Nursing Home Insurance Rates

In the world of healthcare, insurance plays a crucial role in ensuring the smooth operation of facilities and the well-being of residents. Nursing homes, in particular, face unique challenges and risks, making adequate insurance coverage a vital aspect of their operations. This article aims to delve into the factors influencing nursing home insurance rates, exploring the intricacies of this essential topic.

Understanding Nursing Home Insurance

Nursing homes, also known as skilled nursing facilities, provide long-term care for individuals who require assistance with daily activities and medical supervision. These facilities offer a range of services, including skilled nursing care, rehabilitation, and specialized treatments. Given the complex nature of their operations and the vulnerabilities of their residents, nursing homes face a multitude of risks that insurance providers must consider.

Nursing home insurance is a specialized form of coverage tailored to the unique needs of these facilities. It aims to protect nursing homes from financial losses arising from various incidents, such as medical malpractice, property damage, liability claims, and employee-related issues. The insurance rates for nursing homes are influenced by a myriad of factors, each playing a significant role in determining the overall cost of coverage.

Key Factors Affecting Nursing Home Insurance Rates

Risk Assessment and Location

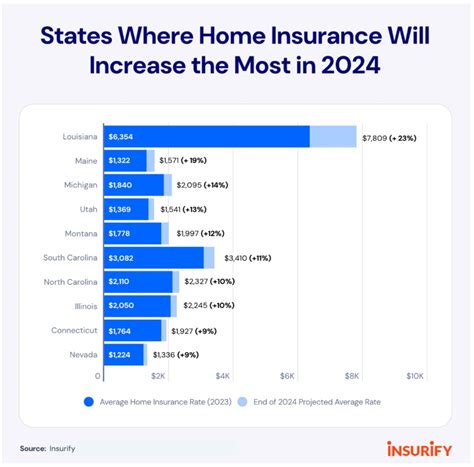

Insurance providers conduct thorough risk assessments to determine the likelihood of incidents and the potential financial impact on nursing homes. Factors such as the facility’s location, proximity to natural disaster-prone areas, and crime rates can influence insurance rates. Nursing homes in high-risk locations may face higher premiums due to the increased likelihood of incidents.

For instance, a nursing home situated in an area prone to flooding or earthquakes may require specialized coverage for natural disasters, leading to higher insurance costs. Similarly, facilities located in high-crime areas might need additional security measures, impacting their insurance rates.

Size and Capacity

The size and capacity of a nursing home are crucial factors in determining insurance rates. Larger facilities with higher resident capacities generally face higher insurance costs due to the increased potential for incidents and claims. The more residents a nursing home accommodates, the greater the risk of medical errors, accidents, and liability issues.

Additionally, the layout and design of the facility can impact insurance rates. Nursing homes with complex structures or multiple levels may require specialized coverage for potential fall-related incidents, increasing insurance premiums.

Staffing and Training

The quality and training of nursing home staff significantly influence insurance rates. Well-trained and experienced staff can reduce the likelihood of incidents and claims, leading to lower insurance costs. On the other hand, facilities with high staff turnover rates or inadequate training programs may face higher insurance premiums.

Insurance providers often assess the staffing ratios and the qualifications of key personnel, such as nurses and administrators. Nursing homes with a strong emphasis on staff development and training programs are more likely to receive favorable insurance rates.

Medical Malpractice History

A nursing home’s history of medical malpractice claims and incidents is a critical factor in determining insurance rates. Insurance providers carefully analyze past claims data to assess the facility’s risk profile. Nursing homes with a high number of medical malpractice claims or a history of severe incidents may face higher insurance premiums.

Insurance companies consider the severity and frequency of claims, as well as the facility's response and management of these incidents. Nursing homes that proactively address medical errors and implement measures to prevent future incidents are more likely to receive favorable insurance rates.

Loss Prevention Measures

Nursing homes that invest in loss prevention measures and safety protocols can significantly impact their insurance rates. Insurance providers recognize the value of proactive risk management and often offer discounts or incentives to facilities that implement effective safety measures.

Examples of loss prevention measures include comprehensive staff training programs, regular safety audits, implementation of advanced medical equipment, and the adoption of best practices in infection control and fall prevention. Nursing homes that demonstrate a commitment to safety and risk mitigation can often negotiate more favorable insurance rates.

Claims History and Claims Management

The claims history of a nursing home is a critical factor in determining insurance rates. Insurance providers analyze the number and severity of claims made by the facility, as well as the facility’s claims management practices. Nursing homes with a low number of claims or a history of successfully managing claims without escalating costs are often rewarded with lower insurance premiums.

Effective claims management involves prompt reporting of incidents, thorough investigation, and timely resolution of claims. Nursing homes that demonstrate a proactive approach to claims management, collaborate with insurance providers, and implement measures to prevent future claims are more likely to receive favorable insurance rates.

