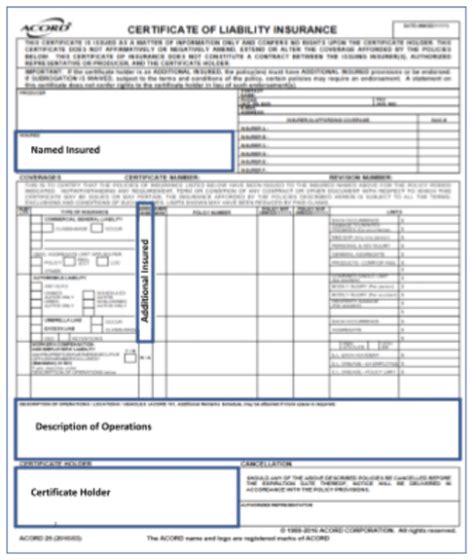

Next Insured

In the rapidly evolving landscape of business and risk management, finding innovative solutions to protect your enterprise is crucial. Enter Next Insured, a cutting-edge platform revolutionizing the way small and medium-sized businesses approach insurance. This comprehensive article will delve into the intricacies of Next Insured, exploring its features, impact, and potential future implications.

The Rise of Next Insured: A Revolutionary Platform

Next Insured is not just another insurance provider; it’s a paradigm shift in the industry. Founded by a team of seasoned professionals with a deep understanding of the challenges faced by modern businesses, Next Insured was conceived to provide a more efficient, tailored, and accessible insurance experience.

The platform's journey began with a simple yet powerful vision: to simplify the complex world of insurance, making it more transparent and user-friendly. With a focus on technology and a customer-centric approach, Next Insured has quickly gained traction, becoming a trusted name in the business community.

What sets Next Insured apart is its ability to leverage advanced technologies, such as AI and machine learning, to offer personalized insurance solutions. By analyzing vast datasets and industry trends, the platform provides accurate risk assessments, ensuring businesses receive coverage tailored to their unique needs.

Key Features and Benefits of Next Insured

Next Insured offers a wide range of features designed to enhance the insurance experience for businesses of all sizes.

- Personalized Coverage: Next Insured understands that no two businesses are the same. Its advanced algorithms analyze a business's operations, industry, and risk profile to provide tailored insurance plans. This ensures businesses receive the right coverage without overpaying for unnecessary add-ons.

- Real-Time Quotes: Say goodbye to lengthy and tedious quote processes. Next Insured's platform provides instant, accurate quotes, allowing businesses to make informed decisions quickly. The platform's transparency ensures businesses understand the breakdown of their quote, fostering trust and confidence.

- Efficient Claims Process: In the event of a claim, Next Insured's streamlined process ensures a swift and stress-free experience. With a dedicated claims team and an intuitive online portal, businesses can track the progress of their claim and receive regular updates.

- Risk Management Tools: Next Insured goes beyond traditional insurance by offering comprehensive risk management tools. These tools help businesses identify potential risks and implement strategies to mitigate them, ultimately reducing the likelihood of claims and fostering a safer work environment.

- Industry Insights: The platform provides valuable industry insights, trend analyses, and best practices. This empowers businesses to make strategic decisions, stay ahead of the curve, and adapt to changing market dynamics.

Case Studies: Real-World Impact of Next Insured

Next Insured’s success is not just theoretical; it has had a tangible impact on businesses across various industries. Let’s explore some real-world examples:

Small Business Success Story

Consider a small e-commerce business owner, Sarah, who struggled to find affordable and comprehensive insurance. With Next Insured, she was able to secure a customized insurance plan that covered her specific risks, such as product liability and cyber security. The platform’s personalized approach saved her money and provided peace of mind, allowing her to focus on growing her business.

| Business Type | Risk Covered | Cost Savings |

|---|---|---|

| E-commerce | Product Liability, Cyber Security | 15% reduction in insurance costs |

Large Enterprise Transformation

For large enterprises, managing insurance portfolios can be a complex task. Next Insured’s platform streamlined the process for a major retail chain, offering a centralized system to manage their diverse insurance needs. The platform’s risk management tools helped identify areas for improvement, resulting in a more efficient and cost-effective insurance strategy.

The Future of Insurance: Next Insured’s Vision

Next Insured is not content with being a mere disruptor; it aims to redefine the insurance industry. With its innovative approach and commitment to technological advancement, the platform is poised to become a leader in the digital insurance space.

The future of Next Insured holds exciting possibilities. Here's a glimpse into what we can expect:

- AI-Driven Risk Assessment: Continued development of AI algorithms will enhance risk assessment accuracy, allowing businesses to make more informed decisions.

- Blockchain Integration: Exploring blockchain technology for secure and transparent insurance transactions, enhancing trust and efficiency.

- Expanded Product Offerings: Next Insured plans to expand its portfolio, offering a broader range of insurance products to cater to diverse business needs.

- Community Building: The platform aims to foster a community of businesses, providing a platform for knowledge sharing and collaboration, further strengthening the insurance experience.

FAQs

How does Next Insured ensure data security?

+Next Insured prioritizes data security. The platform employs advanced encryption protocols and adheres to industry-leading security standards. All data is stored on secure servers, ensuring your information is protected.

Can Next Insured provide insurance for niche industries?

+Absolutely! Next Insured’s strength lies in its ability to customize coverage. Whether you’re in a niche industry or have unique risk factors, the platform can tailor insurance plans to your specific needs.

What sets Next Insured apart from traditional insurance brokers?

+Next Insured offers a tech-driven, customer-centric approach. With real-time quotes, personalized coverage, and efficient claims processes, it provides a more transparent and user-friendly experience. Additionally, its risk management tools and industry insights set it apart, offering a holistic insurance solution.