Individual Health Insurance Plans California

In the vast landscape of health insurance options, California stands out as a leader in promoting access to quality healthcare. With a diverse population and a progressive healthcare system, the state offers a wide range of individual health insurance plans tailored to meet the unique needs of its residents. This article aims to delve into the intricacies of these plans, exploring the benefits, costs, and coverage options available to Californians seeking individual health insurance.

Understanding Individual Health Insurance in California

Individual health insurance plans in California provide coverage for individuals and their families who are not eligible for employer-sponsored group health insurance. These plans are regulated by the California Department of Insurance and are designed to offer comprehensive medical coverage at an affordable cost.

The state's commitment to healthcare accessibility is evident in its implementation of the Affordable Care Act (ACA), which has expanded coverage options and introduced important consumer protections. Under the ACA, Californians can access a range of insurance plans through the state's official health insurance marketplace, Covered California, making it easier to compare and enroll in suitable plans.

Benefits of Individual Health Insurance Plans

Individual health insurance plans in California offer a multitude of benefits, ensuring that residents have access to the care they need when they need it. Here are some key advantages:

-

Comprehensive Coverage: Plans often include a wide range of services, such as doctor visits, hospital stays, prescription drugs, mental health services, and preventive care. This ensures that individuals can access a comprehensive suite of medical services without worrying about financial constraints.

-

Pre-existing Condition Coverage: Thanks to the ACA, insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions. This means that individuals with chronic illnesses or previous health issues can access affordable healthcare without discrimination.

-

Essential Health Benefits: California's individual health insurance plans are required to cover a set of essential health benefits, including ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative services, and more. These benefits ensure that Californians receive a robust level of care.

-

Cost-Sharing Reductions: Many plans offer cost-sharing reductions, which can lower out-of-pocket expenses such as deductibles, copayments, and coinsurance. This makes healthcare more affordable for those with lower incomes or specific health needs.

Choosing the Right Plan: A Guide

With numerous individual health insurance plans available in California, selecting the right one can be a daunting task. Here’s a step-by-step guide to help you make an informed decision:

-

Assess Your Healthcare Needs: Start by evaluating your current and potential future healthcare requirements. Consider factors such as chronic conditions, prescription medications, and the need for specialized treatments. This self-assessment will help you determine the level of coverage you require.

-

Understand Your Budget: Health insurance plans come with varying premium costs, deductibles, and out-of-pocket expenses. Assess your financial situation and determine how much you can comfortably afford to pay for healthcare. Remember that while lower premiums may be appealing, they often come with higher out-of-pocket costs.

-

Explore Plan Options: Utilize resources like Covered California or reputable insurance brokerages to explore the range of plans available. Compare the benefits, costs, and provider networks of different plans to find one that aligns with your healthcare needs and budget.

-

Consider Provider Networks: Check if your preferred doctors, hospitals, and specialists are in the plan's network. Out-of-network care can be significantly more expensive, so ensuring your providers are included is crucial.

-

Read the Fine Print: Don't forget to thoroughly review the plan's policy document. This will provide details on covered services, exclusions, and any limitations or restrictions. Understanding these nuances can prevent unexpected costs or denials of coverage.

Cost and Coverage Analysis

The cost of individual health insurance plans in California can vary based on several factors, including age, location, tobacco use, and the level of coverage desired. Here’s a breakdown of some key considerations:

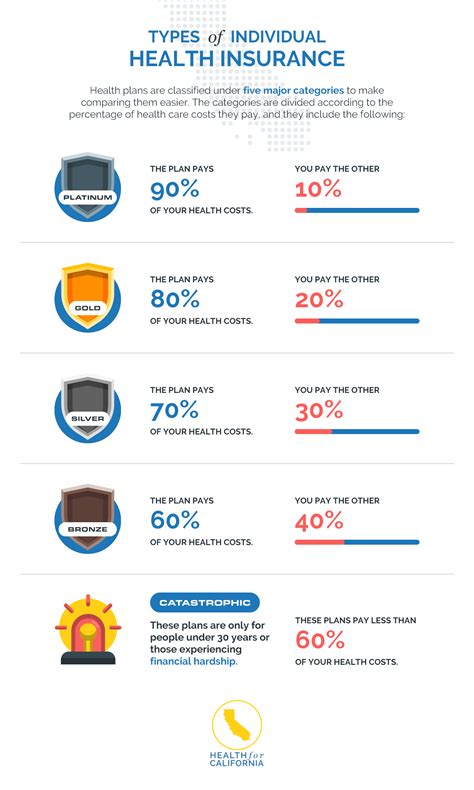

| Plan Type | Average Monthly Premium | Deductible Range |

|---|---|---|

| Bronze Plans | $350 - $450 | $5,000 - $6,000 |

| Silver Plans | $400 - $550 | $2,500 - $4,000 |

| Gold Plans | $550 - $700 | $1,000 - $2,500 |

| Platinum Plans | $750 - $900 | $500 - $1,500 |

It's important to note that these figures are averages and can vary significantly based on individual circumstances. Additionally, Californians with low to moderate incomes may qualify for financial assistance, which can significantly reduce the cost of premiums and out-of-pocket expenses.

