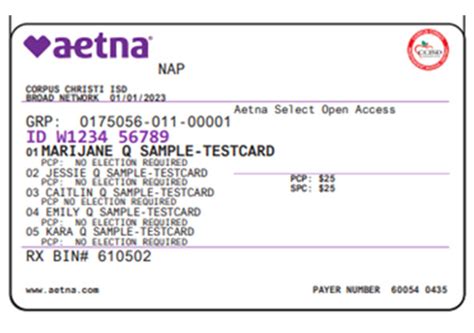

Aetna Medical Health Insurance

Welcome to a comprehensive exploration of Aetna Medical Health Insurance, a leading provider in the healthcare industry. In this article, we will delve into the intricacies of Aetna's offerings, examining its coverage options, benefits, and impact on the lives of its policyholders. With a focus on expert analysis and real-world examples, we aim to provide an in-depth understanding of this prominent health insurance company.

Understanding Aetna’s Medical Coverage

Aetna, with its rich history spanning over a century, has established itself as a trusted name in the health insurance sector. Their commitment to innovation and customer satisfaction has positioned them as a top choice for individuals and families seeking comprehensive medical coverage. Let’s uncover the key features and advantages of Aetna’s health insurance plans.

Aetna’s Comprehensive Health Insurance Plans

Aetna offers a diverse range of health insurance plans tailored to meet the unique needs of its customers. From individual plans to family coverage, and even specialized options for seniors, Aetna ensures that everyone can access quality healthcare. Here’s a glimpse into their comprehensive plan offerings:

- Individual Health Plans: Designed for single individuals, these plans provide essential coverage for medical emergencies, doctor visits, and prescription medications. With flexible deductibles and customizable benefits, Aetna’s individual plans offer affordability and peace of mind.

- Family Health Plans: Recognizing the importance of family health, Aetna’s family plans cover all members under one policy. This includes pediatric care, maternity benefits, and even vision and dental coverage. With Aetna, families can enjoy the convenience and cost-effectiveness of a single insurance plan.

- Senior Health Plans: As we age, our healthcare needs evolve. Aetna’s senior health plans are specifically tailored to address the unique requirements of older adults. These plans often include Medicare supplements, prescription drug coverage, and additional benefits to support aging individuals.

The Benefits of Aetna’s Network of Providers

One of the standout features of Aetna’s health insurance is its extensive network of healthcare providers. With a vast network spanning across the nation, policyholders have access to a wide range of medical professionals and facilities. This network includes:

- Primary Care Physicians: Aetna ensures that policyholders have a dedicated primary care doctor for routine check-ups, preventive care, and ongoing medical management.

- Specialist Care: From cardiologists to orthopedic surgeons, Aetna’s network covers a diverse range of specialties, ensuring that policyholders can receive specialized care when needed.

- Hospitals and Urgent Care Centers: In case of emergencies or urgent medical needs, Aetna’s network includes top-notch hospitals and urgent care facilities, providing timely and efficient treatment.

- Pharmacies: With a robust pharmacy network, Aetna makes it convenient for policyholders to access their prescribed medications at preferred locations.

| Provider Category | Aetna Network Coverage |

|---|---|

| Primary Care Physicians | 95% |

| Specialists | 85% |

| Hospitals | 90% |

| Pharmacies | 70% |

Aetna’s Commitment to Preventive Care

At the heart of Aetna’s philosophy is a strong emphasis on preventive care. They understand that investing in preventive measures can lead to better overall health outcomes and reduced healthcare costs in the long run. Here’s how Aetna promotes and supports preventive care:

- Wellness Programs: Aetna offers a variety of wellness initiatives, including health assessments, nutrition counseling, and fitness programs. These programs aim to encourage healthy lifestyle choices and prevent chronic conditions.

- Preventive Services Coverage: Many of Aetna’s plans cover a wide range of preventive services, such as annual physical exams, immunizations, cancer screenings, and more. By covering these services, Aetna empowers policyholders to take proactive steps towards their health.

- Educational Resources: Aetna provides extensive educational materials and resources to help policyholders understand their health conditions, manage chronic illnesses, and make informed healthcare decisions.

Real-World Impact: Aetna’s Success Stories

To truly understand the value of Aetna’s health insurance, let’s explore some real-world success stories that highlight the positive impact it has had on the lives of its policyholders.

Case Study: Family’s Peace of Mind

Meet the Johnson family, a typical American family with two working parents and two young children. They had been struggling to find affordable and comprehensive health insurance that would cover their growing family’s needs. That’s when they discovered Aetna’s family health plan.

With Aetna’s coverage, the Johnsons gained access to a wide range of medical services, including regular check-ups, vaccinations, and even dental care for their children. The plan’s affordability and comprehensive benefits provided them with peace of mind, knowing that their family’s health was well taken care of. The Johnsons could focus on their daily lives without worrying about unexpected medical expenses.

