Quotes Online For Car Insurance

The world of car insurance is evolving, and with it, the way we seek quotes and compare policies. In an era where convenience and customization are paramount, the online realm offers a seamless solution to finding the perfect car insurance coverage. This article delves into the intricacies of online car insurance quotes, exploring the benefits, the process, and the factors that influence the quotes you receive.

The Rise of Online Car Insurance Quotes

The digital age has transformed the way we approach insurance, making it more accessible and personalized than ever before. With just a few clicks, drivers can now explore a vast array of insurance options, tailored to their specific needs and circumstances. This shift towards online quotes has not only streamlined the insurance-shopping experience but has also empowered consumers to make more informed decisions.

One of the key advantages of obtaining car insurance quotes online is the unparalleled convenience it offers. Whether you're a busy professional or a stay-at-home parent, the ability to compare multiple insurance providers from the comfort of your home or office is a significant advantage. No more tedious phone calls or in-person meetings; the entire process can be completed at your own pace and on your own terms.

Benefits of Online Quotes

- Time Efficiency: Online quotes provide an instant snapshot of insurance options, saving you the time and effort of visiting multiple insurance agencies.

- Personalized Experience: Many online platforms allow you to customize your quote based on your specific needs, ensuring a tailored insurance plan.

- Competitive Pricing: With the ability to compare multiple providers, you can easily identify the most cost-effective options, potentially saving you hundreds of dollars annually.

- Enhanced Transparency: Online quotes often provide detailed breakdowns of coverage, deductibles, and other important policy details, ensuring you understand exactly what you’re paying for.

Understanding the Quote Process

Obtaining an online car insurance quote typically involves a straightforward, user-friendly process. Here’s a step-by-step breakdown:

- Select an Online Platform: Start by choosing a reputable online insurance marketplace or directly visiting the website of an insurance provider.

- Provide Basic Information: You’ll be prompted to enter details such as your name, address, vehicle make and model, and driving history.

- Customize Your Quote: Depending on the platform, you may have the option to choose specific coverage types, adjust deductibles, and add optional features to create a personalized policy.

- Review and Compare: Once your quote is generated, take the time to carefully review the coverage details and compare it with other quotes you’ve obtained. Look for features like comprehensive coverage, collision insurance, and liability protection to ensure you’re adequately insured.

- Purchase or Request a Callback: If you’re satisfied with the quote, you can proceed with the purchase. Some platforms also offer the option to request a callback from an insurance agent for further clarification or assistance.

Factors Influencing Your Quote

It’s important to understand that car insurance quotes are influenced by a variety of factors. Here are some key considerations:

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as how you use it (e.g., commuting, pleasure driving, or business use) can impact your quote.

- Driving History: Your past driving record, including accidents, traffic violations, and claims, is a significant factor in determining your insurance rates.

