How Does Pip Insurance Work

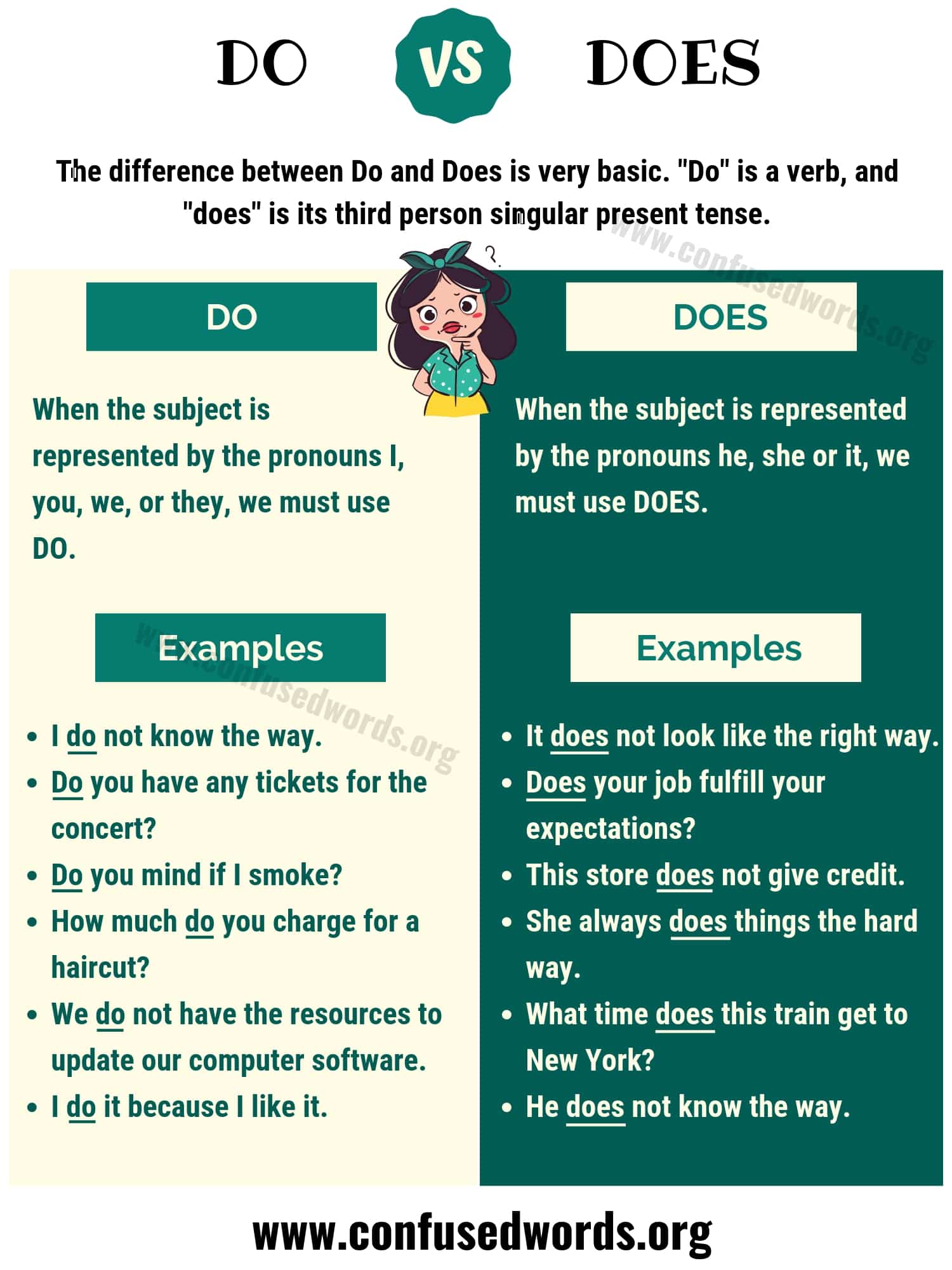

PIP, which stands for Personal Injury Protection, is a type of insurance coverage primarily associated with automobile insurance policies. It is designed to provide financial protection and assistance to policyholders in the event of an automobile accident, regardless of who is at fault. Understanding how PIP insurance works is crucial for drivers, as it can significantly impact their financial well-being and medical care after an accident.

