Aetna Us Healthcare Insurance

In the ever-evolving landscape of healthcare, understanding the intricacies of health insurance plans is crucial. Aetna, a leading name in the US healthcare industry, offers a comprehensive range of insurance options. This article aims to delve into the specifics of Aetna's healthcare insurance plans, exploring their features, benefits, and how they cater to the diverse needs of individuals and families across the nation.

Unraveling Aetna’s Healthcare Insurance Plans

Aetna, with its rich history dating back to the 19th century, has solidified its position as a trusted provider of healthcare services and insurance. Their insurance plans are designed to offer accessibility, affordability, and personalized care to policyholders.

Plan Categories and Coverage Options

Aetna’s healthcare insurance plans can be broadly categorized into individual and family plans, employer-sponsored plans, and Medicare plans. Each category is further subdivided to cater to specific needs and demographics.

- Individual and Family Plans: These plans are tailored for those without employer-sponsored coverage, offering flexibility and customization. Aetna’s individual plans often include options for dental, vision, and prescription drug coverage, ensuring holistic health protection.

- Employer-Sponsored Plans: Many employers offer Aetna plans as part of their benefits package. These plans are designed to meet the needs of a diverse workforce, often providing comprehensive coverage with a focus on preventative care and wellness programs.

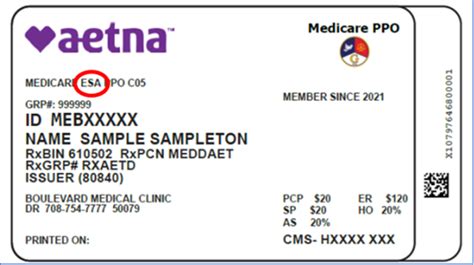

- Medicare Plans: For individuals aged 65 and above, Aetna offers a range of Medicare plans, including Medicare Advantage plans and Medicare Supplement plans. These plans ensure that seniors can access quality healthcare services without financial strain.

Key Features and Benefits

Aetna’s healthcare insurance plans are known for their robust features and benefits, which include:

- Wide Network of Providers: Aetna boasts an extensive network of healthcare providers, including hospitals, physicians, and specialists, ensuring policyholders have ample options for their healthcare needs.

- Preventative Care Focus: Many plans prioritize preventative care, offering coverage for annual check-ups, screenings, and immunizations, which can help detect potential health issues early on.

- Wellness Programs: Aetna often includes wellness programs in their plans, encouraging policyholders to adopt healthy lifestyles. These programs may offer discounts on gym memberships, healthy food options, or smoking cessation programs.

- Prescription Drug Coverage: Depending on the plan, Aetna provides coverage for prescription medications, helping policyholders manage chronic conditions or acute illnesses.

- Telehealth Services: With the rise of telehealth, Aetna has integrated virtual healthcare services into many of its plans, allowing policyholders to consult with healthcare professionals remotely, enhancing accessibility and convenience.

Comparative Analysis: Aetna vs. Competitors

When comparing Aetna to other leading healthcare insurance providers, several key differences emerge. Here’s a brief overview:

| Feature | Aetna | Competitor X | Competitor Y |

|---|---|---|---|

| Network Size | Extensive network with over 1.2 million healthcare professionals and 5,700 hospitals | Smaller network, focusing on specific regions | National network, but with fewer provider options |

| Preventative Care Emphasis | Strong focus on preventative care, offering comprehensive coverage for check-ups and screenings | Limited coverage for preventative services | Moderate emphasis, with some plans offering better coverage than others |

| Wellness Programs | Incorporates wellness programs, encouraging healthy lifestyles | Does not offer dedicated wellness programs | Provides basic wellness incentives |

| Telehealth Integration | Fully integrated telehealth services | Limited telehealth options | Offers telehealth services, but with additional fees |

Real-World Success Stories

Aetna’s insurance plans have positively impacted the lives of many individuals and families. Here are a couple of real-world examples:

Case Study 1: Family Coverage

The Johnson family, with two young children, opted for an Aetna family plan. The plan provided comprehensive coverage for their annual check-ups, immunizations, and even covered a minor surgery for their youngest child. The family appreciated the wide network of providers, ensuring they could choose the best healthcare professionals for their needs.

Case Study 2: Senior Coverage

Ms. Wilson, a retired teacher, chose an Aetna Medicare Advantage plan. The plan covered her annual check-ups, prescription medications, and even offered dental and vision coverage. Ms. Wilson was impressed by the plan's focus on preventative care and the ease of accessing healthcare services through Aetna's network of providers.

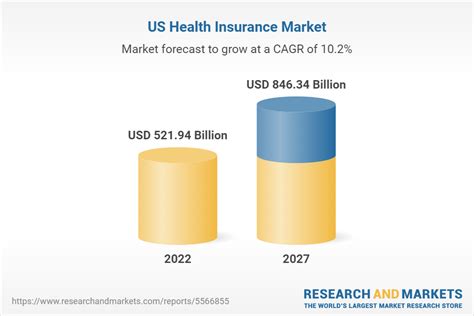

Performance Analysis and Future Outlook

Aetna’s performance in the healthcare insurance market has been impressive. Their commitment to innovation and customer satisfaction has led to steady growth and a positive reputation. With a focus on digital transformation, Aetna is well-positioned to meet the evolving needs of policyholders, particularly in the realm of telehealth and remote healthcare services.

Looking ahead, Aetna is likely to continue its expansion, offering more specialized plans to cater to the unique needs of different demographics. Their focus on preventative care and wellness is expected to remain a key differentiator, attracting health-conscious individuals and families.

Frequently Asked Questions

How do I choose the right Aetna plan for my needs?

+Choosing the right Aetna plan depends on your specific healthcare needs and budget. Consider factors like coverage options, network providers, and any additional benefits like wellness programs or telehealth services. Consulting with an Aetna representative or a healthcare advisor can help you make an informed decision.

What is the enrollment process for Aetna’s insurance plans?

+The enrollment process varies depending on the type of plan. For individual and family plans, you can enroll directly through Aetna’s website or by contacting their customer service. Employer-sponsored plans are typically enrolled through your employer’s benefits department. Medicare plans have specific enrollment periods, so it’s important to plan ahead.

How does Aetna’s network of providers compare to other insurers?

+Aetna boasts one of the largest networks of healthcare providers in the industry, offering policyholders a wide range of options for their healthcare needs. This extensive network ensures that policyholders can access quality care without having to travel far or compromise on their preferred healthcare professionals.