Progressive Auto Insurance Get A Quote

In the dynamic landscape of the insurance industry, Progressive Auto Insurance stands as a prominent player, offering a range of comprehensive and innovative coverage options. This article delves into the intricacies of Progressive's auto insurance, exploring its features, benefits, and the process of obtaining a quote tailored to individual needs.

The Evolution of Progressive Auto Insurance

With a rich history spanning over 40 years, Progressive has consistently adapted to the evolving needs of drivers. From its inception in 1978, the company has revolutionized the insurance sector with its customer-centric approach. Progressive’s commitment to innovation is evident in its introduction of telematics, a technology that assesses driving behavior, offering discounts to safe drivers.

The company's growth trajectory is marked by significant milestones, including its expansion into Canada in 2015, providing its unique suite of services to a wider audience. Progressive's focus on digital innovation has made it a go-to choice for many, with its online platform and mobile app offering seamless access to policies and quotes.

Comprehensive Coverage Options

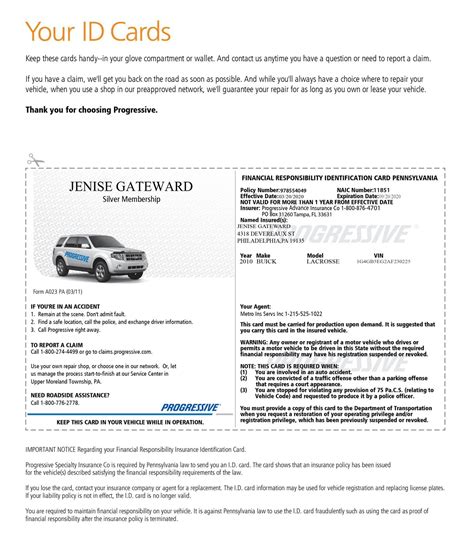

Progressive Auto Insurance offers a comprehensive suite of coverage options, designed to cater to the diverse needs of its customers. The core coverage includes liability, collision, and comprehensive insurance, providing protection against a range of incidents, from accidents to natural disasters.

Additionally, Progressive offers specialized coverage such as uninsured/underinsured motorist coverage, medical payments, and personal injury protection, ensuring that policyholders receive the necessary financial support in the event of an accident.

One of Progressive's standout features is its Customizable Coverage, allowing customers to choose the specific add-ons they require. This flexibility ensures that policyholders are not paying for unnecessary coverage, making Progressive's insurance plans highly cost-effective.

Progressive’s Unique Add-Ons

- Roadside Assistance: Offers 24⁄7 support for emergencies like flat tires or battery issues.

- Rental Car Reimbursement: Covers the cost of a rental car if your vehicle is in the shop due to an insured incident.

- Pet Injury Protection: Provides coverage for veterinary costs if your pet is injured in an accident.

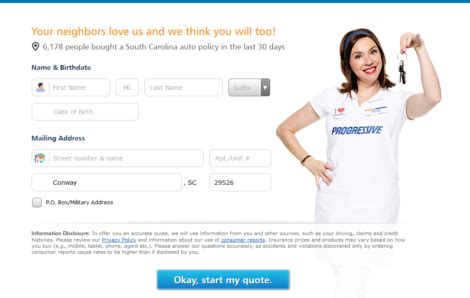

The Process of Getting a Quote with Progressive

Obtaining a quote from Progressive Auto Insurance is a straightforward and efficient process. Policy seekers can initiate the process online, via the Progressive website or mobile app, or opt for a more traditional approach by calling the company’s customer service hotline.

The quote process typically involves providing basic information about the vehicle, the driver's profile, and the desired coverage. Progressive's advanced algorithm then generates a personalized quote, factoring in the unique details provided.

Key Steps in the Quote Process:

- Vehicle Information: Input the make, model, and year of your vehicle, as well as its primary use (e.g., personal, business, pleasure)

- Driver Profile: Provide details about the primary driver, including age, driving record, and any relevant discounts or affiliations.

- Coverage Selection: Choose the desired level of coverage, from basic liability to more comprehensive plans, and select any additional add-ons.

