not only the premium but also deductibles, copayments, and out-of-pocket maximums. Ensure the plan aligns with your budget and provides the coverage you need.

- Review Policy Details: Before making a final decision, thoroughly review the policy details, including the summary of benefits and coverage. Pay attention to exclusions, limitations, and any specific requirements for certain procedures or treatments.

- Enroll and Understand the Process: Once you've chosen a plan, enroll through the appropriate channel, whether it's an online marketplace, your employer, or directly with the insurance company. Make sure you understand the enrollment process and any necessary deadlines.

- Stay Informed and Ask Questions: Throughout the year, stay informed about changes to your coverage, such as network updates or policy renewals. Don't hesitate to reach out to your insurance provider or a licensed professional with any questions or concerns.

Frequently Asked Questions

What if I have a pre-existing condition? Can I still get health insurance?

+Yes, even with a pre-existing condition, you can still obtain health insurance. Under the Affordable Care Act (ACA), insurance companies are prohibited from denying coverage based on pre-existing conditions. However, it’s essential to carefully review the policy details to understand any limitations or exclusions that may apply to your specific condition.

How can I find affordable health insurance options?

+To find affordable health insurance, consider exploring the options available through the ACA marketplace, where you may qualify for subsidies based on your income. Additionally, compare plans from different carriers to find the most cost-effective option that meets your needs. Licensed insurance agents can also guide you toward affordable coverage.

Can I switch health insurance plans during the year?

+In most cases, health insurance plans have specific enrollment periods. You can typically only switch plans during these periods, which are often limited to open enrollment or special enrollment periods due to qualifying life events. However, some states may have additional enrollment options, so it’s best to check with your state’s insurance department.

What happens if I miss the enrollment deadline for health insurance?

+Missing the enrollment deadline can result in a gap in your health insurance coverage. However, there may be exceptions or special enrollment periods available in certain circumstances, such as losing your previous coverage or experiencing a significant life change. It’s essential to reach out to the appropriate authorities or insurance providers to understand your options.

How can I ensure I’m getting the best value for my health insurance premium?

+To get the best value for your premium, it’s crucial to compare plans based on your specific needs and preferences. Consider not only the premium cost but also the deductibles, copayments, and out-of-pocket maximums. Additionally, evaluate the network of providers and any additional benefits or perks offered by the plan. Seeking advice from a licensed insurance professional can help you make an informed decision.