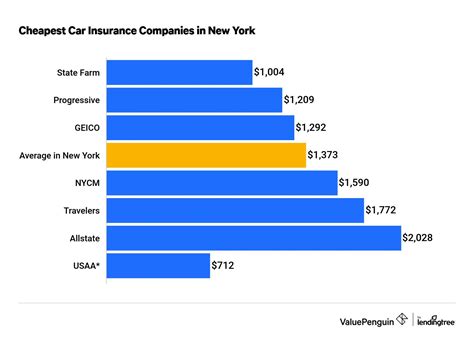

Car Insurance Quote Nyc

Obtaining a car insurance quote in New York City (NYC) can be a complex process due to the unique characteristics of this bustling metropolis. With a population density that's among the highest in the nation, and a notoriously challenging driving environment, NYC presents its own set of considerations when it comes to car insurance. In this comprehensive guide, we'll delve into the specifics of car insurance in NYC, exploring the factors that influence rates, the best practices for obtaining accurate quotes, and the steps you can take to secure the most favorable coverage for your vehicle.

Understanding the Unique Challenges of NYC Driving

Before we dive into the specifics of car insurance quotes in NYC, it’s essential to grasp the distinct challenges that come with driving in this city. NYC’s traffic congestion, aggressive driving culture, and high rates of accidents and thefts all contribute to a complex insurance landscape. These factors significantly impact the cost of car insurance, making it crucial for drivers to understand the unique risks and how they’re reflected in insurance rates.

Traffic Congestion and Accident Rates

NYC is renowned for its heavy traffic, with commuters spending an average of 66 hours per year stuck in traffic jams. This congestion not only causes frustration but also increases the likelihood of accidents. In fact, the city experiences a higher-than-average rate of crashes, with an estimated 4.68 crashes per million vehicle miles traveled (a rate that’s higher than the national average of 3.84). This elevated accident risk is a significant factor in the cost of car insurance, as insurers must account for the increased likelihood of claims.

Furthermore, the complex network of highways, bridges, and tunnels that connect the five boroughs can be challenging to navigate, especially for those unfamiliar with the city. This complexity, coupled with the fast-paced nature of NYC driving, can lead to more frequent and severe accidents.

Theft and Vandalism Concerns

In addition to the high accident rates, NYC also grapples with issues of vehicle theft and vandalism. The city’s dense population and parking challenges create opportunities for theft and other crimes related to vehicles. According to the NYC Police Department, over 10,000 motor vehicles were stolen in 2022, with certain boroughs experiencing higher rates of theft than others. This prevalence of theft not only impacts insurance rates but also necessitates additional security measures, such as comprehensive insurance coverage.

Vandalism is also a concern in NYC, with incidents ranging from broken windows to more extensive damage. While not as prevalent as theft, vandalism can still be a significant expense for vehicle owners, further impacting the need for comprehensive insurance coverage.

Factors Influencing Car Insurance Rates in NYC

Understanding the unique challenges of driving in NYC is just the first step in navigating the complex world of car insurance. The next crucial aspect is grasping the various factors that insurance providers consider when determining rates for NYC drivers. These factors can significantly impact the cost of your insurance, so it’s essential to be aware of them and know how to navigate them to your advantage.

Driver’s Record and History

One of the most significant factors that influence car insurance rates is the driver’s record and history. Insurance providers carefully scrutinize a driver’s record to assess their risk profile. In NYC, where the risk of accidents and traffic violations is higher, a clean driving record is especially valuable. Here’s a breakdown of how your driving record can impact your insurance rates:

- Clean Record: If you've maintained a clean driving record with no accidents or violations, you're likely to receive the most favorable insurance rates. Insurance companies view you as a low-risk driver, which translates to lower premiums.

- Minor Violations: Even a single minor violation, such as a speeding ticket or a parking infraction, can cause your insurance rates to increase. The impact depends on the severity of the violation and your overall driving history.

- Major Violations: More serious violations, like driving under the influence (DUI) or reckless driving, can significantly raise your insurance rates. In some cases, you may even be deemed a high-risk driver, which can lead to even higher premiums or difficulty in finding coverage.

- Accidents: Being involved in an accident, regardless of fault, can also increase your insurance rates. Insurance companies use accident data to assess your risk profile, and even a single accident can impact your rates for several years.

Vehicle Type and Usage

The type of vehicle you drive and how you use it are also critical factors in determining your insurance rates. In NYC, where space is at a premium and driving conditions can be challenging, the choice of vehicle and its intended use can have a significant impact on insurance costs.

- Vehicle Type: The make, model, and age of your vehicle play a role in determining your insurance rates. Generally, newer and more expensive vehicles tend to have higher insurance premiums due to the cost of repairs and replacement parts. Sports cars and high-performance vehicles are often more expensive to insure due to their higher risk of accidents and theft.

