Liability Insurance For A Business Cost

Business liability insurance is an essential aspect of risk management for any company, regardless of its size or industry. This type of insurance acts as a protective shield, safeguarding businesses from financial ruin in the event of unforeseen circumstances. The cost of liability insurance can vary significantly depending on several factors, making it crucial for business owners to understand the factors influencing the premiums and the potential impact on their operations.

In this comprehensive guide, we will delve into the intricacies of liability insurance costs, exploring the key elements that contribute to the final premium. By understanding these factors, businesses can make informed decisions, tailor their insurance coverage to their specific needs, and ultimately, ensure the financial stability and longevity of their enterprises.

Unraveling the Cost of Liability Insurance

The cost of liability insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. These factors can be broadly categorized into two main groups: the characteristics of the business itself and the external factors that influence the insurance market.

Business-Specific Factors

When it comes to business liability insurance, insurers take a close look at the unique characteristics of each enterprise to assess the level of risk they present. Here are some key business-specific factors that can impact the cost of liability insurance:

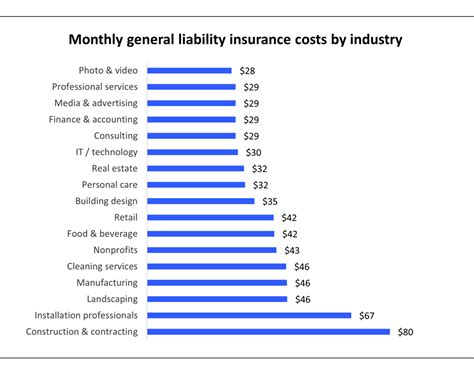

- Industry and Nature of Business: Different industries come with varying levels of risk. For instance, construction companies face higher risks due to the nature of their work, which often involves heavy machinery and potential hazards. On the other hand, a small retail store may have a lower risk profile.

- Company Size and Revenue: Larger companies with higher revenue typically attract higher insurance premiums. This is because larger companies often have more complex operations and a broader scope of potential liabilities.

- Business Location: The geographic location of a business can significantly impact insurance costs. Areas with a higher frequency of natural disasters or a higher crime rate may result in increased premiums.

- Business History and Claims Record: Insurers closely examine a company's past claims history. Businesses with a history of frequent or large claims may face higher premiums, as they are considered a higher risk.

- Type of Business Operations: The specific operations and processes of a business can influence insurance costs. For example, a business that involves the transportation of hazardous materials may incur higher premiums due to the increased risk.

External Factors

Beyond the characteristics of the business, external factors also play a significant role in determining liability insurance costs. These factors are often beyond the control of individual businesses but can have a substantial impact on insurance premiums.

- Economic Conditions: Economic factors, such as inflation and interest rates, can influence insurance costs. During periods of high inflation, insurance premiums may increase to keep pace with rising costs.

- Insurance Market Competition: The level of competition in the insurance market can affect premiums. A highly competitive market may lead to lower premiums as insurers strive to attract customers.

- Regulatory Environment: Government regulations and legal frameworks can impact insurance costs. Changes in legislation or new regulations may prompt insurers to adjust their premiums to account for potential changes in risk exposure.

- Catastrophic Events: Major natural disasters or catastrophic events can cause insurance premiums to rise. When insurers face increased payouts due to widespread damage, they may need to increase premiums to maintain solvency.

Understanding the Insurance Policy

When assessing the cost of liability insurance, it's essential to understand the components of the insurance policy itself. Liability insurance policies can vary significantly in terms of coverage, limits, and deductibles. Here's a breakdown of these key elements:

- Coverage: The coverage provided by a liability insurance policy determines the scope of protection. Different policies may offer specific types of coverage, such as general liability, product liability, or professional liability. Understanding the coverage is crucial to ensure your business is adequately protected.

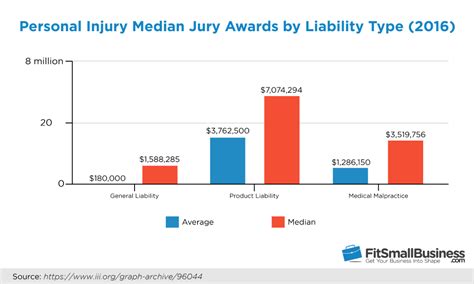

- Policy Limits: Policy limits refer to the maximum amount an insurer will pay for a covered claim. Higher policy limits generally result in higher premiums. It's important to choose limits that align with your business's needs and potential risks.

