Quotes Insurance Automobile

The world of automobile insurance is a complex and essential aspect of vehicle ownership. With countless policies, coverage options, and varying regulations, navigating the landscape of automotive insurance can be a daunting task. In this comprehensive guide, we will delve into the intricacies of automobile insurance quotes, exploring the factors that influence premiums, the coverage options available, and the strategies to secure the best deal for your vehicle. Whether you're a seasoned driver or a first-time car owner, understanding the ins and outs of insurance quotes is crucial to making informed decisions and protecting your investment.

Understanding Automobile Insurance Quotes

Automobile insurance quotes serve as a financial snapshot, providing an estimate of the cost to insure a specific vehicle. These quotes are influenced by a multitude of factors, each playing a unique role in determining the overall premium. From the type of vehicle and its make and model to the driver’s age, location, and driving history, every aspect contributes to the final quote. Understanding these influencing factors is the first step towards securing an affordable and comprehensive insurance policy.

Vehicle-Specific Factors

The type of vehicle you drive is a significant determinant in insurance quotes. Certain makes and models are more prone to accidents, theft, or expensive repairs, leading to higher premiums. Additionally, the vehicle’s age, mileage, and safety features can impact the quote. For instance, a newer car with advanced safety technologies may result in lower premiums due to reduced accident risks.

| Vehicle Category | Average Premium Impact |

|---|---|

| Sports Cars | Higher Premiums |

| Sedans | Moderate Premiums |

| Hybrid/Electric Vehicles | Lower Premiums |

Moreover, the usage of the vehicle can influence quotes. Cars used for personal commuting may have different rates compared to those used for business or pleasure. The annual mileage and the primary purpose of the vehicle are key considerations for insurance providers.

Driver-Related Factors

The driver’s profile is a critical aspect of insurance quotes. Age, gender, and driving experience are common considerations. Younger drivers, especially those under 25, often face higher premiums due to their lack of experience and statistically higher accident rates. Gender can also influence quotes, with some insurers charging slightly different rates based on historical data and accident statistics.

Driving history is another crucial factor. A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents, claims, or moving violations can significantly increase insurance costs. Insurance companies analyze driving records to assess the risk associated with insuring a particular driver.

Coverage Options and Customization

Automobile insurance quotes offer a range of coverage options, allowing policyholders to tailor their insurance plans to their specific needs and preferences. Understanding these coverage options is essential to ensure you have the right protection for your vehicle and your circumstances.

Liability Coverage

Liability coverage is a fundamental aspect of automobile insurance. It provides financial protection in the event that you are found at fault for an accident, covering the costs of injuries and property damage to others involved. This coverage is mandatory in most states and is essential for protecting your assets and financial well-being.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for injured parties in an accident you caused. |

| Property Damage Liability | Pays for the repair or replacement of damaged property in an accident you caused. |

Comprehensive and Collision Coverage

Comprehensive and collision coverage are optional but highly recommended for comprehensive protection. Comprehensive coverage safeguards against non-collision incidents such as theft, vandalism, natural disasters, and damage caused by animals. Collision coverage, on the other hand, covers the costs of repairing or replacing your vehicle after an accident, regardless of fault.

While these coverages come at an additional cost, they provide essential protection against unforeseen events that could result in significant financial losses. It's important to assess your risk tolerance and financial situation to determine the appropriate level of coverage.

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal Injury Protection (PIP) and Medical Payments coverage provide financial support for medical expenses and lost wages resulting from an accident, regardless of fault. These coverages can be crucial in ensuring you and your passengers receive the necessary medical care without incurring substantial out-of-pocket costs.

PIP coverage typically covers a broader range of expenses, including rehabilitation, funeral costs, and lost wages. Medical Payments coverage, on the other hand, provides more limited coverage for medical expenses. The specific coverage limits and benefits can vary depending on the state and the policy.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist coverage protects policyholders when involved in an accident with a driver who has no insurance or insufficient insurance coverage. This coverage can be vital in ensuring you’re not left financially burdened in the event of an accident caused by an uninsured or underinsured driver.

It's important to note that the availability and requirements for this coverage vary by state. Some states mandate this coverage, while others offer it as an optional add-on. Understanding your state's regulations and the potential risks associated with uninsured drivers is crucial when determining the need for this coverage.

Strategies for Securing the Best Automobile Insurance Quotes

Obtaining the most favorable automobile insurance quotes requires a strategic approach. By implementing certain strategies and being mindful of key factors, you can navigate the insurance landscape more effectively and potentially save significant amounts on your premiums.

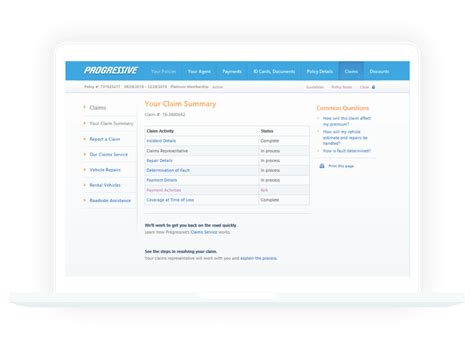

Shop Around and Compare Quotes

One of the most effective ways to secure the best insurance quotes is to compare rates from multiple providers. The insurance market is highly competitive, and rates can vary significantly between companies. By obtaining quotes from several insurers, you can identify the most competitive rates and tailor your coverage to your specific needs.

Online insurance comparison tools and independent insurance agents can be valuable resources for comparing quotes. These tools allow you to input your information once and receive multiple quotes, making the process more efficient and convenient.

