What Is Comprehensive Car Insurance

Comprehensive car insurance is an essential aspect of vehicle ownership, providing extensive coverage and protection for drivers and their vehicles. It goes beyond the basic liability insurance, offering a wide range of benefits to policyholders. In today's dynamic world, where road incidents and unforeseen events are inevitable, comprehensive insurance acts as a safety net, ensuring financial security and peace of mind.

This article aims to delve deep into the world of comprehensive car insurance, exploring its definition, key features, benefits, and how it differs from other types of auto insurance. We will also discuss the factors influencing premiums, the claims process, and provide valuable tips to help you make informed decisions when choosing and utilizing this type of insurance.

Understanding Comprehensive Car Insurance

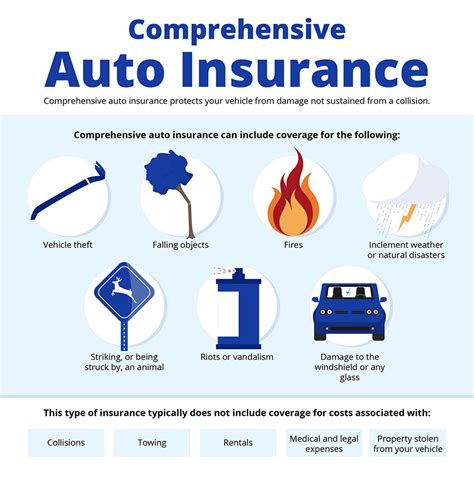

Comprehensive car insurance, often referred to as “full coverage” insurance, is a type of auto insurance policy that offers the broadest range of protections for vehicle owners. It is designed to cover a variety of potential incidents and damages, ensuring that policyholders are financially protected in almost any situation.

This type of insurance is distinct from liability-only insurance, which only covers the policyholder for bodily injury or property damage caused to others in an accident for which they are at fault. Comprehensive insurance, on the other hand, covers a much wider array of scenarios, including incidents not related to collisions, such as theft, vandalism, and natural disasters.

