Average Cost Of Dog Insurance

Dog insurance, a crucial aspect of responsible pet ownership, has gained prominence as more pet owners recognize the financial security it provides. Understanding the average cost of dog insurance is essential for pet parents seeking to provide the best care for their furry companions while managing their budgets effectively. This article aims to delve into the intricacies of dog insurance costs, exploring various factors that influence them and offering valuable insights to help pet owners make informed decisions.

Understanding the Landscape of Dog Insurance Costs

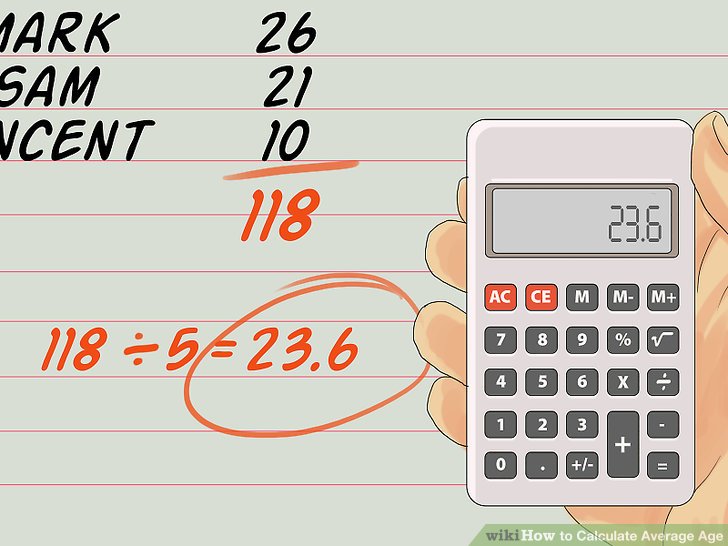

The average cost of dog insurance is a multifaceted topic, influenced by a myriad of variables. From the breed and age of the dog to the specific coverage chosen and the region in which the owner resides, each factor plays a significant role in determining the overall expense. Delving into these details provides a comprehensive understanding of the financial commitment associated with dog insurance, enabling pet owners to make well-informed choices tailored to their unique circumstances.

Breed and Size: Impact on Insurance Premiums

One of the most influential factors in determining the cost of dog insurance is the breed and size of the canine. Certain breeds, known for their robust health or predisposition to specific ailments, often command higher insurance premiums. For instance, larger breeds like Great Danes or Saint Bernards, renowned for their gentle nature and impressive stature, tend to have higher healthcare needs and consequently, higher insurance costs. On the other hand, smaller breeds like Chihuahuas or Poodles, while not immune to health issues, generally have lower insurance premiums due to their typically lower healthcare requirements.

Beyond breed, the size of the dog also plays a pivotal role. Larger dogs, irrespective of breed, often require more extensive medical care, be it for routine procedures or specialized treatments. This increased need for healthcare translates into higher insurance costs, as insurers factor in the likelihood of more frequent and costly claims. Conversely, smaller dogs, while not exempt from health concerns, generally have lower insurance premiums due to their reduced healthcare needs and the potential for less frequent and less expensive claims.

Age and Its Influence on Insurance Rates

The age of a dog is another critical factor that significantly impacts insurance costs. Younger dogs, typically defined as those under the age of 5, generally have lower insurance premiums compared to their older counterparts. This is primarily due to the reduced risk of developing serious health conditions at a younger age. As dogs age, the likelihood of health issues, including chronic conditions and age-related ailments, increases, leading to higher insurance premiums. Insurers factor in this increased risk when determining the cost of coverage for older dogs, as they are more likely to require frequent veterinary visits and specialized treatments.

Moreover, the age of the dog also influences the type of coverage available. Many insurance providers offer specific policies tailored to the needs of younger or older dogs. For instance, younger dogs may benefit from comprehensive coverage that includes routine care, such as vaccinations and spaying/neutering, while older dogs may require policies that offer more extensive coverage for chronic conditions or age-related ailments. Understanding these age-based differences in coverage and costs is essential for pet owners seeking to secure the most appropriate and cost-effective insurance for their dogs.

The Role of Coverage and Deductibles

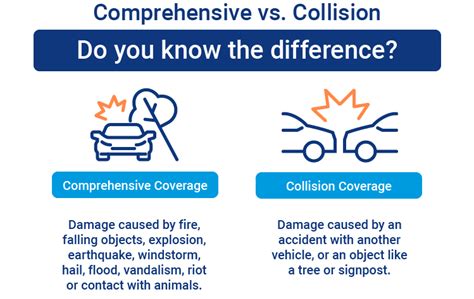

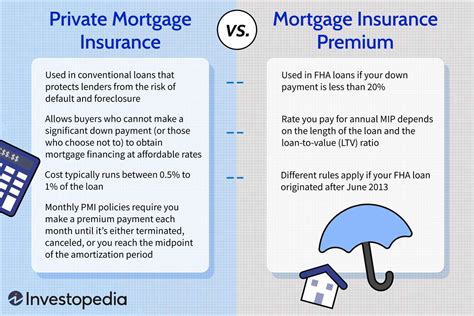

The level of coverage chosen by a pet owner is a critical determinant of the cost of dog insurance. Comprehensive policies that cover a wide range of veterinary services, including routine care, illnesses, accidents, and even chronic conditions, tend to be more expensive than basic plans that provide limited coverage. For instance, a policy that covers only accidents and illnesses may be more affordable than one that also includes routine care, such as annual check-ups and vaccinations.

