Health Insurance Marketplace Washington

The Health Insurance Marketplace, also known as the Health Insurance Exchange, is a vital platform for individuals and families to access affordable health insurance options. In Washington state, the marketplace plays a significant role in providing coverage to residents, offering a range of plans and resources to meet diverse healthcare needs. This article delves into the specifics of the Health Insurance Marketplace in Washington, exploring its features, benefits, and impact on the state's population.

Understanding the Health Insurance Marketplace Washington

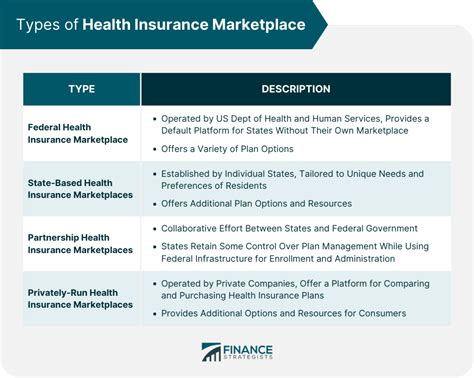

The Health Insurance Marketplace Washington is an online platform designed to simplify the process of comparing and enrolling in health insurance plans. It serves as a centralized hub, bringing together insurance providers and consumers, and offering a user-friendly interface to navigate the often complex world of healthcare coverage.

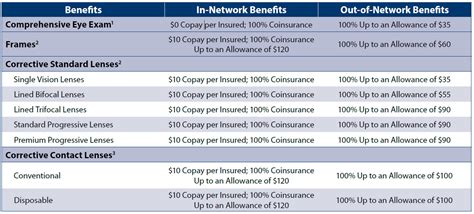

Washington's marketplace is unique in several ways. Firstly, it operates as a state-based marketplace, giving the state government more control over its design and function. This allows for policies and regulations that align closely with the specific needs and demographics of Washington's residents.

Secondly, the marketplace offers a comprehensive range of plans, catering to various income levels and healthcare requirements. From major medical plans to specialized coverage for specific populations, the marketplace strives to ensure that all Washingtonians can access adequate healthcare.

Key Features of the Marketplace

The Health Insurance Marketplace Washington boasts several features that enhance its accessibility and usability. Here are some notable aspects:

- Plan Comparison Tools: Users can easily compare different insurance plans based on cost, coverage, and provider networks. This feature empowers individuals to make informed choices that align with their personal and financial circumstances.

- Income-Based Subsidies: Recognizing that cost is a significant barrier to healthcare access, the marketplace offers income-based subsidies. Those who qualify can receive financial assistance, making insurance more affordable and ensuring that healthcare is within reach for a broader range of residents.

- Special Enrollment Periods: Beyond the annual open enrollment period, the marketplace offers special enrollment opportunities for qualifying life events. This includes marriage, birth or adoption of a child, loss of job-based coverage, and more. These periods allow individuals to enroll outside of the standard timeframe, ensuring continuous coverage.

- Consumer Support: The marketplace provides extensive resources and support to assist consumers in understanding their options and navigating the enrollment process. This includes online tools, telephone assistance, and in-person help from certified navigators and assisters.

Impact on Washington’s Population

The Health Insurance Marketplace Washington has had a profound impact on the state’s population, particularly in terms of healthcare access and financial protection. By offering a centralized platform with a variety of plans, the marketplace has made insurance more accessible and affordable for many residents.

| Metric | Data |

|---|---|

| Uninsured Rate | According to the U.S. Census Bureau, Washington's uninsured rate has decreased significantly since the implementation of the marketplace. In 2013, prior to the marketplace, the uninsured rate stood at 13.6%. By 2021, this rate had dropped to 6.6%, indicating a substantial increase in insurance coverage. |

| Plan Enrollment | During the 2022 open enrollment period, over 290,000 Washingtonians enrolled in or renewed their health insurance plans through the marketplace. This included individuals and families, demonstrating the marketplace's reach and effectiveness in providing coverage. |

Navigating the Marketplace: A Step-by-Step Guide

Understanding how to navigate the Health Insurance Marketplace Washington is crucial for anyone seeking insurance coverage. Here’s a step-by-step guide to help you through the process:

- Assess Your Needs: Before beginning your search, take time to evaluate your healthcare needs and priorities. Consider factors like pre-existing conditions, prescription medication requirements, and desired provider networks. This assessment will help you narrow down your options and choose a plan that best suits your needs.