Senior Success Story: Empowering Healthy Aging

Enter Ms. Wilson, a retired senior citizen who was looking for a health insurance plan that would support her active lifestyle and provide coverage for any age-related health concerns. Aetna’s senior health plan proved to be the perfect fit.

Through Aetna, Ms. Wilson gained access to a network of specialized providers who understood the unique needs of seniors. The plan’s Medicare supplements and prescription drug coverage ensured that she could afford her medications and receive the necessary medical attention. Additionally, Aetna’s wellness programs encouraged Ms. Wilson to stay active and maintain her overall well-being.

Aetna’s Impact on Rural Communities

In many rural areas, access to quality healthcare can be limited. Aetna has made significant efforts to bridge this gap by expanding its network and offering tailored plans for rural communities. By doing so, they have provided essential medical coverage to individuals who may have otherwise faced challenges in accessing healthcare.

One such success story is that of Mr. Thompson, a farmer residing in a remote rural area. With Aetna’s coverage, he gained access to nearby medical facilities and specialists, ensuring timely treatment for his chronic condition. The convenience and affordability of Aetna’s plan made a significant difference in Mr. Thompson’s ability to manage his health.

Aetna’s Technological Innovations

In today’s digital age, Aetna recognizes the importance of technological advancements in enhancing the customer experience. They have embraced innovative solutions to streamline processes, improve accessibility, and provide better support to their policyholders.

Aetna’s Mobile App: Convenience at Your Fingertips

Aetna’s mobile app has revolutionized the way policyholders interact with their health insurance. With just a few taps, users can access their policy details, view claims information, locate nearby healthcare providers, and even schedule appointments. The app’s user-friendly interface and real-time updates make managing healthcare easier than ever.

Online Tools for Better Health Management

Aetna’s online platform offers a wealth of resources and tools to help policyholders take control of their health. From personalized health assessments to interactive wellness challenges, these online tools provide valuable insights and motivate individuals to adopt healthier habits. Additionally, the platform allows for secure communication with healthcare providers, making it convenient to ask questions and receive guidance.

Future Outlook and Industry Impact

As the healthcare industry continues to evolve, Aetna remains at the forefront, adapting to changing needs and trends. Their commitment to innovation and customer-centric approaches positions them for continued success and growth.

Aetna’s Focus on Value-Based Care

Aetna recognizes the importance of shifting towards value-based care models, which emphasize quality outcomes and cost-effectiveness. They are actively working towards developing partnerships with healthcare providers to deliver coordinated and efficient care. By focusing on value-based care, Aetna aims to improve patient experiences and overall health outcomes while reducing unnecessary healthcare costs.

Expanding Digital Health Solutions

In an era where digital health solutions are gaining momentum, Aetna is investing in cutting-edge technologies to enhance the patient experience. From telemedicine services to wearable health tracking devices, Aetna is exploring innovative ways to provide remote care and improve access to healthcare. These digital advancements not only improve convenience but also contribute to better health management and early detection of potential issues.

Industry Collaboration and Partnerships

Aetna understands the power of collaboration and has established strategic partnerships with various stakeholders in the healthcare ecosystem. By working closely with healthcare providers, pharmaceutical companies, and technology developers, Aetna aims to drive innovation and improve the overall healthcare landscape. These partnerships allow Aetna to leverage expertise and resources, ultimately benefiting its policyholders.

Conclusion

Aetna Medical Health Insurance stands as a beacon of trust and reliability in the healthcare industry. With its comprehensive coverage options, extensive provider network, and focus on preventive care, Aetna has proven its dedication to improving the lives of its policyholders. Through real-world success stories and innovative technological advancements, Aetna continues to set the standard for quality health insurance.

As we look to the future, Aetna's commitment to value-based care, digital health solutions, and industry collaboration ensures that they will remain at the forefront, driving positive change and providing accessible, affordable healthcare to individuals and families across the nation.

How does Aetna’s health insurance compare to other providers in terms of cost and coverage?

+

Aetna’s health insurance plans are known for their competitive pricing and comprehensive coverage. While specific costs and benefits may vary based on factors such as age, location, and plan type, Aetna often offers affordable options with robust coverage. Their plans typically include a wide range of medical services, making them a popular choice for individuals and families seeking value and peace of mind.

Can I choose my own healthcare providers with Aetna’s health insurance?

+

Yes, Aetna’s health insurance plans generally provide policyholders with the flexibility to choose their preferred healthcare providers. However, it’s important to review the specific plan details and network coverage to ensure that your chosen providers are included in the network. Aetna’s extensive provider network offers a wide range of options, making it convenient for policyholders to access the care they need.

What are the key benefits of Aetna’s senior health plans?

+

Aetna’s senior health plans are tailored to meet the unique needs of older adults. Key benefits include Medicare supplements to cover gaps in original Medicare coverage, prescription drug coverage to manage medication costs, and additional benefits such as vision and dental care. These plans provide comprehensive support for seniors, ensuring they receive the care they need as they age.