New Jersey Health Insurance

In the ever-evolving landscape of healthcare, understanding your options for health insurance is crucial. For residents of New Jersey, navigating the health insurance market can be a complex task, given the array of plans, providers, and policies available. This comprehensive guide aims to demystify the process, offering an in-depth exploration of New Jersey Health Insurance, with a focus on providing actionable insights and expert advice.

The Landscape of Health Insurance in New Jersey

New Jersey boasts a diverse healthcare system, offering a wide range of insurance plans to cater to the varying needs of its residents. From comprehensive coverage to more specialized plans, the state provides numerous options for individuals, families, and businesses. Understanding this landscape is the first step towards making informed decisions about your health insurance.

Understanding the Basics: Types of Health Insurance Plans

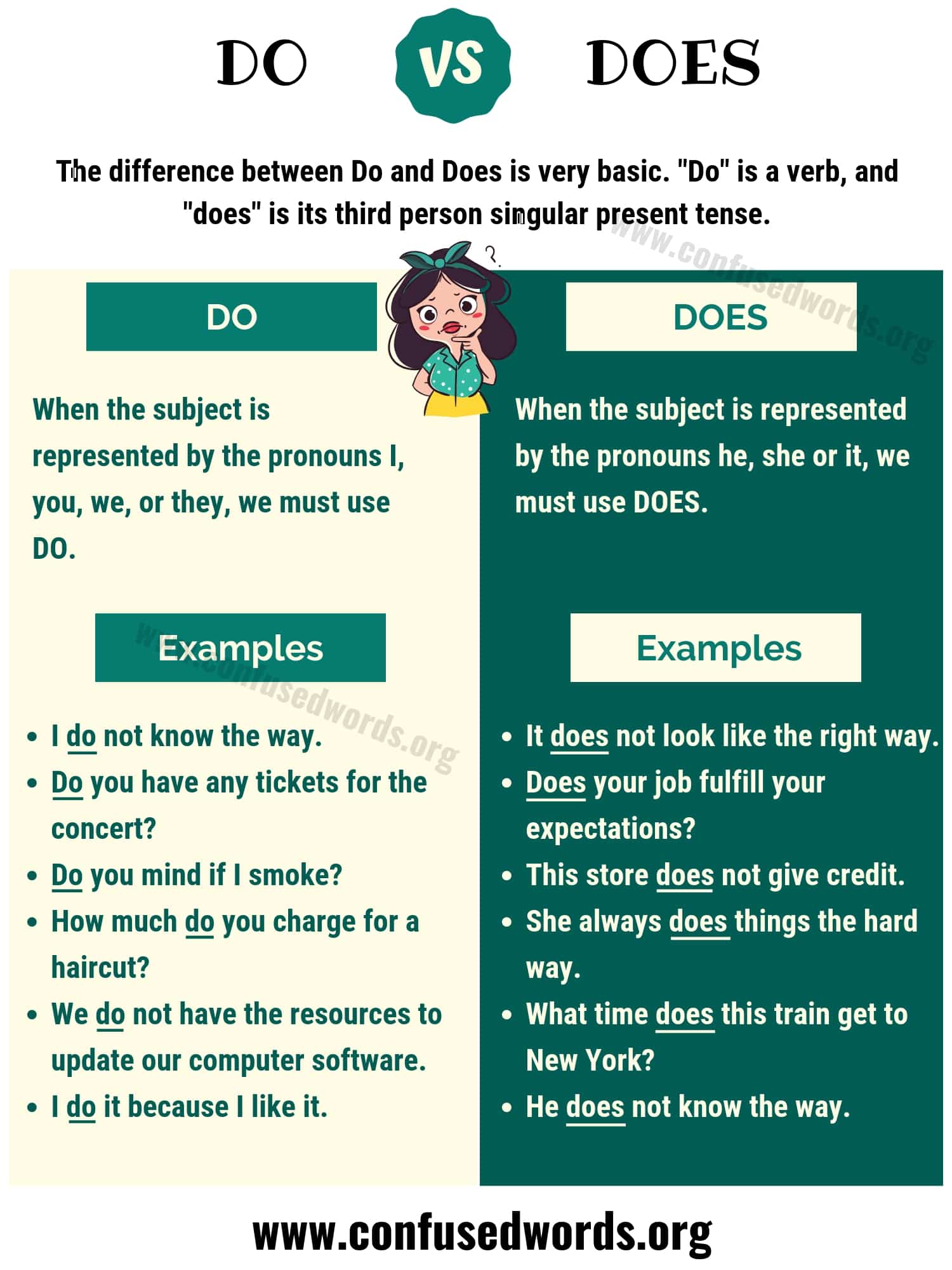

Health insurance plans in New Jersey can generally be categorized into several types, each with its unique features and benefits. These include Individual Plans, designed for single individuals or families, and Group Plans, typically offered by employers as part of their benefits package. Within these categories, you’ll find a spectrum of coverage options, from HMO (Health Maintenance Organization) plans, which often require you to choose a primary care physician and use a network of providers, to PPO (Preferred Provider Organization) plans, which offer more flexibility in choosing healthcare providers but may come with higher costs.