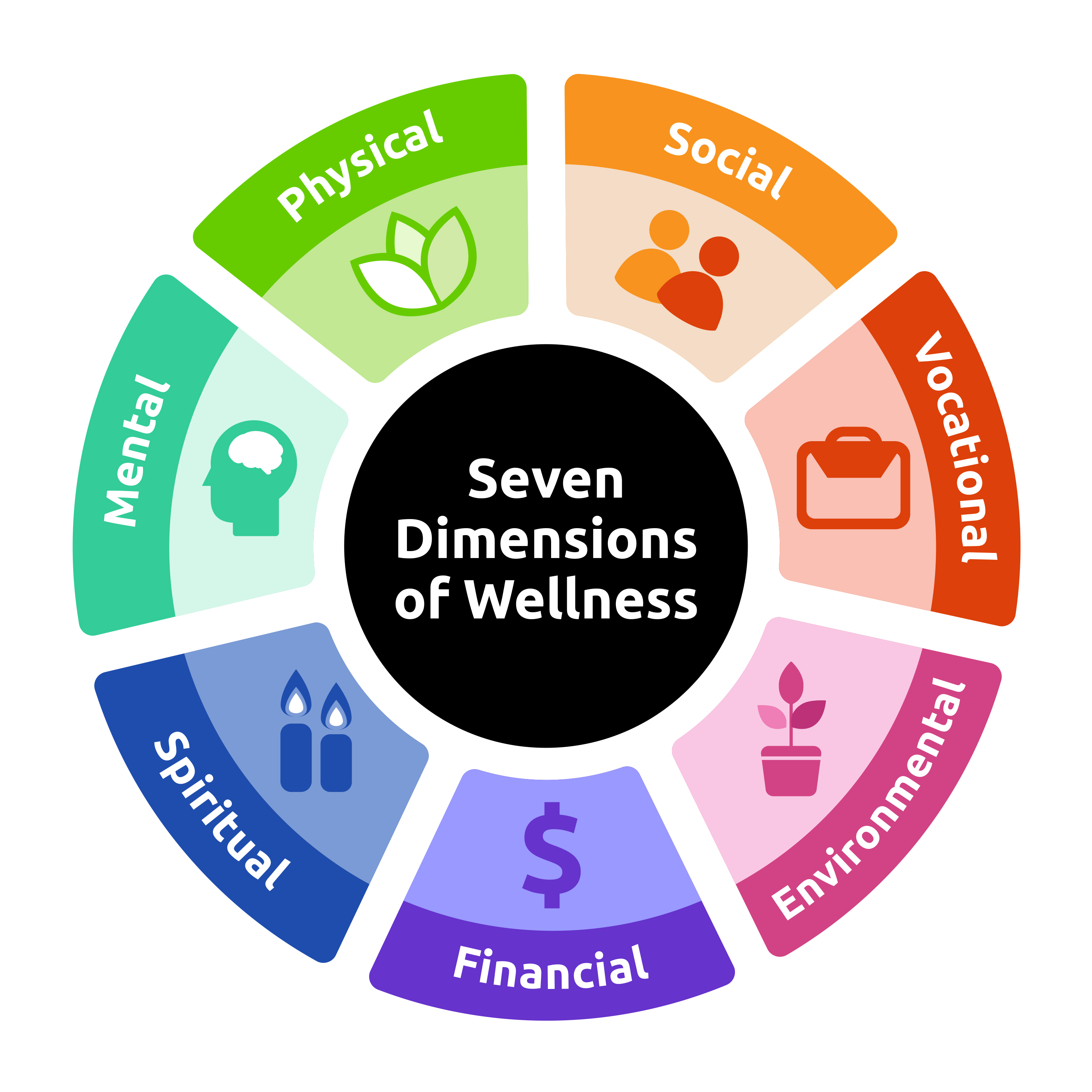

Key Features of Comprehensive Insurance

- Collision Coverage: Pays for damage to your vehicle if you’re involved in a collision, regardless of who is at fault.

- Comprehensive Coverage: Covers damages to your vehicle due to non-collision events like theft, vandalism, natural disasters, and animal strikes.

- Uninsured/Underinsured Motorist Coverage: Provides financial protection if you’re involved in an accident with a driver who doesn’t have enough insurance to cover the damages.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident.

- Rental Car Reimbursement: Helps cover the cost of renting a vehicle while your car is being repaired.

Each of these features can be tailored to your specific needs and budget, making comprehensive insurance a highly customizable option. It's important to note that while comprehensive insurance offers extensive coverage, it doesn't typically include wear and tear or mechanical breakdowns that are part of regular vehicle maintenance.

Benefits of Comprehensive Insurance

The advantages of comprehensive car insurance are multifaceted. Firstly, it provides financial protection in a wide range of scenarios, helping policyholders avoid costly out-of-pocket expenses. This can be particularly beneficial for those who lease or finance their vehicles, as it can cover the cost of repairs or replacements in case of severe damage.

Secondly, comprehensive insurance often includes roadside assistance, which can be a lifesaver in emergency situations. Whether you've run out of gas, locked your keys in the car, or experienced a flat tire, roadside assistance can provide prompt help, ensuring your safety and minimizing inconvenience.

Lastly, comprehensive insurance can provide peace of mind. Knowing that you're protected in various scenarios, from natural disasters to vandalism, can significantly reduce stress and anxiety associated with vehicle ownership. It's a form of insurance that truly lives up to its name, offering a comprehensive solution to protect your vehicle and your finances.

Comparing Comprehensive to Other Auto Insurance Types

Understanding how comprehensive insurance differs from other types of auto insurance is crucial for making informed decisions about your coverage.

Liability-Only Insurance

Liability-only insurance is the most basic form of auto insurance. It covers bodily injury and property damage for which you are at fault in an accident. However, it does not cover any damage to your own vehicle, regardless of the cause. This type of insurance is typically the most affordable, but it leaves you vulnerable to significant financial losses in case of an accident.

