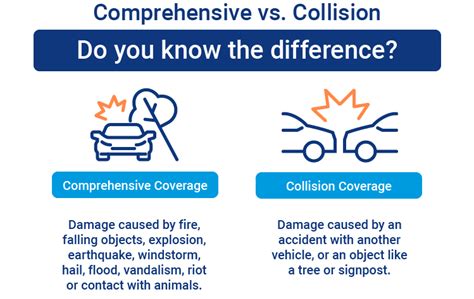

Comprehensive Vs Collision Insurance

When it comes to vehicle insurance, understanding the differences between comprehensive and collision coverage is crucial for making informed decisions about your policy. These two types of coverage offer distinct benefits and protections, each catering to specific situations and risks. In this article, we delve into the intricacies of comprehensive and collision insurance, exploring their features, benefits, and how they can impact your financial well-being in the event of an accident or unforeseen circumstance.

Understanding Comprehensive Insurance

Comprehensive insurance, often referred to as comp coverage, provides protection for your vehicle against a wide range of non-collision-related incidents. It is designed to cover damages caused by events beyond your control, ensuring you have the necessary financial support when faced with unexpected challenges.

Covered Perils and Benefits

Comprehensive insurance typically covers a variety of perils, including:

- Natural Disasters: This covers damages caused by events such as hurricanes, floods, earthquakes, and hail storms.

- Theft and Vandalism: In the unfortunate event of your vehicle being stolen or vandalized, comprehensive coverage has you covered.

- Animal Collisions: Hitting an animal on the road can result in significant damage. Comprehensive insurance provides protection in such situations.

- Falling Objects: Damage caused by falling objects, like tree branches or debris, is also covered.

- Fire and Explosion: If your vehicle is damaged due to fire or an explosion, comprehensive insurance offers financial relief.

Real-World Example

Let’s consider a scenario where a severe thunderstorm hits your area. During the storm, a large branch from a tree falls onto your parked car, causing significant damage to the roof and windshield. In this case, comprehensive insurance would step in to cover the repairs, providing you with the necessary funds to get your vehicle back in shape.

Comprehensive Coverage Limitations

While comprehensive insurance offers extensive protection, it’s important to note its limitations. Typically, comprehensive coverage does not include damages resulting from collisions with other vehicles or objects. For such incidents, collision insurance becomes a vital consideration.

Exploring Collision Insurance

Collision insurance, as the name suggests, specifically addresses damages caused by collisions with other vehicles, objects, or even rollovers. It is designed to provide financial coverage for repairs or replacements needed when your vehicle sustains physical damage due to an accident.

Covered Scenarios

Collision insurance covers a wide range of accident-related situations, including:

- Vehicle-to-Vehicle Collisions: Whether you’re at fault or not, collision insurance ensures you’re covered when involved in an accident with another vehicle.

- Colliding with Objects: Hitting a pole, a fence, or any other stationary object is covered under collision insurance.

- Rollover Accidents: If your vehicle rolls over due to a collision, this coverage ensures you’re financially protected.

Collision Coverage Example

Imagine you’re driving on a rainy night and suddenly lose control of your vehicle, causing it to slide into a streetlight pole. The impact results in severe damage to the front end of your car. In this scenario, collision insurance would be instrumental in covering the costs of repairs or even replacement if the damage is deemed beyond repair.

Comparative Analysis: Comprehensive vs. Collision

While both comprehensive and collision insurance provide valuable protection, they differ in their focus and scope. Comprehensive insurance offers a broader range of coverage, addressing non-collision-related incidents, whereas collision insurance is more specific, targeting accident-related damages. Choosing the right coverage depends on your individual needs and the risks you anticipate facing.

| Coverage Type | Covered Perils |

|---|---|

| Comprehensive | Natural disasters, theft, vandalism, animal collisions, falling objects, fire, and explosion |

