Marketplace Health Insurance Income Limits

Understanding the income limits for health insurance through the Health Insurance Marketplace is crucial for individuals and families seeking affordable healthcare coverage. The Marketplace, established under the Affordable Care Act (ACA), offers a range of plans with subsidies available to those who meet specific income criteria. This article delves into the income limits, providing a comprehensive guide to help you navigate the health insurance landscape and make informed decisions about your coverage.

Income Limits and Eligibility for Health Insurance Subsidies

The Health Insurance Marketplace provides a vital platform for individuals and families to access quality healthcare coverage. At the core of this system are income-based subsidies, designed to make insurance more affordable for those who need it most. Let’s explore how these income limits work and who qualifies for these essential benefits.

Income Eligibility Criteria

The income limits for health insurance subsidies are determined based on an individual’s or family’s Modified Adjusted Gross Income (MAGI). This is the income figure used by the federal government to assess eligibility for various programs, including the Marketplace. MAGI includes most types of income, such as wages, salaries, investments, and business income, but excludes certain tax-exempt items like child support payments and most scholarships.

Eligibility for subsidies is typically based on a percentage of the Federal Poverty Level (FPL). The FPL is a measure of income level issued annually by the Department of Health and Human Services (HHS). It varies depending on family size and the state in which the individual resides. For instance, in 2023, the FPL for a single individual is $13,080, while for a family of four, it's $27,828.

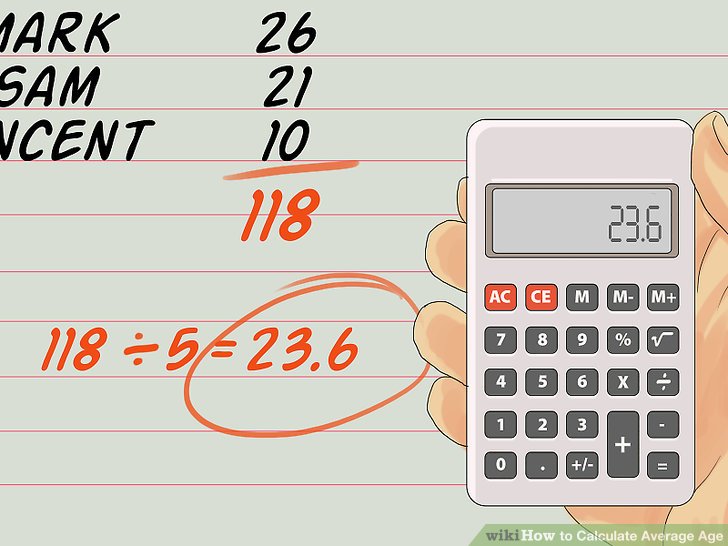

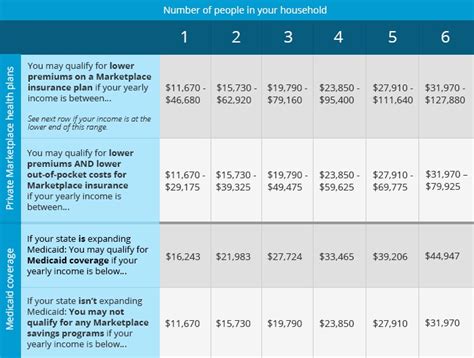

| Family Size | Federal Poverty Level (FPL) in 2023 |

|---|---|

| 1 | $13,080 |

| 2 | $17,720 |

| 3 | $22,360 |

| 4 | $27,828 |

| 5 | $33,396 |

| 6 | $38,964 |

Here's how income eligibility breaks down for the most common family sizes:

- Individuals: To qualify for subsidies, an individual's MAGI must be between 100% and 400% of the FPL. This means their income should be between $13,080 and $52,320 for 2023.

- Families of Four: For a family of four, the income range is $27,828 to $111,312. This accommodates a wide range of family incomes, making health insurance more accessible.

Premium Tax Credits

Premium Tax Credits (PTCs) are a significant benefit offered to those who meet the income criteria. These credits reduce the cost of monthly premiums, making health insurance more affordable. The amount of the credit is based on household income, family size, and the cost of insurance in the individual’s area. For those with incomes between 100% and 400% of the FPL, the PTC can cover a substantial portion of the premium cost.

