Florida Home Insurance Quote

Finding the right Florida home insurance coverage can be a daunting task, especially with the unique challenges that the Sunshine State presents. From extreme weather events to specific insurance regulations, navigating the market requires an understanding of your needs and the available options. This comprehensive guide will walk you through the process of obtaining an accurate Florida home insurance quote, highlighting the key factors that impact your premium and the steps to secure the best coverage for your property.

Understanding Florida’s Home Insurance Landscape

Florida is known for its beautiful beaches, warm climate, and, unfortunately, its susceptibility to hurricanes and other natural disasters. This unique environment influences the home insurance market, with policies often tailored to address specific risks. Understanding these nuances is essential for any homeowner seeking adequate protection.

Natural Disaster Risks and Coverage

One of the primary concerns for Florida homeowners is the potential for catastrophic weather events. Hurricanes, tropical storms, and even tornadoes are not uncommon, and their impact on property can be significant. Home insurance policies in Florida typically include coverage for these events, but there are often additional considerations and potential limitations.

For instance, windstorm deductibles are a common feature in Florida home insurance policies. These deductibles, which can be a percentage of the home’s value or a fixed dollar amount, apply specifically to damage caused by wind-related events. This means that in the event of a hurricane or a strong storm, you may be responsible for a larger portion of the repair costs than you would be for other types of damage.

| Windstorm Deductible Example | Scenario |

|---|---|

| 10% Windstorm Deductible | If your home is insured for $200,000 and sustains $20,000 in wind damage, you'll be responsible for the first $20,000 (10% of the insured value) before your insurance coverage kicks in. |

It's crucial to carefully review your policy's terms regarding windstorm deductibles and understand how they might affect your out-of-pocket expenses in the event of a claim.

Understanding Florida’s Insurance Market

Florida’s insurance market is distinct due to the state’s high risk of natural disasters. This has led to some unique dynamics, including a significant presence of private insurers alongside a state-run entity, the Florida Citizens Property Insurance Corporation (FCPIC). Understanding the role of these entities can help you navigate the market more effectively.

Private insurers in Florida offer a wide range of home insurance policies, often with more comprehensive coverage options and competitive pricing. They cater to a variety of homeowners, from those with high-value properties to those with standard residences. However, private insurers may be more selective about the risks they underwrite, and some may not offer coverage in high-risk areas.

| Private Insurer Advantages | FCPIC Benefits |

|---|---|

| Broader Coverage Options | State-Backed Security |

| Competitive Pricing | Last Resort for High-Risk Properties |

| Tailored Policies | Simplified Application Process |

On the other hand, the FCPIC serves as a safety net for homeowners who cannot find coverage through private insurers. It provides basic home insurance coverage at competitive rates but may have limitations on the types of policies offered and the level of customization available. Understanding your options with both private insurers and the FCPIC can help you make an informed decision about your Florida home insurance quote.

Factors Influencing Your Florida Home Insurance Quote

Several factors come into play when determining the cost of your Florida home insurance policy. These factors can significantly impact your premium, so it’s essential to understand them when seeking a quote.

The Role of Your Home’s Location

Your home’s location is one of the most critical factors in determining your insurance premium. In Florida, this is particularly true due to the state’s geographic susceptibility to hurricanes and other natural disasters. Insurers carefully assess the risk associated with your address, considering factors like:

- Hurricane Risk Zones: Properties in high-risk zones, such as coastal areas or regions with a history of severe storms, will typically have higher premiums.

- Flood Zones: The Federal Emergency Management Agency (FEMA) designates flood zones based on the risk of flooding. Homes in high-risk flood zones may require separate flood insurance policies, which can increase overall insurance costs.

- Wildfire Risk: While not as prevalent as in other states, the risk of wildfires is still a consideration, especially in certain regions of Florida. Homes in these areas may face higher premiums.

It's worth noting that the location factor is not just about the risks associated with natural disasters. Insurers also consider crime rates, proximity to fire stations, and other local factors that could impact the likelihood of a claim.