- Quote Generation: Progressive’s system instantly generates a quote based on the provided information, offering a transparent and accurate estimate.

Progressive's quote process is designed to be transparent and informative, ensuring that customers have a clear understanding of their coverage and costs. The company's commitment to customer satisfaction is evident in its dedication to providing accurate and personalized quotes.

Progressive’s Discounts and Savings

Progressive Auto Insurance is renowned for its commitment to offering competitive rates and a range of discounts to its policyholders. These discounts are designed to reward safe driving behavior and loyalty, making Progressive’s insurance plans highly affordable.

| Discount Type | Description |

|---|---|

| Snapshot Discount | Based on your driving behavior, this discount can save you up to 30% on your policy. |

| Multi-Policy Discount | Combining your auto insurance with other Progressive policies, like home or life insurance, can result in significant savings. |

| Loyalty Discount | Progressive rewards its long-term customers with discounts for maintaining their policy over an extended period. |

| Paperless Discount | Opting for paperless billing and policy management can lead to small but valuable savings. |

Customer Satisfaction and Claims Process

Progressive Auto Insurance prides itself on its customer-centric approach, ensuring that policyholders receive the support they need, when they need it. The company’s 24⁄7 claims hotline provides immediate assistance in the event of an accident or incident, guiding customers through the claims process.

Progressive's claims process is designed to be efficient and stress-free. Policyholders can initiate a claim online, via the Progressive app, or over the phone, with dedicated claims representatives guiding them through the necessary steps. The company's focus on digital innovation allows for a seamless and convenient claims experience.

Progressive's dedication to customer satisfaction is further evidenced by its A+ rating from the Better Business Bureau (BBB), reflecting its commitment to resolving customer concerns and providing exceptional service.

Progressive’s Claims Process Highlights:

- Quick Response: Claims are typically acknowledged and assigned to a representative within 24 hours, ensuring swift action.

- Online Claims Tracking: Policyholders can monitor the progress of their claim online, receiving real-time updates.

- Flexible Repair Options: Progressive offers the choice of repair facilities, allowing customers to select the most convenient and trusted option.

The Future of Progressive Auto Insurance

As the insurance landscape continues to evolve, Progressive Auto Insurance remains at the forefront of innovation. The company’s focus on digital transformation and its commitment to customer satisfaction position it for continued success in the years to come.

With its eye on the future, Progressive is investing in emerging technologies, such as AI and machine learning, to further enhance its services. These advancements are expected to streamline the quote and claims processes, offering even more personalized and efficient experiences.

Additionally, Progressive's focus on sustainability and social responsibility is evident in its initiatives to reduce its environmental impact. The company is committed to minimizing waste, promoting eco-friendly practices, and supporting community initiatives, aligning with the values of an increasingly conscious consumer base.

Progressive’s Future Initiatives:

- Digital Transformation: Progressive plans to enhance its digital platforms, offering even more seamless and intuitive experiences for policyholders.

- Sustainable Practices: The company aims to reduce its carbon footprint and promote eco-friendly initiatives across its operations.

- Community Engagement: Progressive is committed to supporting local communities, with initiatives focused on education, health, and environmental sustainability.

How does Progressive’s Snapshot program work, and what are the potential savings?

+Progressive’s Snapshot program uses a small device or an app to track your driving behavior, such as mileage, speed, and braking. Based on this data, you can receive discounts of up to 30% on your policy. The program encourages safer driving habits and rewards drivers for their good behavior.

What are the eligibility criteria for Progressive’s multi-policy discount?

+To qualify for the multi-policy discount, you must have two or more Progressive policies, such as auto and home insurance, or auto and life insurance. The discount is applied to your auto insurance policy, providing a significant savings opportunity.

How does Progressive’s claims process compare to other insurance providers?

+Progressive’s claims process is renowned for its efficiency and customer-centric approach. With a 24⁄7 claims hotline and online tracking, policyholders can expect a seamless and timely resolution to their claims. Progressive’s focus on customer satisfaction sets it apart in the industry.