How To Buy Medical Insurance

Navigating the Medical Insurance Landscape: A Comprehensive Guide

Understanding how to buy medical insurance is a crucial step towards safeguarding your health and financial well-being. With the right coverage, you can access quality healthcare services without incurring excessive costs. This guide aims to provide an in-depth analysis of the medical insurance landscape, offering practical insights to help you make informed decisions.

Understanding Medical Insurance Basics

Medical insurance, also known as health insurance, is a contractual agreement between an individual (or a group) and an insurance provider. This contract ensures that the insurer will cover a portion or all of the policyholder's medical expenses, depending on the terms and conditions outlined in the policy.

The primary purpose of medical insurance is to protect individuals and families from the potentially devastating financial impact of unexpected medical emergencies. By paying regular premiums, policyholders gain access to a wide range of healthcare services, from routine check-ups and preventative care to specialized treatments and hospital stays.

Here are some key terms and concepts to familiarize yourself with:

- Premium: The amount you pay regularly (monthly, quarterly, or annually) to maintain your insurance coverage.

- Deductible: The initial amount you must pay out of pocket before your insurance coverage kicks in.

- Copayment (Copay): A fixed amount you pay for a covered medical service, often at the time of service.

- Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage of the total cost.

- Out-of-Pocket Maximum: The most you will pay for covered services in a year, excluding premiums.

- Network: A group of healthcare providers (doctors, hospitals, labs) that have a contract with your insurance company. Using in-network providers usually results in lower costs.

- Pre-existing Condition: A health issue you had before your insurance coverage started. Some policies may exclude coverage for pre-existing conditions during a waiting period.

- Open Enrollment Period: A designated time when you can enroll in or change your health insurance plan without a qualifying event.

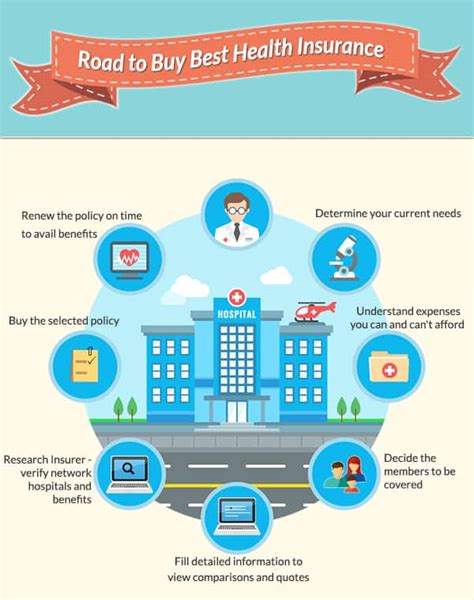

Evaluating Your Insurance Needs

Before purchasing medical insurance, it's essential to assess your specific needs and circumstances. Consider the following factors:

Your Current Health Status

Are you generally healthy, or do you have ongoing medical conditions that require regular treatment? Your health status will influence the type of coverage you need and the associated costs.

Family Size and Composition

Do you need coverage for yourself only, or for your entire family? Different plans offer varying levels of coverage for dependents, so choose a plan that accommodates your family's needs.

Financial Considerations

Your budget plays a significant role in selecting the right insurance plan. While comprehensive coverage may offer more benefits, it often comes with higher premiums. Consider your ability to afford monthly premiums, deductibles, and other out-of-pocket costs.

Preferred Healthcare Providers

If you have a preferred doctor or regularly visit specific healthcare facilities, ensure that they are in-network with the insurance plans you're considering. This can help reduce your out-of-pocket expenses.

Prescription Drug Coverage

If you take prescription medications regularly, make sure your plan includes prescription drug coverage. Some plans have preferred drug lists or require prior authorization for certain medications.

Maternity and Pediatric Care

If you're planning to start a family or have young children, look for plans that offer comprehensive maternity and pediatric care coverage.

Exploring Insurance Plan Options

There are various types of medical insurance plans available, each with its own features and coverage levels. Understanding these options will help you make a more informed choice.

Health Maintenance Organization (HMO)

HMO plans typically offer comprehensive coverage but require you to choose a primary care physician (PCP) and obtain referrals for specialist care. They often have lower premiums and deductibles but may limit your choice of providers to those within the HMO network.

Preferred Provider Organization (PPO)

PPO plans offer more flexibility in choosing healthcare providers, both inside and outside the network. While they may have higher premiums, they often provide broader coverage and don't require referrals for specialist care.

Exclusive Provider Organization (EPO)

EPO plans are similar to PPO plans in that they don't require referrals for specialist care. However, they only cover services provided by in-network healthcare providers, making them more restrictive than PPO plans.

Point of Service (POS) Plan

POS plans combine features of both HMO and PPO plans. You can choose a primary care physician and receive referrals for specialist care, but you also have the option to visit out-of-network providers at a higher cost.