The Role of Insurance Brokers

Given the complexity of nursing home insurance, working with experienced insurance brokers is crucial. Insurance brokers specializing in healthcare facilities can provide valuable insights and guidance to nursing homes seeking adequate coverage. They can help nursing homes navigate the insurance market, compare policies, and negotiate the best rates based on the facility’s unique needs and risk profile.

Insurance brokers play a vital role in risk assessment, helping nursing homes identify potential risks and implement strategies to mitigate them. They can also assist in developing comprehensive insurance plans that cover all aspects of the facility's operations, including liability, property, and business interruption insurance.

Comparative Analysis of Nursing Home Insurance Rates

To illustrate the impact of various factors on nursing home insurance rates, let’s consider a hypothetical scenario. We will compare two nursing homes, Facility A and Facility B, and analyze how their insurance rates differ based on their characteristics and risk profiles.

| Factor | Facility A | Facility B |

|---|---|---|

| Location | Urban area with high crime rates | Suburban area with low crime rates |

| Size and Capacity | 150-bed facility | 100-bed facility |

| Staffing and Training | High staff turnover; basic training programs | Stable staff; comprehensive training programs |

| Medical Malpractice History | Several severe incidents; high claims frequency | Few minor incidents; low claims frequency |

| Loss Prevention Measures | Basic safety protocols; limited investment | Advanced safety measures; proactive risk management |

| Claims History and Management | Poor claims management; high costs | Effective claims management; low costs |

Based on the table above, Facility A, located in an urban area with high crime rates, larger in size, and facing staffing and training challenges, is likely to have higher insurance rates. Its medical malpractice history, poor loss prevention measures, and ineffective claims management further contribute to higher premiums.

On the other hand, Facility B, situated in a suburban area with low crime rates, smaller in size, and boasting a stable and well-trained staff, is likely to receive more favorable insurance rates. Its positive medical malpractice history, proactive loss prevention measures, and effective claims management make it a lower-risk facility in the eyes of insurance providers.

Future Implications and Strategies

The landscape of nursing home insurance is constantly evolving, influenced by changing regulations, advancements in healthcare, and emerging risks. As nursing homes strive to provide quality care while managing costs, insurance rates will continue to be a critical consideration.

To navigate the complexities of nursing home insurance, facilities can implement several strategies. First, investing in comprehensive staff training programs can reduce the likelihood of incidents and claims, leading to lower insurance rates. Second, adopting advanced safety measures and loss prevention protocols can demonstrate a commitment to risk management, potentially resulting in more favorable insurance rates.

Additionally, nursing homes should focus on effective claims management, promptly addressing incidents and collaborating with insurance providers to resolve claims efficiently. By demonstrating a proactive and responsible approach to claims, facilities can build a positive risk profile, ultimately impacting their insurance rates.

Furthermore, staying informed about industry trends and best practices can help nursing homes anticipate and address emerging risks. Regular risk assessments and consultations with insurance brokers can ensure that facilities are adequately covered and positioned to negotiate the best insurance rates.

Frequently Asked Questions

How do insurance rates vary between different states or regions for nursing homes?

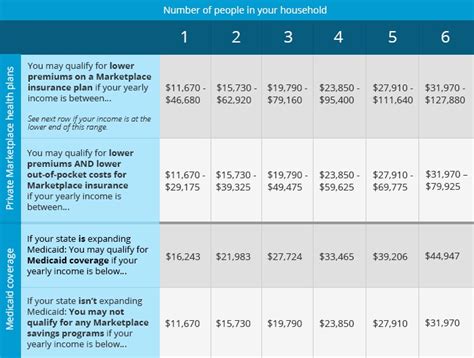

+Insurance rates for nursing homes can vary significantly between states or regions due to differences in regulations, demographics, and the overall risk profile of the area. For instance, states with stricter regulations and higher litigation rates may have higher insurance premiums. Additionally, factors such as the availability of healthcare professionals and the overall cost of living can impact insurance rates.

Are there any ways for nursing homes to lower their insurance rates over time?

+Absolutely! Nursing homes can take proactive measures to reduce their insurance rates. Implementing robust risk management strategies, investing in staff training and development, and maintaining a positive claims history are key factors. By demonstrating a commitment to safety and effective incident management, nursing homes can negotiate more favorable insurance rates over time.

What role does the type of care provided by a nursing home play in determining insurance rates?

+The type of care provided by a nursing home can influence insurance rates. Facilities offering specialized services, such as dementia care or advanced medical treatments, may face higher insurance costs due to the increased complexity and potential risks associated with these services. Insurance providers carefully assess the scope of care provided to determine appropriate coverage and rates.