- Vehicle Usage: How you use your vehicle can also impact your insurance rates. If you primarily use your car for commuting within NYC, your rates may be higher due to the increased risk of accidents and traffic congestion. On the other hand, if you primarily use your vehicle for occasional pleasure trips or short commutes, your rates may be lower.

Location and ZIP Code

Your physical location and ZIP code are critical factors in determining your car insurance rates. In NYC, where different boroughs and neighborhoods can have vastly different characteristics, your specific location can significantly impact your insurance costs. Here’s how location and ZIP code influence your rates:

- Crime Rates: Areas with higher crime rates, particularly those with a higher incidence of vehicle theft and vandalism, tend to have higher insurance rates. Insurance companies factor in the risk of theft and other crimes when determining rates, so neighborhoods with higher crime rates will typically have higher premiums.

- Accident Rates: Areas with a higher incidence of accidents, such as those with busy intersections or a high volume of traffic, may also have higher insurance rates. Insurance companies use accident data to assess the risk of insuring drivers in a particular area, so locations with a higher accident rate will often have higher premiums.

- Population Density: NYC's population density, especially in certain boroughs, can also impact insurance rates. More densely populated areas often have higher rates of accidents and theft, which can drive up insurance costs.

Obtaining Accurate Car Insurance Quotes in NYC

Given the unique challenges and considerations of car insurance in NYC, it’s essential to approach the process of obtaining quotes with a strategic mindset. By understanding the factors that influence rates and taking specific steps to ensure accuracy, you can position yourself to secure the most favorable insurance coverage for your needs.

Working with a Reputable Insurance Broker

One of the most effective ways to navigate the complex world of car insurance in NYC is to work with a reputable insurance broker. Insurance brokers are experts in the field, with extensive knowledge of the market and the ability to provide personalized advice. Here’s why working with a broker can be beneficial:

- Expertise: Insurance brokers have a deep understanding of the NYC insurance market, including the specific challenges and opportunities it presents. They can guide you through the process, explaining the various options and helping you make informed decisions.

- Multiple Quotes: Brokers have relationships with multiple insurance providers, allowing them to shop around for the best rates on your behalf. They can provide you with a range of quotes from different insurers, giving you a comprehensive view of the market and helping you compare rates and coverage options.

- Personalized Advice: Brokers can offer personalized advice based on your specific needs and circumstances. They can help you understand the implications of different coverage options and guide you toward the most suitable plan for your driving habits, vehicle type, and location.

- Negotiation: Brokers often have the ability to negotiate with insurance providers on your behalf. This can be especially beneficial if you have a clean driving record or other factors that might qualify you for lower rates.

Understanding Coverage Options and Customization

Car insurance in NYC offers a range of coverage options, each designed to address specific risks and needs. Understanding these options and customizing your coverage to fit your circumstances is crucial for obtaining the right insurance at the right price. Here’s an overview of the key coverage options and how they can be tailored to your needs:

- Liability Coverage: This is the most basic form of car insurance, providing coverage for damages you cause to others in an accident. It's required by law in most states, including NYC. The minimum liability limits in NYC are $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage. However, many experts recommend increasing these limits to provide more robust protection.

- Collision Coverage: This coverage pays for repairs to your vehicle if you're involved in an accident, regardless of fault. It's especially important in NYC, where the risk of accidents is higher. The cost of collision coverage depends on factors such as your vehicle's make and model, its age, and your deductible.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damage from non-collision events, such as theft, vandalism, weather-related incidents, and collisions with animals. In NYC, where vehicle theft and vandalism are concerns, comprehensive coverage is essential. The cost of comprehensive coverage is typically based on your vehicle's value and the level of risk associated with your location.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the damages. In NYC, where the risk of accidents is high, this coverage is particularly important. The cost of uninsured/underinsured motorist coverage is generally based on your vehicle's value and the limits you choose.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers if you're involved in an accident, regardless of fault. In NYC, where the cost of healthcare can be high, this coverage can provide valuable protection. The cost of medical payments coverage depends on the limits you choose and your specific healthcare needs.

Comparing Quotes and Making Informed Decisions

Once you’ve obtained a range of quotes from different insurance providers, it’s essential to compare them carefully to make an informed decision. This process involves more than just looking at the bottom line; it requires a thorough analysis of the coverage, exclusions, and other fine print to ensure you’re getting the best value for your money.

- Coverage Comparison: Start by comparing the coverage limits and types offered by each insurer. Ensure that you're comparing apples to apples by looking at policies with similar coverage levels. For instance, if one insurer offers a higher liability limit, compare that policy to others with similar higher limits to get an accurate comparison.

- Exclusions and Fine Print: Carefully review the exclusions and limitations in each policy. Insurance policies often have fine print that can significantly impact your coverage, so it's crucial to understand these details. For example, some policies may exclude coverage for certain types of damage or have limitations on rental car coverage.

