Best Price Insurance

The Ultimate Guide to Navigating the Complex World of Insurance: A Deep Dive into Best Price Insurance

In the vast landscape of insurance, finding the right coverage at the best price can be a daunting task. With numerous providers and policies available, it's crucial to make an informed decision that aligns with your specific needs and budget. This comprehensive guide will delve into the intricacies of Best Price Insurance, a leading provider known for its competitive rates and comprehensive coverage options. By understanding the key features, benefits, and real-world examples, you'll be equipped to make an educated choice for your insurance needs.

Best Price Insurance has established itself as a trusted name in the industry, offering a wide range of insurance products tailored to meet diverse requirements. Whether you're seeking auto, home, health, or life insurance, their comprehensive portfolio ensures that you can find the right coverage without compromising on quality or affordability. Let's explore the key aspects that make Best Price Insurance a top choice for individuals and businesses alike.

Understanding Best Price Insurance: A Holistic Approach to Insurance Solutions

Best Price Insurance stands out in the market with its holistic approach to insurance, recognizing that every individual or business has unique needs. Their extensive range of insurance products caters to a broad spectrum of requirements, ensuring that clients can find tailored solutions for their specific circumstances.

Auto Insurance: Comprehensive Coverage for Peace of Mind

Best Price Insurance's auto insurance policies are designed to provide comprehensive protection for vehicle owners. With customizable coverage options, policyholders can choose the level of protection that aligns with their driving habits and preferences. From liability coverage to comprehensive and collision insurance, Best Price Insurance offers a range of benefits, including:

- Competitive rates that won't break the bank.

- Flexible payment plans to suit various financial situations.

- A dedicated claims process, ensuring quick and efficient resolution.

- Optional add-ons such as rental car coverage and roadside assistance.

- Discounts for safe driving records and multi-policy purchases.

Real-world Example: Sarah, a young professional with a clean driving record, chose Best Price Insurance for her auto coverage. With their competitive rates and flexible payment options, she was able to secure comprehensive protection without straining her budget. The added benefit of their efficient claims process gave her peace of mind, knowing that any unforeseen incidents would be handled promptly and professionally.

Home Insurance: Protecting Your Sanctuary

Homeownership comes with its fair share of responsibilities, and Best Price Insurance understands the importance of safeguarding your home and its contents. Their home insurance policies offer a wide range of coverage options, including:

- Dwelling coverage to protect the structure of your home.

- Personal property coverage for your belongings.

- Liability protection to cover legal expenses and damages.

- Optional add-ons such as flood or earthquake coverage for enhanced protection.

- Discounts for security systems and multiple policy purchases.

Real-world Example: John and his family recently purchased their dream home. To protect their investment, they turned to Best Price Insurance for their home insurance needs. With customizable coverage options and competitive rates, they were able to tailor a policy that provided comprehensive protection for their home and personal belongings. The added peace of mind of knowing they were covered in case of unforeseen events made their transition into homeownership smoother and more secure.

Health Insurance: Prioritizing Your Well-being

In today's world, health insurance is more crucial than ever. Best Price Insurance recognizes the importance of accessible and comprehensive health coverage, offering a range of plans to meet diverse healthcare needs. Their health insurance policies include:

- Individual and family plans with various coverage levels.

- Flexible payment options to accommodate different budgets.

- A network of preferred providers for cost-effective care.

- Optional add-ons such as dental, vision, and prescription drug coverage.

- Discounts for healthy lifestyle choices and wellness programs.

Real-world Example: Maria, a self-employed individual, relied on Best Price Insurance for her health coverage. With their range of individual plans, she was able to find a policy that offered comprehensive benefits without straining her finances. The flexibility of their payment options and the extensive network of preferred providers gave her the confidence to prioritize her health and well-being.

Life Insurance: Securing Your Legacy

Life insurance is an essential aspect of financial planning, providing security and peace of mind for your loved ones. Best Price Insurance offers a range of life insurance products to meet various needs, including:

- Term life insurance for temporary coverage.

