Insurance Price Quote

Welcome to this in-depth exploration of the often-confusing world of insurance price quotes. Whether you're a seasoned consumer or a first-time buyer, understanding how insurance companies determine their quotes is crucial to making informed decisions about your coverage. In this article, we'll delve into the factors that influence insurance prices, the quote process itself, and strategies to get the best deal. By the end, you'll have the knowledge and tools to navigate the insurance market with confidence.

Unraveling the Insurance Quote Enigma

Insurance price quotes are a complex web of factors, each playing a unique role in determining the final cost of your policy. Let’s dissect these elements and understand how they contribute to the overall quote.

Risk Assessment: The Core of Insurance Pricing

At its core, insurance is all about risk. Insurance companies assess your level of risk based on various criteria to determine the likelihood of a claim. This risk assessment is the foundation of your insurance quote.

Key factors influencing risk assessment include:

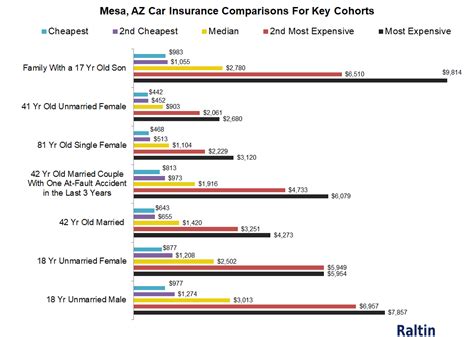

- Personal Information: Your age, gender, and marital status are basic demographic factors that insurers use. For instance, younger individuals often face higher premiums due to their perceived higher risk of accidents.

- Location: Where you live or operate your business plays a significant role. Areas with a higher crime rate or natural disaster risk may attract higher insurance costs.

- Claim History: Previous claims can impact your future quotes. A clean claim history may lead to lower premiums, while frequent claims can increase costs.

- Type of Coverage: Different types of insurance, such as auto, home, or health, have unique risk factors. For example, auto insurance considers driving history and vehicle type, while home insurance assesses property value and location.

The Quote Process: A Step-by-Step Guide

Obtaining an insurance quote typically involves the following steps:

- Information Collection: Insurance providers gather detailed information about you, your assets, or your business. This data forms the basis of their risk assessment.

- Risk Evaluation: Using advanced algorithms and industry data, insurers analyze your risk profile. This step determines your level of risk and, consequently, your premium.

- Quote Generation: Based on the evaluated risk, the insurance company generates a quote. This quote outlines the coverage, deductible, and premium you’d pay for the policy.

- Policy Selection: If the quote meets your needs and budget, you can proceed to purchase the policy. Otherwise, you can request quotes from other insurers or adjust your coverage to find a better fit.

Strategies for Getting the Best Insurance Quote

Navigating the insurance market to find the best quote requires a strategic approach. Here are some tips to help you secure a competitive insurance price:

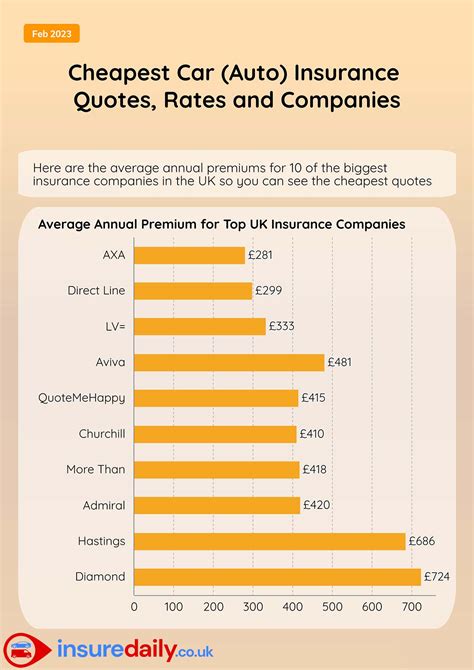

- Compare Quotes: Don’t settle for the first quote you receive. Compare quotes from multiple insurers to identify the most cost-effective option. Online quote comparison tools can simplify this process.

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. This can lead to significant savings.

- Increase Deductibles: Opting for a higher deductible can reduce your premium. However, ensure you can afford the deductible in case of a claim.

- Review Coverage: Regularly review your insurance needs and adjust your coverage accordingly. Avoid over-insuring yourself, as it can lead to unnecessary expenses.

- Negotiate: Don’t be afraid to negotiate with your insurer. Highlight any changes in your risk profile that may warrant a lower premium, such as a clean driving record or home improvements.

The Impact of Technology on Insurance Quotes

The insurance industry has embraced technology to streamline the quote process and enhance accuracy. Here’s how technology is shaping insurance quotes:

- Data Analytics: Advanced data analytics tools enable insurers to analyze vast amounts of data quickly and accurately. This helps in identifying patterns and predicting risks more effectively.

- Telematics: In auto insurance, telematics devices track driving behavior, offering personalized quotes based on actual driving habits. This pay-as-you-drive model can benefit safe drivers.

- Digital Platforms: Online insurance platforms provide convenient, efficient quote comparisons. You can obtain multiple quotes in minutes, making the process faster and more transparent.

Understanding Insurance Quote Variations

Insurance quotes can vary significantly between insurers, even for the same coverage. Here’s why:

| Factor | Impact |

|---|---|

| Company Size | Larger insurers may have more resources for risk assessment and can offer competitive rates. |

| Business Model | Some insurers focus on specific niches, allowing them to offer specialized coverage at competitive prices. |

| Claim Handling | Insurers with efficient claim handling processes may offer lower premiums, as they can manage risks effectively. |

| Market Competition | In competitive markets, insurers may lower prices to attract customers, leading to more affordable quotes. |

The Future of Insurance Quotes: A Look Ahead

The insurance industry is continuously evolving, and the future of insurance quotes holds exciting possibilities. Here’s a glimpse of what we can expect:

- Artificial Intelligence: AI-powered systems will further enhance risk assessment accuracy, leading to more personalized and precise quotes.

- Blockchain Technology: Blockchain can revolutionize insurance by providing secure, transparent transactions and smart contracts, potentially reducing administrative costs and passing the savings to customers.

- Connected Devices: The Internet of Things (IoT) will play a significant role, with connected devices providing real-time data for more accurate risk assessments.

- Data Sharing: Collaborative data sharing between insurers and customers can lead to more efficient risk management and potentially lower premiums.

Frequently Asked Questions

How often should I review my insurance quotes and policies?

+It’s advisable to review your insurance quotes and policies annually, or whenever your circumstances change significantly. This ensures your coverage remains adequate and you’re not overpaying.

Can I negotiate my insurance quote if I’ve had a claim in the past?

+Absolutely! While a claim history may impact your quote, you can still negotiate. Highlight any improvements in your risk profile or changes in your circumstances since the claim. Insurers appreciate proactive risk management.

Are there any disadvantages to using telematics devices for auto insurance quotes?

+Telematics devices can provide accurate quotes based on your driving behavior, but they also mean your driving is constantly monitored. Some drivers may find this invasive. However, for safe drivers, it can lead to significant savings.