Cost-Sharing Reductions

In addition to PTCs, the Marketplace also offers Cost-Sharing Reductions (CSRs) for those with incomes below 250% of the FPL. CSRs lower out-of-pocket costs like deductibles, copayments, and coinsurance. These reductions can significantly decrease the financial burden of healthcare for eligible individuals and families.

Determining Your Income for Subsidy Eligibility

When applying for health insurance through the Marketplace, it’s crucial to accurately report your income to ensure you receive the correct level of subsidies. This income figure is based on your expected income for the upcoming year, known as your projected income. However, you must also report your income for the previous tax year, referred to as your reported income.

If your projected income differs significantly from your reported income, you may need to reconcile the difference when you file your taxes. This process ensures that you receive the appropriate level of subsidies and helps maintain the integrity of the Marketplace system.

Understanding Income Limits for Different Insurance Plans

The Marketplace offers a range of insurance plans, each with its own set of benefits and income eligibility criteria. Let’s explore some of these plans and their specific income limits.

Bronze Plans

Bronze plans are the most affordable of the Marketplace plans, covering 60% of healthcare costs on average. These plans are ideal for those with relatively low healthcare needs or those who prefer a lower monthly premium even if it means paying more out-of-pocket when they need care. To qualify for a Bronze plan, your income must be between 100% and 400% of the FPL.

Silver Plans

Silver plans are the most popular choice among Marketplace enrollees, covering an average of 70% of healthcare costs. These plans offer a balance between premium costs and out-of-pocket expenses. To be eligible for a Silver plan, your income must fall between 100% and 400% of the FPL. Additionally, you may qualify for a reduced out-of-pocket maximum if your income is below 250% of the FPL.

Gold and Platinum Plans

Gold and Platinum plans offer the most comprehensive coverage, with an average coverage of 80% and 90% respectively. These plans are designed for individuals with significant healthcare needs or those who prefer to minimize out-of-pocket costs. Income eligibility for these plans is similar to Bronze and Silver plans, with incomes between 100% and 400% of the FPL.

Catastrophic Plans

Catastrophic plans are designed for individuals under 30 or those with a hardship exemption. These plans provide basic coverage and are typically the least expensive option. While there are no income limits for catastrophic plans, individuals must meet specific criteria to qualify, such as being under 30 or having a hardship that makes other plans unaffordable.

Special Enrollment Periods and Income Changes

The Marketplace recognizes that life circumstances can change, and these changes may affect an individual’s income and eligibility for subsidies. To accommodate these changes, the Marketplace offers Special Enrollment Periods (SEPs) outside of the regular Open Enrollment Period.

Qualifying Life Events

SEPs are triggered by specific life events, such as losing other health coverage, getting married or divorced, having a baby, or moving to a new area. These events can significantly impact an individual’s income and their eligibility for subsidies. When a qualifying life event occurs, individuals have a limited time frame to enroll in a new plan or make changes to their existing coverage.

Income Changes During the Plan Year

If an individual’s income changes significantly during the plan year, they may need to update their income information with the Marketplace. This is especially important if the change affects their eligibility for subsidies. The Marketplace will then adjust the subsidies accordingly to ensure the individual continues to receive the correct level of support.

Income Limits and Health Insurance: Key Takeaways

Understanding the income limits for health insurance through the Marketplace is essential for navigating the complex world of healthcare coverage. By being aware of your income eligibility and the range of plans available, you can make informed decisions about your health insurance. Remember, the Marketplace is designed to provide affordable, quality healthcare for all, and knowing your rights and options is the first step towards achieving that goal.

What happens if my income changes during the plan year?

+If your income changes significantly during the plan year, it’s important to report this change to the Marketplace. This ensures that you continue to receive the correct level of subsidies. You can update your income information through your Marketplace account or by contacting the Marketplace directly.

Can I qualify for subsidies if my income is above 400% of the FPL?

+No, the income limits for health insurance subsidies are set at 400% of the Federal Poverty Level (FPL). If your income exceeds this limit, you may not qualify for subsidies, but you can still purchase insurance through the Marketplace.

How often do income limits change, and where can I find the latest information?

+Income limits are typically updated annually and are based on the Federal Poverty Level (FPL) set by the Department of Health and Human Services (HHS). You can find the latest income limits and other relevant information on the official Marketplace website or by contacting your local health insurance provider or a licensed insurance agent.