Auto Insurance The General Quote

Welcome to an in-depth exploration of The General's auto insurance quotes, a comprehensive guide tailored for individuals seeking an expert perspective on this essential aspect of vehicle ownership. With a focus on providing accurate and insightful information, this article aims to demystify the process of obtaining auto insurance quotes from The General, offering a clear understanding of the factors that influence rates and the steps to secure the best coverage for your needs.

Understanding The General's Auto Insurance Quotes

The General, a renowned provider of auto insurance, offers a streamlined and personalized quoting process. This process is designed to assess individual circumstances and provide tailored coverage options, ensuring drivers can secure the protection they need at competitive rates.

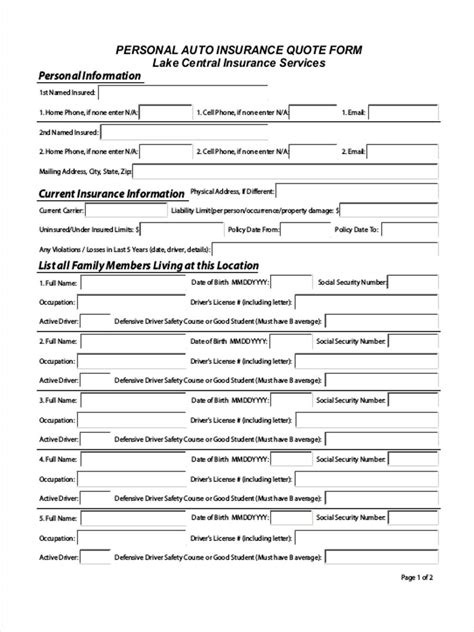

The quote process with The General begins with a series of questions about the driver, their vehicle, and their specific insurance needs. These questions cover various aspects, including personal details, vehicle information, driving history, and desired coverage limits. By providing accurate and detailed responses, individuals can ensure they receive an accurate quote that reflects their unique situation.

Factors Influencing The General's Quotes

The General's quotes are influenced by a range of factors, each playing a critical role in determining the overall cost of insurance. Understanding these factors is key to securing the most advantageous rates.

- Driver Profile: The General considers the age, gender, and marital status of the primary driver. Additionally, driving experience and any previous claims or violations are taken into account. Younger drivers, for instance, may face higher premiums due to their perceived higher risk on the road.

- Vehicle Details: The make, model, and year of the vehicle being insured are significant factors. The General also considers the vehicle's primary use, whether for personal or business purposes, and its safety features. Vehicles with advanced safety systems may be eligible for discounts, while high-performance cars might attract higher premiums.

- Location and Usage: Where the vehicle is garaged and how it is primarily used can impact insurance rates. Urban areas, for example, often have higher rates due to increased traffic and potential for accidents. Similarly, vehicles used primarily for business purposes may attract different rates than those used solely for personal travel.

- Coverage Selection: The level of coverage chosen significantly affects the overall quote. Basic liability coverage is typically the most affordable option, while comprehensive and collision coverage, along with additional endorsements like rental car coverage or roadside assistance, can increase the premium.

- Deductible Choice: Opting for a higher deductible can lower insurance premiums. A deductible is the amount the insured pays out of pocket before the insurance coverage kicks in. Choosing a higher deductible means the insured assumes more financial responsibility, which can lead to lower overall costs.

By considering these factors and understanding their potential impact on insurance rates, individuals can make informed decisions when selecting their coverage and seeking the best quote from The General.

The Process of Obtaining a Quote from The General

The process of obtaining an auto insurance quote from The General is straightforward and efficient. Here's a step-by-step breakdown:

- Online Quote Request: Individuals can initiate the quote process by visiting The General's official website. Here, they can input their basic information, including name, address, and contact details, to begin the quoting process.

- Vehicle and Driver Details: The next step involves providing comprehensive details about the vehicle being insured and the primary driver. This includes make, model, year, mileage, and any safety features or modifications. Additionally, the driver's age, gender, marital status, and driving record are requested.

- Coverage Selection: The General offers a range of coverage options, including liability, collision, comprehensive, and additional endorsements. Individuals can choose the coverage that best suits their needs, with the option to customize their policy further. This step allows for a tailored approach to insurance, ensuring the policy provides the right level of protection.

- Review and Compare: Once the necessary details are provided, The General's system generates a quote based on the information supplied. This quote outlines the proposed coverage, limits, and premium. Individuals can review and compare this quote to other providers or adjust their coverage and deductible to explore different scenarios and find the most cost-effective option.

