Insurance Agent Near Me

Are you searching for a reliable insurance agent in your vicinity? Finding the right insurance professional to guide you through the complex world of insurance policies can be a daunting task. With so many options available, it's crucial to choose an agent who understands your unique needs and can provide personalized advice. This article aims to assist you in your quest, offering a comprehensive guide to finding and working with the best insurance agent near you.

Understanding the Role of an Insurance Agent

An insurance agent, often referred to as an insurance broker or advisor, serves as a crucial intermediary between insurance companies and clients. Their primary role is to help individuals and businesses navigate the intricate landscape of insurance coverage, ensuring they secure the most suitable and comprehensive policies. This professional acts as a trusted advisor, offering expertise and guidance tailored to your specific requirements.

Insurance agents are licensed and trained to represent multiple insurance carriers, allowing them to offer a wide range of policy options. They provide unbiased advice, helping clients make informed decisions about coverage, premiums, and other crucial aspects of insurance. Additionally, agents often assist with policy management, making changes, and addressing any concerns or claims-related issues.

The Importance of Local Agents

While online resources and comparison tools can be helpful in understanding insurance options, working with a local insurance agent offers several advantages. Local agents are often more familiar with the specific needs and regulations of your area, whether it’s for home, auto, health, or business insurance. They can provide insights into local risks, such as natural disasters or crime rates, which may impact your coverage needs.

Furthermore, a nearby agent is easily accessible for face-to-face meetings, which can be invaluable when discussing complex insurance matters. They can also offer a higher level of personalized service, building a relationship based on trust and understanding. Local agents are often well-integrated into the community, which can lead to better service and support.

| Benefits of Local Insurance Agents | Key Advantages |

|---|---|

| Community Knowledge | Understanding local risks and regulations. |

| Accessibility | Convenient face-to-face meetings and quick response times. |

| Personalized Service | Building trust and a long-term relationship. |

| Community Integration | Potential for better service and support. |

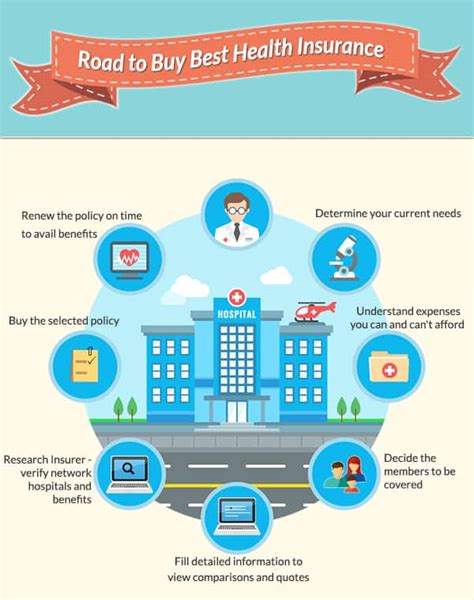

Finding the Right Insurance Agent Near You

When embarking on your search for an insurance agent, consider these key steps to ensure you find the best fit for your needs:

Online Research

Start your search by using online directories and search engines. Enter phrases like “insurance agent near me” or “local insurance brokers” to uncover a list of agents in your area. Explore their websites to learn about their services, specialties, and customer reviews. Check online platforms like Google My Business, Yelp, or industry-specific directories for ratings and feedback.

Online research can also help you understand the insurance landscape in your area. Look for articles or guides specific to your location that might offer insights into common risks and insurance needs. This can give you a better idea of the type of coverage you might require.

Referrals and Recommendations

Word-of-mouth recommendations are often some of the most trustworthy sources when seeking an insurance agent. Ask friends, family, colleagues, or neighbors who they use and why. Personal referrals can provide valuable insights into an agent’s reputation, level of service, and expertise.

You can also seek recommendations from professionals you trust, such as financial advisors, accountants, or lawyers. These professionals often work closely with insurance agents and can provide informed referrals.

Licensing and Credentials

Ensure that any agent you consider is licensed to sell insurance in your state or region. You can verify this by checking with your state’s insurance department or using online tools provided by insurance regulators. Licensed agents have met certain educational and ethical standards, ensuring they are knowledgeable and operate with integrity.

In addition to licensing, look for agents who hold professional designations or certifications. These credentials indicate advanced training and expertise in specific areas of insurance. For instance, a Certified Insurance Counselor (CIC) or a Chartered Property and Casualty Underwriter (CPCU) has undergone rigorous training and examinations to demonstrate their proficiency.

Evaluating Potential Agents

Once you’ve identified a few potential agents, it’s crucial to evaluate them further to ensure they are the right fit for your needs.

Interview Process

Schedule interviews with several agents to assess their suitability. During these meetings, ask about their experience, the types of insurance they specialize in, and their approach to client service. Consider their communication style and whether it aligns with your preferences. Do they listen attentively, ask relevant questions, and provide clear explanations?

Inquire about their typical clients and the types of policies they frequently handle. This can give you an idea of their expertise and whether they have experience with cases similar to yours. Don't hesitate to ask for references or case studies to understand their past work and successes.

