Flood Insurance Coverage

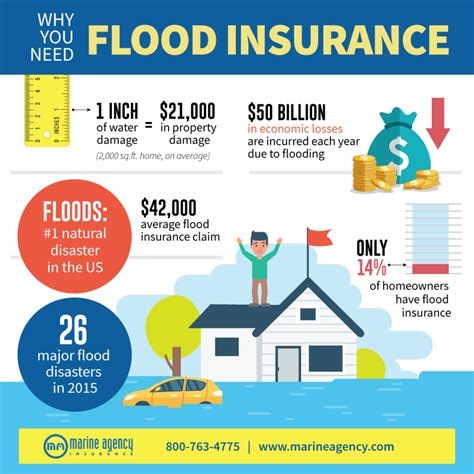

Floods are one of the most common and devastating natural disasters worldwide, causing significant property damage and financial losses. In response to this growing concern, the concept of flood insurance coverage has emerged as a crucial financial safeguard for homeowners, renters, and businesses. This comprehensive guide delves into the world of flood insurance, exploring its necessity, coverage options, and the impact it can have on individuals and communities.

Understanding the Need for Flood Insurance

Floods can strike unexpectedly, often resulting from heavy rainfall, storm surges, or rapid snowmelt. While natural disasters like hurricanes and tropical storms are notorious for causing widespread flooding, even regions with low-risk flood designations can experience unexpected deluges due to climate change and extreme weather events.

Standard homeowners or renters insurance policies typically do not cover flood damage, leaving property owners vulnerable to substantial out-of-pocket expenses for repairs and rebuilding. This gap in coverage highlights the critical importance of flood insurance, especially in areas susceptible to flooding, such as coastal regions, river basins, and low-lying areas.

By purchasing flood insurance, individuals can protect their homes, personal belongings, and businesses from the financial ruin that often follows a flood event. It provides a crucial safety net, ensuring that policyholders have the resources to rebuild and recover after a flood.

The National Flood Insurance Program (NFIP)

In the United States, the primary provider of flood insurance is the National Flood Insurance Program (NFIP), administered by the Federal Emergency Management Agency (FEMA). The NFIP was established to mitigate the financial impact of floods and provide an affordable means of protection for property owners.

The NFIP offers two primary types of flood insurance policies: the Standard Flood Insurance Policy (SFIP) and the Preferred Risk Policy (PRP). SFIPs are designed for properties located in high-risk flood zones, known as Special Flood Hazard Areas (SFHAs), while PRPs are tailored for low-to-moderate-risk zones.

Standard Flood Insurance Policy (SFIP)

SFIPs provide comprehensive coverage for both the structure of a building and its contents. The coverage limits for a building and its contents can be up to 250,000 each, offering a total of 500,000 in protection. For businesses, the SFIP can provide up to $500,000 in coverage for the building and its contents, ensuring that commercial properties are adequately protected.

SFIPs are available to homeowners, renters, and business owners, providing a vital layer of protection against the devastating financial consequences of a flood. These policies are particularly crucial for individuals living in high-risk areas, where the likelihood of flood damage is significantly higher.

Preferred Risk Policy (PRP)

PRPs are designed for properties located in low-to-moderate-risk flood zones. These policies offer a more affordable option for homeowners and renters, with coverage limits ranging from 20,000 to 350,000 for the building and 8,000 to 100,000 for personal belongings.

PRPs are an excellent choice for individuals who want peace of mind without breaking the bank. They provide essential coverage for unexpected flood events, ensuring that policyholders can recover and rebuild without incurring excessive financial strain.

The Impact of Flood Insurance

Flood insurance coverage has a profound impact on individuals, communities, and the economy as a whole. By providing financial protection, flood insurance empowers homeowners and renters to rebuild their lives and properties after a devastating flood.

Protecting Homeowners and Renters

For homeowners, flood insurance offers a critical safety net, ensuring that they can repair and restore their homes after a flood. This protection extends to the personal belongings within the home, providing a comprehensive solution for recovering from flood damage. Renters, too, benefit from flood insurance, as it covers the cost of replacing their possessions, giving them the means to start anew.

Supporting Community Resilience

Communities with a high uptake of flood insurance are better equipped to bounce back from flood events. When a significant portion of the population is insured, the financial burden on the community as a whole is reduced. This enables faster recovery, as funds are available for rebuilding efforts and infrastructure repairs.

Furthermore, the presence of flood insurance can encourage proactive flood risk management within communities. By understanding the importance of flood protection, residents and local governments can work together to implement measures that mitigate flood risks, such as improved drainage systems and coastal defenses.

Economic Stability and Growth

From an economic perspective, flood insurance plays a vital role in maintaining stability and promoting growth. When property owners have flood insurance, they are more likely to have the financial means to rebuild and reinvest in their communities. This stimulates local economies, creating jobs and supporting businesses affected by floods.

Additionally, the availability of flood insurance can attract new residents and businesses to an area, knowing that they are protected from the financial ruin of a flood. This influx of investment can drive economic growth and enhance the overall resilience of the community.

The Future of Flood Insurance

As climate change continues to influence weather patterns, the risk of flooding is expected to increase worldwide. This growing threat underscores the importance of flood insurance and the need for innovative solutions to meet the evolving challenges posed by climate change.

Insurance providers are continuously adapting their policies and coverage options to address the changing landscape of flood risk. This includes the development of more comprehensive policies that take into account the increased frequency and severity of flood events.

Moreover, the integration of advanced technologies, such as satellite imagery and predictive analytics, is enhancing the accuracy of flood risk assessments. These tools enable insurance providers to offer more tailored coverage, ensuring that policyholders receive the protection they need based on their specific flood risk profile.

Community-Based Approaches

In addition to individual flood insurance policies, there is a growing emphasis on community-based approaches to flood protection. This involves the implementation of comprehensive flood risk management strategies at the local level, including the development of flood-resilient infrastructure and the promotion of natural flood defenses.

By combining individual flood insurance with community-wide initiatives, the overall resilience of communities to flooding can be significantly enhanced. This holistic approach ensures that both individuals and the community as a whole are better prepared to withstand and recover from flood events.

Conclusion

Flood insurance coverage is an essential safeguard for homeowners, renters, and businesses in the face of increasing flood risks. By providing financial protection, flood insurance empowers individuals and communities to rebuild and recover from the devastating impacts of floods.

As climate change continues to shape the frequency and severity of flood events, the importance of flood insurance will only grow. With innovative policies, advanced technologies, and community-based approaches, the future of flood insurance looks promising, offering a brighter and more resilient outlook for those living in flood-prone areas.

How can I determine if my property is located in a high-risk flood zone?

+You can access FEMA’s Flood Map Service Center to determine your property’s flood zone designation. This online tool provides detailed flood zone information for specific addresses, helping you understand your flood risk and make informed decisions about flood insurance.

What is the process for filing a flood insurance claim?

+When filing a flood insurance claim, you’ll need to contact your insurance agent or provider to initiate the process. They will guide you through the necessary steps, which typically involve documenting the damage, providing supporting evidence, and submitting a claim form. It’s important to act promptly to ensure a smooth claims process.

Are there any alternatives to the National Flood Insurance Program (NFIP)?

+Yes, some private insurance companies offer flood insurance policies as an alternative to the NFIP. These policies may have different coverage options and pricing structures, so it’s important to compare and understand the specifics of each policy before making a decision. Consult with an insurance professional to explore your options.