The Age and Condition of Your Home

The age and condition of your home are significant factors in determining your home insurance premium. Older homes, especially those built before modern building codes, may pose more risks due to outdated materials and potential structural issues.

Additionally, the condition of your home matters. Well-maintained properties with recent updates and modern safety features (like updated electrical systems and smoke detectors) are often seen as less risky and can lead to lower premiums. Conversely, homes that require significant repairs or have outdated features may face higher insurance costs.

Your Home’s Construction Materials and Features

The materials used to construct your home and its unique features can also influence your insurance quote. Here are some considerations:

- Roofing Materials: Homes with roofs made of materials that are more resistant to wind damage, such as metal or concrete tile, may qualify for lower premiums. On the other hand, older roofs or those made of less durable materials (like asphalt shingles) may increase your insurance costs.

- Hurricane Shutters: Installing approved hurricane shutters or impact-resistant windows can lead to premium discounts. These features provide additional protection against wind damage, making your home a lower risk for insurers.

- Home Security Systems: Modern security systems, including monitored alarms and surveillance cameras, can deter burglaries and other crimes. Insurers often offer discounts for these features, as they reduce the likelihood of claims.

Your Personal Circumstances and Coverage Preferences

Beyond the physical aspects of your home, your personal circumstances and coverage preferences also play a role in determining your home insurance quote.

- Claim History: A history of insurance claims, whether related to your home or other policies, can impact your premium. Insurers consider this history when assessing your risk profile, and a high number of claims may result in higher premiums.

- Coverage Limits and Deductibles: The level of coverage you choose (e.g., the amount of insurance you purchase) and your deductible amount (the portion of a claim you pay out of pocket) directly affect your premium. Higher coverage limits and lower deductibles typically result in higher premiums.

- Discounts and Bundling: Many insurers offer discounts for various reasons, such as loyalty, safety features, or bundling multiple policies (like home and auto insurance) with the same provider. Taking advantage of these discounts can help lower your overall insurance costs.

Securing Your Florida Home Insurance Quote

Now that you understand the factors influencing your Florida home insurance quote, it’s time to take action and secure the coverage you need. Here’s a step-by-step guide to help you through the process:

Step 1: Assess Your Coverage Needs

Start by evaluating your specific needs and preferences. Consider the level of coverage you require, whether you want additional endorsements (such as flood insurance or earthquake coverage), and any personal circumstances that might impact your policy.

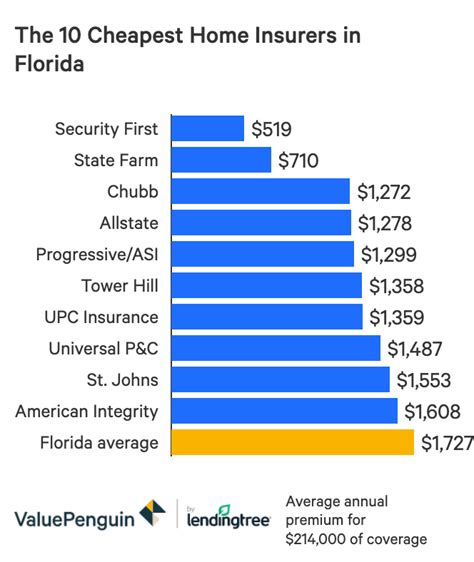

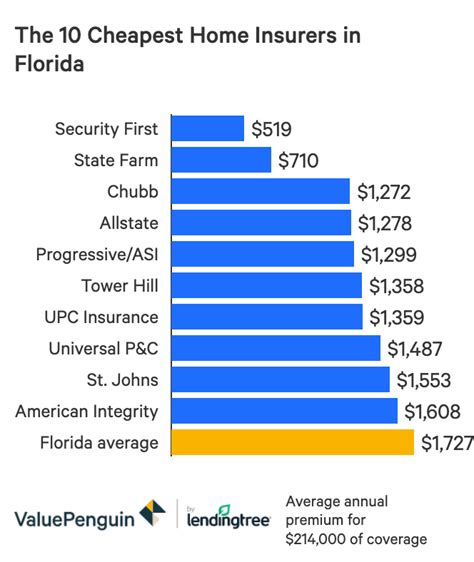

Step 2: Research Insurers and Policies

Research the market to identify insurers that offer policies suited to your needs. Look for companies with a strong presence in Florida and a good reputation for claims handling. Compare the coverage options, deductibles, and any available discounts to get a sense of the best fit for your situation.