Policy Options and Customization

Insurance agents should be able to offer a range of policy options from multiple carriers. Ask about the companies they represent and the types of coverage they can provide. A good agent will tailor their recommendations to your specific needs, providing options that balance coverage and cost-effectiveness.

Discuss your unique circumstances and any specific coverage requirements you might have. A competent agent will take the time to understand your situation and offer personalized advice. They should be able to explain the nuances of different policies, helping you make an informed decision.

Claims Process and Support

The claims process is a critical aspect of insurance, and it’s important to understand how an agent can support you during this time. Inquire about their experience with claims and how they assist clients throughout the process. Do they provide guidance and advocacy, ensuring you receive the full benefits of your policy?

Ask about their availability during a claim. Are they easily reachable, and do they offer ongoing support until the claim is resolved? Understanding their claims process and commitment to client support can give you peace of mind, knowing you'll have assistance when you need it most.

Working with Your Insurance Agent

Once you’ve selected an insurance agent, establishing a strong working relationship is essential for ensuring you receive the best service and advice.

Regular Communication

Maintain open and regular communication with your agent. Keep them informed about any changes in your circumstances that might impact your insurance needs. Whether it’s a new addition to the family, a change in business operations, or a move to a new home, these updates can influence your insurance coverage.

Regular check-ins can also help you stay informed about any changes in the insurance landscape, such as new policies, updated regulations, or shifts in market trends. Your agent can provide valuable insights and advice based on these changes.

Review and Adjust Coverage

Insurance needs can evolve over time, so it’s important to regularly review your policies with your agent. They can help assess whether your current coverage is still adequate or if adjustments are necessary. This review process can ensure you’re not overinsured or underinsured, and it provides an opportunity to explore new options that better suit your changing needs.

During these reviews, discuss any concerns or questions you have about your coverage. Your agent should be able to provide clear and concise explanations, helping you understand your policy and any changes that are recommended.

Seeking Expert Advice

Insurance is a complex field, and it’s normal to have questions or uncertainties. Don’t hesitate to reach out to your agent for expert advice. Whether it’s understanding a specific policy term, exploring options for additional coverage, or seeking guidance on a potential claim, your agent is there to provide clarity and support.

Remember, your agent is your advocate. They should be committed to helping you make informed decisions and ensuring you have the right coverage to protect what matters most to you.

The Future of Insurance Brokerage

The insurance industry is continually evolving, and the role of insurance agents is adapting to meet changing client needs and technological advancements. Here’s a glimpse into the future of insurance brokerage:

Digital Transformation

Insurance agents are increasingly leveraging digital tools and platforms to enhance their services. This includes online portals for clients to access policy information, make payments, and file claims. Agents are also using technology to streamline administrative tasks, allowing them to focus more on client relationships and advice.

Digital transformation also enables agents to offer more personalized services. With advanced analytics and data-driven insights, they can better understand client needs and provide tailored recommendations. This level of customization can lead to more effective coverage and improved client satisfaction.

Collaborative Partnerships

The future of insurance brokerage may see more collaborative partnerships between agents and other professionals. For instance, agents could work closely with financial advisors to provide holistic financial planning that integrates insurance. This integrated approach can offer clients a more comprehensive view of their financial well-being.

Specialization and Niche Markets

As the insurance landscape becomes more complex, agents may increasingly specialize in specific areas. This specialization allows them to develop deep expertise in particular industries or coverage types. For example, some agents might focus on cyber insurance for businesses, while others might specialize in high-net-worth individual insurance.

Specialization can also lead to agents serving niche markets. This could include providing tailored insurance solutions for specific industries, such as healthcare or technology, or catering to unique client needs, like coverage for exotic pets or high-value art collections.

Client Education and Empowerment

The future of insurance brokerage may emphasize client education and empowerment. Agents could take a more proactive role in educating clients about insurance, helping them understand the nuances of different policies and the importance of coverage. This educational approach can lead to more informed decision-making and better protection for clients.

Additionally, agents may use technology to provide clients with real-time updates and insights. This could include mobile apps or online platforms that offer personalized insurance recommendations, policy management tools, and easy access to educational resources.

FAQ

What is the role of an insurance agent, and why do I need one?

+

An insurance agent serves as your trusted advisor in the complex world of insurance. They help you navigate various policies, explain coverage options, and ensure you have the right protection for your needs. With their expertise, they can save you time, money, and potential headaches by guiding you through the insurance process.

How can I find reputable insurance agents in my area?

+

You can use online directories, search engines, or ask for referrals from trusted sources like friends, family, or professionals. Check for licensing and credentials, and look for agents with a strong track record of client satisfaction.

What should I look for in an insurance agent’s credentials and licensing?

+

Ensure they are licensed in your state or region. Look for professional designations like CIC (Certified Insurance Counselor) or CPCU (Chartered Property and Casualty Underwriter), which indicate advanced training and expertise.

How do I know if an insurance agent is a good fit for my needs?

+

Schedule interviews and ask about their experience, specialization, and approach to client service. Evaluate their communication style and whether they understand your unique needs. Seek recommendations and references to gauge their reputation.