Coverage Highlights

California’s individual health insurance plans offer a robust set of benefits, ensuring that residents have access to a wide range of medical services. Here are some key coverage highlights:

-

Preventive Care: Many plans cover preventive services such as annual physicals, immunizations, cancer screenings, and contraceptive care at no additional cost.

-

Mental Health Services: Coverage for mental health and substance use disorder services is mandated by law, ensuring that Californians have access to vital mental health support.

-

Prescription Drugs: Most plans include coverage for prescription medications, although the specific drugs covered may vary. It's important to review the plan's formulary to ensure your required medications are included.

-

Maternity Care: Pregnant women and new mothers can access comprehensive maternity care, including prenatal visits, delivery, and postpartum care, ensuring a healthy start for both mother and child.

-

Dental and Vision: Some plans offer additional coverage for dental and vision services, providing a more holistic approach to healthcare.

Navigating the Enrollment Process

Enrolling in an individual health insurance plan in California can be a straightforward process, especially with the resources provided by Covered California. Here’s a step-by-step guide to help you through the enrollment journey:

-

Determine Eligibility: Start by checking your eligibility for financial assistance or special enrollment periods. Covered California offers a simple eligibility checker to help you understand your options.

-

Compare Plans: Use the Covered California website or an insurance broker to compare plans based on your healthcare needs and budget. You can filter plans by cost, provider network, and specific benefits to find the best fit.

-

Review the Application Process: Familiarize yourself with the application requirements and necessary documents. This may include proof of identity, income, and residency.

-

Apply Online or with Assistance: You can apply online through the Covered California website or seek assistance from a certified insurance agent or navigator. They can guide you through the process and answer any questions.

-

Choose Your Plan: Once your application is approved, you'll receive a confirmation of coverage and details on your chosen plan. Review the plan documents and make sure you understand the coverage and costs.

Special Enrollment Periods

California offers special enrollment periods (SEPs) for individuals who experience certain life events that make them eligible for health insurance outside of the annual open enrollment period. These events include:

- Loss of other health coverage

- Changes in household size due to birth, adoption, or marriage

- Changes in income that affect eligibility for financial assistance

- Moving to a new coverage area

- Gaining citizenship or lawful presence

During these SEPs, individuals can enroll in a health plan or switch plans without waiting for the annual open enrollment period.

The Future of Individual Health Insurance in California

The landscape of individual health insurance in California is continually evolving, with ongoing efforts to improve access and affordability. Here are some key trends and developments to watch:

-

Expanded Coverage Options: California is exploring ways to expand coverage options, including the possibility of a state-based public option. This could provide residents with more affordable and accessible healthcare choices.

-

Innovation in Telehealth: The COVID-19 pandemic has accelerated the adoption of telehealth services, and California is committed to integrating these technologies into its healthcare system. Telehealth can improve access to care, especially for individuals in rural or underserved areas.

-

Addressing Social Determinants of Health: The state is recognizing the impact of social factors on health outcomes and is working to address issues like housing instability, food insecurity, and access to transportation. By tackling these social determinants, California aims to improve overall health and reduce healthcare disparities.

-

Enhanced Consumer Protections: California continues to strengthen consumer protections, ensuring that insurance companies treat their customers fairly and transparently. This includes measures to prevent surprise medical bills and promote price transparency.

Conclusion

California’s commitment to providing accessible and affordable healthcare is evident in its robust individual health insurance plans. With a range of options tailored to different needs and budgets, residents can find comprehensive coverage that fits their unique circumstances. As the state continues to innovate and expand its healthcare offerings, Californians can look forward to a brighter and healthier future.

What is the annual open enrollment period for individual health insurance plans in California?

+The annual open enrollment period typically runs from November 1st to January 15th. During this time, individuals can enroll in a new plan or make changes to their existing coverage for the upcoming year.

Can I enroll outside of the open enrollment period?

+Yes, you can enroll outside of the open enrollment period if you experience a qualifying life event, such as losing other health coverage, getting married, or moving to a new area. These events trigger a special enrollment period, allowing you to enroll or make changes to your coverage.

Are there financial assistance options for individual health insurance plans in California?

+Yes, financial assistance is available for eligible individuals and families. Covered California offers subsidies to help reduce the cost of premiums and out-of-pocket expenses. The amount of assistance depends on your income and family size.

How do I know if I qualify for financial assistance?

+You can use the Covered California eligibility checker to determine if you qualify for financial assistance. This tool considers your income, household size, and other factors to estimate your potential savings.