Owner Insurance Company

In today's world, where unforeseen circumstances can arise at any moment, protecting our assets and ensuring financial stability has become a top priority for many individuals and businesses. This is where insurance companies step in, offering a range of policies to safeguard against potential risks. One such company making waves in the industry is Owner Insurance Company, a provider that specializes in tailoring coverage to meet the unique needs of its clients.

An Innovative Approach to Insurance

Owner Insurance Company stands out in the competitive landscape of the insurance industry with its innovative and client-centric approach. Unlike traditional insurers, this company focuses on understanding the specific requirements of each client, be it an individual homeowner, a small business owner, or a large corporation.

The journey of Owner Insurance Company began in [Founding Year], when a group of industry experts identified a gap in the market. They noticed that many insurance providers offered one-size-fits-all policies, failing to address the diverse needs of their customers. Recognizing this, they set out to create a company that would revolutionize the industry by providing highly customized insurance solutions.

Since its inception, Owner Insurance Company has grown exponentially, establishing a strong presence across [Number of Countries/States] with a network of [Number of Agents/Offices]. Their rapid growth can be attributed to their commitment to offering personalized insurance plans, competitive pricing, and exceptional customer service.

Tailored Insurance Solutions

The cornerstone of Owner Insurance Company’s success lies in its ability to offer tailored insurance solutions. Understanding that every client has unique needs, they go beyond the conventional approach of standard policies. Instead, they conduct thorough assessments of each client’s situation, considering factors such as assets, liabilities, and individual risk profiles.

For instance, when it comes to home insurance, Owner Insurance Company doesn't just offer a generic policy. They take into account the specific features of the home, its location, and the unique risks it may face. Whether it's a historic property with unique architectural features, a home located in an area prone to natural disasters, or a residence with valuable artwork, Owner Insurance Company crafts policies that provide adequate coverage.

Similarly, for business insurance, they recognize that no two businesses are alike. Whether it's a startup tech company, a traditional retail store, or a manufacturing plant, each business has distinct risks and requirements. Owner Insurance Company works closely with business owners to design comprehensive policies that protect against potential liabilities, property damage, and business interruption.

Key Features of Tailored Insurance Plans

- Personalized Coverage Limits: Owner Insurance Company allows clients to set coverage limits that align with their specific needs and budgets. This ensures that clients are neither overinsured nor underinsured, providing peace of mind without unnecessary financial burden.

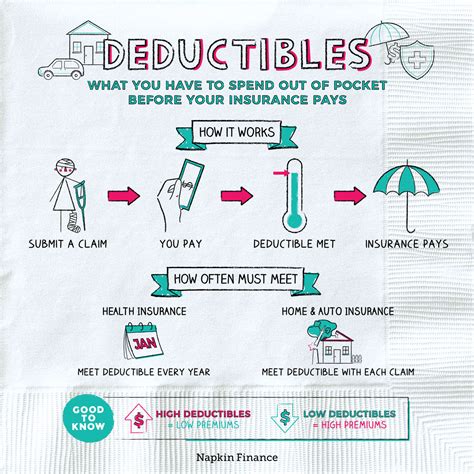

- Flexible Deductibles: They offer flexible deductibles, allowing clients to choose deductibles that suit their risk appetite and financial situation. This flexibility empowers clients to make informed decisions about their insurance coverage.

- Customizable Endorsements: Owner Insurance Company provides a range of endorsements (add-ons) that can be customized to individual policies. These endorsements cater to specific needs, such as coverage for valuable personal belongings, identity theft protection, or liability for rental properties.

- Risk Management Services: Beyond insurance, Owner Insurance Company offers risk management services to help clients mitigate potential risks. This may include advice on property maintenance, security measures, or business continuity planning, ensuring clients are well-prepared for any eventuality.

Competitive Pricing and Customer Satisfaction

Owner Insurance Company’s commitment to personalized insurance doesn’t come at the cost of affordability. Their competitive pricing strategies ensure that clients receive the best value for their money. By offering customized policies, they can provide coverage that is both comprehensive and cost-effective, making insurance accessible to a wider range of clients.

Furthermore, Owner Insurance Company prides itself on its exceptional customer service. Their team of dedicated insurance professionals is known for their expertise, responsiveness, and willingness to go the extra mile for their clients. This commitment to customer satisfaction has resulted in a high retention rate and numerous positive reviews from satisfied customers.

Customer Testimonials

“As a small business owner, I appreciate the personalized approach of Owner Insurance Company. They took the time to understand my business and tailor a policy that provided the coverage I needed without breaking the bank. Their customer service is exceptional, and I feel confident knowing I have a partner who truly cares about my business’s success.” - [Customer Name], Owner of [Business Name]

“I was impressed by how Owner Insurance Company tailored my home insurance policy to my specific needs. They considered the unique features of my home and provided coverage that gave me peace of mind. Their team was always available to answer my questions, and I feel well-protected knowing they have my back.” - [Customer Name], Homeowner in [City]

Future Outlook and Industry Impact

Looking ahead, Owner Insurance Company is poised for continued growth and innovation. With a strong focus on technology and data analytics, they aim to further enhance their ability to provide precise and efficient insurance solutions. By leveraging advanced tools and insights, they can refine their risk assessment processes and offer even more accurate and tailored policies.

Additionally, Owner Insurance Company is committed to expanding its reach and making insurance more accessible. They plan to introduce new products and services, cater to a wider range of clients, and continue to educate the public on the importance of insurance. Their goal is not only to provide insurance coverage but also to empower individuals and businesses to make informed decisions about their financial protection.

In an industry that is often criticized for its complexity and lack of personalization, Owner Insurance Company stands as a beacon of innovation and client-centricity. Their approach to insurance, which prioritizes understanding individual needs and providing tailored solutions, sets a new standard for the industry. As they continue to grow and adapt, Owner Insurance Company is well-positioned to become a leading force in the insurance sector, shaping the future of insurance for the better.

| Company Highlight | Details |

|---|---|

| Founder's Vision | To revolutionize the insurance industry by offering highly customized solutions. |

| Growth Statistics | Rapid expansion with a presence in [Number of Countries/States] and a network of [Number of Agents/Offices] |

| Tailored Insurance Plans | Personalized coverage limits, flexible deductibles, customizable endorsements, and risk management services. |

| Competitive Pricing | Affordable rates without compromising on comprehensive coverage. |

| Customer Satisfaction | High retention rate and positive reviews, attributed to exceptional customer service. |

How does Owner Insurance Company determine the cost of a tailored insurance policy?

+

Owner Insurance Company employs advanced risk assessment techniques, taking into account factors such as the client’s risk profile, the value of their assets, and the specific coverage required. This ensures that the cost of the policy is fair and aligned with the client’s needs.

Can I customize my insurance policy with Owner Insurance Company even if I have a basic plan already in place?

+

Absolutely! Owner Insurance Company believes in the importance of flexibility and personalization. Even if you have a basic plan, you can work with their team to enhance and customize your coverage to better suit your needs.

What sets Owner Insurance Company apart from other providers in the market?

+

Owner Insurance Company stands out with its commitment to offering truly tailored insurance solutions. While many providers offer standard policies, Owner Insurance Company takes the time to understand each client’s unique situation, resulting in more precise and effective coverage.

How can I get in touch with Owner Insurance Company to discuss my insurance needs?

+

You can reach out to Owner Insurance Company through their website, where you’ll find contact details and an easy-to-use form to request a quote. Their team is ready to assist and guide you through the process of finding the right insurance solution for your needs.