Monthly Vehicle Insurance Payment

Welcome to this comprehensive guide on the intricacies of monthly vehicle insurance payments. Vehicle insurance is an essential aspect of owning a car, providing financial protection and peace of mind. However, the process of understanding and managing these payments can be daunting for many. In this article, we will delve into the factors influencing these monthly premiums, explore the various payment options available, and offer valuable insights to help you navigate the world of vehicle insurance with confidence.

Understanding Monthly Vehicle Insurance Premiums

Monthly vehicle insurance payments, or premiums, are the regular installments you pay to your insurance provider to maintain your coverage. These premiums are calculated based on a multitude of factors, each playing a unique role in determining the overall cost of your insurance policy.

Factors Influencing Monthly Premiums

The cost of your vehicle insurance is influenced by a combination of personal and vehicle-related factors. Here are some key considerations:

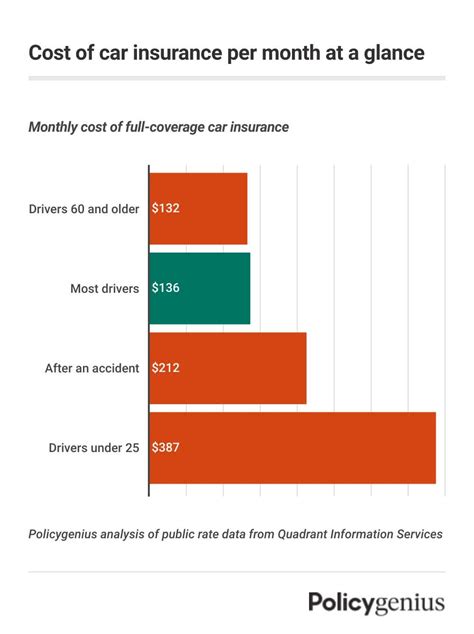

- Driver’s Age and Experience: Younger drivers, especially those under 25, often face higher premiums due to their lack of driving experience. Conversely, mature drivers with a clean driving record may enjoy lower rates.

- Vehicle Type and Value: The make, model, and age of your vehicle impact insurance costs. High-performance cars, luxury vehicles, and older models may attract higher premiums due to their potential for higher repair costs or theft risks.

- Location: The area where you reside and drive significantly affects your insurance rates. Urban areas with higher crime rates or congested traffic may result in increased premiums.

- Driving Record: A clean driving history is favorable when it comes to insurance premiums. Traffic violations, accidents, and DUI convictions can lead to higher rates or even policy cancellations.

- Coverage and Deductibles: The level of coverage you choose, such as liability-only or comprehensive coverage, influences your premiums. Additionally, selecting a higher deductible can reduce your monthly payments but requires a larger out-of-pocket expense in the event of a claim.

- Discounts and Bundling: Many insurance providers offer discounts for safe driving, loyalty, or bundling multiple policies (e.g., auto and home insurance) with the same company.

Understanding these factors is crucial as they provide a foundation for negotiating and managing your insurance premiums effectively.

Payment Options and Flexibility

Insurance providers offer various payment options to accommodate different financial situations and preferences. Here are some common methods:

Monthly Installments

The most common approach is paying your insurance premiums on a monthly basis. This option provides flexibility and allows you to budget your expenses more effectively. However, it’s essential to note that some insurers may charge an additional fee for this convenience.

Semi-Annual or Annual Payments

Paying your insurance premiums semi-annually or annually can often result in significant savings. Many insurers offer discounts for choosing these payment plans, as it reduces administrative costs and provides a more stable financial outlook for the company. This option is ideal for those who can afford the upfront cost and wish to benefit from long-term savings.

Pay-As-You-Drive Insurance

Also known as usage-based insurance, this innovative approach calculates premiums based on your actual driving behavior and mileage. With the help of a telematics device installed in your vehicle, insurers can monitor factors like driving speed, braking habits, and miles driven. This data is then used to determine your premium, offering discounts to safe and cautious drivers.

Alternative Payment Methods

Some insurance providers now offer the convenience of paying premiums through digital wallets, mobile apps, or even cryptocurrency. These methods provide added flexibility and often come with additional perks like faster processing times or small discounts.

Strategies for Managing Monthly Premiums

Effectively managing your monthly vehicle insurance payments is key to maintaining financial stability. Here are some strategies to consider:

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Take the time to compare rates from multiple providers. Online insurance marketplaces and comparison websites can be invaluable tools for this process. By shopping around, you can identify the most competitive rates and find the best value for your insurance needs.

Understand Your Coverage

Take the time to thoroughly understand your insurance policy. Ensure you are aware of the coverage limits, deductibles, and any additional features or endorsements included. This knowledge will help you make informed decisions when it comes to adjusting your coverage or switching providers.