Collision Insurance

Collision insurance covers damage to your vehicle resulting from a collision with another vehicle or object. It’s an essential coverage if you want protection for your own vehicle, but it does not cover non-collision incidents like theft or natural disasters. Collision insurance often comes with a deductible, which is the amount you pay out of pocket before your insurance kicks in.

Comprehensive vs. Collision

While collision insurance covers collision-related damages, comprehensive insurance covers a much broader range of incidents. Comprehensive insurance includes collision coverage, but it also covers non-collision events, making it a more comprehensive option. It’s important to assess your specific needs and the potential risks you might face to determine whether comprehensive or collision insurance is the better fit for you.

Factors Influencing Comprehensive Insurance Premiums

The cost of comprehensive car insurance, like any other type of insurance, is influenced by a variety of factors. These factors can vary significantly depending on your location, personal driving history, and the type of vehicle you own.

Vehicle Type and Value

The make, model, and year of your vehicle play a significant role in determining your insurance premiums. Generally, newer and more expensive vehicles will have higher premiums due to the cost of repairs and replacement parts. Additionally, certain types of vehicles, such as sports cars or luxury vehicles, may be more prone to theft or vandalism, which can also increase your premiums.

Location and Driving Conditions

Where you live and drive can significantly impact your insurance rates. Areas with high crime rates or frequent natural disasters may have higher premiums due to the increased risk of theft, vandalism, or weather-related incidents. Similarly, if you live in an area with a high density of traffic or a high rate of accidents, your premiums may be higher.

Driver’s Age and Gender

Insurance companies often consider the age and gender of the primary driver when calculating premiums. Young drivers, particularly males under the age of 25, are often charged higher premiums due to their perceived higher risk of accidents. Similarly, older drivers may also face higher premiums, especially if they have a history of medical conditions that could affect their driving ability.

Claims History

Your past claims history is a significant factor in determining your insurance premiums. If you’ve made multiple claims in the past, especially for non-collision incidents, your premiums are likely to be higher. Insurance companies use your claims history to assess your risk level and adjust your premiums accordingly.

The Claims Process for Comprehensive Insurance

When an incident occurs that is covered by your comprehensive insurance policy, the claims process can seem daunting. However, with a clear understanding of the process and some helpful tips, you can navigate it smoothly and efficiently.

Reporting the Incident

The first step in the claims process is to report the incident to your insurance company as soon as possible. Most insurance companies have a 24-hour claims hotline, ensuring that you can report an incident at any time. Be sure to have your policy number and relevant details about the incident ready when you call.

Assessing the Damage

Once you’ve reported the incident, your insurance company will send an adjuster to assess the damage. The adjuster will inspect your vehicle and determine the extent of the damage, as well as the cost of repairs. It’s important to allow the adjuster to complete their assessment without interference to ensure an accurate estimate.

Repair or Replacement

Based on the adjuster’s assessment, your insurance company will decide whether to repair or replace your vehicle. If the cost of repairs exceeds a certain percentage of the vehicle’s value (typically around 75-80%), it may be more cost-effective to declare the vehicle a total loss and replace it. In such cases, you’ll receive the actual cash value of your vehicle, which is the current market value of a similar vehicle in good condition.

Filing a Claim

After the adjuster has assessed the damage and determined the cost of repairs or replacement, you’ll need to file a formal claim with your insurance company. This typically involves submitting a claim form and providing supporting documentation, such as photos of the damage, repair estimates, or receipts for any out-of-pocket expenses you’ve incurred.

Receiving Payment

Once your claim has been approved, your insurance company will issue payment for the agreed-upon amount. This payment may be made directly to you, or it may be sent to the repair shop or dealership if your vehicle is being repaired or replaced. If you’ve already paid for any repairs or replacements out of pocket, you’ll be reimbursed for those expenses.

