Health Insurance Colorado

In the vast landscape of healthcare coverage, understanding the nuances of health insurance is paramount, especially when navigating the unique circumstances of a state like Colorado. This comprehensive guide aims to delve into the specifics of Health Insurance in Colorado, shedding light on the critical aspects that affect residents' well-being and financial security.

Understanding Health Insurance in Colorado: A Comprehensive Overview

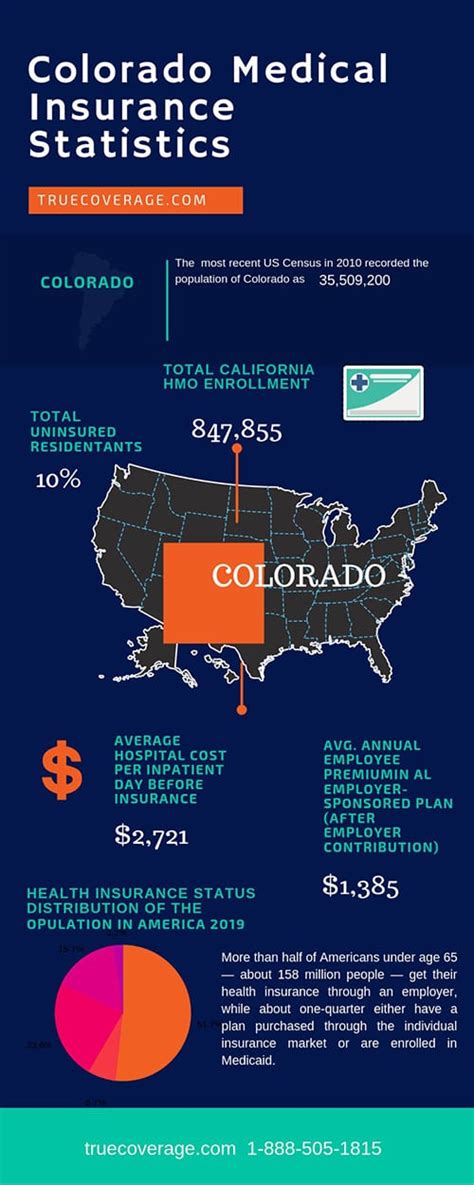

The health insurance landscape in Colorado is a dynamic and intricate system, offering a range of plans and options tailored to the diverse needs of its residents. From individual policies to family coverage, and from employer-sponsored plans to government-assisted programs, Colorado’s health insurance market provides a comprehensive framework to protect its citizens’ health and financial interests.

Individual and Family Plans: Tailored Coverage for Every Need

Colorado's individual and family health insurance plans are designed to offer flexible and comprehensive coverage. These plans typically include a range of benefits, such as preventive care, prescription drug coverage, and access to a network of healthcare providers. With a variety of deductibles, copayments, and out-of-pocket maximums, individuals and families can choose a plan that best suits their healthcare needs and financial circumstances.

| Plan Type | Average Premium | Deductible Range |

|---|---|---|

| Individual Plans | $450 - $800/month | $1,000 - $5,000 |

| Family Plans | $1,200 - $2,500/month | $2,000 - $10,000 |

For example, a young professional in Denver might opt for a higher deductible plan with lower monthly premiums, while a family with children in Boulder might choose a plan with a lower deductible and higher out-of-pocket maximum to ensure comprehensive coverage for their growing family.

Employer-Sponsored Plans: Benefits and Considerations

Many Coloradans receive health insurance coverage through their employers. These employer-sponsored plans often offer competitive rates and comprehensive benefits, as they are partially subsidized by the employer. Employees typically have a choice of several plans, allowing them to select the one that best aligns with their healthcare needs and preferences.

| Plan Type | Employee Contribution | Benefits |

|---|---|---|

| HMO Plans | $150 - $300/month | Lower out-of-pocket costs, restricted provider network |

| PPO Plans | $200 - $400/month | More flexible provider network, higher out-of-pocket costs |

| EPO Plans | $180 - $350/month | Exclusive provider network, no out-of-network coverage |

Consider the case of a tech startup in Colorado Springs offering its employees a choice between an HMO and a PPO plan. The HMO plan, with its lower employee contribution, might appeal to younger, healthier employees, while the PPO plan, with its broader network and more flexible benefits, could be a better fit for employees with specific healthcare needs or those who frequently travel for work.

Government-Assisted Programs: Support for Vulnerable Populations

Colorado recognizes the importance of ensuring healthcare access for all its residents, especially those who might not be able to afford private insurance. The state offers several government-assisted programs to provide health coverage to low-income individuals, families, and vulnerable populations.

- Colorado Medicaid: A state-run program providing comprehensive health coverage to eligible low-income adults, children, pregnant women, and people with disabilities. It covers a wide range of services, including doctor visits, hospital stays, prescription drugs, and more.

- Child Health Plan Plus (CHP+): This program offers low-cost health insurance to children and pregnant women in households with incomes too high to qualify for Medicaid but too low to afford private insurance. It provides coverage for doctor visits, immunizations, hospital stays, and dental care.

- Colorado's Health Insurance Premium Payment (HIPP) Program: This initiative helps certain Medicaid beneficiaries who have employer-sponsored health insurance by reimbursing the cost of their premiums, ensuring they can maintain their coverage.

Performance Analysis: The Impact of Health Insurance in Colorado

Understanding the real-world impact of health insurance is crucial to assessing its effectiveness. Here's an analysis of how health insurance has influenced key health indicators and financial stability in Colorado.