- Purchase or Decline: If satisfied with the quote, individuals can proceed to purchase the insurance policy. The General offers a straightforward purchase process, allowing for quick and easy coverage activation. Alternatively, individuals can decline the quote and explore other options, revisiting the process as needed.

This streamlined process ensures that individuals can efficiently obtain accurate quotes from The General, making informed decisions about their auto insurance coverage.

The Benefits of Choosing The General for Auto Insurance

Selecting The General for auto insurance offers several advantages, providing drivers with peace of mind and comprehensive coverage tailored to their needs.

- Customized Coverage: The General understands that every driver's needs are unique. Their flexible approach to insurance allows individuals to tailor their coverage, ensuring they get the protection they require without paying for unnecessary add-ons. This customization ensures that policies are cost-effective and comprehensive.

- Competitive Rates: Known for offering competitive rates, The General provides affordable insurance solutions without compromising on quality. Their quotes are designed to be transparent and straightforward, ensuring individuals can easily understand the costs associated with their coverage.

- Streamlined Claims Process: In the event of an accident or incident, The General simplifies the claims process. Their efficient system ensures that claims are processed quickly and fairly, minimizing stress and inconvenience for policyholders. This commitment to a smooth claims experience is a key advantage of choosing The General.

- Excellent Customer Service: The General prides itself on its dedicated customer service. Their team is readily available to assist with any queries or concerns, providing personalized support throughout the insurance journey. This level of service ensures that policyholders can easily navigate the insurance process and make informed decisions.

- Online Convenience: The General offers a seamless online experience, allowing individuals to manage their policies, make payments, and access important documents anytime, anywhere. This digital convenience enhances the overall insurance experience, providing policyholders with easy access to their insurance information and tools.

The Impact of The General's Quotes on Insurance Landscape

The General's auto insurance quotes have significantly influenced the broader insurance landscape, driving industry-wide changes and innovations. Their commitment to providing affordable, accessible insurance has set a new standard for the industry, prompting other providers to reevaluate their approaches and offerings.

The General's focus on customization and flexibility has allowed them to cater to a diverse range of drivers, from those seeking basic liability coverage to those requiring more comprehensive protection. This approach has not only expanded their customer base but has also encouraged other providers to adopt similar strategies, resulting in a more competitive and consumer-friendly insurance market.

Additionally, The General's transparent quoting process has raised the bar for clarity and simplicity in the industry. Their straightforward approach to presenting quotes, detailing coverage and costs, has empowered consumers to make more informed decisions. This transparency has fostered trust between insurers and policyholders, leading to improved relationships and a more positive perception of the insurance sector.

The General's success in delivering competitive rates has also challenged other insurers to enhance their own offerings, driving down prices and providing better value to consumers. This increased competition has led to a more dynamic and responsive insurance market, benefiting drivers with a wider range of options and more affordable coverage.

Furthermore, The General's innovative use of technology in their quoting and policy management systems has set a new benchmark for digital convenience in the industry. Their online platforms and mobile apps have made insurance more accessible and easier to manage, influencing other providers to invest in digital solutions and enhance their own online experiences.

Overall, The General's impact on the insurance landscape is significant, driving positive changes that benefit both consumers and the industry as a whole. Their commitment to customization, affordability, and transparency has set a new standard, shaping the future of auto insurance and empowering drivers to make more informed choices.

Frequently Asked Questions

Can I get a quote from The General if I have a poor driving record?

+Absolutely. The General considers all types of driving records when providing quotes. While a poor driving record may result in a higher premium, The General offers competitive rates and is known for providing coverage to drivers with less-than-perfect records. It’s always best to be transparent about your driving history to ensure an accurate quote.

What are the typical coverage options offered by The General?

+The General offers a comprehensive range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist coverage, medical payments, personal injury protection, rental car reimbursement, and roadside assistance. You can customize your policy to include the coverage that best suits your needs and budget.

How can I lower my insurance premium with The General?

+There are several ways to potentially lower your insurance premium with The General. You can consider increasing your deductible, maintaining a clean driving record, taking advantage of available discounts (such as safe driver discounts or multi-policy discounts), and exploring bundling options if you have other insurance needs.

What is the process for filing a claim with The General?

+Filing a claim with The General is straightforward. You can start the process by contacting their customer service team, either through their website, over the phone, or via email. They will guide you through the necessary steps, which typically involve providing details about the incident, submitting any required documentation, and working with their claims adjusters to reach a resolution.

Does The General offer any discounts on auto insurance quotes?

+Yes, The General offers a variety of discounts to help lower your insurance premium. These may include discounts for safe driving, multi-policy bundling, paying your premium in full, having certain safety features in your vehicle, and more. It’s always a good idea to inquire about available discounts when obtaining a quote.