Acv Insurance Term

Welcome to an in-depth exploration of the world of insurance, specifically focusing on the ACV insurance term. This comprehensive guide aims to unravel the complexities surrounding Actual Cash Value (ACV) in the insurance industry. We'll delve into the technical aspects, real-world examples, and practical insights to help you understand how ACV insurance works and its implications.

Understanding Actual Cash Value (ACV) Insurance

Actual Cash Value insurance, often referred to as ACV, is a fundamental concept in the insurance realm. It represents an insurance coverage option where the insurer compensates the policyholder for the actual cash value of a damaged or lost item, rather than its replacement cost.

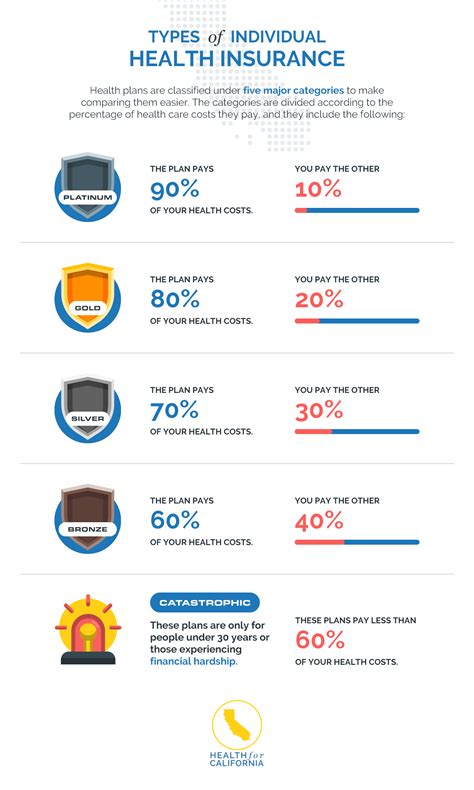

This type of insurance is prevalent in various domains, including property insurance, auto insurance, and even health insurance to some extent. ACV policies are designed to provide a cost-effective solution for insurers and a potentially more affordable option for policyholders.

How ACV Insurance Works

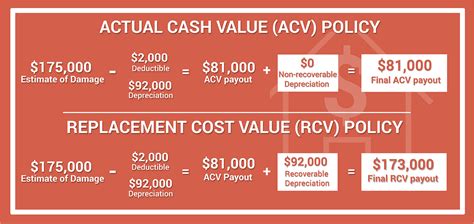

When an insured item is damaged or lost, the ACV insurance policy comes into play. The insurance company assesses the item’s value at the time of loss or damage, considering its age, condition, and market value. This evaluation process is critical to determining the appropriate compensation amount.

Here's a simplified breakdown of the ACV insurance process:

- Claim Initiation: A policyholder reports a loss or damage to their insured item.

- Assessment: The insurance company evaluates the item's actual cash value based on factors like depreciation and market rates.

- Compensation: The insurer pays the policyholder the determined ACV amount, which may be less than the item's original purchase price.

ACV insurance is particularly useful for older items or those with significant depreciation, as it takes into account the item's reduced value over time. However, it may not be the best option for brand-new or high-value items where replacement cost coverage might be more suitable.

Real-World ACV Insurance Examples

To illustrate the concept, let’s consider a few practical scenarios:

- Auto Insurance: Imagine you have an ACV auto insurance policy and your 5-year-old car is involved in an accident. The insurer would assess the car’s ACV, which would likely be lower than its original purchase price due to depreciation. You’d receive compensation based on this ACV, covering the car’s current value.

- Homeowners Insurance: In a homeowners insurance context, ACV comes into play when covering the contents of your home. If a fire damages your 3-year-old laptop, the insurer would determine its ACV, factoring in depreciation and market value, to compensate you accordingly.

- Health Insurance: While ACV is less common in health insurance, it can be applicable for certain medical equipment. For instance, if you have an ACV policy for your hearing aids and they break, the insurer would pay you the ACV of the aids, considering their age and condition.

The Pros and Cons of ACV Insurance

Like any insurance option, ACV insurance comes with its advantages and disadvantages. Understanding these can help you make informed decisions about your insurance coverage.

Advantages of ACV Insurance

- Cost-Effective: ACV policies are often more affordable than replacement cost coverage, making insurance more accessible to a wider range of individuals and businesses.

- Simplicity: The valuation process is straightforward, focusing on the item’s current market value rather than its original cost.

- Suitable for Older Items: ACV insurance is ideal for older assets that have already experienced significant depreciation. It ensures you’re not overinsured.

Disadvantages of ACV Insurance

- Potential Undercompensation: In cases where an item has increased in value or is irreplaceable, ACV insurance might not provide sufficient coverage.

