Low Car Insurance Rates

When it comes to car insurance, finding low rates is a priority for many vehicle owners. The cost of insurance can vary significantly, and understanding the factors that influence these rates is crucial for getting the best deal. This comprehensive guide aims to provide an in-depth analysis of the strategies and considerations to help you secure low car insurance rates. By exploring industry insights and offering practical tips, we'll delve into the world of insurance, empowering you to make informed decisions and potentially save on your premium.

Understanding Car Insurance Rates

Car insurance rates are influenced by a multitude of factors, and insurance companies use complex algorithms to calculate the risk associated with each driver. These rates can vary widely, depending on personal circumstances, driving history, and the type of coverage chosen. Let's break down the key elements that impact insurance premiums.

Risk Assessment Factors

Insurance companies assess risk based on various criteria. Here are some of the primary factors they consider:

- Driving Record: Your history as a driver plays a significant role. A clean driving record with no accidents or traffic violations is likely to result in lower rates. On the other hand, multiple infractions can lead to higher premiums.

- Age and Experience: Younger drivers, especially those under 25, often face higher insurance costs due to their lack of experience. As drivers gain years on the road, their rates tend to decrease.

- Vehicle Type and Usage: The make, model, and year of your vehicle impact insurance costs. Sports cars and luxury vehicles generally have higher premiums due to their value and performance. Additionally, how you use your car matters; high mileage or commercial use can increase rates.

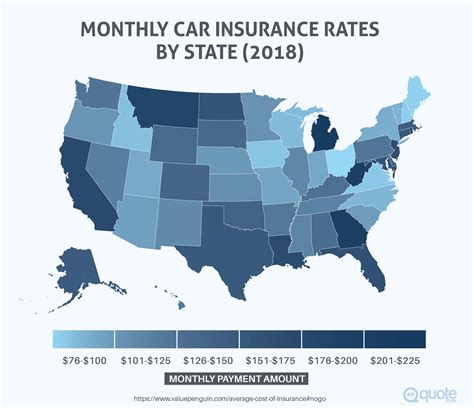

- Location and Zip Code: Where you live and work can affect your insurance rates. Areas with higher crime rates or a history of frequent accidents may result in increased premiums.

- Claims History: If you've made multiple insurance claims in the past, it could impact your future rates. Insurance companies view frequent claims as a sign of higher risk.

Types of Coverage

Car insurance policies offer different types of coverage, each with its own cost implications. Understanding these options is crucial for choosing the right coverage at the best price.

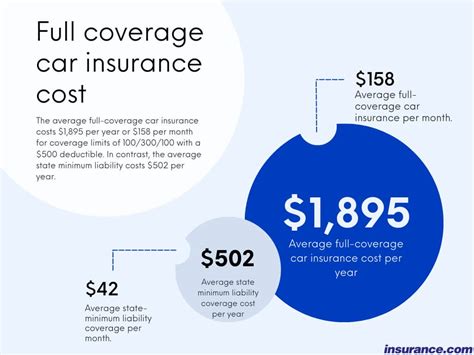

- Liability Coverage: This is the basic level of insurance required by law in most states. It covers damages you cause to others in an accident. Liability coverage typically includes bodily injury liability and property damage liability.

- Collision and Comprehensive Coverage: These optional coverages provide protection for your own vehicle. Collision coverage pays for repairs or replacement if you're in an accident, while comprehensive coverage covers damages from non-accident events like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the damages.

- Personal Injury Protection (PIP) and Medical Payments: PIP and medical payments coverage provide compensation for your own medical expenses and those of your passengers, regardless of fault in an accident.

Strategies for Securing Low Rates

While you can't control all the factors that influence insurance rates, there are several strategies you can employ to potentially lower your premium. Here are some effective approaches:

Shop Around and Compare

One of the most powerful tools at your disposal is the ability to compare quotes from multiple insurance providers. Each company has its own risk assessment methodology, so rates can vary significantly. Use online comparison tools or consult with insurance brokers to get quotes from a variety of carriers. This allows you to find the best deal for your specific circumstances.

