Motorbike Insurance Quotes Online

Welcome to a comprehensive guide on understanding and securing the best motorbike insurance quotes online. As an avid motorcyclist, I understand the importance of having the right insurance coverage to protect your investment and ensure peace of mind while enjoying the open road. In this article, we'll delve into the world of online motorbike insurance quotes, exploring the key factors that influence premiums, the steps to obtaining accurate quotes, and the strategies to secure the most cost-effective coverage tailored to your needs.

Understanding the Factors that Influence Motorbike Insurance Quotes

When it comes to motorbike insurance, a multitude of factors come into play that directly impact the quotes you receive. These factors are carefully considered by insurance providers to assess the level of risk associated with insuring your bike and, consequently, determine the premium you’ll pay. Let’s take a closer look at some of the key influences:

The Make and Model of Your Motorbike

One of the primary factors that insurance companies consider is the make and model of your motorbike. Different bikes have varying safety features, repair costs, and popularity among thieves, all of which can affect the insurance premium. For instance, high-performance sports bikes, known for their speed and agility, often attract higher insurance costs due to the increased risk of accidents and potential for higher repair expenses.

| Bike Model | Average Insurance Premium |

|---|---|

| Harley-Davidson Sportster | $850 annually |

| Kawasaki Ninja ZX-14R | $1200 annually |

| Honda CBR1000RR | $980 annually |

Conversely, more affordable and less powerful bikes may be associated with lower insurance costs. For example, a classic Vespa scooter or a beginner-friendly Honda CBR250R might attract more affordable insurance rates due to their relatively lower speed capabilities and the perception of reduced risk.

Your Riding Experience and History

Your riding experience and history play a significant role in determining your insurance quote. Insurance companies carefully assess your driving record, including any previous accidents, traffic violations, and claims made. A clean driving record with no recent accidents or traffic citations often results in more favorable insurance quotes.

On the other hand, if you've been involved in multiple accidents or have a history of traffic violations, your insurance premium may be higher. Insurance providers consider such factors as an indication of higher risk and adjust their quotes accordingly.

Location and Usage

Where you live and how you use your motorbike can also impact your insurance quote. Insurance companies analyze local crime rates, accident statistics, and weather conditions to assess the risk associated with insuring your bike in a particular area. Areas with higher crime rates or a history of severe weather conditions may result in higher insurance premiums.

Additionally, the purpose for which you use your motorbike can influence your quote. If you primarily use your bike for commuting to work or running errands, your insurance premium might be lower compared to someone who primarily rides for leisure or participates in racing events. The perceived risk associated with different usage scenarios can impact the insurance quote.

Additional Factors

Other factors that can influence your motorbike insurance quote include your age, gender, and marital status. Insurance providers may offer discounts or provide more favorable quotes to certain demographic groups based on statistical data and historical claims experience. For instance, mature riders with a stable driving record often enjoy lower insurance premiums compared to younger riders who are statistically more prone to accidents.

Furthermore, the coverage options you choose and any additional endorsements or add-ons can impact your insurance quote. Comprehensive coverage, which provides protection against theft, fire, and other non-collision incidents, may attract higher premiums compared to basic liability coverage. It's essential to carefully consider your coverage needs and tailor your insurance plan accordingly.

Obtaining Accurate Motorbike Insurance Quotes Online

In today’s digital age, obtaining motorbike insurance quotes online has become a convenient and efficient process. Insurance providers and comparison websites offer online platforms that allow you to quickly and easily compare quotes from multiple insurers. Here’s a step-by-step guide to help you navigate the process and secure the most accurate quotes:

Research and Compare Insurance Providers

Start by researching and comparing different insurance providers that offer motorbike insurance. Look for reputable companies with a solid track record of providing reliable coverage and excellent customer service. Consider factors such as financial stability, customer reviews, and the range of coverage options offered.

Utilize online comparison websites and tools that aggregate insurance quotes from multiple providers. These platforms can save you time and effort by presenting a comprehensive overview of available options, allowing you to quickly compare premiums, coverage limits, and additional benefits.

