Globe Life Insurance

In today's world, financial security and peace of mind are paramount, and insurance plays a crucial role in safeguarding our futures. One such financial service provider is Globe Life Insurance, a company that has gained prominence in the insurance industry for its comprehensive policies and customer-centric approach. This article aims to delve into the intricacies of Globe Life Insurance, exploring its history, products, and the benefits it offers to policyholders.

A Historical Perspective: The Evolution of Globe Life Insurance

The roots of Globe Life Insurance can be traced back to 1951, a time when the insurance landscape was undergoing significant transformations. Founded as a subsidiary of a larger financial institution, the company initially focused on providing life insurance policies to families across the United States. Over the decades, Globe Life Insurance has evolved and expanded its offerings to meet the changing needs of its customers.

In the 1970s, Globe Life Insurance introduced a range of innovative products, including accident insurance and health insurance plans. These initiatives marked a significant shift in the company's strategy, moving beyond traditional life insurance and into the realm of comprehensive financial protection. This period also saw the company strengthen its presence in the market, establishing itself as a trusted provider of insurance solutions.

The 1980s brought about further growth and diversification for Globe Life Insurance. The company expanded its reach by acquiring smaller insurance providers, allowing it to offer a broader range of policies and cater to a wider customer base. This decade also witnessed the introduction of new technologies, with Globe Life Insurance embracing computerization to streamline its operations and enhance customer service.

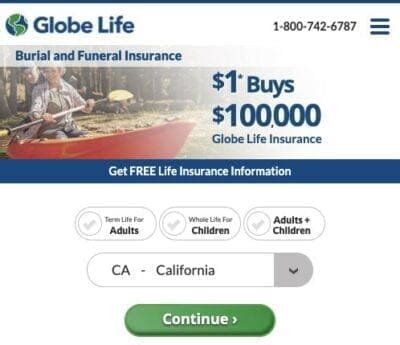

Fast forward to the 21st century, and Globe Life Insurance has solidified its position as a leading insurance provider. With a focus on digital transformation, the company has embraced online platforms and mobile applications, making it easier for customers to access their policies and manage their financial portfolios. This shift towards a digital-first approach has not only improved customer convenience but has also allowed Globe Life Insurance to reach a younger, tech-savvy demographic.

Product Portfolio: Comprehensive Insurance Solutions

Globe Life Insurance offers a diverse range of insurance products designed to cater to the unique needs of its customers. Here’s an overview of some of the key offerings:

Life Insurance Policies

At the core of Globe Life Insurance’s product portfolio are its life insurance policies. These policies provide financial protection to individuals and families, ensuring that their loved ones are taken care of in the event of an untimely demise. Globe Life Insurance offers a variety of life insurance plans, including term life insurance, whole life insurance, and universal life insurance. Each plan is tailored to meet specific needs, whether it’s providing short-term coverage or building long-term savings.

Health Insurance Plans

In addition to life insurance, Globe Life Insurance also offers a comprehensive range of health insurance plans. These policies aim to protect policyholders from the financial burden of medical expenses. Globe Life Insurance’s health insurance plans cover a wide array of medical services, including hospitalization, outpatient care, and prescription medications. The company also provides specialized plans for specific health conditions, ensuring that individuals with pre-existing conditions can access affordable coverage.

Accident Insurance

Accidents can happen at any time, and Globe Life Insurance recognizes the importance of having adequate coverage. Their accident insurance policies provide financial support in the event of an accident, covering expenses such as medical treatment, rehabilitation, and even loss of income. These policies are designed to offer peace of mind, ensuring that policyholders can focus on their recovery without the added stress of financial worries.

Critical Illness Insurance

Critical illnesses can have a devastating impact on both an individual’s health and their financial stability. Globe Life Insurance’s critical illness insurance plans are designed to provide a financial safety net for policyholders diagnosed with serious medical conditions. These policies offer a lump-sum payment upon diagnosis, allowing individuals to focus on their treatment and recovery without the added burden of medical bills.

| Insurance Type | Key Features |

|---|---|

| Life Insurance | Flexible term lengths, tax-free benefits, and cash value accumulation. |

| Health Insurance | Coverage for hospitalization, specialist care, and prescription drugs. |

| Accident Insurance | Financial support for medical treatment and rehabilitation. |

| Critical Illness Insurance | Lump-sum payment upon diagnosis of covered critical illnesses. |

The Benefits of Globe Life Insurance

Choosing Globe Life Insurance as your financial partner comes with a multitude of benefits. Here are some key advantages that policyholders can expect:

Affordable Premiums

One of the most appealing aspects of Globe Life Insurance is its commitment to offering affordable premiums. The company understands that insurance is a necessary investment, and it strives to make its policies accessible to a wide range of individuals and families. By keeping premiums competitive, Globe Life Insurance ensures that its customers can secure the financial protection they need without straining their budgets.

