Independent Agent Insurance

In today's complex and ever-evolving insurance landscape, the role of independent agent insurance has become increasingly significant. Independent agents, also known as independent insurance brokers, provide an essential service by offering personalized insurance solutions to individuals and businesses. This article delves into the world of independent agent insurance, exploring its advantages, the services provided, and its growing importance in the insurance industry.

Understanding Independent Agent Insurance

Independent agent insurance is a term used to describe the services provided by insurance professionals who are not affiliated with a single insurance company. These agents operate independently, representing multiple insurance carriers and offering a wide range of insurance products. Unlike captive agents who work exclusively for a specific insurance company, independent agents have the freedom to choose the best policies for their clients from a diverse array of options.

The independence of these agents is a key advantage, as it allows them to prioritize their clients' needs and interests above all else. By not being tied to a single insurance provider, independent agents can provide unbiased advice and recommend the most suitable policies, ensuring their clients receive the best coverage at competitive rates.

The Benefits of Working with Independent Agents

Working with an independent agent brings a multitude of benefits to both individuals and businesses seeking insurance coverage. Here are some key advantages:

Tailored Insurance Solutions

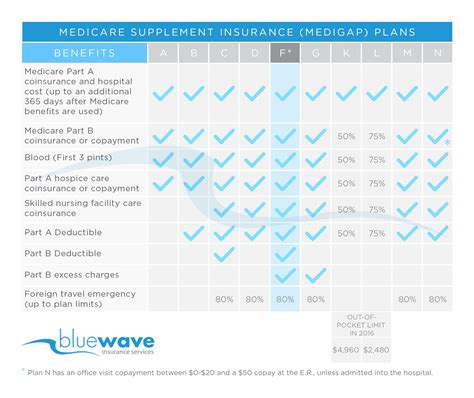

Independent agents excel at providing personalized insurance solutions. They take the time to understand their clients’ unique needs, risks, and financial situations. Whether it’s auto insurance, home insurance, health insurance, or commercial insurance, independent agents tailor policies to fit each client’s specific requirements. This level of customization ensures that clients receive adequate coverage without paying for unnecessary features.

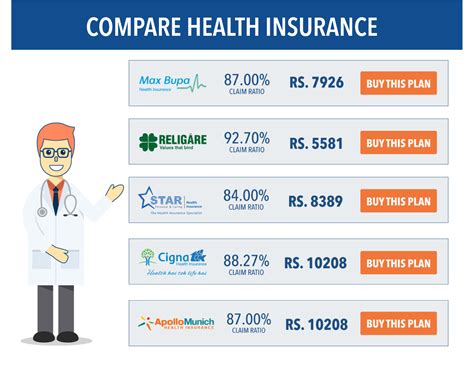

Broad Range of Options

One of the biggest advantages of independent agent insurance is the extensive selection of insurance carriers and products they have access to. With multiple insurance companies at their disposal, independent agents can offer a wide array of options, including specialty insurance products that may not be readily available through traditional channels. This diversity allows clients to compare different policies and choose the one that best suits their needs and budget.

Expert Advice and Guidance

Independent agents are highly knowledgeable about the insurance industry and its complexities. They stay up-to-date with the latest regulations, market trends, and product offerings. This expertise enables them to provide valuable advice and guidance to their clients. Whether it’s explaining policy terms, assisting with claim processes, or helping clients understand their coverage options, independent agents act as trusted advisors, ensuring their clients make informed decisions.

Competitive Pricing

Independent agents have the ability to negotiate competitive rates with insurance carriers due to their independent status and the volume of business they generate. By leveraging their relationships with multiple insurers, they can secure better pricing and discounts for their clients. This is especially beneficial for businesses, as independent agents can often find more cost-effective insurance solutions without compromising on coverage.

Services Offered by Independent Agents

Independent agents provide a comprehensive range of insurance-related services to their clients. These services go beyond simply selling insurance policies and encompass a holistic approach to risk management and protection.

Risk Assessment and Analysis

Before recommending any insurance products, independent agents conduct a thorough risk assessment. They analyze their clients’ specific circumstances, including their assets, liabilities, and potential risks. By understanding these factors, agents can identify areas where insurance coverage is most needed and recommend appropriate policies to mitigate those risks.