Gather the Necessary Information

Before requesting insurance quotes, ensure you have all the necessary information readily available. This includes personal details such as your name, date of birth, contact information, and driving record. Additionally, gather information about your motorbike, including the make, model, year, mileage, and any modifications or enhancements made.

If you're seeking coverage for multiple bikes, have the details for each bike readily accessible. This ensures that you can accurately provide the necessary information when requesting quotes, leading to more precise and tailored insurance options.

Understand the Coverage Options

Take the time to understand the different coverage options available and choose the ones that best align with your needs. Common coverage types include liability coverage, collision coverage, comprehensive coverage, and additional endorsements such as roadside assistance or rental car reimbursement.

Consider the value of your motorbike, the risks you want to protect against, and any specific requirements or legal mandates in your region. Understanding the coverage options will help you make informed decisions and choose an insurance plan that provides the right level of protection without unnecessary expenses.

Provide Accurate and Honest Information

When requesting insurance quotes, it’s crucial to provide accurate and honest information about yourself and your motorbike. Misrepresenting or withholding relevant details can lead to inaccurate quotes and potential issues with your insurance coverage down the line. Insurance companies have access to extensive databases and can verify the information you provide, so honesty is always the best policy.

Disclose any previous accidents, traffic violations, or claims made in the past. While these factors may impact your insurance premium, being upfront about them demonstrates integrity and can help build trust with insurance providers.

Compare Quotes and Choose the Right Coverage

Once you’ve gathered quotes from multiple insurance providers, it’s time to carefully compare them. Evaluate the premiums, coverage limits, deductibles, and any additional benefits or discounts offered. Consider the financial stability and reputation of each insurer, as well as their customer service track record.

Choose an insurance provider that offers a comprehensive coverage plan at a competitive premium. Look for options that provide adequate protection for your motorbike and your personal needs, while also offering value for your money. Remember, the cheapest quote may not always be the best option if it fails to provide the necessary coverage.

Strategies to Secure the Best Motorbike Insurance Quotes

Securing the best motorbike insurance quotes requires a combination of careful planning, thorough research, and a strategic approach. Here are some effective strategies to help you obtain the most cost-effective insurance coverage tailored to your needs:

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare quotes from multiple providers. Utilize online comparison tools and seek recommendations from fellow motorcyclists or trusted sources. By comparing quotes, you can identify the best value for your money and ensure you’re not overpaying for your insurance coverage.

Bundle Your Insurance Policies

If you have multiple vehicles or insurance needs, consider bundling your policies with the same insurance provider. Many companies offer discounts when you combine your motorbike insurance with other policies such as auto insurance, home insurance, or life insurance. Bundling your policies can result in significant savings and streamline your insurance management process.

Take Advantage of Discounts and Promotions

Insurance providers often offer discounts and promotions to attract new customers or reward loyal policyholders. Keep an eye out for these opportunities and take advantage of them when available. Common discounts include multi-policy discounts, safe rider discounts, loyalty discounts, and even discounts for completing motorcycle safety courses.

Improve Your Riding Record

A clean and safe riding record can significantly impact your insurance premium. If you have a history of accidents or traffic violations, consider taking steps to improve your driving behavior. Attend defensive driving courses, practice safe riding habits, and avoid any reckless or negligent behavior on the road. Over time, a positive driving record can lead to more favorable insurance quotes.

Consider Higher Deductibles

Opting for higher deductibles can reduce your insurance premium. A deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. By choosing a higher deductible, you accept a larger financial responsibility in the event of a claim, which can result in lower monthly premiums. However, it’s essential to ensure that you can afford the higher deductible in the event of an accident or loss.

Review and Adjust Your Coverage Annually

Insurance needs can change over time, so it’s important to regularly review and adjust your coverage accordingly. Assess your riding habits, the value of your motorbike, and any changes in your personal circumstances. If your needs have evolved, consider updating your insurance coverage to ensure you have the right level of protection. Additionally, review your insurance policy annually to take advantage of any discounts or promotions that may become available.

Future Implications and Trends in Motorbike Insurance

The world of motorbike insurance is continually evolving, influenced by technological advancements, changing consumer behaviors, and evolving regulatory landscapes. As we look to the future, several trends and implications are shaping the industry and impacting the way insurance quotes are determined and delivered.