Furthermore, the deductible chosen by the pet owner also significantly impacts the cost of insurance. A deductible is the amount the pet owner must pay out-of-pocket before the insurance coverage kicks in. Opting for a higher deductible typically results in lower monthly premiums, as the pet owner assumes more financial responsibility. Conversely, choosing a lower deductible means the pet owner pays less out-of-pocket when a claim is made, but the monthly premiums are usually higher. The balance between deductible and premium must be carefully considered to ensure the pet owner's financial comfort and the dog's health needs are both met.

Regional Variations in Insurance Costs

The geographical location of the pet owner is another factor that can significantly influence the cost of dog insurance. Insurance premiums can vary widely between different regions, often due to differences in the cost of living, veterinary services, and the prevalence of certain health conditions among dogs in those areas. For instance, urban areas with a higher cost of living and more expensive veterinary services may have higher insurance premiums compared to rural areas with lower living costs and more affordable veterinary care.

Additionally, the regional prevalence of specific health conditions can also impact insurance costs. Regions with a higher incidence of certain ailments or diseases among dogs may see higher insurance premiums as insurers factor in the increased risk of claims. For example, areas with a high incidence of tick-borne diseases may see higher premiums for dog insurance, as the risk of tick-related illnesses is greater. Understanding these regional variations is crucial for pet owners, as it allows them to anticipate and plan for the potential financial implications of their dog's insurance needs based on their specific geographical location.

Discounts and Bundling: Strategies to Lower Costs

Despite the various factors that can drive up the cost of dog insurance, there are strategies that pet owners can employ to potentially lower their insurance premiums. One effective approach is to take advantage of any available discounts. Many insurance providers offer discounts for multiple pets, as insuring multiple dogs can be more cost-effective than insuring them individually. Additionally, some insurers offer discounts for pet owners who have multiple policies with them, such as home and auto insurance, a strategy known as bundling.

Another strategy to consider is pet wellness plans. These plans, offered by some veterinary clinics, provide preventive care services such as vaccinations, flea and tick control, and routine check-ups at a discounted rate. While they don't provide the same level of comprehensive coverage as traditional insurance, they can help pet owners save on routine healthcare costs, potentially offsetting some of the costs associated with insurance premiums. However, it's essential to carefully evaluate these plans to ensure they meet the specific healthcare needs of the dog and complement any existing insurance coverage.

| Coverage Type | Average Annual Premium |

|---|---|

| Basic Coverage | $300 - $500 |

| Comprehensive Coverage | $500 - $1,000 |

| Accident-Only Coverage | $200 - $400 |

| Wellness Plans | $150 - $300 |

The Bottom Line: Navigating Dog Insurance Costs

Understanding the factors that influence the average cost of dog insurance is crucial for pet owners looking to provide comprehensive healthcare for their dogs while managing their financial responsibilities effectively. From the breed and size of the dog to the chosen coverage and deductible, each element plays a significant role in determining the overall insurance expense. Additionally, regional variations and the availability of discounts and bundling options offer avenues for pet owners to potentially reduce their insurance costs.

As pet owners navigate the landscape of dog insurance, it's essential to strike a balance between cost and coverage. While cost is a valid consideration, ensuring that your dog has adequate insurance to cover potential health issues is paramount. With a clear understanding of the factors that influence insurance costs and a strategic approach to choosing coverage, pet owners can provide their beloved canine companions with the best possible healthcare while maintaining financial stability.

How do I choose the right coverage for my dog’s insurance plan?

+Choosing the right coverage involves a careful assessment of your dog’s specific healthcare needs and your financial situation. Consider factors like your dog’s breed, age, and any pre-existing conditions. Evaluate the potential risks and costs associated with these factors and choose a plan that offers adequate coverage. Remember, while cost is important, ensuring your dog has the necessary coverage for potential health issues is crucial.

Can I get insurance for my dog if they have a pre-existing condition?

+Some insurance providers offer policies that cover pre-existing conditions, but these plans often come with higher premiums. It’s important to shop around and compare different providers to find the best coverage for your dog’s specific needs. Additionally, consider the potential costs of treating the pre-existing condition without insurance and weigh that against the cost of the insurance premium.

What is the average cost of dog insurance per month?

+The average monthly cost of dog insurance can vary widely depending on various factors, including the breed and age of the dog, the level of coverage chosen, and the region in which the owner resides. Basic coverage plans can range from 25 to 50 per month, while comprehensive plans can cost upwards of $100 per month. It’s essential to obtain quotes from multiple insurers to get an accurate estimate for your specific situation.