Customizable Coverage

Globe Life Insurance recognizes that every individual’s needs are unique. That’s why the company offers customizable coverage options, allowing policyholders to tailor their insurance plans to their specific requirements. Whether it’s increasing coverage limits, adding riders for specific circumstances, or adjusting payment terms, Globe Life Insurance empowers its customers to create insurance portfolios that align with their financial goals.

Excellent Customer Service

Globe Life Insurance prides itself on its dedication to providing exceptional customer service. The company understands that insurance can be complex, and it aims to simplify the process for its policyholders. From the initial application to ongoing policy management, Globe Life Insurance’s team of experts is readily available to guide customers, answer questions, and address concerns. This commitment to customer satisfaction ensures that policyholders can make informed decisions and feel supported throughout their insurance journey.

Digital Convenience

In today’s fast-paced world, convenience is key. Globe Life Insurance understands this and has embraced digital technologies to enhance the customer experience. Policyholders can access their accounts and manage their policies online or through mobile applications. This digital convenience allows for easy policy updates, premium payments, and claim submissions, ensuring that customers can take control of their insurance portfolios whenever and wherever they need to.

Financial Stability and Security

When choosing an insurance provider, financial stability is a top priority. Globe Life Insurance has established itself as a trusted and financially secure company. With a strong track record of successful operations and a commitment to prudent financial management, policyholders can rest assured that their investments are protected. Globe Life Insurance’s stability provides peace of mind, knowing that their financial future is in capable hands.

Future Outlook: Globe Life Insurance’s Continued Growth

As the insurance industry continues to evolve, Globe Life Insurance is well-positioned for continued growth and success. The company’s commitment to innovation and customer-centric approaches has solidified its reputation as a trusted provider of financial services. With a focus on digital transformation and a diverse range of insurance products, Globe Life Insurance is poised to meet the changing needs of its customers and adapt to the evolving landscape.

Looking ahead, Globe Life Insurance plans to further enhance its digital capabilities, making it even easier for customers to access and manage their policies. The company is also exploring new avenues for expansion, including potential partnerships and acquisitions to broaden its product offerings and reach a wider audience. Additionally, Globe Life Insurance is committed to staying at the forefront of industry trends, ensuring that its policies remain relevant and competitive in an ever-changing market.

As Globe Life Insurance continues to evolve, its core values of financial protection, customer satisfaction, and innovation will remain at the heart of its operations. By staying true to these principles, the company is poised to thrive in the years to come, solidifying its position as a leading provider of insurance solutions.

Conclusion

In a world where financial security is a top priority, Globe Life Insurance stands as a beacon of reliability and trust. With a rich history of innovation and a commitment to customer satisfaction, the company has established itself as a prominent player in the insurance industry. By offering a comprehensive range of insurance products, affordable premiums, and exceptional customer service, Globe Life Insurance empowers individuals and families to protect their financial futures and face life’s uncertainties with confidence.

As the company looks towards the future, its dedication to growth and adaptability ensures that it will continue to meet the evolving needs of its customers. With a focus on digital transformation and a customer-centric approach, Globe Life Insurance is well-equipped to navigate the challenges and opportunities that lie ahead. By staying true to its values and embracing innovation, Globe Life Insurance will remain a trusted partner for generations to come, safeguarding the financial well-being of its policyholders.

How can I apply for a Globe Life Insurance policy?

+Applying for a Globe Life Insurance policy is a straightforward process. You can start by visiting their official website and selecting the type of insurance you’re interested in. From there, you’ll be guided through a simple application process, where you’ll provide personal information and choose the coverage that best suits your needs. Globe Life Insurance offers a convenient online application, making it easy to get started with your insurance journey.

What sets Globe Life Insurance apart from other insurance providers?

+Globe Life Insurance stands out for several reasons. Firstly, their commitment to offering affordable premiums sets them apart, making insurance accessible to a wider range of individuals. Additionally, their focus on customization allows policyholders to tailor their coverage, ensuring a personalized insurance experience. The company’s excellent customer service and digital convenience further enhance the overall customer experience, setting Globe Life Insurance apart from its competitors.

Are there any discounts available for Globe Life Insurance policies?

+Yes, Globe Life Insurance offers a variety of discounts to make their policies even more affordable. These discounts may include multi-policy discounts, where you can save by bundling multiple insurance types, or loyalty discounts for long-term policyholders. Additionally, the company may offer discounts for specific occupations or affiliations, so it’s worth exploring the available options to see if you qualify for any savings.