- Deductibles: Deductibles are the amount you, as the policyholder, must pay out of pocket before the insurance coverage kicks in. Higher deductibles can lead to lower premiums, but they also mean you'll be responsible for a larger portion of any claim costs.

Analyzing Real-World Examples

To provide a clearer picture of how these factors influence liability insurance costs, let's examine some real-world examples. These examples will illustrate the variations in premiums based on different business profiles and external factors.

| Business Profile | Premium Range |

|---|---|

| Small Retail Store (Low Risk) | $500 - $1,500 annually |

| Construction Company (High Risk) | $3,000 - $5,000 annually |

| Tech Startup (Moderate Risk) | $1,000 - $2,500 annually |

These examples demonstrate the wide range of premiums businesses can expect based on their unique circumstances. It's worth noting that these figures are for illustrative purposes and actual premiums may vary significantly.

Maximizing Cost-Effectiveness

While liability insurance is essential, businesses can take steps to optimize their coverage and potentially reduce costs. Here are some strategies to consider:

- Shop Around: Compare quotes from multiple insurers to find the best coverage at the most competitive price. Insurance brokers can be a valuable resource in this process.

- Bundle Policies: Some insurers offer discounts when you bundle multiple policies, such as combining liability insurance with property insurance.

- Risk Management: Implementing robust risk management practices can reduce the likelihood of claims and potentially lower insurance premiums. This includes regular safety audits, employee training, and adopting industry best practices.

- Policy Review: Regularly review your insurance policy to ensure it aligns with your business's current needs. As your business grows or changes, your insurance coverage should evolve accordingly.

Future Implications and Industry Trends

The landscape of liability insurance is continually evolving, influenced by various economic, technological, and regulatory factors. Here are some key trends and future implications to consider:

- Rising Claims Costs: As medical costs and litigation expenses continue to rise, the cost of resolving claims is increasing. This trend may lead to higher liability insurance premiums in the future.

- Technology's Impact: The advent of new technologies, such as autonomous vehicles and artificial intelligence, presents both opportunities and challenges for liability insurance. While these technologies may reduce certain risks, they also introduce new and complex liability issues.

- Regulatory Changes: Changes in government regulations can have a significant impact on liability insurance. For example, new laws or regulations related to environmental protection or consumer rights may prompt insurers to adjust their policies and premiums.

- Risk Awareness and Management: Businesses are increasingly recognizing the importance of proactive risk management. This shift in mindset may lead to more effective risk mitigation strategies, potentially reducing the frequency and severity of claims, which could positively impact insurance costs over time.

FAQs

How can I estimate the cost of liability insurance for my business without a specific quote?

+Estimating liability insurance costs without a specific quote can be challenging due to the many factors involved. However, you can use industry averages as a rough guide. For instance, small businesses often pay an average of $500 to $1,000 annually for general liability insurance. Keep in mind that this is just an estimate, and your actual premium may vary based on your business's unique characteristics and the insurer's assessment.

What are some common exclusions in liability insurance policies that I should be aware of?

+Liability insurance policies typically exclude certain types of claims or losses. Common exclusions may include intentional acts, contractual liabilities, pollution or environmental damage, and professional services (unless specifically covered by a professional liability policy). It's crucial to carefully review your policy's exclusions to ensure you understand the limits of your coverage.

How often should I review and update my liability insurance policy?

+It's recommended to review your liability insurance policy annually or whenever significant changes occur in your business. These changes may include expansion into new markets, changes in revenue, or modifications to your business operations. Regular reviews ensure that your insurance coverage remains aligned with your business's evolving needs and that you are not overpaying for unnecessary coverage.

In conclusion, understanding the factors that influence liability insurance costs is crucial for businesses of all sizes. By grasping these elements, businesses can make informed decisions about their insurance coverage, ensuring they are adequately protected without incurring unnecessary expenses. The landscape of liability insurance is ever-evolving, and staying informed about industry trends and best practices is essential for effective risk management.