| Collision | Vehicle collisions, hitting objects, and rollover accidents |

Choosing the Right Coverage

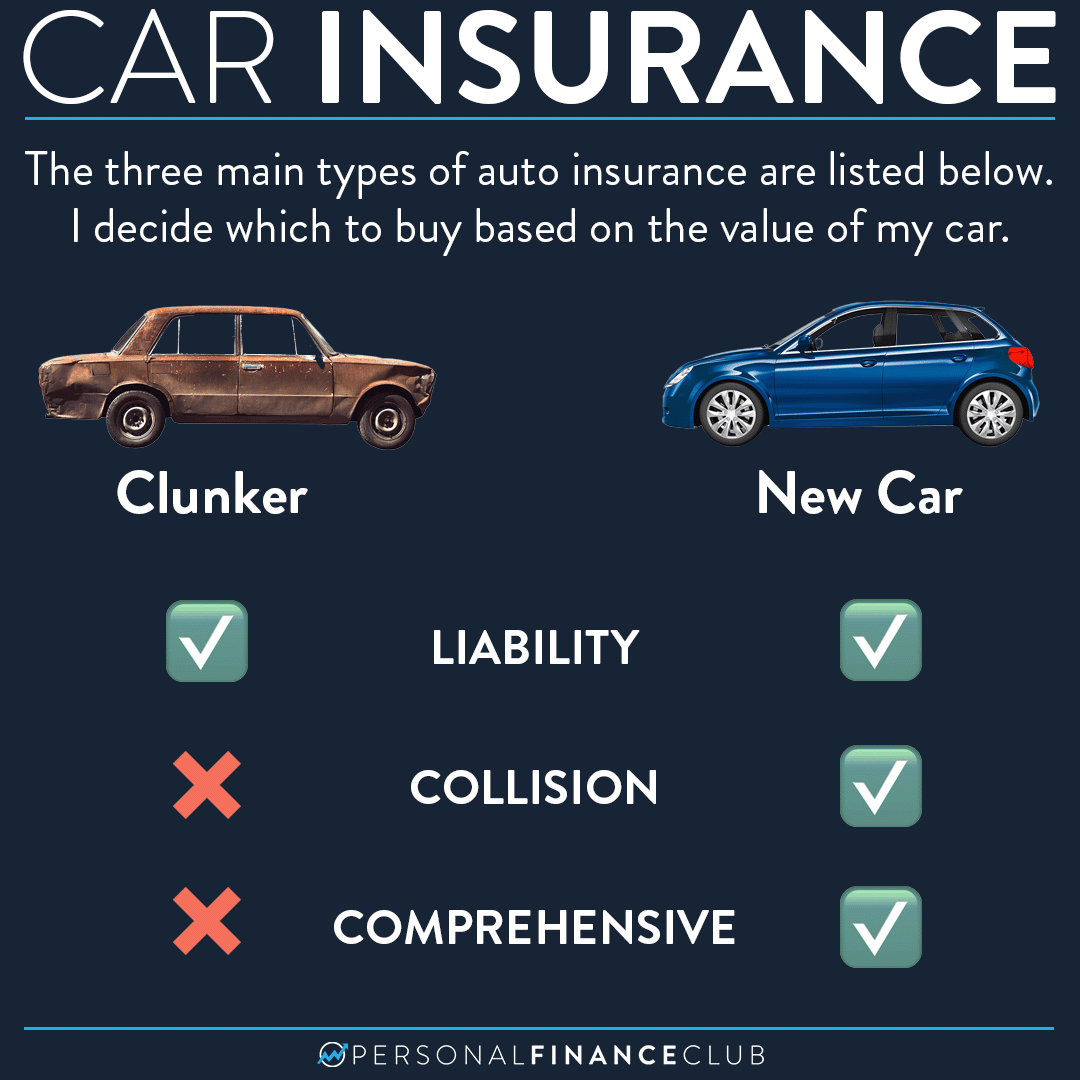

Selecting the appropriate insurance coverage involves careful consideration of your vehicle’s value, your budget, and the risks prevalent in your area. Here are some key factors to guide your decision-making process:

Vehicle Value and Age

The value and age of your vehicle play a significant role in determining the right coverage. If you own a newer or more expensive vehicle, comprehensive and collision insurance may be essential to protect your investment. On the other hand, older vehicles with lower market values may not require such extensive coverage.

Risk Assessment

Assessing the risks you face on a daily basis is crucial. If you live in an area prone to natural disasters or high crime rates, comprehensive insurance becomes a priority. Similarly, if you frequently drive in congested areas or on busy highways, collision insurance provides valuable peace of mind.

Budget and Cost Considerations

Insurance premiums can vary based on the coverage you choose. It’s important to balance your budget with the level of protection you desire. Opting for higher deductibles can lower your premiums but may also increase your out-of-pocket expenses in the event of a claim.

Performance Analysis: Comprehensive vs. Collision

To illustrate the performance of comprehensive and collision insurance, let’s examine some real-world scenarios and their financial implications:

Scenario 1: Natural Disaster

Your area is hit by a devastating hurricane, resulting in widespread flooding. Your vehicle, insured with comprehensive coverage, is damaged by floodwaters. Comprehensive insurance steps in to cover the repairs or even provide funds for a replacement if necessary.

Scenario 2: Collision with a Deer

While driving on a rural road, you unfortunately hit a deer. Your vehicle sustains significant damage to the front end. In this case, collision insurance would be instrumental in covering the repair costs, ensuring you’re not left with a hefty bill.

Scenario 3: Theft and Vandalism

Your parked car is broken into, and the thieves cause extensive damage to the interior and exterior. Comprehensive insurance would provide coverage for the repairs, helping you restore your vehicle to its pre-theft condition.

Future Implications and Expert Insights

As the automotive industry evolves, so do the risks and challenges faced by vehicle owners. With the rise of autonomous driving technologies and the increasing prevalence of extreme weather events, the landscape of insurance coverage is bound to adapt. Here are some insights from industry experts on the future of comprehensive and collision insurance:

Autonomous Vehicles and Insurance

“As autonomous vehicles become more common, the focus of insurance may shift from driver-related accidents to system failures and cybersecurity risks. Insurers will need to adapt their policies to cover these emerging challenges.”

Climate Change and Natural Disasters

“With climate change leading to more frequent and severe natural disasters, comprehensive insurance will become even more crucial. Insurance providers may need to adjust their policies and rates to account for these changing risks.”

Conclusion

Understanding the differences between comprehensive and collision insurance is essential for making informed choices about your vehicle’s protection. By carefully considering your needs, assessing risks, and staying informed about industry developments, you can ensure you have the right coverage to safeguard your financial well-being and peace of mind.

What is the difference between comprehensive and collision insurance?

+

Comprehensive insurance covers a wide range of non-collision incidents, such as natural disasters, theft, and vandalism, while collision insurance specifically addresses damages caused by collisions with other vehicles or objects.

Do I need both comprehensive and collision insurance?

+

The need for both coverages depends on your individual circumstances. If you own a newer or more valuable vehicle, both comprehensive and collision insurance are recommended. However, for older vehicles with lower market values, comprehensive insurance alone may suffice.

Are there any exclusions or limitations to comprehensive insurance coverage?

+

Yes, comprehensive insurance typically does not cover damages resulting from collisions with other vehicles. It primarily focuses on non-collision-related incidents.