Pet Insurance Pre Existing Conditions Covered

In today's pet-centric world, pet insurance has become an increasingly popular way for pet owners to safeguard their furry friends' health and well-being. One of the most crucial aspects of pet insurance is understanding its coverage, especially when it comes to pre-existing conditions. While the topic of pet insurance and pre-existing conditions can be complex, it is essential to delve into the details to make informed decisions about your pet's healthcare.

Understanding Pet Insurance and Pre-Existing Conditions

A pre-existing condition in the context of pet insurance refers to any medical condition, illness, or injury that your pet has been diagnosed with or treated for prior to enrolling in an insurance plan. These conditions can range from common ailments like allergies and skin issues to more serious and chronic problems such as diabetes, arthritis, or heart disease.

Many pet owners wonder whether pet insurance covers pre-existing conditions. The answer is not a simple yes or no; it depends on various factors, including the insurance provider, the policy terms, and the specific condition. Let's explore this topic in more detail to provide a comprehensive understanding.

The Complexity of Pre-Existing Conditions Coverage

Pet insurance policies can vary significantly between different providers, and the coverage for pre-existing conditions is no exception. While some insurance companies may exclude pre-existing conditions altogether, others offer more flexible options.

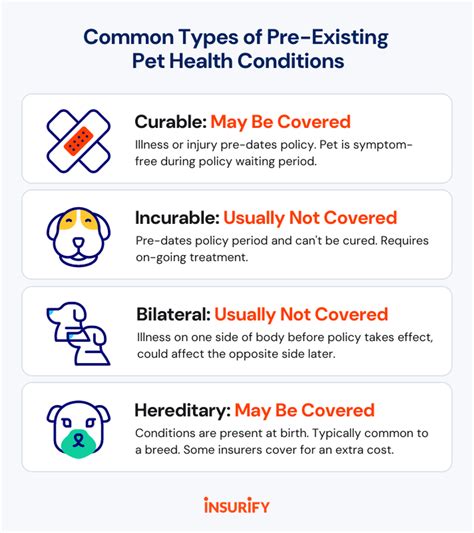

In general, there are three primary approaches that insurance providers take regarding pre-existing conditions:

- Exclusion of Pre-Existing Conditions: Some pet insurance policies explicitly state that they will not cover any costs related to pre-existing conditions. This means that if your pet has been diagnosed with a condition before enrolling in the insurance plan, any treatments, medications, or procedures for that condition will not be reimbursed.

- Waiting Periods and Exclusions: Many pet insurance companies implement a waiting period for certain conditions. During this waiting period, usually lasting a few months, the insurance company will not cover any expenses related to that specific condition. However, after the waiting period expires, the condition may be covered.

- Partial or Full Coverage: A select few insurance providers offer more comprehensive coverage for pre-existing conditions. These policies often come with higher premiums but provide peace of mind for pet owners with pets who have known health issues. Such policies may offer partial coverage, where a percentage of the treatment costs are reimbursed, or full coverage, where the insurance company covers the entire expense.

It is important to note that even within these categories, there can be variations. Some policies may have specific exclusions or limitations for certain pre-existing conditions, while others might offer coverage for a limited number of treatments or procedures.

Evaluating Pet Insurance Policies

When considering pet insurance, it is crucial to carefully evaluate the policy details, especially regarding pre-existing conditions. Here are some key factors to consider:

Review the Policy’s Exclusions

Read through the policy’s exclusions section carefully. This will provide clarity on which conditions are not covered and under what circumstances. Look for any specific exclusions related to pre-existing conditions and understand the implications.

Waiting Periods and Timelines

Pay attention to the waiting periods mentioned in the policy. Understand how long you must wait before a pre-existing condition becomes eligible for coverage. Consider the timeline and whether it aligns with your pet’s current health status.

Coverage Limits and Reimbursement Rates

Check the coverage limits and reimbursement rates for pre-existing conditions. Some policies may have lower limits or reimbursement rates compared to other conditions. Ensure that the coverage aligns with your pet’s potential needs.

Seeking Professional Advice

Consulting with a veterinarian or a pet insurance specialist can provide valuable insights. They can help you understand the policy’s fine print and make an informed decision based on your pet’s health history and potential future needs.

Real-World Examples and Case Studies

Let’s explore some real-world scenarios to illustrate how pet insurance policies handle pre-existing conditions:

Case Study 1: Exclusion of Pre-Existing Conditions

Let’s imagine you have a dog named Max who was diagnosed with a chronic skin condition a year ago. You decide to enroll Max in a pet insurance plan with an insurance company that excludes pre-existing conditions. Unfortunately, Max’s skin condition flares up, and you incur significant veterinary expenses. In this case, the insurance company would not cover any of the costs related to Max’s skin condition, as it is considered a pre-existing condition.

Case Study 2: Waiting Periods and Partial Coverage

Suppose you have a cat named Bella who has been diagnosed with diabetes. You enroll Bella in a pet insurance policy that offers coverage for pre-existing conditions but with a 6-month waiting period. During this waiting period, you must pay for Bella’s diabetes treatment out of pocket. After the waiting period, the insurance company will start reimbursing a portion of the treatment costs, typically at a certain percentage.

Case Study 3: Comprehensive Coverage

Consider a pet owner, Sarah, who has a dog with a known heart condition. She enrolls her dog in a specialized pet insurance plan that offers full coverage for pre-existing conditions. This policy ensures that all necessary treatments, medications, and procedures related to the heart condition are covered, providing Sarah with the financial support she needs to provide the best possible care for her dog.

The Importance of Transparency and Communication

When dealing with pet insurance and pre-existing conditions, transparency and open communication are essential. It is crucial to have honest discussions with your veterinarian and the insurance provider to understand the implications of any pre-existing conditions your pet may have. By being proactive and informed, you can make the best decisions for your pet’s healthcare.

Future Implications and Industry Trends

The pet insurance industry is evolving, and there is a growing awareness of the importance of covering pre-existing conditions. While some insurance providers may still have strict exclusion policies, others are recognizing the need for more comprehensive coverage. As the industry adapts, we may see more pet insurance companies offering flexible options and specialized plans for pets with pre-existing conditions.

Additionally, advancements in veterinary medicine and technology are making it possible to better manage and treat various conditions, which may influence insurance providers to reconsider their coverage policies. The future of pet insurance may bring more inclusive and pet-friendly options, providing greater peace of mind to pet owners.

Conclusion: Making Informed Decisions

Understanding pet insurance coverage for pre-existing conditions is crucial for any pet owner. By evaluating different policies, seeking professional advice, and being aware of industry trends, you can make informed decisions to ensure your pet receives the best possible care. Remember, pet insurance is a valuable tool to manage unexpected veterinary costs, and with the right coverage, you can provide your furry friend with the healthcare they deserve.

Can I get pet insurance for a pet with a pre-existing condition?

+While some pet insurance companies may exclude pre-existing conditions, others offer varying levels of coverage. It is essential to carefully review policy details and consult with insurance providers to find the best option for your pet’s specific needs.

How long is the typical waiting period for pre-existing conditions?

+Waiting periods for pre-existing conditions can vary between insurance providers. Some policies may have waiting periods ranging from a few months to a year. It is crucial to review the specific policy terms to understand the timeline.

Are there any pet insurance plans that offer full coverage for pre-existing conditions?

+Yes, there are specialized pet insurance plans that provide full coverage for pre-existing conditions. These policies often come with higher premiums but can be beneficial for pets with known health issues. It is worth exploring these options to ensure comprehensive coverage.