Additionally, EPO (Exclusive Provider Organization) plans, which restrict coverage to a specific network of providers, and POS (Point of Service) plans, which combine elements of HMOs and PPOs, are also available. Each type of plan comes with its own set of advantages and disadvantages, and understanding these can help you choose the plan that best fits your healthcare needs and budget.

| Plan Type | Description |

|---|---|

| HMO | Requires a primary care physician and network usage; often more cost-effective. |

| PPO | Offers flexibility in provider choice; may have higher premiums. |

| EPO | Restricts coverage to a specific provider network. |

| POS | Combines features of HMO and PPO; allows for flexible provider choice with additional costs. |

Key Considerations: Cost and Coverage

When evaluating health insurance plans, two critical factors come into play: cost and coverage. Premiums, deductibles, copayments, and out-of-pocket maximums are all aspects of the cost structure that can vary significantly between plans. It’s essential to consider these financial aspects alongside the coverage offered, which includes the specific healthcare services and treatments that are included in the plan.

For instance, while some plans may offer a low monthly premium, they might have higher deductibles or limited coverage for certain services. On the other hand, plans with higher premiums often come with lower deductibles and more comprehensive coverage. Balancing these factors is crucial to ensure you're getting the right plan for your healthcare needs and financial situation.

Navigating the Market: Choosing the Right Health Insurance

With a plethora of options available, choosing the right health insurance plan in New Jersey can be a daunting task. However, by breaking down the process and considering a few key factors, you can make an informed decision that aligns with your needs.

Assessing Your Healthcare Needs

The first step in choosing a health insurance plan is to assess your healthcare needs. Consider factors such as your current health status, any ongoing medical conditions, and your healthcare preferences. For instance, if you have a chronic illness or require regular specialist visits, a plan with comprehensive coverage and lower out-of-pocket costs might be more suitable. On the other hand, if you’re generally healthy and rarely visit the doctor, a plan with lower premiums and higher deductibles could be a more cost-effective option.

Exploring Plan Options

Once you have a clear understanding of your healthcare needs, it’s time to explore the various plan options available in New Jersey. This involves researching different providers, comparing plan features, and evaluating the cost-benefit ratio of each option. Online resources, such as the New Jersey Department of Banking and Insurance website, offer valuable tools and resources to help you compare plans and make an informed choice.

During your exploration, consider factors such as the plan's provider network, coverage limits, and any additional benefits or perks it might offer. For example, some plans might include wellness programs, prescription drug coverage, or dental and vision benefits. These added features can significantly enhance the value of your insurance plan.

Understanding Network Providers

The concept of network providers is crucial when choosing a health insurance plan, especially for HMO and EPO plans. These plans typically require you to use healthcare providers within their network to ensure coverage. Understanding which doctors, hospitals, and specialists are included in the network can help you make a more informed decision, especially if you have a preferred healthcare provider or specialist you wish to continue seeing.

Additionally, being aware of any out-of-network costs is essential. While HMO and EPO plans often don't cover out-of-network care, PPO and POS plans usually offer some coverage, albeit with higher costs. Understanding these nuances can help you avoid unexpected expenses and ensure you're receiving the care you need.

Maximizing Your Health Insurance Benefits

Once you’ve chosen your health insurance plan, the next step is to make the most of the benefits it offers. This involves understanding the plan’s coverage, utilizing its features effectively, and staying informed about any changes or updates.

Understanding Your Coverage

A thorough understanding of your health insurance coverage is essential to ensure you’re maximizing its benefits. This includes knowing what’s covered, such as doctor visits, hospital stays, prescription drugs, and preventive care services. It also involves understanding any limitations or exclusions, such as pre-existing condition exclusions or limitations on certain types of treatments.

Reviewing your plan's summary of benefits and coverage document can provide a detailed breakdown of what's included and what's not. This information is crucial for making informed decisions about your healthcare and ensuring you're not incurring unexpected costs.