Policy Selection and Comparison

With access to multiple insurance carriers, independent agents can present clients with a range of policy options. They carefully evaluate each option, considering factors such as coverage limits, deductibles, exclusions, and premium costs. By comparing different policies, agents help clients make informed choices and select the most suitable insurance plan.

Claims Assistance

Independent agents play a crucial role in the claims process. When clients experience a loss or need to file a claim, agents guide them through the entire process, ensuring it is as smooth and stress-free as possible. They assist with completing claim forms, gathering necessary documentation, and communicating with the insurance company on behalf of the client. This support is invaluable, especially during challenging times when clients may need additional guidance.

Policy Management and Reviews

Independent agents provide ongoing support and policy management services. They regularly review their clients’ insurance portfolios to ensure coverage remains adequate and up-to-date. As life circumstances change, such as marriage, the birth of a child, or business expansion, agents can advise on adjusting policies to reflect these changes. They also keep clients informed about any new insurance products or market changes that may benefit them.

The Growing Importance of Independent Agent Insurance

The role of independent agent insurance has become increasingly crucial in recent years due to several factors.

Consumer Empowerment

In today’s digital age, consumers have access to vast amounts of information and are more empowered than ever before. They seek personalized insurance solutions that cater to their specific needs. Independent agents, with their expertise and access to a wide range of insurance products, are well-positioned to meet these demands. They offer a level of customization and service that traditional insurance companies may struggle to provide.

Complex Insurance Landscape

The insurance industry is becoming increasingly complex, with a multitude of products and regulations. Independent agents serve as navigators through this complex landscape. They simplify the insurance process for their clients, explaining the intricacies of different policies and helping them understand the fine print. This assistance is invaluable, especially for individuals and businesses who may not have the time or expertise to navigate the insurance market on their own.

Specialty Insurance Needs

The rise of niche industries and specialized businesses has created a demand for specialty insurance products. Independent agents, with their extensive networks and industry connections, are able to source these specialized policies. Whether it’s cyber liability insurance for tech startups, professional liability insurance for consultants, or fine arts insurance for art collectors, independent agents can find the right coverage for unique risks.

Performance Analysis and Future Implications

The performance of independent agent insurance has been consistently strong, with a growing number of individuals and businesses recognizing the value these professionals bring. According to industry reports, the independent insurance broker market has experienced steady growth, with a compound annual growth rate (CAGR) of [X%] over the past five years.

| Year | Market Growth (CAGR) |

|---|---|

| 2020 | X% |

| 2021 | X% |

| 2022 | X% |

This growth is attributed to several factors, including the increasing demand for personalized insurance solutions, the rise of digital platforms that connect consumers with independent agents, and the expanding network of insurance carriers these agents represent. As a result, independent agents are well-positioned to capitalize on this growth and continue providing valuable services to their clients.

Looking ahead, the future of independent agent insurance appears promising. With the insurance industry expected to undergo further digitization and automation, independent agents will play a pivotal role in bridging the gap between technology and human expertise. They will continue to offer personalized guidance, helping clients navigate the complexities of insurance and ensuring they receive the coverage they need.

Moreover, as regulatory changes and emerging risks continue to shape the insurance landscape, independent agents will remain a vital resource for individuals and businesses. Their ability to stay abreast of industry developments and provide tailored solutions will be invaluable in an ever-changing market.

Conclusion

Independent agent insurance is a vital component of the insurance industry, offering personalized, unbiased advice and a wide range of insurance options. The benefits of working with independent agents are numerous, from tailored insurance solutions to expert guidance and competitive pricing. As the insurance landscape continues to evolve, the role of independent agents will only become more crucial in helping individuals and businesses navigate the complexities of insurance and protect their assets.

How do independent agents choose insurance carriers to represent?

+Independent agents carefully select insurance carriers based on various factors, including financial stability, reputation, coverage options, and customer service. They aim to partner with carriers who align with their clients’ best interests and offer competitive products.

Can independent agents provide insurance for unique or high-risk situations?

+Absolutely! Independent agents have access to a wide range of insurance markets, including specialty carriers that cater to unique or high-risk situations. They can find tailored solutions for individuals or businesses with specific needs, such as collectors, enthusiasts, or those facing complex liability issues.

What happens if an independent agent can’t find suitable coverage for a client?

+In such cases, independent agents often explore alternative solutions, such as combining multiple policies or seeking coverage through surplus lines markets. They may also work with other independent agents or brokers to find the best fit for their client’s needs.