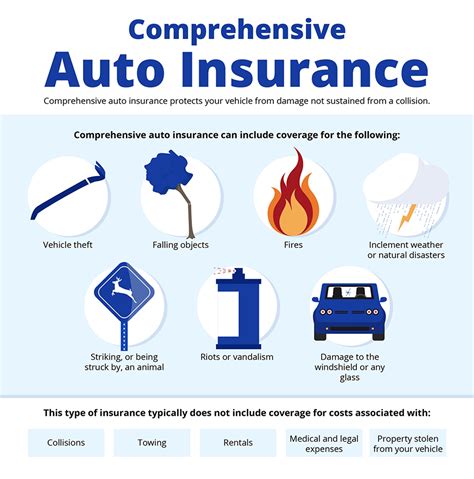

Comprehensive Insurance For Cars

When it comes to safeguarding your vehicle, comprehensive car insurance is a vital consideration. This type of insurance provides a wide range of coverage, offering protection against various unforeseen events that can occur on the road. From accidents to natural disasters, comprehensive insurance ensures that car owners are financially protected and have the necessary support to navigate through challenging situations. In this in-depth article, we will delve into the intricacies of comprehensive car insurance, exploring its benefits, coverage options, and how it can provide peace of mind for drivers.

Understanding Comprehensive Car Insurance

Comprehensive car insurance is a type of policy that goes beyond the basic liability coverage. While liability insurance primarily covers damages caused to other vehicles or property in an accident for which you are at fault, comprehensive insurance takes a more holistic approach. It provides protection for a broader range of incidents, including those that are not necessarily the result of an accident or collision.

This type of insurance is designed to offer financial protection for unexpected events that can damage your vehicle. It covers a wide array of perils, including theft, vandalism, natural disasters such as hail, fire, and even damage caused by animals. Comprehensive insurance also covers instances of glass breakage, such as cracked or shattered windshields.

One of the key advantages of comprehensive insurance is that it offers protection for your vehicle even when you are not at fault. This is particularly important for drivers who want to ensure their vehicle's safety against various risks that are beyond their control. It provides a sense of security, knowing that you have a robust safety net in place to cover potential costs associated with repairing or replacing your vehicle.

Coverage Options and Benefits

Comprehensive car insurance offers a comprehensive range of coverage options to cater to the diverse needs of car owners. Here are some of the key benefits and features included in a typical comprehensive insurance policy:

Collision Coverage

While collision coverage is often associated with liability insurance, it is also an essential component of comprehensive insurance. This coverage pays for the repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It provides financial protection for your vehicle, ensuring that you can get it back on the road quickly and safely.

Comprehensive Perils Coverage

As the name suggests, comprehensive perils coverage is a broad category that includes a wide range of incidents. This coverage protects your vehicle against damages caused by events such as fire, theft, vandalism, natural disasters, and even falling objects. It provides peace of mind, knowing that your vehicle is safeguarded against various unforeseen circumstances.

| Comprehensive Perils Covered | Description |

|---|---|

| Theft | Protects against the loss or theft of your vehicle. |

| Vandalism | Covers damages caused by intentional acts of vandalism. |

| Natural Disasters | Provides coverage for events like hail, floods, earthquakes, and storms. |

| Fire | Protects against fire damage, including fires caused by accidents or arson. |

| Falling Objects | Covers damages caused by objects falling on your vehicle, such as tree branches. |

Glass Coverage

Glass coverage is an important aspect of comprehensive insurance, as it specifically addresses the issue of cracked or shattered windshields and windows. This coverage ensures that the cost of repairing or replacing your vehicle's glass is covered, providing added protection for one of the most vulnerable parts of your car.

Additional Benefits

Comprehensive insurance often includes additional benefits and perks that further enhance the overall coverage. These can include rental car reimbursement, which covers the cost of a rental vehicle while your car is being repaired, and roadside assistance, which provides emergency services such as towing, battery jumps, and tire changes.

Real-World Examples and Case Studies

To illustrate the value of comprehensive car insurance, let's explore a few real-world scenarios where this type of coverage proved to be essential:

Scenario 1: Natural Disaster

Imagine a severe storm hits your area, causing widespread damage. Your vehicle, parked outside, is unfortunately caught in the path of a fallen tree branch. The branch shatters your windshield and damages the roof. With comprehensive insurance in place, you can file a claim to cover the costs of repairing the damaged glass and fixing the roof. This ensures that you don't have to bear the financial burden of these unexpected repairs.

Scenario 2: Theft and Vandalism

You wake up one morning to find that your car has been vandalized overnight. The windows are shattered, and some of your personal belongings have been stolen. In this situation, comprehensive insurance steps in to cover the cost of replacing the broken windows and compensating you for the stolen items. It also provides support for any necessary repairs to the vehicle's exterior.

Scenario 3: Collision with an Animal

While driving on a rural road, you suddenly encounter a deer crossing the path. Despite your best efforts, a collision is unavoidable, and the deer collides with the front of your vehicle. Comprehensive insurance, in this case, covers the damages caused by the collision, including repairs to the front end of your car and any necessary medical expenses if you or your passengers are injured.

