Cheap Professional Liability Insurance

In the world of business and professional services, the importance of having adequate insurance coverage cannot be overstated. For many entrepreneurs and professionals, one of the primary concerns is finding affordable professional liability insurance that provides comprehensive protection without breaking the bank. This comprehensive guide aims to delve into the intricacies of professional liability insurance, offering insights into how to secure the best coverage at the most favorable rates.

Understanding Professional Liability Insurance

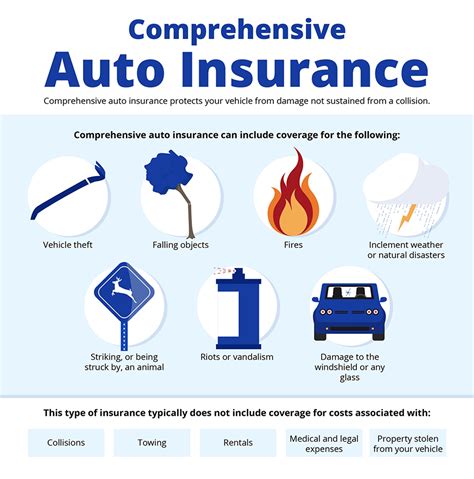

Professional liability insurance, often referred to as errors and omissions insurance (E&O), is a specialized form of coverage designed to protect professionals against claims of negligence, errors, or omissions in the services they provide. This type of insurance is essential for a wide range of professionals, including but not limited to lawyers, doctors, consultants, architects, and many others.

The primary purpose of professional liability insurance is to provide financial protection in the event that a client or customer sues the insured professional for alleged mistakes or failures in the course of providing professional services. These mistakes can range from simple oversights to more serious allegations of professional misconduct.

While the specifics of professional liability insurance can vary depending on the nature of the business and the jurisdiction, it typically covers legal expenses, settlements, and damages resulting from such claims. This coverage is vital as it helps professionals focus on their core expertise without the constant worry of potential financial ruin due to a single mistake or misstep.

Why Cheap Professional Liability Insurance is a Smart Choice

Securing affordable professional liability insurance is not just a cost-saving measure; it’s a strategic decision that can significantly impact the long-term viability and growth of a business. Here’s why opting for cheap professional liability insurance is a wise choice for many professionals:

Cost-Effectiveness

The most obvious benefit of cheap professional liability insurance is the reduced cost. Professional liability insurance policies can often be a significant expense, especially for small businesses or startups operating on tight budgets. By finding affordable options, businesses can allocate their resources more efficiently, allowing for investments in other critical areas such as marketing, technology, or talent acquisition.

Tailored Coverage

Inexpensive professional liability insurance is not necessarily a one-size-fits-all solution. Many insurance providers offer customizable policies, allowing businesses to select the coverage limits and endorsements that best fit their specific needs. This flexibility ensures that businesses are not paying for unnecessary coverage while still maintaining adequate protection.

Peace of Mind

Having professional liability insurance provides a sense of security and peace of mind. It assures professionals that they are protected in the event of a claim, allowing them to focus on their work without constant worry about potential legal battles or financial repercussions. This peace of mind can be especially crucial for businesses just starting, as it allows them to build a solid foundation without the added stress of potential liabilities.

Enhanced Credibility

In many industries, having professional liability insurance is not just a nice-to-have but a necessity. Clients and customers often prefer to work with professionals who are insured, as it demonstrates a level of commitment to the profession and a willingness to take responsibility for their actions. Carrying affordable professional liability insurance can thus enhance a business’s credibility and reputation, making it more attractive to potential clients.

Finding the Best Cheap Professional Liability Insurance

Securing cheap professional liability insurance that offers comprehensive coverage requires a strategic approach. Here are some key steps to guide you in your search:

Define Your Coverage Needs

Before shopping for insurance, it’s crucial to understand your specific coverage needs. Consider the risks associated with your profession, the potential claims that could arise, and the level of protection you require. This self-assessment will help you communicate your needs effectively to insurance providers and ensure you get the right coverage.

Compare Multiple Quotes

Don’t settle for the first insurance quote you receive. Take the time to compare quotes from several providers. Online insurance marketplaces can be a great resource for this, as they often provide a platform to compare multiple quotes side by side. Make sure to compare not just the prices but also the coverage limits, deductibles, and any exclusions.