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of sensors and data analytics to monitor driving behavior, is gaining traction in the insurance industry. Usage-based insurance (UBI) programs, also known as pay-as-you-drive or pay-how-you-drive, leverage telematics to assess driving habits and offer insurance premiums based on real-time data. This shift towards UBI is expected to gain momentum, providing riders with more personalized and dynamic insurance options.

Enhanced Data Analytics and Risk Assessment

Advancements in data analytics and risk assessment methodologies are enabling insurance providers to make more informed decisions when determining insurance quotes. By analyzing vast amounts of data, including historical claims data, driving behavior patterns, and geographical risk factors, insurers can more accurately assess the risk associated with insuring a particular motorbike and rider.

Connected Motorbikes and Smart Technology

The integration of smart technology and connectivity into modern motorbikes is revolutionizing the riding experience and presenting new opportunities for insurance providers. Connected motorbikes equipped with sensors and GPS technology can provide real-time data on vehicle performance, maintenance needs, and even rider behavior. This data can be utilized by insurance companies to offer more tailored and dynamic insurance plans, rewarding safe riding habits and providing real-time risk assessments.

Environmental and Sustainability Considerations

With a growing emphasis on environmental sustainability and green initiatives, the insurance industry is also adapting. Insurance providers are increasingly offering incentives and discounts for environmentally friendly motorbikes, such as electric motorcycles or hybrid scooters. As the market for sustainable transportation options expands, insurance quotes may become more favorable for riders opting for eco-friendly bikes.

Regulatory Changes and Market Dynamics

The insurance industry is subject to various regulatory changes and market dynamics that can impact insurance quotes. Changes in government regulations, tax policies, and industry standards can influence the cost of insurance coverage. Additionally, market competition and consumer preferences can drive insurers to offer more competitive premiums and innovative coverage options to stay ahead of the curve.

Conclusion: Empowering Your Motorbike Insurance Journey

Obtaining the best motorbike insurance quotes online is a journey that requires careful consideration, research, and a strategic approach. By understanding the factors that influence insurance premiums, taking advantage of online comparison tools, and implementing effective strategies, you can secure insurance coverage that protects your investment while aligning with your budget and personal needs.

As the world of motorbike insurance continues to evolve, staying informed about emerging trends and technologies will empower you to make the most of your insurance options. Whether it's leveraging telematics and usage-based insurance programs, exploring the benefits of connected motorbikes, or embracing environmentally conscious transportation choices, the future of motorbike insurance promises exciting opportunities for riders seeking tailored and cost-effective coverage.

So, gear up, hit the open road with confidence, and ride into a future where your motorbike insurance journey is both secure and rewarding.

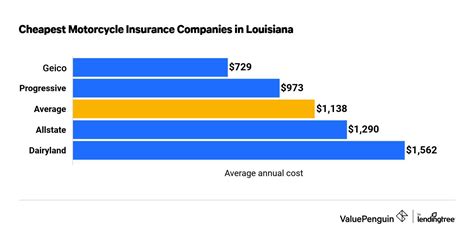

What is the average cost of motorbike insurance?

+The average cost of motorbike insurance can vary widely based on factors such as the make and model of your bike, your riding experience, location, and coverage options chosen. On average, motorbike insurance premiums range from a few hundred dollars to over a thousand dollars annually. It’s important to obtain multiple quotes to find the most competitive rate for your specific circumstances.

Are there any ways to lower my motorbike insurance premium?

+Yes, there are several strategies to lower your motorbike insurance premium. These include shopping around for quotes, bundling your insurance policies, taking advantage of discounts and promotions, improving your riding record, and considering higher deductibles. Additionally, regularly reviewing and adjusting your coverage to align with your changing needs can help you secure the most cost-effective insurance plan.

What coverage options should I consider for my motorbike insurance?

+The coverage options you choose for your motorbike insurance depend on your specific needs and the value of your bike. Common coverage types include liability coverage, which protects you in the event of an accident where you’re at fault; collision coverage, which covers damages to your bike in the event of a collision; and comprehensive coverage, which provides protection against theft, fire, and other non-collision incidents. Additionally, consider add-ons such as roadside assistance or rental car reimbursement for added peace of mind.