Utilizing Plan Features

Health insurance plans often come with a range of features and benefits beyond basic coverage. These can include wellness programs, disease management programs, and discounts on health-related services. Taking advantage of these features can not only improve your overall health but also provide significant cost savings.

For example, many plans offer incentives for participating in wellness programs, such as gym memberships or weight loss programs. These initiatives can help prevent health issues before they arise, reducing the need for more costly medical interventions down the line. Additionally, disease management programs can provide valuable support and resources for individuals with chronic conditions, helping them better manage their health and reduce the risk of complications.

Staying Informed and Engaged

Staying informed about your health insurance plan and the broader healthcare landscape is crucial to maximizing your benefits. This involves regularly reviewing your plan’s updates and changes, such as modifications to the provider network or coverage limits. It also means staying engaged with your healthcare providers, understanding their role in your plan’s network, and ensuring they’re providing the care you need within the scope of your coverage.

Additionally, keeping abreast of any changes in the healthcare industry, such as new treatments or advancements in medical technology, can help you make more informed decisions about your healthcare and ensure you're taking advantage of the latest advancements in medical care.

Future Implications and Trends in New Jersey Health Insurance

The world of health insurance is constantly evolving, and New Jersey is no exception. As the healthcare landscape continues to change, it’s essential to stay informed about the future implications and trends that could impact your health insurance coverage and options.

The Impact of Healthcare Reform

Healthcare reform efforts, both at the federal and state levels, can significantly influence the availability and affordability of health insurance. In New Jersey, the implementation of the Affordable Care Act (ACA) has had a profound impact on the health insurance market, expanding coverage options and protecting consumers from certain practices, such as being denied coverage due to pre-existing conditions.

However, the future of healthcare reform is uncertain, and any changes to the ACA or other federal policies could have significant implications for health insurance in New Jersey. It's crucial to stay informed about these potential changes and how they might affect your coverage, premiums, and access to care.

Emerging Technologies and Their Impact

The rapid advancement of healthcare technologies is also shaping the future of health insurance. From telemedicine and digital health records to artificial intelligence and genetic testing, these innovations are changing the way healthcare is delivered and insured. For instance, the increasing use of telemedicine can provide more accessible and cost-effective care, particularly for individuals in rural areas or with limited mobility.

Additionally, the integration of digital health records can improve the efficiency and accuracy of healthcare delivery, while also providing valuable data for insurance companies to assess risk and set premiums. As these technologies continue to evolve and become more widespread, they will likely play an increasingly significant role in shaping the future of health insurance in New Jersey and beyond.

Changing Consumer Demands and Expectations

Consumer demands and expectations are also evolving, shaping the future of health insurance. Today’s consumers are increasingly seeking more personalized and flexible healthcare options, as well as greater transparency and value for their insurance premiums. This shift is driving insurance providers to offer more tailored plans, innovative benefits, and improved customer service.

For instance, some insurance companies are now offering plans with a focus on wellness and prevention, providing incentives for healthy behaviors and early detection of health issues. Others are exploring new models, such as reference-based pricing or value-based insurance designs, which aim to provide more cost-effective care while maintaining quality. As consumer demands continue to evolve, these trends are likely to shape the future of health insurance in New Jersey and the broader healthcare industry.

What is the Affordable Care Act (ACA) and how does it affect health insurance in New Jersey?

+The Affordable Care Act (ACA), also known as Obamacare, is a federal law that aims to make health insurance more accessible and affordable. In New Jersey, the ACA has expanded coverage options, protected consumers from certain practices, and implemented various reforms. It requires most individuals to have health insurance, provides subsidies to help with premiums, and ensures that pre-existing conditions cannot be used to deny coverage or charge higher premiums.

How can I find the best health insurance plan for my needs in New Jersey?

+To find the best health insurance plan in New Jersey, it’s essential to assess your healthcare needs, compare plan options, and understand the cost-benefit ratio. Consider factors such as your health status, preferred providers, and financial situation. Utilize resources like the New Jersey Department of Banking and Insurance website to compare plans and get expert advice. Remember, the “best” plan is the one that aligns with your needs and provides the coverage and value you’re seeking.

What should I do if I have a complaint or issue with my health insurance provider in New Jersey?

+If you have a complaint or issue with your health insurance provider in New Jersey, there are several steps you can take. First, try to resolve the issue directly with your provider’s customer service department. If that doesn’t work, you can file a complaint with the New Jersey Department of Banking and Insurance. They can investigate your issue and work towards a resolution. Additionally, you can seek advice from consumer advocacy groups or legal professionals who specialize in healthcare law.