Cheapest Place For Car Insurance

Finding the cheapest car insurance can be a daunting task, as rates vary greatly depending on various factors such as your location, driving history, vehicle type, and insurance provider. While it's impossible to pinpoint a single location as the absolute cheapest, we can explore some regions and strategies to help you secure the most affordable car insurance coverage.

Understanding Regional Variations

Car insurance rates are heavily influenced by geographical factors. Insurance companies assess the risk associated with insuring drivers based on their location. Areas with a higher population density, busy highways, or a history of frequent accidents and claims tend to have higher insurance rates. Conversely, rural areas with lower traffic volumes and fewer claims may offer more affordable insurance options.

Low-Cost Insurance Regions in the United States

In the US, several states consistently offer more affordable car insurance rates. According to recent data, these include:

- Maine: Known for its low insurance rates, Maine benefits from a relatively low population density and a history of safe driving. The average annual premium in Maine is significantly lower than the national average.

- Ohio: Ohio is another state with consistently affordable insurance rates. The state’s insurance laws and a relatively low frequency of accidents contribute to this affordability. A driver in Ohio might pay around 1,300 annually for comprehensive coverage.</li> <li><strong>North Carolina</strong>: This state is known for its competitive insurance market, which often results in lower rates. North Carolina's average annual premium is well below the national average, with some providers offering comprehensive coverage for as low as 1,000 per year.

For example, a driver with a clean record and a standard sedan could expect to pay around 1,200 annually for comprehensive coverage in Maine, compared to the national average of 1,674.

Global Perspectives

Beyond the US, car insurance rates can vary significantly across countries. In general, countries with stricter driving laws, efficient public transportation systems, and lower traffic volumes tend to have more affordable insurance rates. Some countries known for their relatively low insurance costs include:

- Norway: Despite its harsh winters, Norway has a well-maintained road infrastructure and strict driving laws, leading to lower insurance rates.

- Switzerland: With a strong focus on road safety and a well-regulated insurance market, Switzerland offers competitive insurance rates.

- New Zealand: This country’s efficient road safety measures and relatively low population density contribute to lower insurance costs.

Factors Influencing Insurance Rates

While location is a significant factor, it’s not the only determinant of car insurance rates. Here are some other key factors that insurance providers consider when calculating premiums:

Driving History

A clean driving record is crucial for securing affordable insurance. Insurance companies reward safe drivers with lower premiums. On the other hand, a history of accidents, traffic violations, or DUI convictions can significantly increase your insurance costs.

Vehicle Type and Usage

The make, model, and age of your vehicle play a role in insurance rates. Sports cars and luxury vehicles often have higher insurance costs due to their expensive repair and replacement parts. Additionally, how you use your vehicle matters. If you drive long distances for work or frequently commute during peak hours, your insurance rates may be higher.

Insurance Coverage and Deductibles

The level of insurance coverage you choose also affects your premiums. Comprehensive and collision coverage, which protect against various types of damage, typically cost more than liability-only coverage. However, increasing your deductible (the amount you pay out of pocket before insurance coverage kicks in) can lower your premiums.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers damage you cause to others' property and medical expenses for their injuries. |

| Collision Coverage | Pays for repairs to your vehicle after a collision, regardless of fault. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, vandalism, or natural disasters. |

Shopping Around and Comparing Quotes

One of the best ways to find the cheapest car insurance is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, even for the same level of coverage. Use online tools and insurance comparison websites to get quotes from various insurers. Additionally, consider bundle discounts if you’re also looking for home or renters insurance.

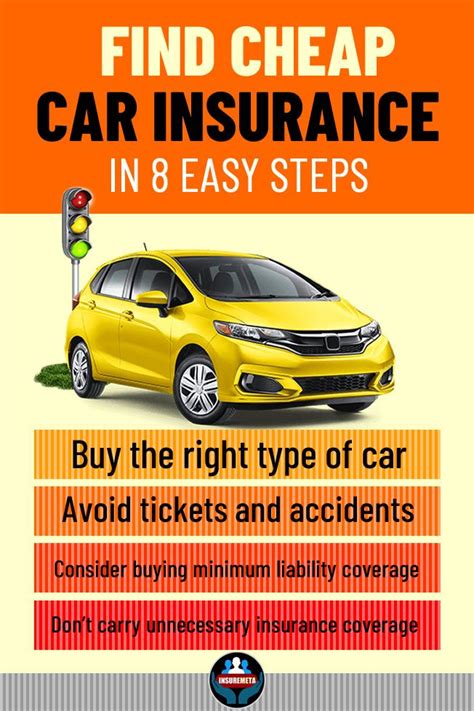

Tips for Lowering Your Insurance Costs

Here are some strategies to help you reduce your car insurance premiums:

- Maintain a Clean Driving Record: Strive to be a safe and responsible driver. Avoid traffic violations and accidents to keep your insurance costs down.

- Consider Higher Deductibles: Opting for a higher deductible can lower your monthly premiums. However, ensure you can afford the higher out-of-pocket expense if an accident occurs.

- Explore Discounts: Many insurance companies offer discounts for various reasons, such as safe driving, loyalty, good grades (for younger drivers), and vehicle safety features. Ask your insurer about available discounts and how you can qualify.

- Reduce Coverage on Older Vehicles: If you have an older car with a low market value, consider dropping collision and comprehensive coverage. This step might make sense if the cost of insurance exceeds the value of your vehicle.

Conclusion: Finding the Best Deal

While there isn’t a one-size-fits-all answer for the cheapest place for car insurance, understanding the factors that influence rates and exploring various options can help you secure the most affordable coverage. Remember that location is just one piece of the puzzle; your driving history, vehicle type, and coverage choices also play significant roles. By being a cautious driver, shopping around, and taking advantage of available discounts, you can significantly reduce your car insurance costs.

How often should I compare car insurance quotes to find the best rates?

+It’s a good practice to compare quotes annually, especially when your policy is up for renewal. However, if you’ve had a life change (e.g., moved to a new location, purchased a new vehicle, or got married), it’s advisable to compare quotes sooner to ensure you’re getting the best rate.

Can my credit score impact my car insurance rates?

+Yes, in many states, insurance companies use credit-based insurance scores to determine your premiums. A higher credit score often correlates with lower insurance rates, so maintaining a good credit score can indirectly reduce your insurance costs.

Are there any car insurance companies that specialize in offering low rates to high-risk drivers?

+Some insurance companies cater specifically to high-risk drivers, offering specialized programs with lower rates. These companies understand the challenges of high-risk drivers and work to provide affordable coverage. Research and compare options to find the best fit for your situation.