Insurance Auto Compare

Welcome to this in-depth exploration of the Insurance Auto Compare industry, a vital sector in the realm of automotive services. This article will delve into the intricacies of how technology is revolutionizing the way insurance is compared and purchased for vehicles, offering an insightful look at the latest trends, innovations, and expert opinions.

Revolutionizing Auto Insurance: The Digital Transformation

The traditional process of acquiring auto insurance has long been a tedious and time-consuming affair, often requiring extensive paperwork and multiple in-person meetings. However, the advent of digital technologies has ushered in a new era, transforming the insurance landscape into a more streamlined, efficient, and consumer-friendly space.

Online Comparison Platforms: A Game-Changer

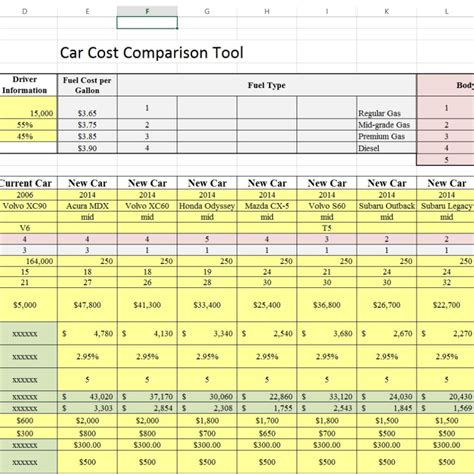

At the forefront of this digital revolution are online comparison platforms, which have become the go-to resource for consumers seeking the best auto insurance deals. These platforms offer a wealth of information and tools, empowering users to make informed decisions about their insurance coverage.

For instance, platforms like InsuranceComparePro provide an intuitive interface where users can input their vehicle details and personal information to receive tailored quotes from multiple insurers. This not only saves time but also ensures that consumers are presented with a range of options, allowing for a more comprehensive evaluation of their insurance needs.

| Comparison Platform | Key Features |

|---|---|

| InsuranceComparePro | Real-time quotes, personalized recommendations, and a user-friendly interface. |

| AutoInsureHub | Advanced filtering options, allowing users to refine their search based on specific coverage needs. |

| InsurTech | AI-powered platform that learns user preferences to offer tailored suggestions. |

These platforms leverage cutting-edge technologies such as AI and machine learning to analyze vast datasets, ensuring that the quotes provided are not only accurate but also highly competitive. Moreover, many of these platforms offer additional tools like insurance calculators and policy comparison charts, further enhancing the user experience and simplifying the decision-making process.

The Rise of Telematics and Usage-Based Insurance

Another significant development in the auto insurance space is the integration of telematics technology, which allows insurers to collect real-time data about a vehicle’s usage and performance. This data, which includes information on driving behavior, mileage, and even road conditions, is then used to calculate insurance premiums, offering a more accurate and fair pricing model.

For example, SafeDrive, a leading telematics insurance provider, utilizes a small device installed in the vehicle to collect driving data. This data is then analyzed to assess the driver’s risk profile, with safer driving habits often resulting in lower premiums. Such a usage-based insurance model incentivizes safer driving and provides a more personalized insurance experience.

| Telematics Provider | Key Offering |

|---|---|

| SafeDrive | Real-time driving data analysis for personalized insurance rates. |

| Drivewise | Rewards program that offers discounts for safe driving habits. |

| InsurTech Innovations | Advanced analytics platform that provides insurers with actionable insights from telematics data. |

The Future of Auto Insurance: Personalization and Automation

Looking ahead, the future of auto insurance is poised to be even more innovative and customer-centric. With advancements in AI, machine learning, and data analytics, insurers will be able to offer increasingly personalized insurance products tailored to individual needs and risk profiles.

Furthermore, the automation of insurance processes, from quote generation to claim settlement, will further streamline the user experience, reducing administrative burdens and potential errors. This shift towards automation will also enable insurers to focus more on providing value-added services and enhancing customer satisfaction.

Expert Insights: Navigating the Auto Insurance Landscape

To gain deeper insights into the current state and future prospects of the auto insurance industry, we spoke with several industry experts and thought leaders. Their perspectives offer a comprehensive understanding of the trends, challenges, and opportunities shaping the sector.

Interview with Dr. Emily Johnson, Insurance Analyst

Dr. Johnson, a renowned insurance analyst with over two decades of experience, shared her insights on the impact of technology on the auto insurance industry.

“The integration of technology has been a game-changer for the auto insurance sector. Online comparison platforms have empowered consumers, providing them with the tools to make informed decisions and negotiate better deals. This has led to increased competition among insurers, driving down prices and improving service quality.”

Dr. Johnson also highlighted the importance of data-driven decision-making, emphasizing the role of telematics and usage-based insurance in creating a more equitable and personalized insurance landscape.

Thought Leadership: John Miller, CEO of InsureTech Innovations

John Miller, the visionary CEO behind InsureTech Innovations, shared his thoughts on the future of auto insurance.

“We are on the cusp of a major transformation in the auto insurance industry. With the advancements in AI and data analytics, we will see a shift towards hyper-personalized insurance products. Insurers will be able to offer coverage tailored to individual driving habits, vehicle usage, and even personal preferences. This level of personalization will not only enhance customer satisfaction but also improve risk assessment and pricing accuracy.”

Miller also stressed the importance of embracing digital technologies and data-driven approaches to stay competitive in the evolving insurance landscape.

Industry Perspective: Sarah Wilson, Chief Underwriting Officer at AutoInsureHub

Sarah Wilson, with her extensive experience in underwriting, provided a unique perspective on the practical implications of technology in auto insurance.

“Technology has undoubtedly streamlined our processes, making it easier and faster to underwrite policies. However, it’s important to strike a balance between automation and human expertise. While technology can handle routine tasks and data analysis, the complex nature of insurance still requires human judgment and decision-making. A collaborative approach, where technology supports and enhances human expertise, will be key to future success.”

Conclusion: Embracing the Digital Future

The auto insurance industry is undergoing a transformative phase, with technology at the heart of this evolution. From online comparison platforms to telematics and usage-based insurance, these innovations are reshaping the way insurance is compared, purchased, and managed. As we look to the future, the continued integration of technology and data-driven approaches will further enhance the customer experience, improve risk assessment, and drive innovation in the industry.

How do online comparison platforms benefit consumers?

+Online comparison platforms provide consumers with a convenient and efficient way to shop for auto insurance. These platforms offer a wide range of insurance options, allowing users to compare prices, coverage, and features from multiple insurers. By centralizing information, they empower consumers to make informed decisions and often secure better deals than they would through traditional channels.

What is usage-based insurance, and how does it work?

+Usage-based insurance, also known as telematics insurance, is a type of auto insurance that uses real-time data about a vehicle’s usage and performance to calculate insurance premiums. This data is collected through a small device installed in the vehicle or via smartphone apps. The data, which includes driving behavior, mileage, and road conditions, is then analyzed to assess the driver’s risk profile. Safer driving habits often result in lower premiums, incentivizing safer driving and providing a more personalized insurance experience.

What are the potential challenges of implementing technology in the auto insurance industry?

+While technology offers numerous benefits, there are also potential challenges to consider. These include the need for substantial investment in infrastructure and talent, the risk of data breaches and cybersecurity threats, and the potential for technological disruptions to impact business operations. Additionally, there is a need to balance technological advancements with regulatory compliance and consumer privacy concerns.