Texas Department Of Insurance License Search

The Texas Department of Insurance (TDI) is a state agency responsible for regulating the insurance industry within the state of Texas. It plays a crucial role in protecting consumers and ensuring fair practices in the insurance market. One of its essential functions is the licensing and oversight of insurance professionals and entities operating in Texas. The TDI License Search is a valuable tool for individuals and businesses seeking to verify the legitimacy and credibility of insurance providers and agents.

Understanding the TDI License Search

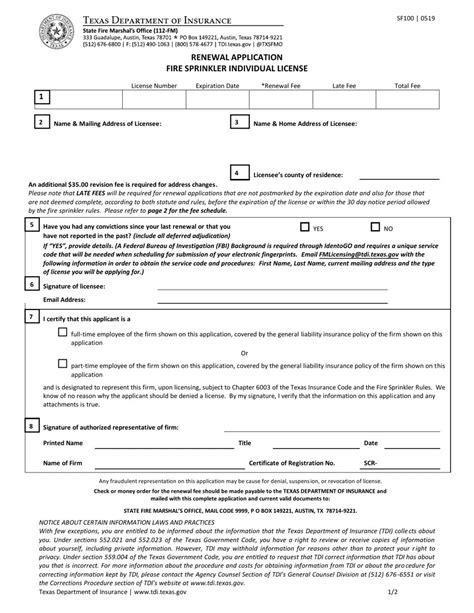

The TDI License Search platform allows users to conduct comprehensive searches for insurance-related licenses, registrations, and appointments. This online tool provides an efficient and convenient way to access vital information about insurance professionals and entities, ensuring transparency and accountability in the industry.

Whether you're an individual seeking to purchase insurance, a business looking to partner with an insurance provider, or a consumer wanting to verify the credentials of an insurance agent, the TDI License Search is an indispensable resource. It empowers users with the knowledge they need to make informed decisions and protect their interests.

Features and Benefits of the TDI License Search

The TDI License Search offers a user-friendly interface, making it accessible to a wide range of users. It provides a quick and straightforward way to search for licenses and registrations by various criteria, including:

- License Number: Users can directly input a known license number to retrieve detailed information about the licensee.

- Individual or Business Name: Search by name to find licenses and registrations associated with a specific individual or business entity.

- Line of Authority: Narrow down the search by selecting the specific line of insurance authority, such as property, casualty, life, or health insurance.

- Company Name: Search for insurance companies or organizations registered with the TDI.

The search results provide comprehensive information about the licensee, including their license status, type, and expiration date. It also offers details on the licensee's appointments, appointments with other insurers, and any disciplinary actions or complaints filed against them. This transparency allows users to assess the credibility and reliability of insurance professionals and entities before engaging in business transactions.

| License Status | Description |

|---|---|

| Active | The license is currently valid and in good standing. |

| Inactive | The license is not currently active, possibly due to suspension or expiration. |

| Revoked | The license has been permanently canceled due to serious violations or misconduct. |

| Expired | The license has passed its renewal date and is no longer valid. |

Utilizing the TDI License Search for Consumer Protection

The TDI License Search is a powerful tool for consumers to safeguard their interests and ensure they are dealing with legitimate and reputable insurance professionals. By conducting a simple search, consumers can:

- Verify the license status of an insurance agent or broker to ensure they are authorized to sell insurance products.

- Check for any disciplinary actions or complaints against a licensee, which may indicate past misconduct or unethical practices.

- Ensure the insurance company they are considering is duly registered and licensed to operate in Texas.

- Cross-reference the license information provided by an insurance professional with the official TDI records to confirm its accuracy.

By utilizing the TDI License Search, consumers can make informed decisions and protect themselves from potential scams, fraud, or unlicensed insurance providers. It empowers them to take an active role in their insurance transactions and ensures a more secure and trustworthy environment.

Additional Resources and Assistance

In addition to the online license search, the Texas Department of Insurance provides various resources and assistance to consumers and industry professionals. These include:

- Consumer Complaints: The TDI has a dedicated Consumer Protection Division that handles complaints against insurance companies, agents, and other industry professionals. Consumers can file complaints online or by mail, and the TDI will investigate and take appropriate action.

- Education and Outreach: The TDI offers educational resources and programs to help consumers understand their insurance options, rights, and responsibilities. This includes guides, workshops, and online tools to assist in making informed insurance decisions.

- Market Conduct Examinations: The TDI conducts regular examinations of insurance companies to ensure compliance with laws and regulations. These examinations assess the financial stability, business practices, and consumer protection measures of insurance entities.

