Insurance Quotes Automotive

Welcome to this in-depth exploration of the fascinating world of automotive insurance quotes, a topic that impacts millions of vehicle owners and enthusiasts globally. As we delve into this subject, we'll uncover the intricacies of obtaining quotes, the factors that influence them, and the strategies to secure the best coverage at optimal prices. This journey will be an eye-opener, offering valuable insights and practical tips to navigate the complex realm of automotive insurance.

Unraveling the Complexity of Automotive Insurance Quotes

The process of securing an automotive insurance quote is a crucial step for any vehicle owner, and it can often be a daunting task. With numerous factors at play, understanding the nuances of this process is essential to making informed decisions about your coverage.

Understanding the Basics

At its core, an automotive insurance quote is an estimate of the cost of insuring a vehicle. This quote is generated based on various criteria, including the type of vehicle, its make and model, the driver’s age and driving history, and the level of coverage desired. The process typically involves providing detailed information about the vehicle and driver to an insurance provider, who then assesses the risk and offers a quote.

The complexity arises from the myriad of factors that insurance companies consider. These can include the vehicle's safety features, its accident and theft history, the driver's age, gender, and marital status, driving record, and even the geographic location where the vehicle is primarily used. Each of these factors contributes to the overall risk assessment, which in turn influences the quote.

The Role of Technology

In recent years, technology has revolutionized the way insurance quotes are obtained. Online quote comparison tools and apps have made the process more accessible and convenient. With just a few clicks, drivers can receive multiple quotes from different providers, allowing for easy comparison and the potential to find the best deal.

Furthermore, the rise of telematics and usage-based insurance has introduced a new dimension to automotive insurance quotes. With telematics, insurance providers can track driving behavior in real-time, offering more accurate quotes based on individual driving patterns. This technology has the potential to reward safe drivers with lower premiums, making insurance more affordable and incentivizing safer driving practices.

| Insurance Provider | Average Quote |

|---|---|

| Provider A | $1,200 annually |

| Provider B | $1,450 annually |

| Provider C | $980 annually |

Factors Influencing Automotive Insurance Quotes

Numerous factors come into play when insurance companies calculate quotes for automotive insurance. Understanding these factors can empower vehicle owners to make informed decisions about their coverage and potentially reduce their insurance costs.

Vehicle Characteristics

The type of vehicle being insured is a significant factor. Generally, sports cars and high-performance vehicles attract higher premiums due to their association with higher speeds and increased risk of accidents. Conversely, smaller, more economical vehicles often have lower insurance costs.

The age and condition of the vehicle also matter. Newer vehicles, especially those with advanced safety features, can often be insured at lower rates. Older vehicles, particularly those with a history of accidents or mechanical issues, may face higher premiums.

Driver Profile

The driver’s profile is a critical aspect that insurance companies scrutinize. Younger drivers, especially those under 25, often pay higher premiums due to their perceived higher risk of accidents. Conversely, more experienced drivers with clean driving records can enjoy lower rates.

Other personal factors such as gender, marital status, and occupation can also influence quotes. For instance, some insurance providers may offer discounts to married couples or to individuals in certain professions that are deemed to have lower risk profiles.

