Best Home Insurance

Home insurance is an essential safeguard for homeowners, providing financial protection against a wide range of unforeseen events that could lead to costly repairs or replacements. The right home insurance policy can offer peace of mind, ensuring that you're prepared for the unexpected. With so many options available, choosing the best home insurance can be a daunting task. This comprehensive guide aims to navigate you through the process, offering expert insights and practical advice to make an informed decision.

Understanding Your Home Insurance Needs

Before diving into the world of home insurance policies, it's crucial to understand your specific needs. Every homeowner's situation is unique, and the coverage you require will depend on factors such as the location and size of your home, the value of your possessions, and any specific risks associated with your area.

Consider the following key aspects when assessing your home insurance needs:

- Dwelling Coverage: This covers the physical structure of your home, including walls, roofs, and permanent fixtures. It's essential to ensure this coverage aligns with your home's current market value.

- Personal Property Coverage: This protects your belongings against damage or loss due to covered perils. It's crucial to assess the value of your possessions and choose a policy that provides adequate coverage.

- Liability Coverage: This safeguards you against lawsuits and medical bills if someone is injured on your property. It's a vital aspect of home insurance, providing financial protection in case of accidents.

- Additional Living Expenses: In the event your home becomes uninhabitable due to a covered peril, this coverage will help cover the costs of temporary housing and additional living expenses.

- Optional Coverages: Depending on your needs, you may want to consider additional coverages such as flood insurance, earthquake insurance, or coverage for high-value items like jewelry or art.

Researching and Comparing Home Insurance Providers

With a clear understanding of your insurance needs, the next step is to research and compare different home insurance providers. There are numerous companies offering a wide range of policies, and it's essential to find one that offers the coverage you need at a competitive price.

Key Factors to Consider When Comparing Providers:

- Financial Strength: Choose an insurance company with a strong financial rating. This ensures they have the financial stability to pay out claims in the event of a disaster.

- Coverage Options: Look for a provider that offers a range of coverage options, including the specific coverages you require. Some companies may specialize in certain types of coverage, so be sure to research thoroughly.

- Customer Service: Excellent customer service is vital when dealing with insurance claims. Read reviews and ratings to gauge the provider's reputation for customer satisfaction.

- Policy Features: Compare the features and benefits of different policies. Look for additional perks such as discounts for multiple policies, loyalty rewards, or free add-ons.

- Pricing: While price is an important factor, it's not the only consideration. Ensure you're comparing policies with similar coverage limits and deductibles to get an accurate comparison.

The Top Home Insurance Providers and Their Offerings

Now, let's delve into some of the top home insurance providers and explore the unique features and benefits they offer.

State Farm

State Farm is one of the largest insurance providers in the United States, offering a comprehensive range of insurance products, including home insurance. Here's what sets them apart:

- Coverage Options: State Farm offers customizable home insurance policies, allowing you to tailor your coverage to your specific needs. They provide coverage for dwellings, personal property, liability, and additional living expenses.

- Discounts: State Farm offers a range of discounts, including multi-policy discounts if you bundle your home and auto insurance, as well as discounts for safety features like burglar alarms and smoke detectors.

- 24/7 Claims Service: State Farm provides 24-hour claims service, ensuring you can access support whenever you need it.

- Financial Strength: With an A++ rating from AM Best, State Farm is known for its financial stability, giving customers peace of mind.

Allstate

Allstate is another leading insurance provider, known for its innovative approach to insurance and its range of coverage options.

- Coverage Options: Allstate offers a variety of coverage options, including standard home insurance policies and specialty coverages for high-value homes and unique risks.

- Innovative Features: Allstate's home insurance policies come with innovative features like Claim Satisfaction Guarantee and Value Added Services, providing added peace of mind.

- Discounts: Allstate offers a range of discounts, including multi-policy discounts, safe home discounts, and claim-free discounts.

- Digital Tools: Allstate provides digital tools like the Allstate Mobile App and the Allstate Digital Locker, making it easy to manage your policy and track your belongings.

USAA

USAA is a highly regarded insurance provider that caters specifically to military members, veterans, and their families. They offer a range of insurance products, including home insurance, tailored to the unique needs of military personnel.

- Military-Focused: USAA's home insurance policies are designed with the specific needs of military families in mind, offering coverage for unique situations like deployment or frequent relocations.

- Competitive Pricing: USAA is known for offering competitive rates on home insurance, providing excellent value for money.

- 24/7 Claims Support: USAA provides around-the-clock claims support, ensuring military members and their families can access assistance whenever needed.

- Additional Perks: USAA offers a range of additional perks, including discounts for multi-policy bundles, loyalty rewards, and access to a network of trusted contractors for repairs and renovations.