Consider Higher Deductibles

Opting for a higher deductible can significantly reduce your monthly premiums. However, it’s essential to ensure that you have the financial means to cover this expense in the event of a claim. Higher deductibles are an effective strategy for those with a stable financial situation and a low risk of frequent claims.

Bundle Policies

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with the same provider. Many insurers offer substantial discounts for customers who choose this option, as it simplifies administrative processes and provides a more comprehensive view of your insurance needs.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep your insurance premiums low. Avoid traffic violations, practice safe driving habits, and regularly maintain your vehicle to reduce the risk of accidents or breakdowns. By demonstrating a responsible and cautious driving attitude, you can earn the trust of insurance providers and potentially qualify for lower rates.

The Impact of Claims on Premiums

Filing a claim can have a direct impact on your insurance premiums. When you make a claim, your insurer evaluates the cost of the claim and adjusts your premiums accordingly. Here’s what you need to know:

Understanding Claim Adjustments

After a claim, your insurance provider will review your driving record and claim history. Based on this assessment, they may choose to increase your premiums. The extent of the increase depends on various factors, including the severity of the claim, the frequency of previous claims, and the overall risk assessment associated with your driving behavior.

Strategies for Minimizing Premium Increases

To minimize the impact of claims on your premiums, consider the following strategies:

- Maintain a high credit score. Insurance providers often use credit-based insurance scores to assess risk, and a good credit history can help offset the impact of a claim.

- Choose a higher deductible when filing a claim. By opting for a higher deductible, you can reduce the cost of the claim and potentially mitigate premium increases.

- Consider alternatives to filing a claim. If the cost of the damage is relatively minor, you may choose to pay for repairs out of pocket to avoid a claim and potential premium increases.

- Review your coverage limits and consider adjustments. After a claim, it’s a good time to reassess your coverage needs and make any necessary adjustments to ensure you have the right level of protection without overpaying.

Future Trends and Innovations in Vehicle Insurance

The world of vehicle insurance is continually evolving, driven by technological advancements and changing consumer expectations. Here are some trends and innovations to watch:

Telematics and Usage-Based Insurance

The use of telematics devices and usage-based insurance is expected to grow significantly in the coming years. As these technologies become more sophisticated and widely adopted, insurers will gain a deeper understanding of individual driving behaviors, enabling more accurate risk assessments and potentially leading to more tailored insurance products.

Artificial Intelligence and Machine Learning

AI and machine learning are transforming the insurance industry. These technologies are being used to streamline claims processing, automate risk assessments, and enhance fraud detection. By leveraging these tools, insurers can improve efficiency, reduce costs, and offer more accurate and personalized insurance products.

Digital Transformation

The insurance industry is undergoing a digital transformation, with insurers investing heavily in digital platforms and mobile apps. This shift towards digital services provides customers with greater convenience, allowing them to manage their policies, make payments, and file claims online or through mobile devices.

Blockchain Technology

Blockchain technology has the potential to revolutionize the insurance industry by enhancing data security, streamlining claims processes, and improving transparency. By leveraging blockchain, insurers can create a secure and immutable record of insurance transactions, reducing the risk of fraud and improving trust between insurers and policyholders.

Conclusion

Understanding and managing your monthly vehicle insurance payments is an essential aspect of responsible car ownership. By familiarizing yourself with the factors influencing premiums, exploring various payment options, and implementing effective management strategies, you can navigate the world of vehicle insurance with confidence. Additionally, staying informed about the latest trends and innovations in the industry will ensure you remain at the forefront of insurance advancements, ultimately benefiting from more personalized and efficient insurance solutions.

How often should I shop around for insurance quotes?

+It’s recommended to shop around for insurance quotes annually or anytime you experience a significant life change, such as getting married, buying a new car, or moving to a new location. Regularly comparing rates ensures you’re getting the best value for your insurance needs.

Can I negotiate my insurance premiums?

+While insurance premiums are primarily determined by actuarial data and risk assessments, you can negotiate certain aspects of your policy. For example, you can discuss coverage limits, deductibles, and any additional endorsements to find a balance that suits your needs and budget.

What should I do if my insurance premiums increase after a claim?

+If your premiums increase after a claim, it’s essential to review your policy and understand the reasons for the increase. You can then consider strategies like increasing your deductible, adjusting your coverage limits, or shopping around for more competitive rates from other insurers.

Are there any discounts available for safe driving habits?

+Yes, many insurance providers offer discounts for safe driving habits. These discounts may be based on factors like accident-free years, defensive driving courses completed, or even the installation of telematics devices that monitor and reward safe driving behaviors.

How can I ensure my insurance policy covers my specific needs?

+To ensure your insurance policy covers your specific needs, it’s crucial to thoroughly review the policy documents and understand the coverage limits, deductibles, and any exclusions. Consider your unique circumstances, such as the value of your vehicle, your driving habits, and any additional risks you may face, and tailor your policy accordingly.