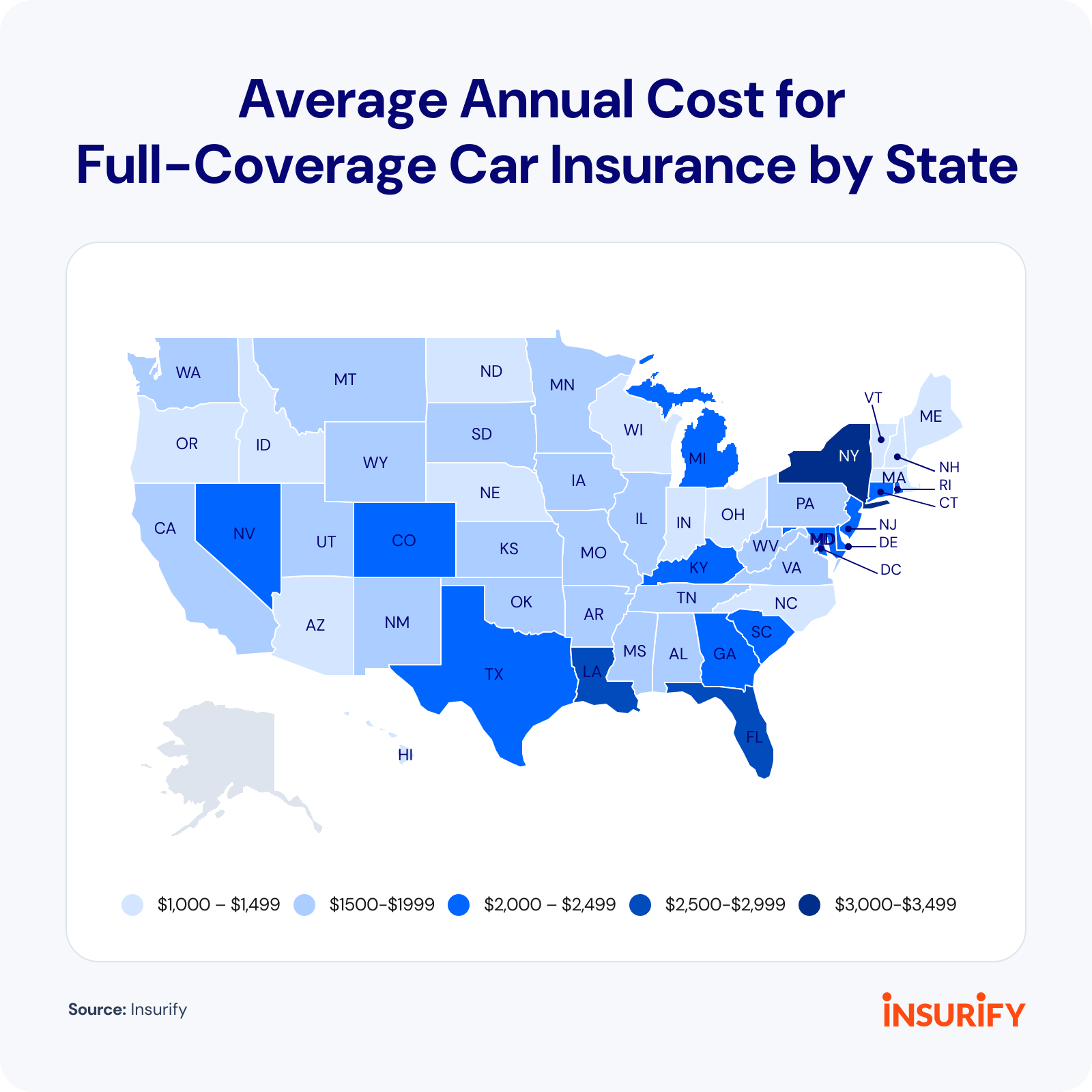

- Location and Demographics: Insurance rates can vary based on your geographical location and demographic factors such as age, gender, and marital status.

- Coverage and Deductibles: The level of coverage you choose (e.g., liability-only vs. comprehensive coverage) and your preferred deductibles will directly affect your premium.

- Discounts and Bundles: Many insurance providers offer discounts for safe driving, loyalty, or bundling multiple policies (e.g., auto and home insurance) with the same provider.

Maximizing Your Online Quote Experience

To make the most of your online car insurance quote journey, consider these tips:

- Research and Compare: Don’t settle for the first quote you receive. Compare multiple quotes to identify the best combination of coverage and price.

- Be Honest and Accurate: Provide accurate and honest information when obtaining quotes. Misrepresentations can lead to issues down the line, including claim denials.

- Explore Discounts: Many insurance providers offer a wide range of discounts. Take the time to understand the discounts you may be eligible for and factor them into your quote comparison.

- Consider Bundling: If you have multiple insurance needs (e.g., auto, home, and life insurance), consider bundling your policies with a single provider to potentially save more.

The Future of Car Insurance Quotes

As technology continues to advance, the car insurance quote process is likely to become even more efficient and personalized. Expect to see further innovations in the use of data analytics and artificial intelligence to provide more accurate and tailored quotes. Additionally, the integration of telematics and usage-based insurance (UBI) will offer drivers the opportunity to further customize their insurance based on their actual driving behavior.

In conclusion, online car insurance quotes offer a convenient, transparent, and personalized way to find the right coverage for your needs. By understanding the process, the influencing factors, and the potential future developments, you can navigate the world of car insurance with confidence and ensure you're getting the best value for your money.

How do I know if an online insurance quote is accurate?

+Accurate online quotes rely on the precision of the information you provide. Be as detailed and honest as possible when inputting your details. Additionally, compare quotes from multiple providers to get a better sense of the market rate for your specific circumstances.

Can I switch insurance providers easily if I find a better quote online?

+Switching insurance providers is generally a straightforward process. However, it’s important to ensure you’re not left with any gaps in coverage. Make sure your new policy is effective before canceling your old one. Some providers may also offer incentives to stay, so it’s worth exploring all your options.

What if I have specific insurance needs, like classic car insurance or commercial vehicle coverage?

+Online quotes can also cater to specialized insurance needs. Many providers offer specific policies for classic cars, commercial vehicles, and other unique situations. Be sure to explore these options and compare quotes to find the best coverage for your unique circumstances.