- Explore Plan Options: Visit the Health Insurance Marketplace Washington website and explore the available plans. You can filter your search based on your assessment, comparing costs, coverage, and provider networks. Pay attention to the plan's network of doctors and hospitals to ensure access to the care you require.

- Check Eligibility for Subsidies: The marketplace offers income-based subsidies to make insurance more affordable. Determine if you qualify for these subsidies by entering your household income and family size. If eligible, you can apply these subsidies to lower your monthly premiums and out-of-pocket costs.

- Enroll in a Plan: Once you've found a plan that meets your needs and budget, proceed with enrollment. This typically involves providing personal and household information, as well as payment details. Ensure you review the plan's benefits and coverage limits thoroughly before finalizing your enrollment.

- Manage Your Coverage: After enrolling, it's essential to stay informed about your coverage and rights. Familiarize yourself with your plan's benefits and limitations, and know how to access care. Keep an eye on your policy renewal dates and any changes to your plan's network or benefits. If your circumstances change, such as a job loss or family growth, you may be eligible for a special enrollment period to update your coverage.

Tips for a Successful Enrollment

To ensure a smooth enrollment process, consider the following tips:

- Start your search early during the open enrollment period to allow ample time for comparison and decision-making.

- Gather all necessary documents, such as income statements and identification, before beginning the enrollment process.

- Seek assistance if needed. Certified navigators and assisters are available to guide you through the marketplace and enrollment process.

- Review your plan's summary of benefits and coverage to understand what is and isn't covered.

Future Outlook and Developments

The Health Insurance Marketplace Washington continues to evolve and adapt to meet the changing needs of its residents. Here are some key developments and future prospects:

Enhanced Consumer Protections

Washington state is committed to strengthening consumer protections within the marketplace. This includes implementing policies that ensure fair and transparent pricing, as well as improved access to care for vulnerable populations. By prioritizing consumer rights, the marketplace aims to provide a secure and equitable environment for all residents seeking insurance coverage.

Expanding Plan Options

The marketplace is continuously working to expand its plan offerings, aiming to provide a diverse range of options to cater to different demographics and healthcare needs. This includes introducing new plan types, such as short-term plans and dental-only plans, to increase accessibility and choice for Washingtonians.

Technology and Innovation

To enhance the user experience, the marketplace is investing in technological advancements. This includes developing user-friendly mobile applications and online tools to streamline the enrollment process and provide real-time updates and notifications. By embracing innovation, the marketplace aims to make healthcare insurance more accessible and convenient for all.

FAQ

When is the annual open enrollment period for the Health Insurance Marketplace Washington?

+

The annual open enrollment period typically runs from November 1st to December 15th each year. During this time, individuals and families can enroll in or change their health insurance plans for the upcoming year.

Are there any special enrollment periods besides the annual open enrollment?

+

Yes, the Health Insurance Marketplace Washington offers special enrollment periods for qualifying life events. These include marriage, birth or adoption of a child, loss of job-based coverage, and more. Individuals who experience these events can enroll outside of the standard open enrollment period.

How can I determine if I’m eligible for income-based subsidies?

+

To determine your eligibility for income-based subsidies, you can use the marketplace’s online tool. Enter your household income and family size to see if you qualify for financial assistance. If eligible, you can apply these subsidies to lower your monthly premiums and out-of-pocket costs.

The Health Insurance Marketplace Washington is a powerful tool in ensuring accessible and affordable healthcare for the state’s residents. With its user-friendly platform, comprehensive plan offerings, and focus on consumer protections, it continues to make a positive impact on the health and well-being of Washingtonians. As the marketplace evolves, it remains dedicated to meeting the changing needs of its population, ensuring that healthcare remains within reach for all.