- Insurance Company Ratings : The TDI provides access to financial and market conduct ratings for insurance companies operating in Texas. These ratings help consumers evaluate the financial strength and stability of insurance providers.

By leveraging these additional resources, consumers and industry professionals can further enhance their understanding of the insurance market, make informed choices, and ensure a fair and competitive environment.

The Importance of Licensing and Regulation in the Insurance Industry

The licensing and regulation of insurance professionals and entities are critical aspects of maintaining a stable and trustworthy insurance market. Licensing ensures that individuals and businesses meet specific qualifications and standards before entering the industry. It helps protect consumers from unqualified or fraudulent individuals who may pose a risk to their financial well-being.

Regulation by the TDI further ensures that insurance professionals and companies adhere to ethical practices, uphold consumer rights, and maintain financial stability. The TDI's oversight includes monitoring insurance rates, reviewing policy forms, and enforcing laws and regulations to prevent unfair or deceptive practices.

Through licensing and regulation, the TDI plays a vital role in fostering a robust and consumer-centric insurance market. It provides a framework for fair competition, ensures consumer protection, and promotes transparency and accountability among insurance professionals and entities.

The Role of TDI in Consumer Education and Outreach

Beyond its regulatory functions, the Texas Department of Insurance actively engages in consumer education and outreach initiatives. Recognizing the importance of informed consumers in a complex insurance market, the TDI strives to empower individuals and businesses with the knowledge they need to navigate the insurance landscape effectively.

The TDI's consumer education programs cover a wide range of topics, including:

- Insurance Basics: Providing fundamental knowledge about different types of insurance, such as auto, home, health, and life insurance, to help consumers understand their coverage needs.

- Policy Selection: Guiding consumers on how to choose the right insurance policy based on their individual circumstances and needs.

- Claim Processes: Educating policyholders on their rights and responsibilities during the claims process, including tips for filing claims efficiently and avoiding common pitfalls.

- Consumer Rights: Informing consumers about their legal rights and protections under Texas insurance laws, including the right to appeal insurance decisions and dispute settlements.

- Fraud Prevention: Raising awareness about common insurance scams and fraudulent practices, and providing tips on how to identify and avoid them.

The TDI's outreach efforts extend beyond traditional educational materials. They organize community events, workshops, and seminars to engage directly with consumers and provide personalized guidance. These interactive sessions allow consumers to ask questions, clarify doubts, and gain a deeper understanding of the insurance landscape.

By investing in consumer education and outreach, the TDI aims to create a more informed and empowered consumer base. This not only benefits individual policyholders but also contributes to a healthier insurance market overall, characterized by informed decision-making, reduced disputes, and a stronger trust between consumers and insurance providers.

Conclusion

The Texas Department of Insurance License Search is a powerful tool that empowers consumers, businesses, and individuals to make informed decisions in the insurance market. By utilizing this resource, users can verify the legitimacy and credibility of insurance professionals and entities, ensuring a safer and more transparent environment. The TDI's commitment to licensing, regulation, and consumer education further strengthens the insurance industry in Texas, fostering a culture of trust and accountability.

Frequently Asked Questions

How often should I verify an insurance professional’s license using the TDI License Search?

+It’s recommended to verify an insurance professional’s license status before entering into any insurance transaction. Additionally, it’s advisable to conduct periodic checks, especially if you have an ongoing relationship with the professional. This ensures that their license remains active and in good standing.

What should I do if I find an insurance professional with a revoked or expired license through the TDI License Search?

+If you discover that an insurance professional’s license is revoked or expired, it’s essential to avoid conducting any business with them. Engaging with an unlicensed professional can expose you to potential risks and legal consequences. It’s best to report such findings to the TDI to help maintain the integrity of the insurance market.

Can I trust insurance companies that are not licensed by the TDI?

+No, it’s crucial to ensure that any insurance company you deal with is duly licensed by the TDI. Operating without a valid license is a serious violation and can indicate potential fraud or unethical practices. Always verify the company’s license status through the TDI License Search before engaging in any business transactions.

Are there any fees associated with using the TDI License Search tool?

+No, the TDI License Search is a free and publicly accessible tool. The Texas Department of Insurance provides this service to promote transparency and consumer protection in the insurance market. You can conduct as many searches as needed without incurring any costs.

How can I stay updated on changes or updates to an insurance professional’s license status?

+The TDI License Search platform provides real-time information on license status. To stay informed about any changes, you can bookmark the search results page and revisit it periodically. Additionally, the TDI may send out notifications or updates regarding significant changes in the insurance industry, so it’s beneficial to subscribe to their official communication channels.