Leverage Technology

The insurance industry has embraced technology, and there are now numerous online tools and resources available to help you find the best deals. These tools can provide personalized quotes based on your profession, location, and specific needs. Additionally, many insurance providers now offer digital applications and management platforms, making it easier and more efficient to purchase and manage your policy.

Seek Expert Advice

If you’re unsure about your coverage needs or the best insurance options, consider seeking advice from an insurance broker or agent. These professionals have extensive knowledge of the insurance market and can provide valuable insights tailored to your specific situation. They can also help negotiate better rates and ensure you’re getting the most value for your money.

Read the Fine Print

When comparing insurance policies, it’s crucial to read the fine print. Understand the terms and conditions, including any exclusions or limitations, before making a decision. While cheap professional liability insurance is attractive, it’s important to ensure you’re not sacrificing essential coverage in the process.

Case Studies: Affordable Professional Liability Insurance in Action

To illustrate the impact of affordable professional liability insurance, let’s examine two case studies:

Case Study 1: A Small Consulting Firm

Imagine a small consulting firm specializing in marketing strategies for startups. The firm has a team of highly skilled professionals but operates on a tight budget. By opting for affordable professional liability insurance, they were able to secure comprehensive coverage without straining their finances. This allowed them to focus on growing their business and taking on more clients without the worry of potential liabilities.

Case Study 2: An Independent Contractor

Consider an independent contractor who provides web design services. As a sole proprietor, they face unique challenges in terms of insurance coverage. By shopping around and comparing quotes, they were able to find an affordable professional liability insurance policy that met their needs. This policy provided them with the peace of mind to continue their business, knowing they were protected in the event of a claim.

The Future of Professional Liability Insurance

The professional liability insurance landscape is evolving, driven by technological advancements and changing business needs. Here’s a glimpse into the future of this critical insurance coverage:

Digital Transformation

The insurance industry is undergoing a digital transformation, with more providers offering online applications, policy management, and even claims processing. This shift towards digital solutions not only enhances efficiency but also makes insurance more accessible and affordable for professionals.

Personalized Coverage

Advancements in data analytics and machine learning are enabling insurance providers to offer more personalized coverage. By analyzing a business’s specific risks and historical data, providers can tailor policies to provide the most relevant and cost-effective coverage.

Emphasis on Prevention

In the future, professional liability insurance may place a greater emphasis on risk prevention rather than just claims coverage. This could involve providing resources and tools to help businesses mitigate risks and prevent errors before they occur, ultimately reducing the likelihood of claims.

Collaborative Insurance Models

Collaborative insurance models, where businesses pool resources to create customized insurance plans, may become more prevalent. These models can offer cost savings and more tailored coverage, especially for small businesses or those in niche industries.

Conclusion: The Value of Affordable Professional Liability Insurance

Securing cheap professional liability insurance is not just a financial decision; it’s a strategic move that can significantly impact a business’s long-term success and sustainability. By understanding your coverage needs, leveraging technology, and seeking expert advice, you can find affordable insurance that provides the protection you need without compromising your financial stability.

In an increasingly competitive business landscape, affordable professional liability insurance is a vital tool for professionals to mitigate risks, build credibility, and focus on what they do best. As the insurance industry continues to evolve, staying informed and adaptable will be key to ensuring you have the right coverage at the right price.

What are the typical costs of professional liability insurance?

+The cost of professional liability insurance can vary widely depending on factors such as the profession, the size of the business, the level of coverage required, and the insurance provider. On average, premiums can range from a few hundred dollars to several thousand dollars annually. However, it’s important to note that these costs can be significantly reduced by shopping around, comparing quotes, and tailoring your coverage to your specific needs.

How can I reduce the cost of my professional liability insurance?

+There are several strategies to reduce the cost of your professional liability insurance. First, consider increasing your deductible, as this can lower your premium. Additionally, look for providers that offer discounts for things like multi-policy purchases, payment methods, or membership in certain professional organizations. Lastly, ensure your business practices are as risk-mitigated as possible, as this can also reduce your insurance costs.

Are there any online resources to help me find cheap professional liability insurance?

+Absolutely! There are numerous online insurance marketplaces and comparison websites that can help you find affordable professional liability insurance. These platforms allow you to compare quotes from multiple providers, often with additional filters and tools to help you tailor your search to your specific needs. Some popular options include Insureon, Policygenius, and InsureMyRental, among others.