Bundle Policies for Discounts

Many insurance companies offer discounts when you bundle multiple policies, such as combining your automobile insurance with homeowners or renters insurance. Bundling policies not only simplifies your insurance management but also can result in substantial savings on your premiums. It’s a win-win situation, providing both convenience and cost-effectiveness.

Utilize Discounts and Rewards

Insurance companies often provide discounts and rewards to policyholders who meet certain criteria. These can include safe driving records, good student discounts, loyalty discounts, and discounts for taking defensive driving courses. By taking advantage of these opportunities, you can reduce your insurance costs and make your policy more affordable.

Additionally, some insurers offer usage-based insurance programs that reward safe driving behaviors. These programs use telematics devices or smartphone apps to track your driving habits, and safe drivers can qualify for discounts based on their real-time data. This approach incentivizes safe driving and can lead to significant savings over time.

Maintain a Good Credit Score

Your credit score is a significant factor in determining your insurance premiums. Insurance companies often use credit-based insurance scores to assess the risk associated with insuring a particular individual. Maintaining a good credit score can lead to lower premiums, as it indicates a lower risk of filing claims.

Improving your credit score involves consistent and responsible financial behavior. This includes paying bills on time, reducing debt, and regularly monitoring your credit report for any errors or discrepancies. By taking proactive steps to improve your credit score, you can positively impact your insurance rates and overall financial well-being.

The Future of Automobile Insurance Quotes

The landscape of automobile insurance quotes is evolving, driven by technological advancements and changing consumer expectations. The rise of telematics and usage-based insurance is transforming the way insurance is priced and delivered, offering more personalized and dynamic coverage options. As technology continues to advance, we can expect further innovations in the insurance industry, enhancing the accuracy and fairness of quotes while providing greater flexibility and customization for policyholders.

Furthermore, the increasing adoption of autonomous vehicles and advanced driver-assistance systems (ADAS) is expected to have a significant impact on automobile insurance. As these technologies mature and become more widespread, they have the potential to reduce accident rates and revolutionize the way insurance is structured. The focus may shift from individual driver risk to vehicle performance and overall safety, leading to new coverage models and potentially lower premiums for policyholders.

Telematics and Usage-Based Insurance

Telematics and usage-based insurance programs are gaining traction, offering policyholders the opportunity to actively influence their insurance rates based on their driving behavior. These programs use real-time data collection to assess factors such as mileage, driving speed, acceleration, and braking habits. Safe drivers who adhere to best practices can benefit from reduced premiums, while those with riskier driving habits may see their rates increase.

By incentivizing safe driving behaviors, telematics and usage-based insurance not only provide financial benefits to policyholders but also contribute to overall road safety. As these programs become more prevalent, we can expect a shift towards a more dynamic and data-driven insurance landscape, where premiums are tailored to individual driving patterns rather than broad demographic categories.

Autonomous Vehicles and ADAS

The advent of autonomous vehicles and the widespread integration of ADAS technologies are poised to revolutionize the automobile insurance industry. These advanced technologies have the potential to significantly reduce accident rates, as they are designed to enhance driver safety and minimize human error. As a result, insurance providers may adjust their risk assessments and pricing models to reflect the reduced likelihood of accidents associated with these technologies.

As autonomous vehicles and ADAS become more common, we can anticipate a paradigm shift in automobile insurance. The focus may shift from individual driver risk to the performance and safety features of the vehicle itself. This could lead to new coverage models that prioritize vehicle technology and overall safety, potentially resulting in more affordable and tailored insurance options for policyholders.

Conclusion

Automobile insurance quotes are a critical aspect of vehicle ownership, providing the financial protection necessary to navigate the complexities of the road. By understanding the factors that influence quotes, exploring the available coverage options, and employing strategic approaches to secure the best deals, policyholders can ensure they have the right protection at the most competitive rates. As the insurance landscape continues to evolve with technological advancements and changing consumer needs, staying informed and proactive is key to making the most of your automobile insurance coverage.

FAQ

How often should I review and update my automobile insurance policy?

+It is generally recommended to review your automobile insurance policy annually or whenever you experience significant life changes. These changes can include buying a new vehicle, moving to a different location, getting married or divorced, or adding a young driver to your policy. Regularly reviewing your policy ensures that your coverage remains adequate and that you are not overpaying for unnecessary coverage.

What factors can lead to an increase in my automobile insurance premiums?

+Several factors can influence an increase in your automobile insurance premiums. These include a history of accidents or traffic violations, making a claim on your policy, purchasing a new vehicle with a higher risk profile, or moving to an area with a higher crime rate or increased accident frequency. It’s important to be aware of these factors and take proactive steps to maintain a clean driving record and choose vehicles with lower insurance costs.

Can I switch automobile insurance providers if I find a better deal?

+Absolutely! Shopping around for the best automobile insurance quotes is a smart financial move. If you find a more competitive rate or better coverage options with another provider, you have the freedom to switch. Many insurance companies make the switching process straightforward, and you can often obtain a quote and complete the necessary paperwork online. Just ensure that you carefully review the new policy to understand any changes in coverage or benefits.

Are there any additional coverages I should consider beyond the basic liability and collision coverage?

+Yes, there are several additional coverages that can provide valuable protection beyond the basics. These include comprehensive coverage for non-collision incidents, personal injury protection (PIP) or medical payments coverage for medical expenses and lost wages resulting from an accident, and uninsured/underinsured motorist coverage to protect you in the event of an accident with a driver who has no or insufficient insurance. Assessing your specific needs and financial situation can help determine which additional coverages are most beneficial for you.