In this comprehensive guide, we will delve into the intricacies of PIP insurance, exploring its features, benefits, and how it operates in different scenarios. By the end of this article, you should have a clear understanding of PIP insurance and its role in ensuring your safety and financial security on the road.

The Fundamentals of PIP Insurance

PIP insurance is a mandatory coverage in some states and an optional add-on in others. It is a no-fault insurance, meaning it provides benefits to the policyholder and their covered passengers regardless of who caused the accident. This feature is particularly advantageous as it streamlines the claims process and ensures timely access to medical care and other benefits.

Key Features of PIP Insurance

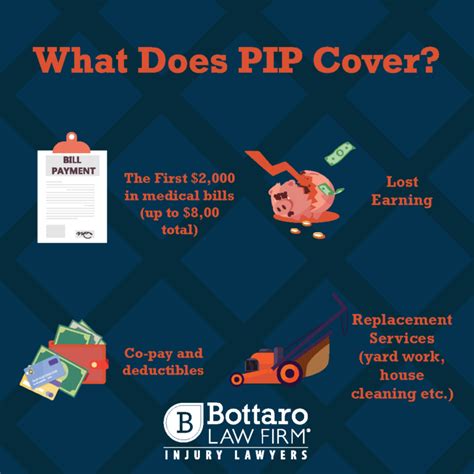

- Medical Expenses Coverage: PIP primarily covers medical expenses resulting from an automobile accident. This includes doctor visits, hospital stays, surgery costs, rehabilitation, and even prescription medications.

- Lost Wages: In many policies, PIP covers a portion of lost income if the policyholder is unable to work due to injuries sustained in the accident.

- Funeral Expenses: PIP can also provide coverage for funeral and burial expenses if the policyholder or their covered passengers pass away as a result of the accident.

- Essential Services: Some policies include coverage for essential services like childcare or housecleaning if the policyholder is unable to perform these tasks due to their injuries.

The specific coverage and limits of PIP insurance can vary widely depending on the state and the policy. Policyholders should carefully review their PIP coverage to understand the exact benefits and limitations of their plan.

How PIP Claims Work

In the event of an automobile accident, policyholders should take the following steps to initiate a PIP claim:

- Seek Medical Attention: The first priority after an accident should always be to ensure the well-being of all individuals involved. Seek medical attention, even if injuries seem minor, as some conditions may not be immediately apparent.

- Notify Your Insurance Provider: Contact your insurance company as soon as possible to report the accident and initiate the claims process. Provide accurate and detailed information about the accident.

- Submit Medical Bills: As you receive medical treatment, keep track of all related expenses. Submit these bills to your insurance provider for processing.

- Follow Up: Stay in regular contact with your insurance provider to ensure your claim is being processed efficiently. Provide any additional information or documentation as needed.

It's important to note that PIP claims are typically processed and paid out more quickly than traditional liability claims, as they are not dependent on establishing fault.

Comparing PIP to Other Types of Insurance

While PIP insurance is a crucial component of automobile insurance, it is not the only type of coverage available. Understanding how PIP differs from other types of insurance can help policyholders make informed decisions about their coverage.

PIP vs. Liability Insurance

Liability insurance is a standard component of most automobile insurance policies. It covers the policyholder’s legal responsibility for bodily injury and property damage to others in an accident for which they are at fault. Unlike PIP, liability insurance does not provide coverage for the policyholder’s own injuries or damages.

PIP and liability insurance complement each other, and it is recommended to have both for comprehensive protection. PIP provides immediate coverage for medical expenses and other benefits, while liability insurance ensures financial protection if the policyholder is found at fault for an accident.

PIP vs. Medical Payments Coverage

Medical Payments Coverage (MedPay) is another type of insurance coverage that provides financial assistance for medical expenses resulting from an automobile accident. While it is similar to PIP in this regard, there are some key differences:

- Limits: MedPay typically has lower coverage limits compared to PIP, which may not be sufficient for extensive medical treatments.