Improve Your Driving Record

Your driving history is a critical factor in insurance rates. To improve your chances of getting lower premiums, focus on maintaining a clean record. Avoid traffic violations, and if you're involved in an accident, ensure you're not at fault. Even a single speeding ticket can increase your insurance costs, so safe driving is essential.

Consider Bundling and Loyalty Discounts

Many insurance companies offer discounts when you bundle multiple policies together. For example, you might be able to save by combining your car insurance with home or renters' insurance. Additionally, staying with the same insurer for an extended period often results in loyalty discounts, so consider the long-term benefits of sticking with a trusted provider.

Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can potentially lower your insurance premium. However, it's important to ensure that you have the financial capacity to cover a higher deductible in the event of a claim.

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach where your premium is based on your actual driving behavior. Insurers use telematics devices or smartphone apps to track factors like mileage, driving speed, and time of day. If you're a cautious driver with limited mileage, this type of insurance could result in significant savings.

Take Advantage of Discounts

Insurance companies offer a range of discounts to attract customers. Some common discounts include:

- Good Student Discount: Many insurers provide discounts for students with good grades, recognizing that academic success often correlates with responsible driving.

- Safe Driver Discount: If you've maintained a clean driving record for a certain period, you may be eligible for a safe driver discount.

- Low Mileage Discount: If you drive fewer miles annually, you might qualify for a low mileage discount.

- Anti-Theft Devices: Installing approved anti-theft devices in your vehicle can lead to reduced insurance costs.

- Membership or Affiliation Discounts: Certain professional associations, alumni groups, or even AAA membership can sometimes result in insurance discounts.

Analyzing Performance and Future Implications

The insurance industry is dynamic, and keeping up with the latest trends and innovations is essential for securing the best rates. Here's an analysis of current performance and future implications:

Current Performance Analysis

In recent years, the insurance market has seen a shift towards more personalized and data-driven approaches. Usage-based insurance and telematics technology have gained traction, offering drivers the opportunity to demonstrate their safe driving habits and potentially lower their premiums. Additionally, the rise of digital platforms and comparison tools has made it easier for consumers to shop around and find the most competitive rates.

Future Implications

Looking ahead, the insurance industry is likely to continue its digital transformation. Insurtech startups are disrupting traditional insurance models, offering innovative solutions and enhanced customer experiences. This could lead to even more personalized insurance products and dynamic pricing models. As autonomous vehicles become more prevalent, the industry may also see a shift in liability and coverage types.

Conclusion

Securing low car insurance rates requires a combination of strategic planning, a good driving record, and an understanding of the insurance landscape. By comparing quotes, leveraging discounts, and adopting safe driving practices, you can significantly reduce your insurance premiums. Remember, the insurance industry is constantly evolving, so staying informed is key to staying ahead and securing the best deals.

Frequently Asked Questions

How often should I review my insurance policy and rates?

+It's a good practice to review your insurance policy and rates annually, or whenever your circumstances change significantly. This ensures you're always getting the best value for your insurance needs.

<div class="faq-item">

<div class="faq-question">

<h3>Can I switch insurance providers to get a better rate?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! Shopping around and comparing quotes is an effective way to find better rates. If you find a more competitive offer, switching providers can result in significant savings.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What factors can I control to lower my insurance rates?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>You can control factors like your driving record, the type of vehicle you drive, and your annual mileage. Maintaining a clean driving record, choosing a less expensive vehicle, and reducing your annual mileage can all lead to lower insurance rates.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any specific discounts I should look for when shopping for insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, common discounts include safe driver discounts, good student discounts, low mileage discounts, and discounts for anti-theft devices. Additionally, bundling your insurance policies (e.g., car and home) can often result in significant savings.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How does my credit score impact my insurance rates?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>In many states, insurance companies use credit-based insurance scores to assess risk. A higher credit score can potentially lead to lower insurance rates, as it's seen as an indicator of financial responsibility.</p>

</div>

</div>