Improving Health Outcomes and Access to Care

Health insurance coverage has played a pivotal role in improving health outcomes across Colorado. Data shows a significant reduction in the percentage of Coloradans who report delaying or forgoing medical care due to cost, dropping from 17.4% in 2013 to 11.3% in 2019. This indicates that health insurance is successfully removing financial barriers to accessing necessary healthcare services.

Furthermore, the state has seen improvements in key health indicators, such as a decline in the infant mortality rate and an increase in the percentage of adults receiving recommended preventive care. These improvements are directly linked to increased health insurance coverage, ensuring more Coloradans have access to the care they need to maintain their health.

Financial Protection and Affordability

Health insurance also provides crucial financial protection for Coloradans. A study conducted in 2018 found that insured individuals were more likely to have access to needed medical care and less likely to face financial hardship due to medical bills. This financial protection is especially critical in a state like Colorado, where the cost of healthcare can be prohibitively high for those without insurance.

However, the affordability of health insurance remains a challenge. Despite the availability of subsidies and assistance programs, many Coloradans still struggle to afford coverage. The state is actively working to address this issue through initiatives like the Colorado Health Benefit Exchange, which aims to make insurance more accessible and affordable for all residents.

Future Implications and Trends in Colorado's Health Insurance Landscape

Looking ahead, several trends and developments are shaping the future of health insurance in Colorado. These changes are influenced by national healthcare policies, technological advancements, and evolving consumer needs.

Embracing Digital Health and Telemedicine

The integration of digital health technologies and telemedicine is transforming the way healthcare is delivered and accessed in Colorado. With the increasing availability of high-speed internet and advanced digital tools, health insurance providers are incorporating telemedicine services into their plans. This allows patients to access medical advice, consultations, and even certain procedures remotely, improving convenience and accessibility.

For instance, some insurance plans now offer virtual visits with primary care physicians, specialists, and mental health professionals. This not only enhances access to care, especially in rural areas, but also reduces the cost and inconvenience of in-person visits.

Focus on Preventive Care and Wellness

There is a growing emphasis on preventive care and wellness initiatives in Colorado's health insurance landscape. Insurance providers are recognizing the long-term benefits of investing in preventive measures, such as health screenings, immunizations, and lifestyle interventions, to reduce the incidence of costly chronic diseases. This shift is aligned with the state's public health goals and aims to create a healthier population.

Many insurance plans now offer incentives and rewards for engaging in preventive care and adopting healthy behaviors. This includes discounted gym memberships, wellness program reimbursements, and reduced premiums for maintaining a healthy lifestyle.

Addressing Mental Health and Substance Abuse

Mental health and substance abuse are critical concerns in Colorado, and the health insurance industry is stepping up to address these issues. Insurance providers are expanding their coverage for mental health services, including counseling, therapy, and medication management. Additionally, they are working to remove stigma and increase access to care by offering telehealth services for mental health treatment.

Moreover, Colorado is leading the way in substance abuse treatment coverage. The state's insurance plans often include comprehensive coverage for substance abuse disorders, ensuring that residents have access to the treatment they need without facing financial barriers.

FAQs: Common Questions About Health Insurance in Colorado

How can I find the best health insurance plan for my needs in Colorado?

+

To find the best health insurance plan in Colorado, consider your specific healthcare needs, budget, and preferred provider network. Review the different plan types (HMO, PPO, EPO) and compare their premiums, deductibles, and covered services. You can also use online tools and resources provided by the Colorado Division of Insurance to compare plans and get personalized recommendations.

Are there any government-assisted health insurance programs in Colorado for low-income individuals and families?

+

Yes, Colorado offers several government-assisted health insurance programs. These include Colorado Medicaid, which provides comprehensive health coverage to eligible low-income individuals and families, and Child Health Plan Plus (CHP+), which offers low-cost insurance to children and pregnant women who don’t qualify for Medicaid but have low incomes. There’s also the Health Insurance Premium Payment (HIPP) Program, which helps certain Medicaid beneficiaries cover the cost of their employer-sponsored health insurance.

What is the average cost of health insurance in Colorado, and are there ways to reduce these costs?

+

The average cost of health insurance in Colorado can vary significantly based on factors such as age, location, and the type of plan. Individual plans can range from 450 to 800 per month, while family plans can cost between 1,200 and 2,500 per month. To reduce costs, consider higher deductible plans, which often have lower premiums. You can also explore government-assisted programs if you meet the income eligibility criteria. Additionally, some employers offer health insurance as a benefit, which can significantly reduce out-of-pocket costs.

How does Colorado’s health insurance market compare to other states in terms of coverage and affordability?

+

Colorado’s health insurance market is known for its competitiveness and variety of plan options. The state has a diverse range of insurers, including national carriers and local providers, which can lead to more affordable options. In terms of coverage, Colorado’s plans often offer comprehensive benefits, including robust mental health and substance abuse treatment coverage. However, like in many other states, affordability remains a challenge, and many Coloradans still struggle to afford insurance despite the availability of subsidies and assistance programs.

Are there any unique features or initiatives in Colorado’s health insurance landscape that set it apart from other states?

+

Yes, Colorado has several unique features and initiatives in its health insurance landscape. One notable initiative is the Colorado Health Benefit Exchange, which is a state-run online marketplace where individuals and small businesses can shop for and compare health insurance plans. The exchange aims to make insurance more accessible and affordable by providing a transparent platform for consumers. Additionally, Colorado has been a leader in integrating digital health and telemedicine into its health insurance plans, improving access to care and reducing costs.