Understanding Policy Terms and Conditions

When comparing home insurance policies, it's crucial to carefully review the terms and conditions to ensure you understand the coverage provided and any potential limitations or exclusions.

Key Terms to Understand:

- Policy Limits: This refers to the maximum amount the insurance company will pay out for a covered loss. It's important to ensure your policy limits align with the value of your home and possessions.

- Deductibles: This is the amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles can lead to lower premiums, so it's a trade-off to consider.

- Exclusions: These are specific events or situations that are not covered by your policy. It's essential to review the exclusions to ensure you're aware of any limitations.

- Coverage Period: This refers to the length of time your policy is valid. Most home insurance policies are renewed annually, but it's important to confirm the coverage period.

- Claims Process: Understanding the claims process is crucial. Know what steps to take in the event of a claim and ensure you're aware of any time limits or requirements.

Additional Considerations for Choosing the Best Home Insurance

Beyond the basic coverage and pricing, there are several additional factors to consider when choosing the best home insurance for your needs.

Customer Service and Claims Handling

Excellent customer service and efficient claims handling are crucial aspects of any insurance provider. Look for providers with a reputation for prompt and fair claims handling, as this can make a significant difference in the event of a claim.

Discounts and Rewards

Many insurance providers offer discounts and rewards to policyholders. These can include multi-policy discounts, loyalty rewards, or discounts for safety features. Taking advantage of these can help reduce your insurance costs.

Digital Tools and Resources

In today's digital age, many insurance providers offer online tools and resources to make managing your policy easier. Look for providers that offer mobile apps, online policy management, and digital resources to track your belongings and manage your insurance needs.

Making an Informed Decision

Choosing the best home insurance involves a thorough evaluation of your needs, a comparison of providers, and a careful review of policy terms and conditions. By understanding your specific requirements and researching the market, you can find a policy that offers the coverage you need at a competitive price.

Remember, home insurance is a long-term investment, and it's essential to choose a provider that you can trust to support you in the event of a claim. Take the time to research, compare, and understand the fine print to ensure you're making an informed decision.

Frequently Asked Questions

How much does home insurance typically cost?

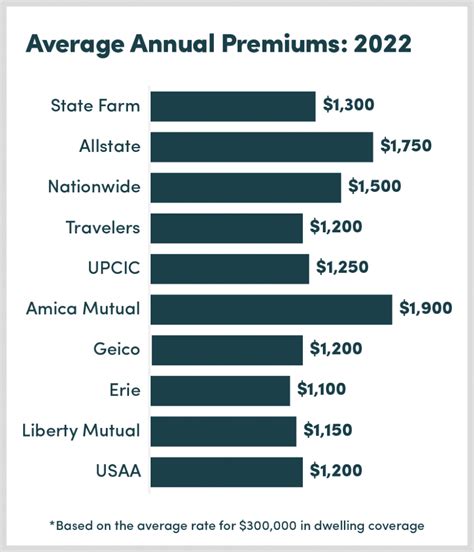

+The cost of home insurance can vary significantly depending on factors such as the location and size of your home, the value of your possessions, and the level of coverage you require. On average, homeowners can expect to pay between 500 and 1,500 per year for home insurance. However, it’s important to note that this is just an estimate, and your actual premium may be higher or lower based on your specific circumstances.

What are some common exclusions in home insurance policies?

+Common exclusions in home insurance policies can include damage caused by earthquakes, floods, or hurricanes, unless specific coverage is purchased for these events. Other exclusions may include damage caused by pests, vermin, or insects, as well as wear and tear, gradual deterioration, or maintenance issues. It’s important to carefully review the exclusions in any policy you’re considering to ensure you understand what is and isn’t covered.

Can I bundle my home and auto insurance to save money?

+Yes, bundling your home and auto insurance policies with the same provider can often result in significant savings. Many insurance companies offer multi-policy discounts, which can reduce your overall insurance costs. By bundling your policies, you not only save money but also streamline your insurance management, as you only have to deal with one provider for both your home and auto insurance needs.

What should I do if I’m not satisfied with my home insurance provider?

+If you’re not satisfied with your home insurance provider, it’s important to take action. First, carefully review your policy and the terms and conditions to ensure you understand the coverage provided and any potential issues. If you feel the provider is not meeting your needs or offering fair value, consider shopping around for alternative providers. Compare policies, coverage limits, and premiums to find a provider that better suits your requirements. Don’t be afraid to switch providers if you find a better option that meets your needs and offers better value.

How often should I review my home insurance policy?

+It’s a good idea to review your home insurance policy annually to ensure it still meets your needs. Life circumstances can change, and your insurance requirements may evolve. Regular policy reviews allow you to make adjustments as needed, ensuring you have adequate coverage at all times. Additionally, reviewing your policy annually provides an opportunity to shop around for better rates or additional coverage options, helping you stay informed and in control of your insurance needs.