Tips for Maximizing Your Comprehensive Insurance Coverage

To ensure you’re getting the most out of your comprehensive insurance policy, consider these valuable tips:

- Understand Your Policy: Carefully read through your policy documents to understand exactly what is and isn't covered. This will help you make informed decisions and avoid any surprises in the event of a claim.

- Choose the Right Deductible: Opt for a higher deductible if you're comfortable with a larger out-of-pocket expense in the event of a claim. This can lower your monthly premiums, but it's important to choose a deductible that you can afford to pay if needed.

- Maintain a Clean Driving Record: Your driving history plays a significant role in determining your insurance premiums. Strive to maintain a clean driving record by practicing safe driving habits and avoiding accidents and traffic violations.

- Explore Discounts: Many insurance companies offer discounts for various reasons, such as safe driving, good grades (for young drivers), or loyalty. Ask your insurance provider about any discounts you may be eligible for to lower your premiums.

- Bundle Your Policies: If you have multiple insurance needs, such as auto, home, and life insurance, consider bundling them with the same provider. Many insurance companies offer significant discounts for bundling multiple policies, making it a cost-effective option.

Future Implications of Comprehensive Car Insurance

The future of comprehensive car insurance is likely to be shaped by several key factors, including technological advancements, changing driving habits, and evolving consumer expectations.

Technological Advancements

The integration of technology in vehicles is expected to have a significant impact on comprehensive insurance. As more vehicles become equipped with advanced safety features and autonomous driving capabilities, the risk of accidents may decrease, potentially leading to lower insurance premiums. Additionally, the use of telematics, which monitors driving behavior in real-time, could provide more accurate assessments of individual risk, further influencing insurance rates.

Changing Driving Habits

Shifts in driving habits, such as an increase in remote work and a preference for car-sharing services, could also impact comprehensive insurance. With fewer people commuting to traditional offices, the risk of certain types of accidents may decrease, affecting insurance rates. Furthermore, the rise of electric vehicles and the potential for more sustainable transportation options could also influence insurance needs and costs.

Evolving Consumer Expectations

As consumer expectations continue to evolve, insurance companies may need to adapt their comprehensive insurance offerings to meet new demands. This could include providing more personalized coverage options, offering enhanced digital experiences, and developing innovative solutions to address emerging risks, such as cyber threats or data breaches associated with connected vehicles.

Conclusion

Comprehensive car insurance is a vital aspect of responsible vehicle ownership, offering extensive protection against a wide range of potential incidents and damages. By understanding the key features, benefits, and differences between comprehensive and other types of auto insurance, you can make informed decisions to ensure your vehicle and finances are adequately protected.

As you navigate the world of comprehensive insurance, keep in mind the factors that influence premiums, familiarize yourself with the claims process, and implement strategies to maximize your coverage. Additionally, stay attuned to the future implications of comprehensive insurance, as technological advancements, changing driving habits, and evolving consumer expectations are likely to shape the landscape of auto insurance in the years to come.

What is the difference between comprehensive and liability-only insurance?

+Comprehensive insurance offers a wide range of protections, covering damages to your vehicle due to collisions, theft, vandalism, natural disasters, and more. Liability-only insurance, on the other hand, only covers bodily injury and property damage for which you are at fault in an accident. It does not provide any coverage for damage to your own vehicle.

Does comprehensive insurance cover wear and tear or mechanical breakdowns?

+No, comprehensive insurance typically does not cover wear and tear or mechanical breakdowns that are part of regular vehicle maintenance. It focuses on providing coverage for incidents that are unexpected and out of the policyholder’s control.

How do I choose the right deductible for my comprehensive insurance policy?

+Choosing the right deductible depends on your comfort level with a larger out-of-pocket expense in the event of a claim. Opting for a higher deductible can lower your monthly premiums, but it’s important to choose a deductible that you can afford to pay if needed. Consider your financial situation and the potential risks you might face when deciding on a deductible.