- Valuation Complexity: Determining the ACV of certain items, especially those with unique or sentimental value, can be challenging and may lead to disputes.

- Limited Coverage: ACV policies may not cover all types of losses or damages, and policyholders should carefully review the exclusions and limitations.

Comparing ACV with Other Insurance Options

To provide a comprehensive understanding, let’s compare ACV insurance with other common insurance coverage types:

ACV vs. Replacement Cost Coverage

Replacement cost coverage, often referred to as RC, is an alternative insurance option where the insurer compensates the policyholder for the cost of replacing a damaged or lost item with a new one of similar quality.

| Comparison Factor | ACV Insurance | Replacement Cost Coverage |

|---|---|---|

| Valuation Basis | Actual cash value (considering depreciation) | Replacement cost (new item cost) |

| Cost | Generally more affordable | Often more expensive |

| Suitable for... | Older items with significant depreciation | Newer items or those with high replacement costs |

ACV vs. Actual Loss Sustained (ALS) Coverage

Actual Loss Sustained (ALS) coverage is another insurance option that provides compensation based on the actual loss experienced by the policyholder. Unlike ACV, ALS considers the specific circumstances of the loss, including factors like market fluctuations or unique item value.

| Comparison Factor | ACV Insurance | Actual Loss Sustained (ALS) Coverage |

|---|---|---|

| Valuation Flexibility | Less flexible, focuses on ACV | More flexible, considers specific loss circumstances |

| Cost | Varies but often more affordable | May be more expensive due to broader coverage |

| Suitable for... | Standard, depreciating items | Items with unique value or market fluctuations |

Industry Insights and Expert Tips

As an expert in the insurance industry, here are some valuable insights and tips to consider when navigating ACV insurance:

Expert Insights

- ACV insurance is an excellent option for businesses and individuals managing older assets, as it provides a cost-effective way to insure them.

- For high-value or unique items, consider supplementing ACV insurance with additional coverage or endorsements to ensure adequate protection.

- Regularly review your insurance policies and consider your changing needs. As assets age or market values fluctuate, your insurance coverage may need adjustments.

Tips for Policyholders

- Understand your policy’s coverage limits and exclusions. Know what is and isn’t covered to avoid surprises.

- Keep accurate records of your insured items, including purchase receipts, appraisals, and photographs. These can be valuable in claim situations.

- Consider the depreciation of your assets when selecting insurance coverage. Older items may be better suited for ACV insurance, while newer items might require replacement cost coverage.

The Future of ACV Insurance

The insurance industry is evolving, and ACV insurance is no exception. Here’s a glimpse into the potential future implications and developments:

Emerging Trends

- Digitalization: The rise of digital insurance platforms and apps is streamlining the ACV insurance process, making it more accessible and efficient.

- Data-Driven Valuation: Advanced data analytics and AI are improving the accuracy and speed of ACV assessments, benefiting both insurers and policyholders.

- Customized Coverage: Insurers are increasingly offering tailored ACV insurance solutions to meet the unique needs of diverse businesses and individuals.

Potential Challenges

- Changing Market Dynamics: Fluctuating market conditions can impact the accuracy of ACV assessments, requiring insurers to adapt their valuation processes.

- Regulatory Changes: Shifts in insurance regulations can influence the availability and cost of ACV insurance, affecting both insurers and policyholders.

- Consumer Awareness: As consumers become more educated about insurance options, insurers may need to enhance their communication strategies to ensure policyholders understand the implications of ACV insurance.

FAQ

How is the actual cash value (ACV) of an item determined?

+The ACV of an item is determined by assessing its current market value, considering factors like age, condition, and depreciation. Insurers often use guidelines and formulas to calculate ACV accurately.

Is ACV insurance always more affordable than replacement cost coverage?

+Generally, ACV insurance is more cost-effective, especially for older items. However, the affordability can vary based on the insured item’s type, value, and the specific insurance provider’s policies.

Can I choose between ACV and replacement cost coverage for the same item?

+Yes, many insurance providers offer the flexibility to choose between ACV and replacement cost coverage for specific items or categories of items. This allows policyholders to tailor their coverage to their needs and budget.

What happens if the ACV assessment is disputed by the policyholder?

+In case of a dispute, policyholders can provide additional evidence, such as recent appraisals or purchase receipts, to support their claim for a higher ACV. Insurers may also engage independent appraisers to resolve the dispute.

Are there any limitations or exclusions with ACV insurance coverage?

+Yes, ACV insurance policies often have specific limitations and exclusions. It’s crucial to carefully review the policy’s terms and conditions to understand what is and isn’t covered, as well as any potential restrictions or deductibles.