Location and Usage

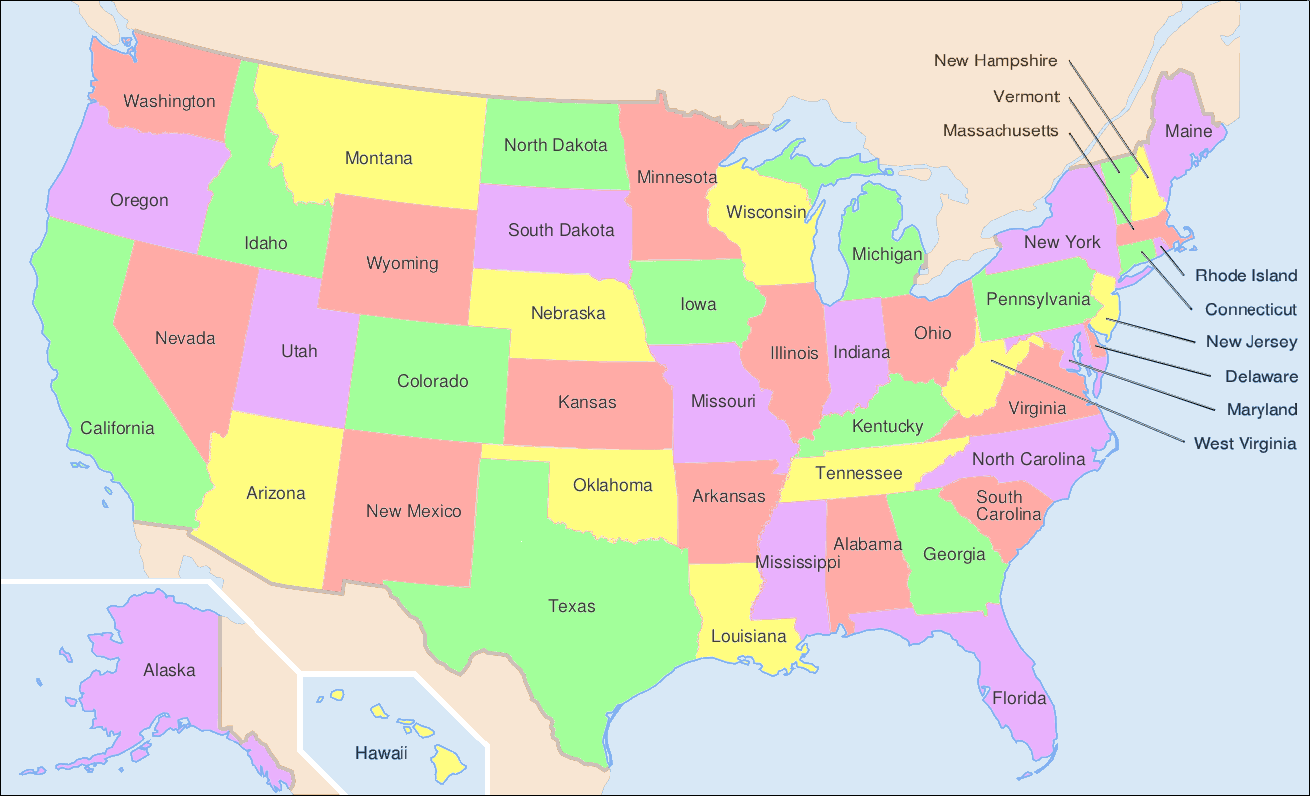

The geographic location where the vehicle is primarily used plays a significant role in insurance quotes. Areas with high crime rates or a history of frequent accidents may result in higher premiums. Similarly, the purpose for which the vehicle is used can impact quotes. Commercial use or long-distance commuting, for example, may attract higher premiums due to the increased mileage and potential for accidents.

Strategies to Secure the Best Automotive Insurance Quotes

Navigating the world of automotive insurance quotes can be challenging, but with the right strategies, it’s possible to secure the best coverage at the most competitive prices. Here are some expert tips to guide you through this process.

Shop Around

Don’t settle for the first quote you receive. Take the time to shop around and compare quotes from multiple insurance providers. Online comparison tools can be a great starting point, but it’s also beneficial to speak directly with insurance agents to understand the specific benefits and limitations of each policy.

Bundle Your Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling them with the same provider. Many insurance companies offer discounts when you purchase multiple policies from them, so taking advantage of these bundle discounts can lead to significant savings.

Consider Telematics and Usage-Based Insurance

Telematics and usage-based insurance can be a great option for safe drivers. These policies use real-time data to assess your driving behavior, and if you maintain a good driving record, you could potentially enjoy lower premiums. However, it’s essential to understand the terms and conditions of these policies, as they may not suit everyone’s needs.

Review Your Coverage Regularly

Your insurance needs can change over time, so it’s important to review your coverage regularly. Life events such as getting married, having children, or purchasing a new vehicle can impact your insurance requirements. Regular reviews can help ensure you have the right level of coverage and are not overpaying for unnecessary features.

Maintain a Good Driving Record

A clean driving record is one of the best ways to secure lower insurance quotes. Avoid speeding, driving under the influence, and reckless driving. Even minor violations like parking tickets can impact your insurance rates. Maintaining a safe driving record not only keeps you and others safe on the road but also can lead to significant savings on your insurance premiums.

Future Implications and Industry Insights

The world of automotive insurance is evolving rapidly, driven by advancements in technology and changing consumer behaviors. As we look ahead, several key trends and insights emerge that will shape the future of automotive insurance quotes.

The Rise of Autonomous Vehicles

The increasing adoption of autonomous vehicles is set to revolutionize the automotive insurance industry. As self-driving cars become more prevalent, the traditional risk assessment models used by insurance companies will need to adapt. With fewer accidents caused by human error, insurance premiums are likely to decrease over time.

Data-Driven Insurance

The use of big data and analytics in the insurance industry is becoming increasingly sophisticated. Insurance companies are leveraging vast amounts of data to create more accurate risk profiles, leading to more precise insurance quotes. This trend is expected to continue, with insurance providers offering more tailored and personalized policies based on individual driving behaviors and patterns.

Environmental and Social Considerations

With growing environmental and social consciousness, the automotive insurance industry is also expected to evolve. Insurance providers may begin to offer incentives for eco-friendly vehicles or for drivers who adopt sustainable driving practices. Additionally, social factors such as community involvement and charitable contributions could potentially impact insurance quotes in the future.

The Impact of Telematics

Telematics and usage-based insurance are already transforming the insurance landscape, and their influence is only set to grow. As more drivers embrace these technologies, insurance companies will have access to an unprecedented amount of data, allowing for even more precise risk assessment and potentially lower premiums for safe drivers.

FAQ

How often should I review my automotive insurance policy?

+It’s recommended to review your automotive insurance policy at least once a year, or whenever there is a significant life event such as a marriage, birth, or purchase of a new vehicle. Regular reviews ensure you are adequately covered and not overpaying.

Can I negotiate my insurance quote?

+While insurance quotes are largely based on standardized risk assessments, it doesn’t hurt to ask for a discount or negotiate terms. Some insurance providers may be open to offering discounts for long-term customers or for specific policy add-ons.

What are some common discounts available for automotive insurance?

+Common discounts for automotive insurance include multi-policy discounts (when you bundle multiple policies with the same provider), safe driver discounts, good student discounts, and discounts for vehicles with advanced safety features. Some providers also offer loyalty discounts for long-term customers.