- Whole life insurance for permanent protection.

- Customizable coverage amounts to suit different financial goals.

- Accelerated death benefit riders for critical illness coverage.

- Waiver of premium options for added financial protection.

Real-world Example: Michael, a young father, wanted to ensure that his family was financially secure in the event of his untimely passing. He chose Best Price Insurance for their range of life insurance options. With their customizable coverage and affordable premiums, he was able to secure a policy that provided substantial benefits for his family, giving him the peace of mind that comes with knowing they would be taken care of.

The Best Price Insurance Advantage: Going Beyond Insurance

Best Price Insurance's commitment to their clients goes beyond providing insurance coverage. They prioritize exceptional customer service and a seamless experience, ensuring that policyholders receive the support they need every step of the way. Here's how they deliver on their promise of going the extra mile:

- 24/7 Customer Support: Best Price Insurance understands that insurance needs can arise at any time. Their dedicated customer support team is available around the clock to assist with policy inquiries, claims, and any other concerns.

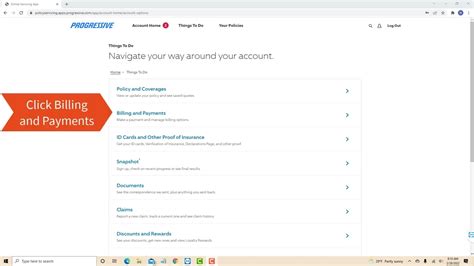

- Online Account Management: Policyholders can access their accounts and manage their insurance needs conveniently through the Best Price Insurance website. From viewing policy details to making payments, the online platform offers a seamless and efficient experience.

- Educational Resources: Best Price Insurance believes in empowering their clients with knowledge. Their website provides a wealth of educational resources, including articles, guides, and FAQs, to help policyholders understand their coverage and make informed decisions.

- Claims Excellence: In the event of a claim, Best Price Insurance's dedicated claims team ensures a smooth and efficient process. With a focus on timely resolution, they work diligently to provide the support and compensation policyholders deserve.

Real-world Example: After a minor car accident, David turned to Best Price Insurance's 24/7 customer support for assistance. The team promptly guided him through the claims process, ensuring that his experience was as stress-free as possible. With their efficient handling of his claim, David could focus on getting his vehicle repaired without any additional worries.

Best Price Insurance: A Trusted Partner for Your Insurance Journey

In a complex and ever-evolving insurance landscape, Best Price Insurance stands as a beacon of reliability and affordability. With their comprehensive range of insurance products, competitive rates, and exceptional customer service, they have earned the trust of countless individuals and businesses. Whether you're seeking auto, home, health, or life insurance, Best Price Insurance offers the coverage and support you need to navigate life's uncertainties with confidence.

As you embark on your insurance journey, remember that Best Price Insurance is dedicated to being more than just an insurance provider. They are your partners in safeguarding what matters most, ensuring that you can focus on living your best life with the peace of mind that comes from comprehensive and affordable coverage.

What sets Best Price Insurance apart from other providers?

+Best Price Insurance stands out with its holistic approach to insurance, offering a comprehensive range of products tailored to individual needs. Their competitive rates, flexible payment options, and dedicated customer support make them a trusted partner for all insurance needs.

How can I customize my insurance policy with Best Price Insurance?

+Best Price Insurance provides customizable coverage options for auto, home, health, and life insurance. You can choose the level of protection that suits your needs and preferences, ensuring a tailored policy.

What additional benefits do Best Price Insurance’s policies offer?

+Best Price Insurance’s policies include benefits such as flexible payment plans, efficient claims processes, optional add-ons, and discounts for safe practices. These features enhance the overall value and convenience of their insurance offerings.

How can I get a quote for Best Price Insurance’s coverage?

+To get a quote for Best Price Insurance’s coverage, you can visit their website, call their customer support team, or schedule a consultation with one of their insurance advisors. They’ll guide you through the process and help you find the best coverage for your needs.