Check Car Insurance Rates

Unveiling the Landscape of Car Insurance Rates: A Comprehensive Guide

In the intricate world of automotive finance, understanding the factors that influence car insurance rates is crucial for making informed decisions. This comprehensive guide delves into the intricate details, offering an expert perspective on how insurance providers calculate these rates and what steps you can take to secure the best coverage at an optimal price.

With the plethora of insurance providers and varying policies, navigating the car insurance landscape can be daunting. However, by grasping the fundamental principles and key variables, you'll be equipped to compare policies effectively and make choices tailored to your specific needs.

The Intricacies of Car Insurance Rate Calculation

Car insurance rates are determined through a meticulous process, taking into account a multitude of factors. These variables collectively paint a picture of the risk profile associated with insuring a particular vehicle and driver. Here's a closer look at the key components that insurance providers consider:

Vehicle Type and Usage

The type of vehicle you drive significantly influences your insurance rates. For instance, sports cars and high-performance vehicles often carry higher premiums due to their association with increased speed and potential for accidents. On the other hand, compact cars and family sedans typically attract more affordable rates.

Additionally, the intended use of your vehicle plays a role. If you primarily use your car for commuting, insurance rates might be lower compared to those who frequently engage in high-mileage driving or use their vehicles for commercial purposes.

Driver Profile and History

Your personal driving record is a critical factor in insurance rate calculations. Insurance providers scrutinize your driving history, including any previous accidents, traffic violations, and claims made. A clean driving record can lead to more favorable insurance rates, while a history of accidents or violations may result in higher premiums.

Age and gender are also considered, as statistical data suggests that younger drivers, particularly males, tend to be involved in more accidents. As a result, insurance rates for this demographic are often higher.

Location and Environmental Factors

The geographical location where you reside and drive your vehicle impacts insurance rates. Areas with higher crime rates, frequent natural disasters, or dense traffic may see elevated insurance costs. Similarly, the climate and weather patterns of your region can also influence rates, with extreme weather conditions posing a higher risk of accidents.

Coverage and Policy Options

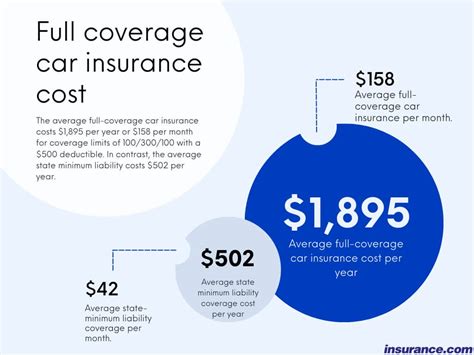

The level of coverage you choose significantly affects your insurance rates. Comprehensive coverage, which includes protection for a wide range of incidents like theft, vandalism, and natural disasters, typically carries higher premiums. Conversely, liability-only coverage, which provides protection for damages caused to others, may be more affordable.

Additionally, the choice of deductible can impact your rates. A higher deductible, which means you pay more out-of-pocket before insurance coverage kicks in, often results in lower monthly premiums.

Discounts and Special Programs

Insurance providers frequently offer discounts to encourage safe driving practices and reduce their risk exposure. These discounts can be significant and include:

- Safe Driver Discounts: Recognizing drivers with a clean record, these discounts can lead to substantial savings.

- Multi-Policy Discounts: Bundling your insurance policies, such as home and auto insurance, can result in reduced rates across the board.

- Telematics-Based Insurance: Some providers offer programs where your driving behavior is monitored, and safe driving habits can lead to lower rates.

Strategies for Securing the Best Car Insurance Rates

Armed with an understanding of the factors influencing car insurance rates, you can employ several strategies to secure the most favorable coverage:

Shop Around and Compare

The car insurance market is highly competitive, with numerous providers offering a range of policies. By taking the time to compare quotes from different insurers, you can identify the best value for your specific needs. Online comparison tools and insurance brokerages can streamline this process, making it easier to find the most competitive rates.

Consider Higher Deductibles

While a higher deductible may mean you pay more out-of-pocket in the event of an accident, it can lead to significant savings on your monthly premiums. If you're a cautious driver with a low risk of accidents, this strategy can be particularly effective in reducing your insurance costs.

Explore Discount Opportunities

Insurance providers offer a variety of discounts, and it's worth taking the time to understand which ones you may be eligible for. From safe driving incentives to multi-policy discounts, these savings can add up and significantly reduce your overall insurance costs.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to secure lower insurance rates. Avoid traffic violations and accidents, and if you do have a violation or accident on your record, take steps to improve your driving habits and reduce the likelihood of future incidents.

Bundle Your Policies

If you have multiple insurance needs, such as home, auto, and life insurance, consider bundling your policies with a single provider. Many insurers offer substantial discounts for customers who do so, as it simplifies their operations and reduces administrative costs.

The Future of Car Insurance Rates

The car insurance landscape is evolving, driven by technological advancements and changing consumer expectations. Here's a glimpse into some of the trends and developments that may shape the future of car insurance rates:

Telematics and Usage-Based Insurance

Telematics technology, which monitors driving behavior and provides real-time data, is gaining traction in the insurance industry. Usage-based insurance programs, where premiums are determined based on actual driving habits rather than general risk profiles, are becoming more common. This shift towards personalized insurance rates may offer opportunities for drivers to save by demonstrating safe and responsible driving.

Connected Cars and Data Analytics

With the rise of connected cars and the Internet of Things (IoT), insurers are gaining access to a wealth of data about vehicle usage and performance. This data can provide insights into driving patterns, vehicle health, and even driver behavior. As insurers incorporate this data into their risk assessment models, it may lead to more accurate and personalized insurance rates.

Autonomous Vehicles and Risk Mitigation

The advent of autonomous vehicles has the potential to significantly reduce the number of accidents on the road, as human error is a leading cause of collisions. As these vehicles become more prevalent, insurance rates may reflect this reduced risk, leading to lower premiums for drivers.

Sustainable and Electric Vehicles

The transition to sustainable and electric vehicles is gaining momentum, and insurance providers are taking note. These vehicles often have advanced safety features and are associated with lower accident rates. As a result, insurance rates for electric and hybrid vehicles may become more competitive, offering savings for environmentally conscious drivers.

Conclusion: Navigating the Complexities

Understanding the intricacies of car insurance rates is essential for making informed decisions about your automotive finance. By grasping the factors that influence these rates and adopting strategic approaches, you can secure the best coverage at the most favorable price.

As the car insurance landscape continues to evolve, staying abreast of emerging trends and technological advancements will be key to unlocking the most advantageous insurance rates. With a combination of knowledge, strategic planning, and a proactive approach, you can navigate the complexities of car insurance with confidence and secure the coverage you need at a price that suits your budget.

How often should I review my car insurance policy and rates?

+It’s a good practice to review your car insurance policy and rates annually or whenever your circumstances change significantly. This ensures you stay up-to-date with the most competitive rates and coverage options available.

Can I negotiate car insurance rates with my provider?

+While insurance rates are typically based on standardized risk assessment models, you can negotiate certain aspects of your policy, such as coverage limits and deductibles. Discussing your needs and concerns with your provider may lead to more favorable terms.

What impact does credit score have on car insurance rates?

+In many states, insurance providers are allowed to use credit scores as a factor in determining insurance rates. Generally, a higher credit score is associated with lower insurance premiums, as it’s seen as an indicator of financial responsibility and stability.