Consider both private insurers and the FCPIC. While private insurers may offer more comprehensive coverage, the FCPIC can be a viable option for basic coverage, especially for those who struggle to find insurance elsewhere.

Step 3: Gather Necessary Information

To obtain an accurate quote, you’ll need to provide detailed information about your home and your personal circumstances. This typically includes:

- Your home’s address and location details.

- The age, size, and construction materials of your home.

- Information about any safety features or upgrades, such as hurricane shutters or security systems.

- Details about your previous insurance history and claim records.

- Your preferred coverage limits and deductibles.

Step 4: Obtain Quotes and Compare

Contact multiple insurers to obtain quotes based on the information you’ve provided. Compare the quotes carefully, considering not just the premium amount but also the coverage details, deductibles, and any exclusions. Look for policies that offer the right balance of coverage and affordability for your needs.

Step 5: Choose Your Insurer and Policy

Once you’ve reviewed the quotes and selected the insurer and policy that best meet your needs, it’s time to make your choice. Finalize your application, providing any additional information or documentation required. Remember to carefully review the policy documents to ensure you understand the terms and conditions before finalizing your purchase.

Frequently Asked Questions

How can I lower my Florida home insurance costs?

+

There are several strategies to reduce your home insurance costs in Florida. First, ensure your home is well-maintained and equipped with modern safety features like hurricane shutters and a robust security system. This can lead to premium discounts. Additionally, consider increasing your deductible, which can lower your premium but may result in higher out-of-pocket expenses in the event of a claim. Bundling your home and auto insurance policies with the same provider can also result in savings. Finally, shop around and compare quotes from multiple insurers to find the most competitive rates.

What happens if I live in a high-risk flood zone and can’t afford flood insurance?

+

Living in a high-risk flood zone can be challenging, especially when it comes to affording flood insurance. In these cases, it’s crucial to explore options like the National Flood Insurance Program (NFIP), which offers flood insurance policies at standardized rates. Additionally, some insurers offer private flood insurance policies, which may be more affordable. It’s important to note that while flood insurance is not typically included in standard home insurance policies, it is essential for protecting your home and finances in high-risk areas.

Can I negotiate my Florida home insurance quote with my insurer?

+

While negotiating insurance quotes is not as common as in other industries, there are opportunities to discuss your policy and potential discounts with your insurer. Review your policy annually and discuss any changes in your circumstances or home improvements that might qualify you for discounts. Additionally, don’t hesitate to ask about loyalty discounts or other promotional offers. While insurers may not always negotiate on the premium itself, they might be able to offer additional coverage or other benefits to make your policy more suitable to your needs.

What should I do if I’m denied coverage by private insurers in Florida?

+

If you’re denied coverage by private insurers, it’s important to understand your options. First, review the reasons for the denial and address any correctable issues, such as updating your home’s safety features or addressing maintenance concerns. If these issues are resolved, you can reapply with the same or different insurers. Additionally, consider applying with the Florida Citizens Property Insurance Corporation (FCPIC), which serves as a safety net for those who cannot find coverage elsewhere. The FCPIC offers basic coverage at competitive rates, though it may have limitations on policy customization.

Remember, securing the right Florida home insurance coverage is a critical step in protecting your property and financial well-being. By understanding the factors that influence your quote and following the steps outlined above, you can navigate the market with confidence and find the policy that best meets your needs.