- Usage: MedPay is primarily used for minor accidents or when the policyholder’s state does not require PIP coverage.

- Fault: MedPay coverage is often dependent on establishing fault, whereas PIP is a no-fault insurance.

Real-World Examples of PIP Insurance

To better understand how PIP insurance works in practice, let’s explore a couple of hypothetical scenarios:

Scenario 1: Minor Accident with No Injuries

Imagine you are involved in a minor fender bender with another vehicle. Thankfully, no one is injured, and the damage to your car is minimal. In this case, you may choose not to file a PIP claim as there are no medical expenses or lost wages to cover. However, it’s important to review your policy to understand any potential deductibles or out-of-pocket expenses associated with property damage.

Scenario 2: Serious Accident with Medical Expenses

Now, consider a more serious accident where you sustain injuries that require hospitalization and extensive medical treatment. In this scenario, PIP insurance becomes crucial. You would initiate a PIP claim to cover your medical expenses, lost wages, and any other benefits outlined in your policy. The insurance provider would process your claim and provide payments to cover these expenses, ensuring you can focus on your recovery without the added stress of financial burden.

Maximizing Your PIP Insurance Benefits

To ensure you receive the full benefits of your PIP insurance, consider the following tips:

- Review Your Policy: Familiarize yourself with the specifics of your PIP coverage, including limits, deductibles, and any exclusions. This knowledge can help you make informed decisions after an accident.

- Keep Detailed Records: Maintain a comprehensive record of all medical expenses, lost wages, and other relevant costs associated with your accident. This documentation will be essential when filing your PIP claim.

- Communicate with Your Insurer: Stay in regular contact with your insurance provider throughout the claims process. They can provide guidance and ensure your claim is processed efficiently.

- Consider Additional Coverage: Depending on your state and individual needs, you may want to consider increasing your PIP coverage limits to ensure you have adequate protection in the event of a serious accident.

Future Implications and Potential Changes

The landscape of automobile insurance, including PIP coverage, is constantly evolving. As states and insurance providers adapt to changing needs and technologies, we can expect to see some potential shifts in PIP insurance:

- Telemedicine and Digital Health: With the increasing popularity of telemedicine, PIP insurance may begin to cover virtual medical consultations and treatments, providing policyholders with convenient access to healthcare services.

- Autonomous Vehicles: As autonomous vehicles become more prevalent, the frequency and nature of accidents may change. This could impact the role and coverage of PIP insurance, potentially shifting the focus to cover injuries resulting from system failures or technological malfunctions.

- Legislative Changes: State regulations regarding PIP insurance are subject to change. Policyholders should stay informed about any updates to their state’s insurance laws to understand the impact on their coverage.

Conclusion

PIP insurance is a vital component of automobile insurance, providing policyholders with essential financial protection and access to medical care in the event of an accident. By understanding the features, benefits, and claims process of PIP insurance, drivers can make informed decisions about their coverage and be better prepared for the unexpected. As the insurance industry continues to evolve, staying informed about potential changes and adapting to new technologies will be key to maximizing the benefits of PIP insurance.

What states require PIP insurance?

+Currently, 12 states require PIP insurance as a mandatory coverage. These states include Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah. However, it’s important to note that insurance laws can change, so it’s always advisable to check the specific regulations in your state.

Can I use my PIP coverage for accidents outside my state?

+PIP coverage is typically limited to accidents that occur within the state where the policy was issued. However, some insurance providers offer optional endorsements or add-ons that extend PIP coverage to out-of-state accidents. It’s important to review your policy or consult with your insurance agent to understand the specific coverage limits and options available to you.

How long does it take to receive PIP benefits after an accident?

+The timeline for receiving PIP benefits can vary depending on several factors, including the complexity of your claim, the responsiveness of your healthcare providers, and the efficiency of your insurance company’s claims processing. In general, PIP claims are processed more quickly than traditional liability claims, often within a few weeks. However, more complex cases or disputes over coverage may take longer to resolve.