High Deductible Health Plan (HDHP)

HDHPs are paired with Health Savings Accounts (HSAs) and offer lower premiums. However, you'll need to pay higher deductibles before your insurance coverage begins. These plans are ideal for those who don't anticipate frequent medical expenses.

Comparing Plan Features and Costs

Once you've narrowed down your options based on your needs, it's time to compare the specific features and costs of different plans.

Premium Costs

Premiums are the most visible cost associated with medical insurance. While it's tempting to choose the plan with the lowest premium, consider your overall healthcare needs and the potential for unexpected medical expenses.

Deductibles and Out-of-Pocket Maximums

Deductibles represent the amount you must pay before your insurance coverage starts. Out-of-pocket maximums, on the other hand, are the most you'll pay in a year for covered services, excluding premiums. Higher deductibles often result in lower premiums, so consider your ability to afford these upfront costs.

Network Coverage and Preferred Providers

Review the plan's network of healthcare providers to ensure your preferred doctors and facilities are included. Out-of-network care can be significantly more expensive, so it's crucial to understand the network coverage.

Prescription Drug Coverage

If you take prescription medications, compare the plans' prescription drug formularies. Some plans may cover certain medications at a lower cost or require prior authorization.

Additional Benefits and Services

Look for plans that offer additional benefits such as wellness programs, disease management resources, or mental health coverage. These features can enhance your overall healthcare experience.

Enrolling in Your Chosen Plan

Once you've selected the plan that best meets your needs, it's time to enroll. The enrollment process typically involves providing personal and health-related information, as well as paying the initial premium.

Keep in mind that there are designated open enrollment periods when you can enroll in or change your health insurance plan. Outside of these periods, you may need a qualifying event, such as a change in employment status or a significant life event, to make changes to your coverage.

Utilizing Your Insurance Coverage

Now that you have your medical insurance coverage, it's essential to understand how to use it effectively.

Understanding Your Policy

Familiarize yourself with your policy's terms and conditions, including what's covered, any exclusions or limitations, and your responsibilities as a policyholder. This knowledge will help you make informed decisions about your healthcare.

Choosing In-Network Providers

Whenever possible, choose healthcare providers within your plan's network to minimize out-of-pocket costs. Check with your insurance company to confirm which providers are in-network.

Using Your Insurance Card

Always carry your insurance card with you when visiting healthcare providers. It contains important information, such as your policy number and group number, which providers will need to verify coverage.

Filing Claims

If you receive medical services that aren't covered by your insurance plan, you may need to file a claim to be reimbursed for those expenses. Follow the instructions provided by your insurance company for filing claims.

Managing Your Insurance Coverage Over Time

Medical insurance is not a one-time purchase; it requires ongoing management and periodic reviews to ensure it continues to meet your needs.

Annual Policy Review

Set aside time each year to review your insurance coverage. Evaluate whether your current plan still aligns with your health needs, family situation, and financial circumstances. Make any necessary adjustments during the open enrollment period.

Keeping Your Information Up-to-Date

Inform your insurance company of any changes in your personal information, such as a change of address, marriage, or the birth of a child. These updates may impact your coverage and premiums.

Understanding Policy Changes

Stay informed about any changes to your policy, such as modifications to the network of providers, prescription drug coverage, or benefits. Your insurance company should provide advance notice of such changes.

Exploring New Plans

Even if you're satisfied with your current plan, it's worth exploring new options periodically. Insurance providers may introduce new plans or enhance existing ones, offering better coverage or more competitive pricing.

FAQ

Can I buy medical insurance outside of the open enrollment period?

+Yes, but only if you have a qualifying event, such as a change in employment status, marriage, or the birth of a child. These events allow you to enroll outside of the open enrollment period.

What happens if I miss the open enrollment period?

+If you miss the open enrollment period and don't have a qualifying event, you may need to wait until the next open enrollment period to make changes to your coverage. However, some states and insurance companies offer special enrollment periods for certain circumstances.

How do I know if a healthcare provider is in-network with my insurance plan?

+You can check the insurance company's website, which often provides a searchable database of in-network providers. Alternatively, you can call the insurance company's customer service number or ask your healthcare provider directly.

Can I change my insurance plan during the year if I'm not satisfied with it?

+In most cases, you'll need to wait until the next open enrollment period to make changes to your plan. However, if your insurance company makes significant changes to your plan's coverage or benefits, you may have the option to switch plans during the year.

What is a Health Savings Account (HSA), and how does it work with medical insurance?

+A Health Savings Account is a tax-advantaged savings account that can be used to pay for qualified medical expenses. HSAs are often paired with High Deductible Health Plans (HDHPs). You can contribute pre-tax dollars to your HSA and use the funds to cover out-of-pocket medical expenses.

By following this comprehensive guide, you can navigate the medical insurance landscape with confidence and select a plan that provides the coverage you need while aligning with your financial situation. Remember, medical insurance is a crucial investment in your health and well-being, so take the time to understand your options and make informed decisions.