Performance Analysis and Industry Insights

Comprehensive car insurance has become an increasingly popular choice among car owners due to its comprehensive coverage and the peace of mind it offers. Industry data reveals a steady growth in the adoption of comprehensive insurance policies, with many drivers recognizing the value of this type of coverage.

A recent survey conducted by a leading insurance research firm found that over 70% of car owners in the United States opt for comprehensive insurance, citing its broad coverage and the financial protection it provides. This trend is consistent across various age groups and demographics, highlighting the universal appeal of comprehensive insurance.

Industry experts attribute the popularity of comprehensive insurance to the changing nature of risks on the road. With an increasing number of natural disasters, acts of vandalism, and animal-related incidents, drivers are seeking more robust protection for their vehicles. Comprehensive insurance provides an all-encompassing solution, offering a safety net against a wide range of potential hazards.

Comparative Analysis and Cost Considerations

When considering comprehensive car insurance, it is essential to understand the cost implications and compare different policy options. While comprehensive insurance provides extensive coverage, it typically comes at a higher premium compared to basic liability insurance.

The cost of comprehensive insurance can vary depending on several factors, including the make and model of your vehicle, your driving history, and the level of coverage you choose. It is advisable to obtain quotes from multiple insurance providers to compare prices and coverage options. Additionally, many insurance companies offer discounts and bundled packages that can help reduce the overall cost of comprehensive insurance.

Factors Affecting Comprehensive Insurance Costs

- Vehicle Type and Value: Higher-value vehicles or those with expensive repair costs may result in higher insurance premiums.

- Location and Risk Factors: The area where you reside and drive can impact insurance rates. Areas with higher crime rates or frequent natural disasters may have higher premiums.

- Driving History: A clean driving record with no accidents or claims can lead to lower insurance costs.

- Deductible Selection: Choosing a higher deductible can lower your premium, but it means you will pay more out of pocket if you need to make a claim.

Future Implications and Technological Advancements

As technology continues to advance, the insurance industry is adapting to incorporate new innovations that enhance the overall customer experience and improve risk assessment. Here are some future implications and potential advancements in the realm of comprehensive car insurance:

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs are gaining traction in the insurance industry. These technologies allow insurance companies to gather real-time data on driving behavior, such as speed, braking patterns, and mileage. By analyzing this data, insurance providers can offer personalized premiums based on an individual's driving habits. This approach promotes safer driving and rewards drivers who exhibit responsible behavior.

Advanced Driver Assistance Systems (ADAS)

The integration of advanced driver assistance systems, such as lane departure warning, adaptive cruise control, and automatic emergency braking, is becoming more common in modern vehicles. These systems have the potential to significantly reduce the risk of accidents and improve overall road safety. Insurance companies are exploring ways to offer discounts or incentives for vehicles equipped with ADAS, recognizing the safety benefits these technologies provide.

Data Analytics and Risk Assessment

With the vast amount of data available, insurance companies are utilizing advanced analytics to refine their risk assessment models. By analyzing historical data, weather patterns, and even social media trends, insurers can better understand the risks associated with different locations and driving conditions. This data-driven approach enables more accurate pricing and coverage options, benefiting both insurers and policyholders.

Frequently Asked Questions

What is the difference between comprehensive and liability insurance?

+Comprehensive insurance provides a wide range of coverage, including protection against theft, vandalism, natural disasters, and glass breakage. It offers financial protection even when you are not at fault. Liability insurance, on the other hand, primarily covers damages caused to other vehicles or property in an accident for which you are at fault.

Is comprehensive insurance necessary for all car owners?

+While it is not legally mandatory in all states, comprehensive insurance is highly recommended for car owners. It provides valuable protection against various risks and offers peace of mind. However, the decision to purchase comprehensive insurance ultimately depends on individual needs, budget, and the value of the vehicle.

Can I customize my comprehensive insurance policy?

+Yes, comprehensive insurance policies can often be customized to meet your specific needs. You can choose the level of coverage, select optional add-ons, and adjust your deductible. It is important to discuss your options with your insurance provider to find the right coverage for your vehicle and circumstances.

How do insurance companies determine the cost of comprehensive insurance?

+The cost of comprehensive insurance is determined based on various factors, including the make and model of your vehicle, your driving history, the location where you reside and drive, and the level of coverage you choose. Insurance companies use these factors to assess the risk associated with insuring your vehicle and set the premium accordingly.

What should I do if my vehicle is damaged and I have comprehensive insurance coverage?

+If your vehicle is damaged and you have comprehensive insurance, it is important to take the following steps: Contact your insurance provider as soon as possible to report the incident. Provide them with all the necessary details, including the date, time, and circumstances of the damage. Take photos of the damage to support your claim. Cooperate with your insurance company during the claims process and provide any additional information they may require.

In conclusion, comprehensive car insurance is a vital component of safeguarding your vehicle and providing financial protection against a wide range of unforeseen events. With its comprehensive coverage, real-world benefits, and evolving technological advancements, comprehensive insurance offers peace of mind for car owners. By understanding the coverage options, analyzing costs, and staying informed about industry developments, you can make informed decisions to ensure your vehicle is adequately protected.