- Customer Service and Claims Process: Consider the insurer's reputation for customer service and the ease of their claims process. In the event of an accident or other covered incident, you'll want to work with an insurer that provides prompt and efficient service. Look for reviews and ratings from independent sources to get a sense of the insurer's track record.

- Discounts and Special Programs: Explore the discounts and special programs offered by each insurer. Many insurers offer discounts for safe driving, multiple policies, or certain vehicle features. These discounts can significantly reduce your premiums, so it's worth shopping around to find the best deals.

Strategies for Securing the Best Car Insurance in NYC

Now that you have a comprehensive understanding of the factors that influence car insurance rates in NYC and how to obtain accurate quotes, it’s time to explore strategies for securing the best insurance coverage for your needs. By implementing these strategies and staying informed about your options, you can navigate the complex world of car insurance with confidence and ensure you’re getting the most value for your money.

Bundling Your Policies for Discounts

One effective strategy for reducing your car insurance premiums in NYC is to bundle your policies with the same insurer. Many insurance providers offer discounts when you combine multiple policies, such as auto insurance with homeowners or renters insurance. This not only simplifies your insurance management but can also lead to significant savings.

- Homeowners or Renters Insurance: If you own a home in NYC, consider bundling your auto insurance with your homeowners insurance policy. Similarly, if you rent an apartment or house, you can bundle your auto insurance with your renters insurance. This can lead to discounts on both policies, as insurers often offer multi-policy discounts to encourage customers to bundle their coverage.

- Other Policies: Depending on your circumstances, you may also have other insurance policies that can be bundled with your auto insurance. For example, if you have a life insurance policy or a business insurance policy, inquire about the possibility of bundling these with your auto insurance for potential discounts.

Exploring Usage-Based Insurance Programs

Usage-based insurance (UBI) programs are an innovative approach to car insurance that allows insurers to tailor rates based on your actual driving behavior. These programs use telematics devices or smartphone apps to track factors like miles driven, driving speed, and braking habits. By providing insurers with a more detailed picture of your driving behavior, UBI programs can lead to significant discounts for safe drivers.

- Telematics Devices: Some insurance providers offer UBI programs that use small devices installed in your vehicle to track your driving behavior. These devices typically plug into your car's onboard diagnostics port and transmit data to the insurer. If you're a safe driver, you may qualify for substantial discounts through these programs.

- Smartphone Apps: Other UBI programs use smartphone apps to track your driving behavior. These apps typically use your phone's GPS and accelerometer to gather data on your driving habits. While the potential for discounts is similar to telematics devices, smartphone apps offer the convenience of not having to install a separate device in your vehicle.

Maintaining a Clean Driving Record

As we’ve discussed earlier, your driving record is a critical factor in determining your car insurance rates. Maintaining a clean driving record is one of the most effective ways to keep your insurance premiums low, especially in NYC where the cost of insurance can be high. Here are some tips for keeping your driving record clean:

- Safe Driving Habits: Practice safe driving habits at all times. This includes obeying traffic laws, maintaining a safe following distance, and avoiding aggressive driving behaviors like speeding and sudden lane changes. By driving defensively and being mindful of your surroundings, you can significantly reduce your risk of accidents and violations.

- Avoid Distracted Driving: Distracted driving is a major cause of accidents, and it's especially prevalent in NYC with its busy streets and heavy traffic. Make a conscious effort to avoid distractions while driving, such as using your phone, eating, or engaging in other activities that take your attention away from the road.

- Regular Vehicle Maintenance: Keeping your vehicle in good working condition is not only important for your safety but can also help you avoid accidents and violations. Regular maintenance, such as oil changes, tire rotations, and brake inspections, can help prevent mechanical failures that could lead to accidents.

Considerations for High-Risk Drivers

If you’ve had a major violation or accident in the past, you may be considered a high-risk driver, which can significantly impact your insurance rates. While it can be challenging to secure affordable insurance as a high-risk driver, there are still strategies you can employ to manage your insurance costs and improve your driving record over time.

- High-Risk Insurance Providers: Consider working with insurance providers that specialize in covering high-risk drivers. These providers often have more flexible underwriting guidelines and may offer more competitive rates than standard insurers. However, it's important to shop around and compare quotes to ensure you're getting the best deal.

- Safe Driving Courses: Enrolling in a safe driving course or defensive driving program can help improve your driving skills and reduce the likelihood of future accidents. Many insurance providers offer discounts for completing these courses, and they can also help you remove points from your driving record in some states.

- File an Affidavit of Correction: In some cases, you may be able to file an affidavit of correction to have certain violations removed from your driving record. This is typically only possible for minor violations, and the process varies by state. Check with your local DMV to see if this is an option for you.

Future Outlook and Emerging Trends in NYC Car Insurance

As we look ahead to the future of car insurance in NYC, several emerging trends and technological advancements